Digital transformation has been the buzzword du jour for quite a while now. Everyone, from C-suite executives to entry-level employees, has heard about it and may have even enthusiastically participated in the organizational effort to make it happen. The digital transformation wave has caught on to such an extent that even industries that did not enjoy a high degree of digital maturity have taken the leap of faith to reap its benefits. The same can be said about digital transformation in the insurance industry.

Digital transformation in insurance has given the sector a significant boost. It helps insurers overcome underlying challenges while keeping up with change. It also unlocked new avenues to improve products and services and make them more customer-oriented. If you are still on the fence as to whether it is viable, here’s everything you need to know about insurance company digital transformation.

Table of Contents

What is Digital Transformation Insurance?

Notable Insurance Digital Transformation Trends

Benefits of Digital Transformation in Insurance

Challenges in Insurance Digital Transformation and How to Overcome Them

Steps for Successful Digital Transformation in the Insurance Industry

What is Digital Transformation Insurance?

Digital transformation in insurance means using technology to improve how insurance companies work and serve customers. It helps insurers replace manual processes with faster, simpler digital ones. This includes buying policies, managing claims, and communicating with customers online. The goal is to make insurance easier to access, easier to manage, and more reliable for everyone.

Notable Insurance Digital Transformation Trends

“Today’s insurance ecosystem is not just about the business of selling and servicing (re)insurance or technology enablement through package and custom applications, cloud migration and digital tools. It is about more than leveraging newer technologies, such as machine learning, blockchain and artificial intelligence (AI), and new sources of data from sensors, GIS or IoT.”

– Gail McGiffin, Managing Director and Global Insurance Advisory Lead at EPAM

First, let’s begin by understanding the current market conditions that establish a conducive environment for digital transformation for insurance companies:

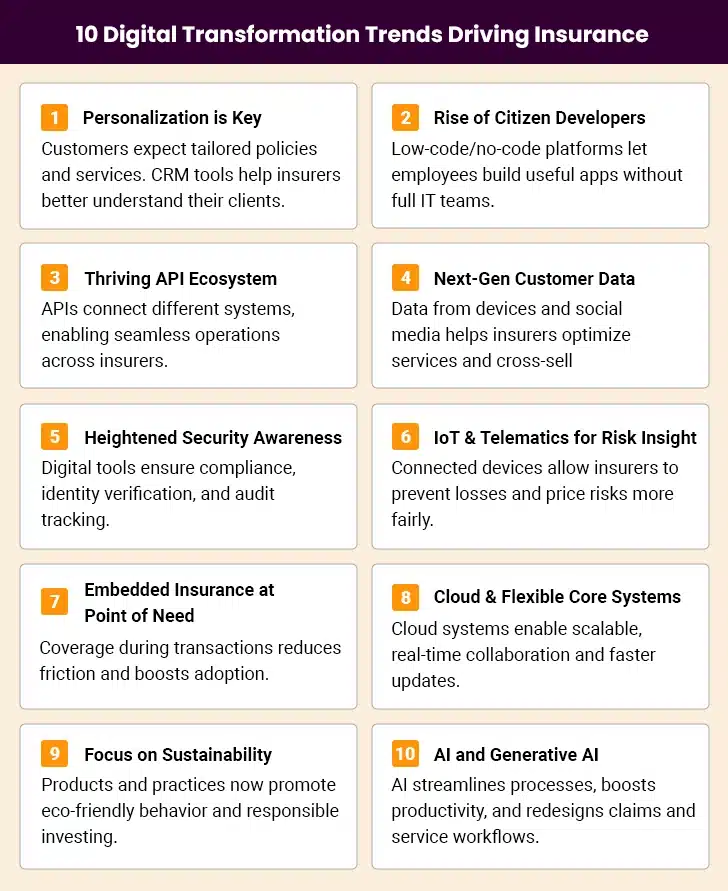

1. Pressing Demand for Personalization

There is no contesting the fact that customers want personalization, be it in marketing or product offerings. With digital transformation in the insurance industry, it is possible to implement end-to-end services and product personalization. Tools like Customer Relationship Management (CRM) platforms allow insurers to gain a 360-degree view of a prospect and tailor campaigns, strategies, and policies based on their profile. Making allowances for customer preferences helps insurers lay the foundation for meaningful customer relationships.

2. Rise of the Citizen Developer

Insurers have hesitated to embrace digitalization due to the hassles of selecting and retaining an in-house development team to build customized solutions. Not to mention that the timeline for such product deliveries is stretched so far that it may border on obsolescence. Low-code and no-code platforms have made it easier for laypersons to develop niche digital solutions. As such, existing team members can be an asset in developing practical, usable solutions to replace legacy systems.

3. A Thriving API Economy

The insurance sector is highly segmented, with various stakeholders using digital tools that align with their tech stacks. As such, gaining familiarity with disparate ecosystems is a challenge presented by insurance company digital transformation. With an Application Programming Interface (API), it is possible to integrate different products and services and patch them together into a digital universe that operates seamlessly. By connecting disparate systems, APIs act as the glue that holds the entire digitized vertical of the insurance industry together.

4. Next-Gen Customer Data Availability

Data is the fuel that drives the insurance industry. Everything – from customer name to policy number is data, which comes in handy while processing customer requests. With digitalization, insurers can leverage data intelligently to optimize the use of their resources and assets.

At the same time, the influx of first-party customer data, whether through social media or smart wearable devices, makes it easier to enhance products and services. Consolidated customer data across multiple lines of business, is an excellent way to improve cross-sell and up-sell opportunities and accelerate revenue growth.

5. Growing Awareness Around Security

Insurance is a highly regulated industry. Failure to comply with the extant laws or guidelines could hamper the insurance business. At the same time, any lapses attract hefty fines and public distrust. Digital transformation for insurance companies plays a crucial role in safeguarding their interests and those of policyholders by establishing a comprehensive system of checks and balances. From identity verification to traceable auditing, digitalization ensures compliance on all fronts.

6. IoT and Telematics for Proactive Risk Insight

Connected devices such as vehicle trackers, home sensors, and health wearables are slowly reshaping how insurers understand risk. These devices continuously share usage and behaviour data, giving insurers a clearer picture of real-world conditions. Instead of relying only on historical records, insurers can now assess risk as it unfolds.

This shift allows insurance companies to move from reactive models to preventive ones. For example, alerts about unsafe driving or water leaks can help reduce losses before they occur. Over time, this leads to fairer pricing, fewer claims, and stronger trust between insurers and policyholders.

7. Embedded Insurance at the Point of Need

Insurance is increasingly becoming part of everyday transactions. Rather than purchasing coverage separately, customers are offered insurance at the exact moment it makes sense. This could be while booking a trip, buying a gadget, or signing up for a service.

This approach reduces friction and decision fatigue for customers. It also helps insurers reach people when coverage feels relevant rather than forced. Embedded insurance simplifies access and quietly improves adoption without aggressive selling. In fact, BCG reports that embedded insurance could account for over $70 billion in gross written premiums by 2030.

8. Cloud Migration and More Flexible Core Systems

Many insurers are gradually moving away from rigid legacy systems that are costly to maintain and slow to change. Cloud and hybrid environments offer greater flexibility and reliability. They allow insurers to scale operations based on demand and support faster updates across systems.

This transition also improves collaboration across teams and geographies. With data and applications accessible in real time, insurers can respond faster to market shifts, regulatory changes, and customer expectations.

9. Growing Focus on Sustainability and Responsible Practices

Environmental, social, and governance considerations are influencing insurance strategies more than before. Customers are becoming aware of how businesses operate, not just what they sell. Insurers are responding by offering products that encourage responsible behavior, such as discounts for eco-friendly homes or safe driving habits. Beyond products, sustainability also shapes investment decisions and risk assessment. This steady shift reflects a more thoughtful approach to long-term growth and resilience.

10. AI and Generative AI

AI is becoming central to insurance’s digital transformation. Research shows that insurers who adopt AI early and at scale capture significantly more value than those moving slowly. Service and operations teams supported by AI-powered knowledge assistants have achieved productivity gains of over 30 percent, enabling employees to respond faster and with greater confidence.

Today, insurers fall into three broad stages of AI adoption. Some remain limited to small pilot projects with low investment. Others experiment across teams with moderate spending and local impact. The most advanced insurers invest $25 million or more annually. They are using AI to redesign end-to-end processes across claims, service, and operations.

Benefits of Digital Transformation in Insurance

When one considers the advantages as a whole, it is evident that digital transformation for insurance companies offers, satisfied customers, higher profit margins, and accelerated yet sustainable growth. Here’s a quick dive into the benefits of insurance digital transformation:

I. Faster Claims Processing and Settlements

Digital tools allow insurers to handle claims much faster than before. Instead of sending paperwork back and forth, customers can upload photos and documents online, and systems can assess them quickly. This reduces waiting times. Faster settlements build trust and lessen anxiety for customers when they need help most. Automated checks also reduce mistakes, making the process more accurate. This improvement in speed and dependability helps insurers stay competitive while providing a smoother, more reassuring claims experience for policyholders.

II. Improved Customer Experience and Convenience

Digital transformation gives policyholders simple, anytime access to their accounts through apps or websites. Customers can check policy details, pay premiums, or start claims without speaking to an agent. This removes the need to visit offices or wait on hold, creating an effortless experience that feels familiar to people accustomed to online services in other parts of their lives. Insurers can also use data to offer personalized suggestions that make customers feel understood and valued. Better experiences often lead to stronger loyalty and more referrals.

III. Lower Operational Costs

By turning manual tasks into digital processes, insurers can greatly reduce costs. Work that once required many hours of human effort can now be done automatically. This not only saves money but also frees employees to focus on tasks that need human judgment, such as helping confused customers or designing new products. Over time, these savings can be reinvested into growth, new services, or better training, giving insurers a firmer, more resilient foundation.

IV. More Accurate Risk Assessment

Digital transformation enables insurers to analyze large volumes of data quickly. This helps them understand patterns in customer behavior, weather events, health trends, and more. With better insights, insurers can more precisely estimate risk for each policyholder. This accuracy benefits customers by making pricing fairer and policies better aligned with real needs. It also helps insurers avoid losses by reducing guesswork in underwriting and pricing, making the entire system more equitable and robust.

V. Better Fraud Detection and Prevention

Insurance fraud costs the industry billions every year. Digital systems can detect unusual patterns and anomalies that would be very hard for a human to spot. By analyzing claims data in real time, insurers can flag suspicious cases early and investigate them promptly. This protects honest customers from higher premiums caused by fraud and saves companies substantial amounts of money. With clearer digital records, insurers can trace actions more easily, making the entire ecosystem more trustworthy and secure.

VI. Enhanced Risk Management

Risk is the essence of insurance, and digital transformation improves how it is measured and managed. Insurers can now use real-time data to monitor sudden shifts, such as rising crime in a region or an uptick in weather-related claims. This continuous risk monitoring makes planning more precise. Instead of reacting only after losses occur, insurers can take preemptive steps that protect both themselves and their customers. This predictive clarity fosters a more stable and resilient business model.

VII. Instant Policy Issuance and Onboarding

Traditionally, starting a new policy could take days or weeks, with agents checking paper files and double-checking information by phone. Digital systems can verify identity and data instantly as customers submit them online. This means someone can be fully insured within minutes, creating an excellent first impression and strengthening the bond between the customer and the insurer.

Quick onboarding also helps insurers grow faster, as simple products become easier for customers to buy without barriers or delay.

VIII. Enhanced Transparency and Trust

Digital platforms let customers view up-to-date information on their policies, claim status, and premium history at any time. This openness removes uncertainty and fosters confidence. Customers no longer have to wonder whether a claim is stuck somewhere or whether a payment was received; they can check for themselves. This clear, open flow of information deepens trust between insurers and policyholders. It also helps regulators and internal managers monitor activities without confusion, thereby improving accountability.

X. Greater Organizational Adaptability

Insurance markets shift quickly when events such as natural disasters, economic changes, or new laws occur. Digital transformation gives insurers the agility to adjust products, pricing, and processes without long delays. Systems that can be updated quickly allow companies to stay relevant and responsive. This adaptability helps insurers avoid stagnation and keeps them able to respond with resilience and nimbleness in the face of uncertain conditions.

XI. New Opportunities for Growth and Innovation

Once core processes are digitized, insurers can explore new offerings that were previously hard to deliver. For example, they can bundle services such as home security alerts or health and wellness programs that tie into insurance plans. Digital transformation also enables partnerships with other service providers, opening fresh revenue sources beyond traditional premiums. This expansion into adjacent areas strengthens customer relationships and makes insurance feel more useful and relevant in daily life.

Embark on Your Digital Transformation Journey

Challenges in Insurance Digital Transformation and How to Overcome Them

Insurance digital transformation is not without its challenges. Many insurers struggle with legacy systems, slow internal adoption, and the complexity of managing change at scale. However, these challenges can be overcome with a clear roadmap, phased implementation, and strong leadership support.

1. Legacy System Dependency

Most insurance firms continue to use legacy systems that are slow, rigid, and costly to maintain. In addition, they are difficult to integrate with newer digital solutions.

To get around this, insurers must transition to cloud-based solutions in phases. APIs can be implemented to bridge the gap between old and new systems, making operations smoother. A phased rollout approach should be followed, with the core processes upgraded first to reduce disruption while embracing new technologies.

2. Regulatory Compliance and Legal Barriers

The insurance sector is highly regulated, with strict regulations on data protection, cybersecurity, and equitable pricing. Digital transformation programs must keep pace with evolving laws, which can be intricate and time-consuming.

To overcome this challenge, insurers need to collaborate closely with legal professionals and regulatory authorities. Investing in compliance automation tools and AI-based monitoring helps insurers stay compliant with regulations. Audits and employee training on compliance best practices further minimize legal exposures.

3. Employee Resistance to Change

Most employees are likely to resist digital change for fear of losing their jobs or due to an inability to work with new technologies. Such resistance slows down the implementation process and reduces efficiency.

Insurers must concentrate on change management to counter this. Offering on-the-job training, workshops, and ongoing assistance helps employees build confidence with new digital technologies. Leadership must clearly articulate the advantages of digital transformation and engage employees in decision-making. Identifying and rewarding employees who adopt digital change can also stimulate adoption.

4. Lack of Digital Skills in the Workforce

Most insurance professionals are skilled but lack the technical know-how to run sophisticated digital platforms. Without training, digital transformation in insurance will not be maximally effective.

To counter this, companies can invest in ongoing learning initiatives. Collaborating with technology firms and similar learning institutions can offer specialized training for workers. Promoting a digital-first approach through upskilling initiatives and certifications makes the shift into the digital age easier.

5. Integration Challenges Between Various Technologies

Insurance firms employ numerous digital tools in multiple processes such as underwriting, claims adjudication, and customer support. In most case, the tools do not integrate well, resulting in inefficiencies.

APIs and cloud-based platforms bring disparate systems together, creating a seamless digital experience. Careful research must be done before incorporating new technologies for compatibility. Collaborating with knowledgeable technology consultants also helps simplify the integration process and reduce downtime.

6. Customer Adoption Challenges

While younger customers can readily adopt digital insurance services, older customers can find it difficult to navigate online platforms and might prefer conventional interactions.

To address this, insurers can offer a hybrid solution that integrates digital self-service with human assistance. Making digital interfaces easy to use, providing chatbots for help, and giving step-by-step instructions eases the process for all customers. Implement multiple customer support channels, including phone, email, and live chat, to enhance digital adoption.

7. Handling High Volumes of Data

The insurance sector generates huge volumes of data, ranging from customer data to claims history. If not managed, data can quickly become overwhelming and difficult to analyze properly.

Insurers can process large datasets quickly through artificial intelligence (AI) and machine learning (ML). Insurers can also centralize data repositories through cloud solutions and integrate real-time analytics tools. Data hygiene practices such as regularly updating redundant records, help maintain data accuracy and usability.

8. Providing Seamless Customer Experience

An underwhelming digital experience can enrage customers and prompt dissatisfaction. Dull navigation, slow response rates, and inadequate personalization can push customers away.

To enhance customer experience, insurers must invest in friendly interfaces, mobile apps, and AI-enabled chatbots that respond instantly. Soliciting customer feedback and regularly enhancing digital platforms delivers a smooth, pleasant experience. Personalization powered by AI and analytics can take a step further in improving customer engagement and fostering long-term loyalty.

Overcoming these challenges is possible with careful planning and execution. Our case study illustrates how we helped a multi-line insurer successfully navigate its digital transformation journey.

Steps for Successful Digital Transformation in the Insurance Industry

Digital transformation in insurance requires a clear direction and execution. While products and regulations may differ, the core approach remains consistent. Irrespective of the lines of business, the insurance digital transformation journey is broadly the same and involves the following key steps:

Step I. Conduct a pan-organization review of the existing processes, deficiencies, and tech stacks.

Step II. Identify urgent gaps and prioritize them by impact. While doing so, also identify areas/tasks that can be automated.

Step III. Create a digital transformation roadmap with milestones that detail the end goal, stakeholders, anticipated outcomes, and related details. Circulate it across the organization to sensitize everyone and bring them on board.

Step IV. Make data hygiene a priority and implement a robust data management system that centralizes data for consistency.

Step V. Prepare for migration to a cloud-first, modern infrastructure and gradually replace legacy systems with digital alternatives.

Step VI. Train and sensitize employees, agents, brokers, etc., and motivate them to adopt digital solutions.

Step VII. Analyze, assess, and monitor to streamline processes, workflows, products, and services.

Thus, we have covered People, Process, and Technology, the three primary pillars of digital technology. Do note that these steps are merely indicative and the overall digital transformation in insurance strategy varies from business to business.

Closing Thoughts

Insurance industry digital transformation is no longer just a nice-to-have feature or a competitive differentiator; it is the medium to make your business future-ready. With the insurance digital transformation trends pointing in a favorable direction and the ever-increasing Insurtech options available, now is an excellent time to take the plunge and get started with your insurance industry digital transformation journey.

Schedule a consultation with an expert from Damco and you will have a reliable tech partner, mentor, and enabler to accompany you along the way!