Insurers have been leveraging the art of predictive analysis for decades. In the early days, insurers worked with limited resources and reference points, which made policy pricing mostly intuitive. However, modern-day predictive analytics tools perform holistic and well-rounded analysis of several data points to make informed decisions on pricing and customizing policies. According to a survey, more than 80 percent of European life insurers that leverage predictive analytics reported a positive business impact. In this post, we will briefly discuss the concept of predictive analytics in insurance and witness a few use cases in action.

What is Predictive Analytics?

Predictive analytics is a branch of data analytics that deals with interpreting and analyzing data to generate forecasts regarding the risks and probabilities of the events that take place in the future. From its very definition, it becomes abundantly clear that predictive analytics in insurance underwriting can find immense usage in several applications. Let’s take a look at how predictive analytics serves as a basis to develop models that can make predictions in insurance.

What is Predictive Modeling in Insurance?

Predictive modeling in insurance utilizes techniques like data mining, statistics, artificial intelligence, machine learning, deep learning, and more, to analyze and comprehend the large data sets. These findings are then made available in the form of highly detailed reports that highlight the level of risks and other factors that may govern policy formulation and underwriting.

Core Strengths of Predictive Analytics

The key benefits offered by predictive analytics for insurance businesses are:

Cost Savings

Insurers can leverage predictive analytics tools to gain meaningful insights and use them to make better decisions, plug gaps, and optimize business processes. All of these enable insurers to cut operational costs.

Identifying Potential Markets

Predictive analytics can help insurers identify and target potential markets where business opportunity is high. Demographic data can reveal behavior patterns and characteristics, so insurers know where to target their sales and marketing efforts at.

Providing a Personalized Experience

By leveraging predictive analytics, insurers can quickly and accurately consolidate data from multiple sources to generate new insights that paint a more complete picture of their customer. They can understand the buying habits and risk profiles in a better way to drive interactions positively. It also provides the capability to comb through IoT-enabled data to understand the needs, desires, and advice of their customers.

Optimized Resource Utilization

Predictive analytics in insurance makes it easier to assign resources to higher-priority tasks to ensure the smooth discharge of business. By improving resource availability and uptime, it offers a boost to overall productivity.

Introduce New Tailored Products and Services

With predictive analytics, insurers can anticipate future requirements. Such inputs can help them fine-tune the specifications of the existing products and services to enhance customer satisfaction and profitability. At the same time, these insights may also allow insurers to diversify their offerings.

Applications and Use of Predictive Analytics in Insurance

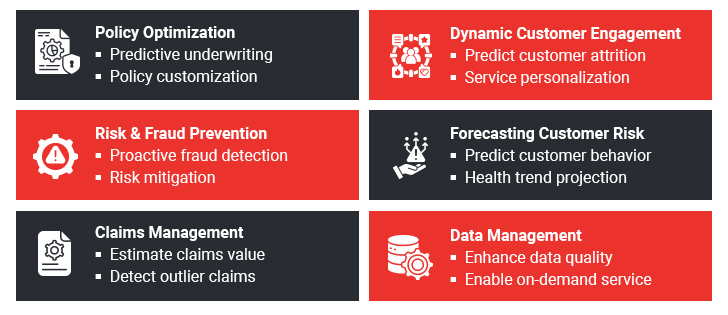

The following are some of the current applications of predictive analytics for insurance:

1. Policy Optimization

Traditionally, policy pricing followed a tiered approach where insurers would adjust the customer against specifications that they deemed them fit. However, as personalization takes the center stage, one can no longer follow the one-size-fits-all model.

With predictive analytics in underwriting, insurers can now customize policy plans by tapping into granular customer data. They can gain insights by analyzing historical data to understand customer preferences, price sensitivity, and behavioral signals.

For instance, predictive underwriting in life insurance can help insurers match the policy specifications and cost in line with the expectations of the customers.

Similarly, the policy can accommodate external dynamic factors, such as market conditions, associated risks, risk concentrations, etc. Resultantly, the insurers can then adjust the premiums on a case-to-case basis.

2. Risk and Fraud Detection

If you wish to address insurance fraud, predictive analytics can be of great help.

For instance, predictive analytics software can collect customer data to extract behavioral information that one can correlate with fraudulent or high-risk activities. It can flag down suspicious customer patterns and alert insurance agencies in real time. In fact, businesses can maintain a record of such instances to assign risk scores against problematic clients.

Using predictive analytics, carriers can also retroactively pursue corrective measures. For example, many insurers use social media data for signs of fraudulent behavior, leveraging data gathered after a claim is settled to monitor insureds’ online activity for red flags.

On the other hand, insurance agencies can also use it to tackle internal fraud and application manipulation. It serves as a forensic tool that points towards fraud. Businesses can make use of predictive modeling in insurance to implement transparency and accountability among all their employees.

3. Insurance Claims Management

Insurance claims management is a highly data-intensive limb of insurance processing and involves several variables and input points. According to US insurance fraud statistics, in 2020 alone, 18 percent of all insurance claims contained an element of fraud. By using predictive analytics for insurance claims management, insurers can automate, detect fraud, extend self-servicing options, and offer faster payouts. It streamlines and standardizes the end-to-end process with due consideration for disruptive exigencies. The application of advanced predictive analytics in insurance claims can make the end-to-end FNOL process, involving claims triage, more quick and agile. Furthermore, such predictive analytics platforms can easily integrate with existing or legacy software, which furthers your attempt at digitalization.

Predictive analytics can help insurers identify claims that unexpectedly become high-cost losses, which are known as “Outlier Claims”. P&C insurance companies can review previous claims for similarities – and send automatic alerts to claims handlers. Advanced notification in this area can help insurers cut down on these outlier claims.

4. Dynamic Customer Engagement

According to a KPMG report report, customer experience has emerged as the most vital KPI to measure insurance business performance.

We have already gone into the specifics of how predictive analytics in insurance underwriting will set the stage for customizing services and optimizing policies. That, by itself, lays the foundation for a heightened customer experience and subsequent customer loyalty.

When it comes to boosting the customer experience, the use of predictive analytics in insurance is far-reaching. There are many ways through which companies can use predictive analytics to drive customer engagement and loyalty. For example, predictive analysis can help comprehend user intent when they approach customer service. Similarly, predictive analytics-driven automation can streamline the claims settlement process and make it painless. As a matter of fact, one can even leverage predictive analytics to understand application abandonment issues and take corrective measures to fix them!

Predictive analytics can also focus on the history and behavior of loyal customers and anticipate their needs. This insight can be used by insurers to modify their current process or products based on the information which may help them increase their loyal customer base.

All in all, such proactive measures will improve customer engagement levels.

5. Forecasting Customer Risk

Predictive analytics and AI-driven solutions can help insurers categorize their customers based on their risk profiles. For example, health insurers can leverage predictive analytics for gauging the mortality and morbidity risks associated with individual customers. Such insights help insurers customize and fine-tune the insurance policies to match the risk profiles of a diverse clientele.

Additionally, predictive analytics in insurance also helps insurers gain a 360-degree view of the customer. The intricate analysis of customer data goes beyond generic risk assessment. Rather, it helps insurers get a better understanding of mortality and morbidity risk factors. Gaining a nuanced perspective on a customer’s risks enables insurers to optimize policies in a way that ensures adequate coverage and risk mitigation.

6. Data Management

Data is the most valuable resource in today’s business landscape. As such, leveraging predictive analytics in the insurance industry enables insurers to maximize the potential of available data. From optimizing underwriting processing to supporting straight-through claims processing, predictive analytics, and data have been working in tandem to furnish invaluable insights to insurers for a while now.

However, the catch is that in order to extract maximum value out of data, insurers must have robust data management capabilities. Predictive analytics for insurance companies can refine data quality, integrate disparate datasets, and identify intricate patterns. Through data management solutions, predictive analytics tools can create comprehensive customer profiles, identify new opportunities, and determine customer profitability. Insurance data modelling can enable insurers to harness invaluable insights obtained from data management systems to offer on-demand services to customers through cloud-based platforms.

Deliver Business Growth with Data-Driven Intelligence

Final Thoughts

According to a pre-pandemic survey, more than two-thirds of insurers credited predictive analytics with reducing issues and underwriting expenses, and 60% say the resulting data was helping them increase sales and profitability. With the maturation of data-driven analytical technology, these statistics related to the positive impact of predictive modeling in insurance are bound to grow at an accelerated rate. At the same time, embracing predictive analytics in insurance could be the key to thriving in this highly competitive market. Companies that exploit this positive trend will naturally manage to be successful in increasing their market share while boosting customer loyalty.

Case in Focus

A leading claims adjuster partnered with us to address challenges in property estimation. We leveraged advanced tools and technologies such as OCR, ML, Pytorch, and Fast AI and developed an advanced neural network AI model for image processing. It helped rectify inaccuracies in loss estimates and ensured precise identification of roof materials. As a result, the claims adjuster was able to improve its accuracy in the loss estimation reports and gain a competitive edge. To know more, refer to the complete case study.