“The greatest danger in times of turbulence is not the turbulence; it is to act with yesterday’s logic.”—Peter F. Drucker.

Imagine an insurance company where claims are processed within seconds, fraud is detected before it happens, customers receive tailored products instantly, and regulations are met with just a few clicks. That future is closer than you think, but it requires a strategic plan to harness artificial intelligence’s (AI) power.

For CTOs in the insurance space, translating AI’s potential into practical steps for adoption can feel overwhelming. That’s where the three-tiered approach comes in. It’s not just a tool; it’s a roadmap for managing innovation while maintaining operational stability. It helps CTOs prioritize what to implement now, what to develop next, and what to watch for in the long run.

This blog unpacks the three-tiered approach to AI adoption in insurance. We’ll explain what each tier means, what technical skills the teams need, and how CTOs can lead their organization through this AI-driven transformation.

Table of Contents

AI Maturity: A Journey, Not a Straight Line

The Three-Tiered Approached for AI Adoption: A Strategic View

Unlocking Competitive Advantage with a Three-Tiered AI Strategy

Why AI and Why Now?

AI isn’t a futuristic luxury anymore. It has become the bedrock of successful insurance operations. AI is essential for staying competitive and unlocking new growth.

“Insurers are adapting, developing, and piloting innovative AI applications in pursuit of greater efficiency to drive customer and distributor satisfaction. In addition, insurers have access to a wider and larger selection of data than ever before, and AI is a crucial technology in managing that data,” says Scott Hawkins, managing director and head of insurance research at Hartford.

As evident from the numbers, AI presents various opportunities. But here’s the challenge: most insurance companies only scratch the surface. Insurance CTOs must look at AI through a broader lens—not just what’s trending now, but what skills and technologies insurers will need in the next five–seven years. To unlock AI’s full potential, insurers must confront its inherent challenges head-on. The following table outlines the industry’s key obstacles and the AI-powered solutions that can help overcome them.

| Challenge | AI-Powered Solution |

|---|---|

| Data privacy | Use AI for data anonymization and monitoring |

| Ethical bias | Implement explainable AI models |

| Job displacement | Reskill and upskill via AI simulators |

| Regulatory changes | Harness AI-driven compliance tools and dashboards |

| Cyber threat | Deploy predictive AI for threat detection |

AI Maturity: A Journey, Not a Straight Line

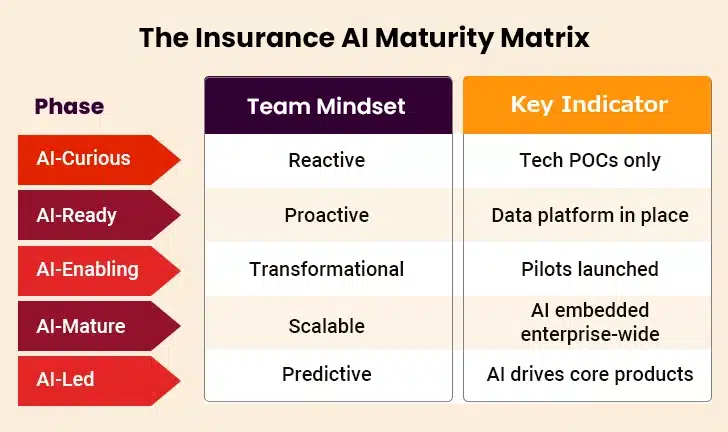

Before diving into the tiers of AI adoption, one must understand one truth: not all insurers start at the same point. Some already use AI to optimize underwriting or automate workflows, while others are still exploring use cases.

The AI adoption framework doesn’t assume CTOs start from scratch. It simply helps chart the path forward, wherever they begin. To support this journey, the insurance AI maturity matrix outlines five progressive phases from experimentation to enterprise-wide adoption, highlighting how mindset, capabilities, and outcomes evolve at each stage.

The Three-Tiered Approach for AI Adoption: A Strategic View

To truly harness the power of AI and progress through the stages of maturity, insurance enterprises need a robust strategy. The three-tiered approach provides a structured way to look at growth and innovation over time. It offers a clear roadmap for insurance enterprises. This strategy helps integrate AI, from immediate operational improvements to long-term transformative capabilities.

- Tier 1: The present

- Tier 2: The near future

- Tier 3: The distant future

Each tier requires different AI capabilities and technical skills. Let’s explore what they mean for insurance companies and what the IT roadmap should look like.

Tier 1: Optimizing the Now

In this phase, insurance companies aim to improve their core functions using existing technologies in this phase. The existing practices and systems are analyzed for their efficiency and sustainability while keeping in mind the current societal demands. The analysis involves a thorough exploration of innovations designed to strengthen the current systems without fundamentally altering the core principles.

Key Objectives

- Make daily operations faster and smarter

- Improve customer service

- Reduce manual processing errors

Required AI-Technical Skills

- Data analysis and management

- Automation of claims lifecycle

- AI-assisted decision-making

Real-Life Application

Think of automated claims processing. Instead of waiting weeks for a payout, policyholders upload a photo of damaged property or vehicle, and AI assesses the damage severity and processes payment within hours. As such, data-driven risk assessment is essential here. AI tools crunch thousands of data points to make fair, accurate evaluations. Fraud detection also gets a boost, catching suspicious patterns early.

And it’s not just about systems; it’s about people, too. Insurance staff must now be trained to work alongside these tools. AI becomes their assistant, not their replacement. The insurance sector is built on trust and speed, and tier 1 ensures business systems deliver both efficiently.

Tier 2: Moving Toward Innovation

Tier 2 is the exciting middle ground. It’s where innovation starts to seep into traditional systems and reshape them. The stage involves in-depth examination of transitional innovations and their role in reshaping the AI-journey. It includes both H2- innovations, enhancing the lifespan of H1 systems through incremental improvements, and H2+ innovations, which create the foundation of an entire new system by challenging and changing the status quo.

Key Objectives

- Introduce new services

- Create personalized customer journeys

- Stay compliant while navigating AI ethics

Required AI-Technical Skills

- Fraud detection using machine learning

- Ethical AI design and governance

- Customer engagement strategies

- Behavioral analytics

Real-Life Application

Imagine an AI model predicting which policyholders are most likely to switch providers based on their digital interactions. With that knowledge, the team can step in with personalized policy reviews, loyalty discounts, or coverage upgrades to retain them. This is what Tier 2 enables.

Today’s customers want more than just policies. They want intelligent recommendations, 24/7 assistance, and seamless experiences. AI makes that possible, with personalized AI-driven insurance products achieving 50% higher customer satisfaction.

But here’s the catch: innovation must be ethical.

As AI becomes more embedded in decision-making, concerns about bias, transparency, and data privacy rise. Companies must develop frameworks to ensure their AI behaves responsibly, and that’s where ethical governance skills come in. These frameworks typically include:

- Bias detection and mitigation procedures

- Clear documentation of model intent, data sources, and outcomes

- AI ethics committees or review boards

For insurers, it means ensuring that underwriting models don’t reinforce bias, claim automation remains explainable, and policyholder data is used only with proper consent.

Wearable devices and mobile apps can be integrated to promote health-focused engagement. They allow insurers to track activity, reward healthy habits, and promote wellness. This improves customer outcomes and helps insurers manage risk, enabling dynamic premiums and usage-based models. For instance, insurers can offer discounts for healthy behavior tracked via a smartwatch.

Stop Underusing AI and Start Driving Impact

Tier 3: Transforming the Future

Tier 3 is where things get futuristic, but not unattainable. This phase is about game-changers, not just improvements. The phase explores transformative visions and a shift from legacy H1 systems while addressing the unmet demands and futuristic challenges. The analysis identifies new technologies that could facilitate and conditions that may hinder this shift.

Key Objectives

- Build AI-native insurance models

- Automate new product types

- Tackle emerging risks like cyber threats

Required AI-Technical Skills

- Parametric insurance automation

- Regulation-aware AI tools

- Cybersecurity intelligence and prediction

Real-Life Application

Parametric insurance is an insurance type where payouts are triggered automatically based on measurable events, and no claims process is needed. During the COVID-19 pandemic, parametric insurance saw rapid growth. AI-enabled sensors and climate data were used to trigger payments for business interruptions. It involved no forms, no delays—just instant help.

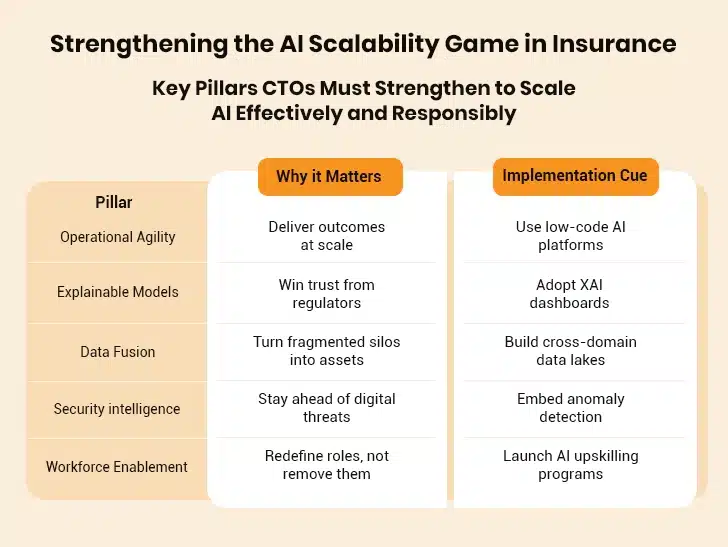

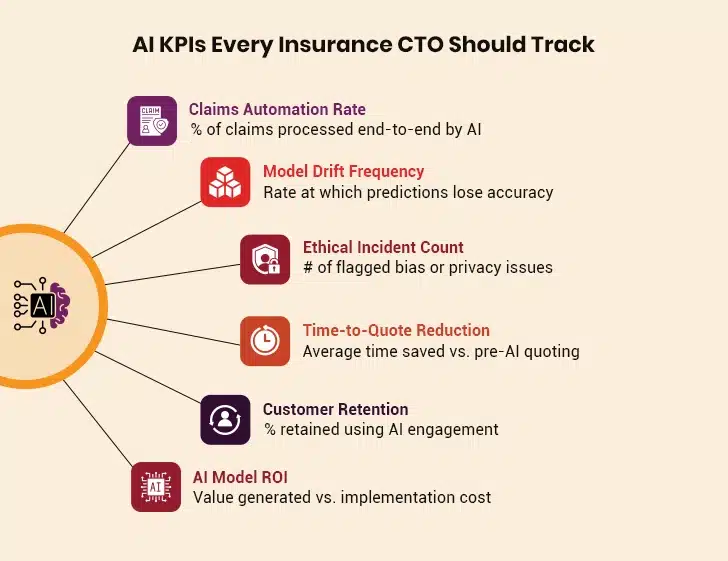

If Tier 1 is about doing things better, and Tier 2 is about doing new things, then Tier 3 is about doing entirely different things. However, to truly reach Tier 3, where AI drives different ways of delivering value, CTOs must focus on the right performance metrics while strengthening key pillars to scale AI to this level.

Unlocking Competitive Advantage with a Three-Tiered AI Strategy

Implementing AI without a clear strategy is like sailing without a compass. For insurance enterprises, a structured, three-tiered approach ensures that AI efforts are aligned with business goals, scalable over time, and resilient against emerging risks. From unlocking quick wins to driving ethical compliance and enhancing customer experiences, this approach delivers long-term, sustainable value.

1. Faster Time-to-Value

For CTOs, a three-tiered AI strategy offers a smart path to quick, measurable wins. Teams can demonstrate early value by starting small via pilot projects targeting clear pain points. For instance, insurers can cut claims processing time from weeks to minutes by automating the workflows with AI. Quick results like this help build stakeholder trust and unlock support for broader AI integration. Early momentum boosts team morale and accelerates enterprise-wide adoption.

2. Stronger Compliance

AI adoption must be paired with solid data governance. CTOs who lead with compliance-first strategies are better positioned to handle rising regulatory demands. Regulations increasingly require transparency around AI-driven decisions and algorithmic fairness. A structured, tiered strategy embeds these practices from the start. Proactive governance lowers risk and strengthens relationships with regulators and customers, critical for long-term credibility.

3. Improved Customer Experience

CTOs are uniquely positioned to use AI for real-time personalization. AI systems process vast customer datasets to recommend policies, adjust premiums, or resolve queries faster. For instance, AI-powered insurance CRMs can significantly reduce service time. Results like these reflect the power of intelligent automation: reduced response times, higher satisfaction, and better retention. CTOs who prioritize customer-facing innovation can turn AI into a growth engine.

Transform Your Insurance Strategy with AI Innovation

4. Operational Efficiency

A tiered strategy empowers CTOs to automate low-value tasks early, such as data entry for policy administration, routine claims triage, appointment scheduling, and sending renewal reminders. This frees teams for strategic work. Automation in underwriting, claims, and policy servicing can dramatically cut costs. When deployed incrementally, these tools reduce disruption while delivering steady gains in output and accuracy.

5. Competitive Advantage

AI maturity is now a business differentiator. Companies with strong AI governance report higher adoption and faster ROI. CTOs who champion AI enhance product offerings and attract top talent. Engineers and analysts want to work with modern, mission-driven technology. Forward-thinking CTOs who embed innovation into the company’s DNA gain an edge in both talent acquisition and customer loyalty.

6. Scalable Architecture

CTOs know that scale is everything. A tiered AI strategy supports modular deployment, allowing teams to build scalable solutions without re-engineering core systems. Initial use cases like document classification or claims triage can serve as templates for expansion into other business units.

Reusability and integration readiness are built into the architecture, enabling faster rollout across underwriting, fraud detection, and customer service. This approach conserves budget, reduces technical debt, and speeds enterprise transformation.

7. Better Data Utilization: Turn Silos Into Strategic Assets

Many insurers struggle with fragmented data across legacy systems. A well-executed AI strategy helps CTOs break down these silos, creating unified data lakes or federated access models. This enables enterprise-grade analytics and real-time decision-making.

Data becomes a strategic asset when AI is applied across claims, policyholder behavior, and risk models. CTOs can drive smarter pricing, proactive risk management, and continuous innovation, all fueled by connected intelligence.

Final Thoughts

AI can elevate insurers, making them faster, smarter, more personal, and more resilient. But only if adopted with intention, transparency, and a long-term view.

The AI adoption framework isn’t just a planning tool; it’s a mindset. It’s a way to honor today’s success while preparing for tomorrow’s reinvention.

Every CTO charting an AI path must remember:

- Tier 1 is about doing things better;

- Tier 2 is about doing new things;

- Tier 3 is about doing bold things that change the game.

The future of insurance isn’t just digital. It’s intelligent. As such, the companies that master all three horizons will be pioneers.