The life insurance industry has always found itself between a rock and a hard place. On the one hand, they naturally want the bereaved families to benefit from the policyholder’s life insurance. But on the other hand, they simply cannot afford to skip past the due diligence required in the procedural formalities. This generally creates a stressful experience for families and a heavy workload for insurance staff.

Fortunately, technological advancements are making it easier for life insurance businesses to solve this problem. Insurers can now strike the perfect balance between managing customer expectations and ensuring profitability. AI solutions help them organize operations and process claims much faster. Smart assistants allow them to address customers’ doubts within seconds. Connected intelligence tools help them monitor users’ lifestyles and create tailored policies that encourage them to pursue disease-free lifestyles. As a result, insurers and beneficiaries are both benefiting from this innovation that is disrupting the life insurance sector.

This blog explores emerging trends in the life insurance industry that are shaping its future direction and bringing breakthroughs.

Table of Contents

Which Emerging Trends in the Life Insurance Industry Are Enabling Its Transformation?

Which Emerging Trends in the Life Insurance Industry Are Enabling Its Transformation?

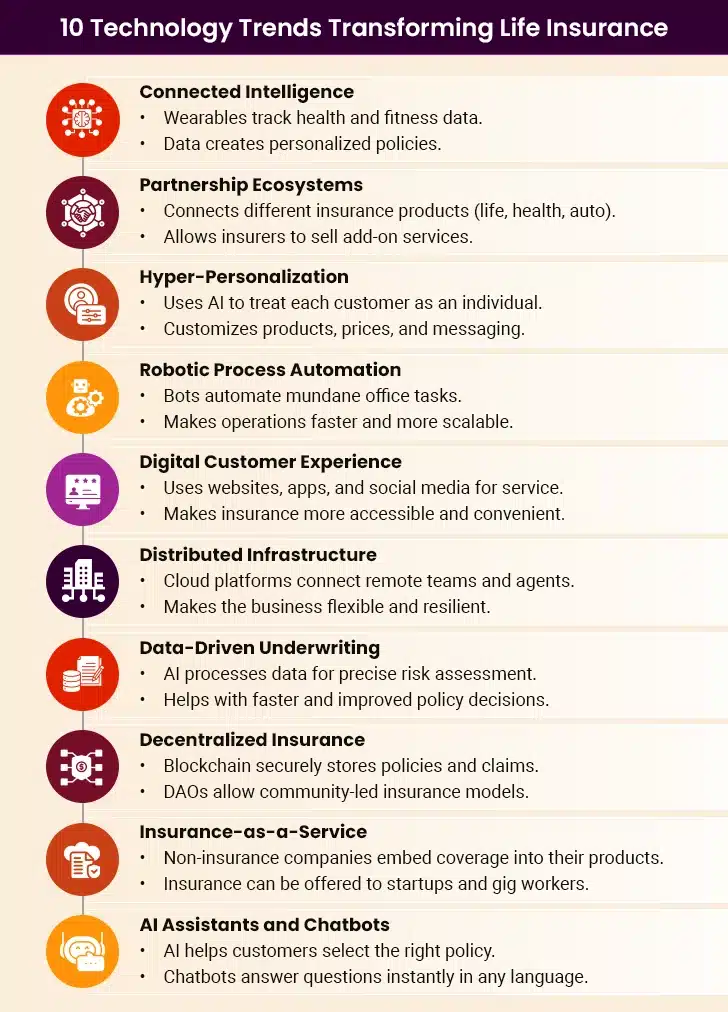

Insurers are now embracing technology to solve longstanding problems and meet the changing expectations of present-day customers. These tools are transforming core processes, assisting with accurate underwriting and claims processing, and enabling better customer service. The following life insurance technology trends explain this shift.

1. Connected Intelligence

Connected intelligence powered by the Internet of Things (IoT) remains one of the most revolutionary technologies. It relies on smart wearables that collect tons of customer data, especially the metrics revolving around their health and fitness markers. Such data, when paired with the already available information such as any preexisting condition, family history of diseases, comorbidities, etc., allows companies to intervene in a timely manner to elongate lifespan and its quality. Insurers can even convert life insurance policies and premiums into a recalibrated usage-based dynamic policy that incentivizes healthy habits or preventive care.

2. Partnership Ecosystems

Connected intelligence has paved the way for a new technology-led transformation in the life insurance industry. It has laid the foundation for the partnership ecosystem. Such a connected space ensures that no vertical of insurance remains in isolation, and multiple products or services can exist in tandem. As such, life insurance can be tied to health insurance or auto insurance to maximize value.

Such cohesiveness can be highly beneficial for multi-line insurers that can push for the sale of related add-on products or services. However, small insurers can also benefit from such a business architecture as they can form fruitful partnerships and symbiotic relationships that supplement customers’ demands.

3. Hyper-Personalization

Hyper-personalization enables insurers to make their customers feel seen and heard as an individuals rather than a cohort or customer segment. It enables insurers to customize their products, services, and messaging to cater to the specific requirements and preferences of every customer uniquely.

By leveraging data analytics, artificial intelligence, and machine learning, insurance businesses can efficiently analyze high volumes of customer data and gain actionable insights into their behavior, preferences, and needs. It can also accurately predict the risk parameters for the individual, which influences the policy underwriting process. On the whole, the life insurance policy enhances the value of the policyholder’s life as per their terms, and remains meaningful even beyond.

4. Robotic Process Automation

Robotic Process Automation, or RPA, allows life insurers to develop, deploy, and maintain robots that introduce automation. While at face value, this small-scale automation may not seem like a major feat, RPA solutions contribute to the grander scheme of things. They improve the overall efficiency and productivity of the organization as RPA solutions can successfully handle all routine, repeated, and redundant activities that are otherwise a drain on resources. In doing so, it injects a high degree of scalability into your business operations without soiling the customer experience.

One can even expand on this low-hanging fruit and introduce complex automated workflows that will absolutely decouple organizational performance from the number of employees or any such variables.

Life Insurer Achieves 99.9% Data Accuracy Through Data Warehouse Solution

5. Digital Customer Experiences

The digitalization of the insurance industry has birthed digital customer experiences for all, and life insurance is no exception to this industry-wide norm. A life insurance customer’s journey now includes an assortment of digital touchpoints, from the obvious ones like websites and emails to offbeat channels like social media or instant messaging platforms. Such digitalization of the customer experience makes the insurer highly accessible and approachable while also cutting the sales cycle short.

Even when it comes to post-sale servicing or claims settlement, digital experiences are making everything far more convenient and customer-friendly. Not to forget that digital-first customer experiences offer room to introduce personalization and other such elements to woo the customers, engage, delight, and retain them, and attract long-term benefits.

6. Distributed Infrastructure

Insurance has always been a distributed sector with the on-field agents and in-office employees, and we’re not even accounting for the brokers, agents, and other stakeholders yet. Such a distributed architecture becomes even more disparate and separated in recent times, with the work-from-anywhere models becoming increasingly popular.

Against this background, technologies like cloud computing and automation led to the introduction of everything-as-a-service (SaaS, PaaS, CPaaS, etc.). Such platforms are making it easier for insurers to overcome geographical boundaries while acquiring talent or serving customers. A modular and digital-first infrastructure will impart some amount of resilience and elasticity to the business that yields reszults in the long run.

7. Data-Driven Underwriting

Insurers have moved away from older paper-based processes to data-backed underwriting that’s fueled by newer technologies. Many now use AI systems that ingest and analyze data from many sources to create detailed risk profiles. The systems also spot complex links between seemingly unrelated variables, such as activity levels and mortality rates, for highly precise risk evaluation.

Swiss Re’s Magnum platform, for instance, delivers instantaneous coverage decisions for life insurance applications. For more complicated cases, their Underwriting Ease platform provides support.

AI is also excellent at detecting fraud, which is a key part of assessing risk. Advanced algorithms can spot inconsistencies even in unstructured datasets. They can detect odd linguistic patterns that suggest someone is lying. This protects insurers from losses due to fraudulent applications.

8. Decentralized Insurance

Blockchain creates a permanent and transparent record of transactions across a network of computers. Its unchangeable nature makes the blockchain fit for storing policy and customer documents securely. Smart contracts are programs on this network that execute actions (e.g., verifying claims and releasing payments) when certain conditions are fulfilled. This cuts administration costs and speeds up settlements, and at the same time, reduces fraud.

Groups called Decentralized Autonomous Organizations, or DAOs, offer a new way to run insurance companies. A community of stakeholders makes decisions collectively, so there is no central control. This shared model differs from regular organizational structures, where executives are responsible for creating strategies. DAOs can help reduce bureaucracy and settle claims much faster in the domain of life insurance.

Did You Know? The global blockchain in insurance market is estimated to reach a whopping $59 billion by 2032.

9. Insurance-as-a-Service

Companies provide digital insurance products to other businesses rather than selling directly to consumers through this business model. The digital offering manages everything from distribution to claims management and customer support. People call it “embedded insurance” because it merges coverage into products right when people need it.

IaaS platforms let businesses add insurance components to their offerings without dealing with the complex rules of the insurance industry. They do not have to think about assessing risk or managing policies themselves. This makes it much easier for new companies to enter the market as they can avoid the complicated world of traditional insurance operations.

This model is especially helpful for startups and gig workers. The growth of non-traditional employment has created a significant gap in financial protection. Workers often cannot get employer-sponsored life insurance. Embedded life insurance fills this void by offering protection through the platforms these workers already use, like digital banking.

10. AI Assistants and Chatbots

AI is completely changing how life insurance companies interact with their customers. AI assistants are now a pivotal part of helping people choose the right policy. These systems look at customers’ personal information and preferences and then suggest policies that are a perfect fit for their needs and situation.

Smart assistants convert confusing insurance terms into simple language. Because people understand what they are buying, they are more likely to complete the purchase. This has led to a major boost in policy sales for many companies.

The insurance industry needs to offer support at all hours as it moves more of its services online. AI chatbots provide this unflagging support by answering questions about policies, claims, and coverage anytime. Natural language processing allows these smart systems to communicate in hundreds of languages. This breaks down language barriers and makes insurance accessible to more people.

How Life Insurers Succeed with Tech Transformation?

“In 10-15 years’ time, I see the insurance industry as having almost fully automated, AI-assisted end-to-end processes.”

– Megan Bingham-Walker, Co-Founder and CEO, Anansi Technology

Companies that perform well know that digital transformation in the life insurance industry needs a clear plan. They do not just implement random projects. Using data to predict outcomes, along with a proper execution plan, helps them get full benefits from any technology.

I. Starting with Projects That Matter

Successful insurance companies find opportunities that address their current gaps and future goals. They do not work on isolated projects but focus on improving entire domains. Most start with just one to three domains to make a substantial impact and avoid overburdening their teams. They generally test their initiatives in controlled settings (e.g., using automated underwriting for easy policies first) before expanding them.

II. Building Strong Teams with Smart Training

Your people are as important as your technology. Smart insurers add AI training to their staff’s learning plans. They create a culture where everyone knows what AI can do and where it may fail to deliver. This creates a symbiotic relationship between humans and machines. Workshops help teams understand AI initiatives and share what they learn, making the whole company benefit.

III. Tracking Progress with Clear Data

Smart insurers set clear and quantifiable goals to see if technology is helping the business. To give an example, they can aim for better customer experience or reduced quote-to-bind time. This links the technology they buy to the results they want to see. By remaining focused on goals they can measure, they make their initiatives bring results that make a perceptible difference.

Modernize your Operations by Leveraging the Latest Technologies

Closing Thoughts

All in all, the life insurance industry is experiencing a tech-led revolution that is enriching the sector in more than one way. The technologies discussed above are sowing the seeds of digital transformation in the life insurance industry and paving the path for behaviors that are set to reshape the vertical. Companies that adopt them can realize measurable gains in customer satisfaction, process efficiency, and cost savings. Life insurers that wish to stay ahead of the curve and derive long-term results can leverage them to gear up for the changes to come in the future.

Case in Focus

A reputed multinational life insurance provider faced issues staying up-to-date and relevant with the latest insurance industry trends and customer expectations. Upon consulting Damco, they came to realize how their disconnected legacy systems were eroding brand reputation and profit margins. Damco’s experts set to work in modernizing the life insurance business’s infrastructure and, in the process, saved them a whopping $2 million. How? You will have to read this case study.