Vast volumes of unstructured data. Inflationary pressures on claims. Increasing customer expectations. Escalating risks. This is the face of today’s global insurance industry. Regulatory changes drive insurers to adjust their customer acquisition strategies away from pricing and shift their focus toward brand loyalty, customer experience, and product innovation. Moreover, insurance firms must focus on value generation through new products while reducing claims costs to remain profitable in a rough market with limited scope to adjust pricing.

Are these challenges intimidating? Sure. Are they unbeatable? Not if insurers know how to act!

To steer their firms successfully through these challenges while optimizing long-term business value, insurers have begun to consider deploying generative AI or Gen AI seriously. According to Oxford Economics, Gen AI could augment the USA’s GDP by 1.8%-4% by 2032. And as an industry, insurance is poised to benefit significantly, given the treasure of massive unstructured data and the widespread reliance on manual processes across underwriting and claims management.

Table of Contents

Select a Core Operational Area for Gen AI to Improve Key Processes

Focus on E2E Domain-Level Transformation to Achieve Greater Value

Emphasis on Gen AI and AI and Their Integration with Other Technologies

Adopt a Strategic Approach Toward Build, Buy, or Wait

Develop Reusable Codes to Ensure Maintainability and Scalability

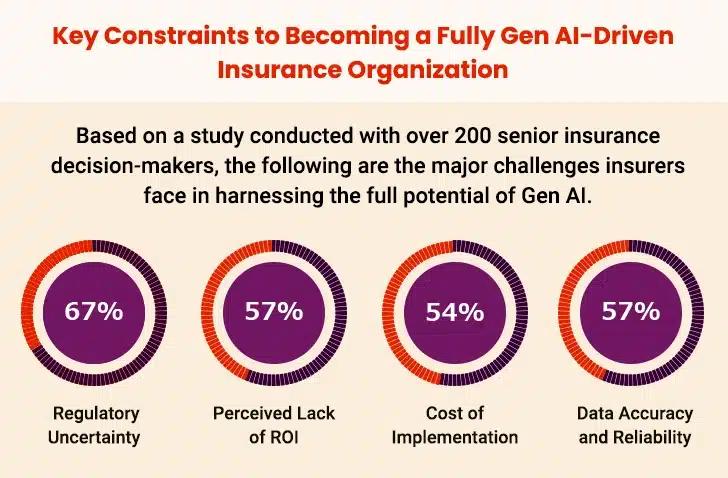

Insurance firms have a clear understanding of these opportunities. According to a recent McKinsey survey of over 50 executives from Europe’s leading insurance groups, more than half predicted that Gen AI could lead to 10-20 percent productivity gains, 1.5-3.0 percent premium growth, and 1.5-3.0 percent improvement in technical results. At the same time, one-third of respondents stated that they have initial Gen AI use cases in the pipeline, 20 percent categorized their AI maturity as advanced, and 60 percent stated their data is dynamically ‘evolving’. However, certain hurdles are keeping several insurers from making significant strides in the Gen AI journey.

Though challenges like compliance, OpEx, and data concerns are immense, the facts mentioned above showcase the transformed equation between the insurance industry and technologies like Gen AI. The question is no longer if insurance organizations should adopt Gen AI but how to do so most effectively. Based on our experience and work with leading successful AI journeys in the insurance industry, we’ve narrowed down six key traits that set leading Gen AI adopters apart.

Select a Core Operational Area for Gen AI to Improve Key Processes

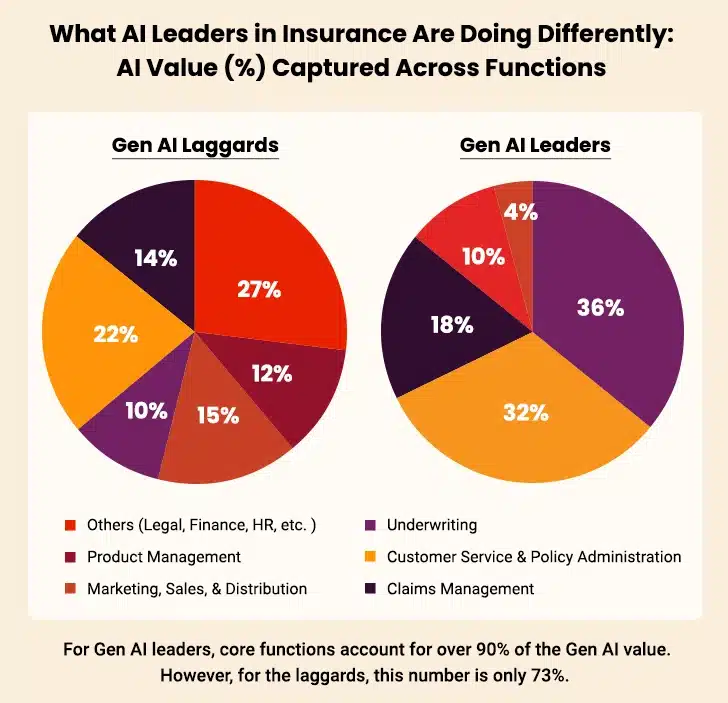

Frontrunning insurers strategically deploy Gen AI to transform their core business operations. The idea is to find top-priority functions that Gen AI can improve to fundamentally transform the insurance business model.

- Establish the next milestone for cloud strategy and functional teams. For the successful launch and scalability of Gen AI use cases, it is vital to establish a cross-functional team and a robust cloud strategy.

- Balance performance with cost for long-term flexibility. It is essential to understand and maintain the ratio of costs versus performance. Choose components and individual models that prioritize flexibility and scalability without the complexity of vendor lock-in.

- Address the data challenge upfront. Addressing data-related concerns before building the AI tool is a prerequisite. For insurance, this means capturing data in age-old paper-based documents and converting it into a pre-defined digital format.

- Double down on investments in adoption and change management. Driving Gen AI adoption at scale, when it can lead to massive productivity gains, requires equal focus and investments in change management, user engagement, and training.

“If you’re not embarrassed by the first version of your product, you’ve launched too late.”

– Reid Hoffman, LinkedIn Co-Founder

Focus on E2E Domain-Level Transformation to Achieve Greater Value

To unlock Gen AI’s real potential and drive greater value, leading insurers focus on a more holistic approach of comprehensive, end-to-end domain and subdomain transformations rather than individual use cases. This involves identifying end-to-end processes within a domain connecting several Gen AI use cases. The key question to be asked here is: Which domain stands to benefit the most from a full-scale E2E transformation?

Consider the claims process domain. While applications such as customer services, fraud detection, settlement optimization, and claims eligibility checks through Gen AI-powered chatbots are beneficial on their own, a full-scale E2E transformation of the entire claims processing domain could multiply the impact manifold. This is the potential of synergies, where different use cases connect, interact, and reinforce each other, creating a more efficient and cohesive ecosystem.

Emphasis on Gen AI and AI and Their Integration with Other Technologies

Tools such as ChatGPT have successfully created hype around Gen AI; however, the holistic value of AI in insurance is divided into 60-80 percent from traditional AI and the remaining 20-40 percent from Gen AI. Organizations leading the Gen AI game in insurance understand these numbers and ensure their Gen AI initiatives complement, not replace, the traditional AI use cases. The key question is, “How to create a systematic mapping of our business that discovers improvement opportunities, whether driven by GenAI, AI, or any other tech stack?”

For instance, call center interactive voice response systems and analytics rules can be augmented with Gen AI-driven intent identification and action. Moreover, an AI-powered claims severity system can be combined with proactive Gen AI claims prevention by adding a layer of weather data and personalized outreach initiatives. This comprehensive approach ensures that organizations benefit from AI, Gen AI, and other technologies to bring holistic improvements across diverse operations.

Are You Ready to Lead with Gen AI?

Adopt a Strategic Approach Toward Build, Buy, or Wait

Frontrunning organizations develop a clear perspective on where and when to develop in-house Gen AI solutions versus purchasing off-the-shelf systems. This balance ensures that such organizations harness the benefits of advanced technologies while averting the vendor lock-in risk. The right question to be asked here is, “What are the business areas that we want to develop as our competitive edge and, therefore, need in-house Gen AI applications?”

In a scenario involving LLMs with sensitive, proprietary data, opting for a bespoke solution is better. Contrarily, the requirement of Gen AI applications, which can be integrated with existing platforms such as CRM, off-the-shelf options are more practical, especially when minimal customization is required. Such a strategic approach ensures that insurers invest in developing capabilities where they matter while leveraging external capabilities to improve effectiveness and efficiency.

Develop Reusable Codes to Ensure Maintainability and Scalability

For insurance firms choosing to develop their own Gen AI solutions, it is vital to develop code components and workflows that are entirely reusable. Such reusable components can be configured into different modules and application frameworks and repurposed for different use cases. The question to be asked is, “What core modular components do we need, and how to create a scalable blueprint to assemble these components efficiently?”

Consider Risk Management as a Vital Aspect

For effective risk mitigation, it is critical to ensure the involvement of a dedicated risk team in product development from the beginning. The question to ask is “How does the development of Gen AI applications enable better risk management?”

The risk management team can define various risk frameworks across key departments with fail-safe measures, including real-time performance monitoring, and trigger the alarm if issues arise. This collaborative approach embeds risk mitigation into the application development process from day one.

In a dynamically evolving insurance landscape with disruption and complexity as new norms, Gen AI is no longer one of the many trends but a strategic imperative. Insurers who act decisively with a set vision and well-thought-out roadmap have already started unlocking significant value across customer experience, agent productivity, and profitability. The winners are eventually the ones who focus on blending AI innovations with practical execution, with a focus on high-impact domains. The frontrunners have solved the puzzle of integrating Gen AI with existing technologies, balancing build and buy, and embedding risk management. They have understood that Gen AI is not a tool but a transformation catalyst. The question is, are you ready to be the frontrunner or play catch-up?