Optimize Brokers’ Efficiency & Productivity While Improving Sales Revenue with BrokerEdge

Digital innovation continues to transform the insurance broker industry. However, in most cases, staying on the digital transformation bandwagon overshadows the need to deliver a cost effective and optimized user experience for brokers. To stay ahead, brokers must provide their customers with the best insurance deals in real-time while ensuring an enriching and seamless experience.

Thus, it is important to have a unified insurance broker platform where applications meant for different insurance processes can “talk” to each other while giving brokers detailed insight on customers in just one click. Addressing this critical need, Damco has introduced BrokerEdge, a comprehensive broker operation management software that meets the grass-root requirements of modern-day brokers and is also equipped to handle the impending changes to make their business future-ready. As the hands behind the best insurance broker software, we understand the unique challenges that insurance brokers face in managing their operations, clients, and policies. That’s why we have developed this unique and powerful insurance broker software tailored specifically to meet the unique needs of a growth-oriented insurance broker like you.

Fueled by decades of technology expertise and insurance domain acumen, Damco’s BrokerEdge is a smart insurance brokerage software that helps brokers stay on top of their key tasks like product and policy administration, client servicing and claims processing across multiple lines of businesses faster, anytime, anywhere. A unique insurance broking software with a single view dashboard to keep a tab on individual and group policy journeys, BrokerEdge also works as an accounting software for insurance brokers and supports end-to-end fronting and co-brokering accounting processes such as opportunity management, underwriting, quote processing, and relationship management, thus driving productivity and business growth. Transform your insurance brokerage with BrokerEdge – our comprehensive insurance broker management software!

How has BrokerEdge Helped Our Clients?

30+

Global Brokers as Proud Users

30%+

Growth in New Client Acquisition

70%+

Improvement in Customer Satisfaction

30%

Improvement in Operational Productivity

27%

Improvement in Conversion Ratio

31%

Improvement in Retention Ratio

Digitize the Broker Operations of Your Choice withBrokerEdge’s Configuration Modules

A powerful and feature rich insurance brokerage software, BrokerEdge digitalizes the broking operations with its scalable, flexible, and easy to configure modules, thus reducing brokers’ costs, time, and efforts.

Product Administration

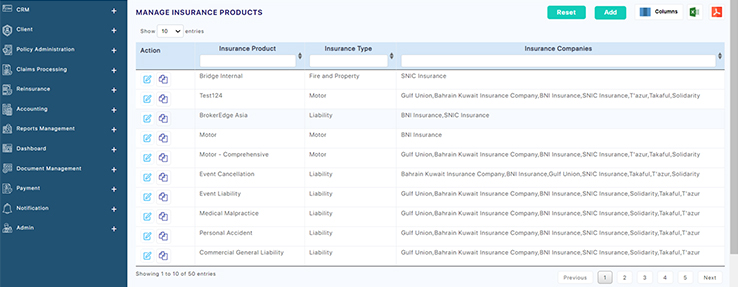

Configure your system, set-up multiple insurance companies, products, and manage automated or manual rates.

Policy Administration

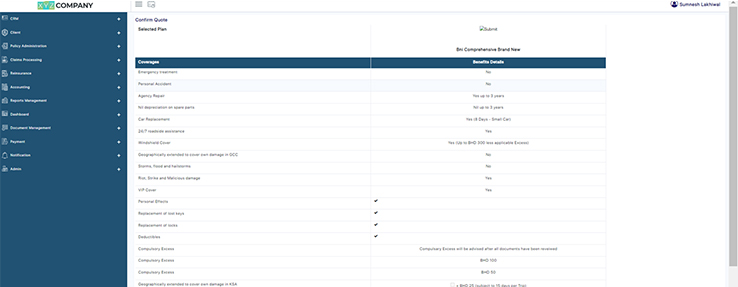

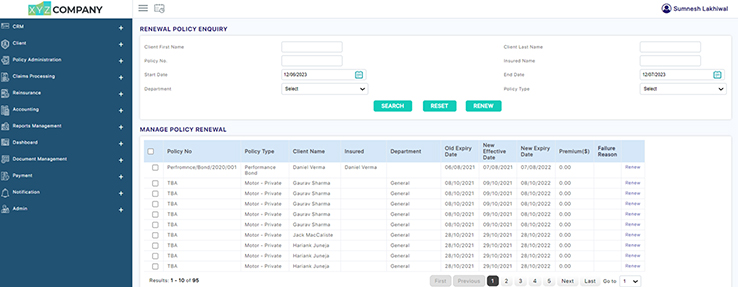

Enable users to create quick quotes, compare quotes, manage binders, perform endorsements, renewals, cancellations and register claims. Auto-generate renewal notices and setup reminders.

Insurer Connectivity

Connect with insurer system with ready APIs or EDI methods. Push or receive all information in real time. Get away with operational redundancy and improve efficiency.

Dashboard & Reporting

Access to all standard & statistical reports out of the box. View them on the dashboard interface available on web and mobile.

CRM

Get a 360-degree view of the customers for better servicing. Assisted sales process to help track your leads end-to-end and engage in up-selling/cross-selling.

Digital Document Repository

Upload documents against a policy or claim and manage them accordingly within this interface. Eliminate paper trails.

Customer Portal

Self-service policies or register FNOL with a quick upload of claim-related photos and videos on either web or mobile platforms. Update profile or make payments against policies.

Producer Portal

Allow producers to register new businesses and manage commissions with the easily configurable agent/producer sections.

Mobile Application

The mobile app lets customers self-service policies, update contact information, view policy status, make payments, report a new claim, and more.

Bridge the Gap Between Insurance Carriers and Customers with BrokerEdge

Download BrochureBrokerEdge’s Value Proposition

BrokerEdge, a comprehensive insurance broking software, supports brokers to focus on all aspects of broking including client services, underwriting, quote processing, claim processing to deliver a seamless customer experience powered by essential features and future-ready functionalities on one platform.

Cutting-edge & Transformative Functionalities

Integrated P&C and Benefits Management

- Supports more than 18 LoBs across Property & Casualty, Specialty, Liability, Life & Health offerings

- Easy management of complex billings with automated employee benefit workflows

Underwriting Guides

- Easy onboarding and management of insurance companies, their logos and addresses

- Quick premium generation via API integrations or rate setups

A Growth Supportive, Pay-As-You-Go Model

- Supports unlimited number of users with no restriction on active users

- A subscription-based SaaS model that can be scaled as the business grows

Automated Insurer Connectivity

- Ready API availability for integration with multiple insurance companies

- Seamless data exchange between systems via API or EDI

Strong & Innovative Technological Functionalities

- Easy quotes comparison from various insurance companies through APIs or Excel uploads

- Seamless digital policy buy out

- Automated quotation journey starting from lead creation and opportunity mapping

- Automated payment reminders, renewal notices, birthday greetings, and occasion-related wishes

- One view or window for managing operations across different products from multiple carriers

Why BrokerEdge for Your Insurance Broking Business?

Single dashboard view of all customers

Reduced manual labor with digitized operations and workflows

Increased efficiency and productivity

Superior process automation and management

Improved customer relationships

Better communication with insurance carriers