A policy management system can reduce the time to create a policy, manage, and communicate policies and procedures more efficiently which ultimately drives better customer experiences. But how exactly can this software drive growth for your business? And how to choose one for your business? Let’s find out.

A policy management system can reduce the time to create a policy, manage, and communicate policies and procedures more efficiently which ultimately drives better customer experiences. But how exactly can this software drive growth for your business? And how to choose one for your business? Let’s find out.

Table of Contents

Challenges in Manual or Legacy Policy Management Systems Key Features of Insurance Policy Software Choosing the Right Policy Software: A Step-by-Step Approach Summing UpChallenges in Manual or Legacy Policy Management Systems

Traditional policy management typically relies on manual processes which contribute to variations, errors, delays, data silos, and heavier administrative burdens. With this context, it comes as no surprise that around two-thirds of life insurance carriers find manual data collection clogs business processes and erodes profits. Not to mention that the increasing and inflationary burden of resource requirements – be it in the form of staff, real estate, consumables, etc. – only makes traditional policy management highly inefficient and unsustainable.As a result, traditional policy management presents severely limiting challenges that hinder growth and minimize profit margins, which leaves insurers struggling to stay in the green.

Key Features of Insurance Policy Software

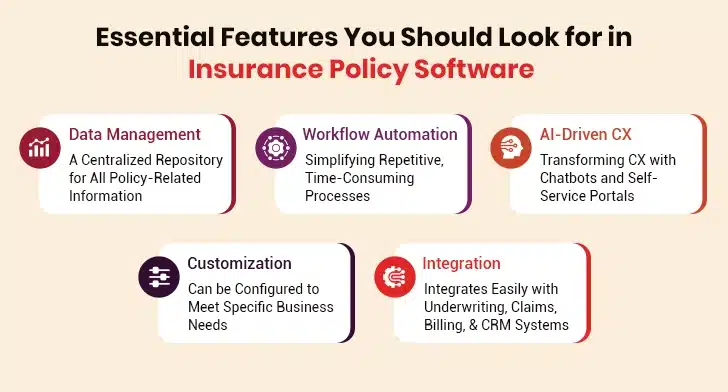

From the above, it is evident that insurers are left to their devices to digitize and select a software solution that caters to their requirements. However, with the wealth of options available in the market, choosing just one can be a tough task. Fortunately, insurers can zero in on the insurance policy management systems worth their salt by seeking out the following features:

From the above, it is evident that insurers are left to their devices to digitize and select a software solution that caters to their requirements. However, with the wealth of options available in the market, choosing just one can be a tough task. Fortunately, insurers can zero in on the insurance policy management systems worth their salt by seeking out the following features:

1. Data Management

In the fast-paced and highly customer-focused insurance landscape, efficient data management, and its governance and security serve as a foundation for sustainable business growth. To understand its implications, consider this: better management of data can help save a business $12.9 million every year.2. Workflow Automation

Policy software powered by automation technologies can be a game-changer for insurers seeking to drive accelerated growth. By automating repetitive and time-consuming tasks such as policy issuance, renewals, endorsements, and claims processing, insurers can significantly enhance operational efficiency. This efficiency translates into faster turnaround times, improved customer service, and the ability to handle a larger volume of policies and claims. Moreover, automation ensures accuracy and regulatory compliance, thereby reducing compliance and regulatory risks. With these advantages, insurers can redirect their human resources toward strategic initiatives, product innovation, and expanding their market presence.3. AI-Driven CX

Artificial Intelligence (AI) is a notable disruptor, enhancing the capabilities of all software solutions, and policy software is no exception.

With AI-powered tools, policy management gains a competitive edge as insurers manage to transform the customer experience (CX), deliver accuracy and reliability, and offer convenience, all packed in one. It is the underlying technology behind innovations like data analytics, predictive modeling, data-driven risk assessment, chatbots, and more. Each of these can simplify the insurance value chain and streamline processes.

It also unlocks opportunities for self-service by allowing customers to access policy-related information or to raise claims. Seeing as how 88% of customers prefer this facility, policy lifecycle management software can propel CX to new heights.

Artificial Intelligence (AI) is a notable disruptor, enhancing the capabilities of all software solutions, and policy software is no exception.

With AI-powered tools, policy management gains a competitive edge as insurers manage to transform the customer experience (CX), deliver accuracy and reliability, and offer convenience, all packed in one. It is the underlying technology behind innovations like data analytics, predictive modeling, data-driven risk assessment, chatbots, and more. Each of these can simplify the insurance value chain and streamline processes.

It also unlocks opportunities for self-service by allowing customers to access policy-related information or to raise claims. Seeing as how 88% of customers prefer this facility, policy lifecycle management software can propel CX to new heights.

4. Customization

The uniqueness of every insurance business calls for equally unique software. However, the associated costs of such software development and the highly typical talent requirement can discourage even the most established insurance companies from getting a bespoke solution. In such cases, the customization capabilities are the next best thing. Even if insurers invest in white-label solutions, the software should be configurable to a degree that it matches the specific business requirements. From tailoring workflows to editing forms to generating detailed reports of focus areas, a competent software solution will transfer control into the hands of the insurer.Accelerate Growth with a Unified Policy & Claims Management Software

5. Integration

There is no contesting the fact that we are living in the InsurTech era. This means that almost every insurance workflow or process has a digital equivalent. Whether businesses have achieved this already or plan on doing it in the near future, they need to plan their digital assets in a manner that everything fits cleanly and works frictionlessly in the digital infrastructure. For this reason, there is a strong need for software with powerful integration features to make your insurance business future-ready. After all, such a platform would not operate in a vacuum. If anything, it will work closely with other systems and frameworks, like underwriting, claims, billing, and CRM solutions.Choosing the Right Policy Software: A Step-by-Step Approach

Now that we have discussed the essential features insurers should look for in policy software, let’s discuss how they can choose one to meet their business needs.1. Assess Business Needs

Insurance companies often rush into implementing new software without understanding their own operations. That’s why a majority of these projects fail. Before selecting any policy software, insurers must get a full picture of their operations. A review of the existing workflows helps find bottlenecks that slow things down. Policy complexity is a common cause of concern among insurers. Complex, tedious applications drive many of their customers away. Claims processing, arguably the most important customer touchpoint, often suffers from delays and complicated procedures that erode trust. Additionally, insurers handle massive amounts of data in many formats. In the absence of a system with strong data integration features, proper assessment of risks may become difficult. Plus, insurance workflows involve a lot of repetitive back-office tasks (e.g., processing forms and issuing policies) that require automation. A well-crafted Request for Proposal (RFP) becomes useful at this stage. A thorough RFP makes it easy to compare vendor solutions against your specific business requirements.2. Define Must-Have Requirements

Picking the right software starts with knowing exactly what your organization needs. It is essential to separate the “must-have” features that support critical business processes from the “nice-to-have” ones that might help but aren’t crucial.A. Functional Requirements

The software should have specific functions to support business operations. Here are the key capabilities you should look for:- Policy Management: The software should handle the entire policy lifecycle, from creation and underwriting to renewal and cancellation. It should store all policy-related information in one central location. This makes finding relevant information painless. No need to scour multiple systems or paper documents.

- Workflow Automation: Insurers should look for tools that streamline repetitive tasks to boost efficiency. The tool should help them reduce processing time for policy issuance, renewal, and cancellation.

- Integration Capabilities: No software can operate in isolation. It should talk to the existing tools and platforms, as this helps data flow seamlessly.

B. Technical Requirements

In addition to functional requirements, it’s important to see how the software operates within your infrastructure.- Scalability: No insurance business stays the same forever. The software should be able to handle increasing policy volumes, customer data, and transactions without slowing down. A truly scalable solution makes the addition of new functionalities and modules seamless. This eliminates the need for costly replacements every few years.

- Security: Insurance companies deal with sensitive customer data. This makes security non-negotiable. The software should offer data encryption, role-based access control, multi-factor authentication, and complete audit trails. These features protect businesses against unauthorized access. They also ensure compliance with data protection rules.

- Deployment Options: Businesses can choose between on-premises and cloud-based solutions. Cloud solutions offer easier scalability and lower maintenance costs. On-premises deployment provides greater control over data. It better serves organizations with strict regulatory demands. A hybrid approach combining both models may be ideal for companies that want the best of both worlds.

3. Research and Shortlist Potential Solutions

The research phase can make or break the success of your project. So, it’s important not to rush it.A. Vendor Discovery

There are many approaches to finding appropriate vendors:- Industry directories that give unbiased analyses of insurance systems

- Professional networks

- Referrals from industry peers

- Platforms like G2 and Capterra

B. Compare Offerings

A systematic comparison framework helps compare potential vendors. Each solution should be reviewed against your requirements with a strong focus on:- How well the core features align with business needs

- Whether the software integrates easily with existing systems

- Whether the system can accommodate future growth

- Whether it complies with regulations and secures critical data

C. Check References

It is essential to check references thoroughly before shortlisting a vendor. Insurers should focus on:- Case studies to get a complete picture of a software’s capabilities

- Testimonials to learn about the vendor’s support quality

- Vendor’s track record in providing customer-centric solutions

- Industry review websites, such as Clutch, to check credibility

4. Finalize a Solution Through Trials

A structured trial with real-life business scenarios should happen before you commit to any vendor. Spending a few months testing the software boosts the chances of success. Stakeholders from all departments—underwriting, claims processing, IT, and higher management—should participate in these trials. These sessions should focus on:- End-to-End Process Testing: Check how the software handles complete policy lifecycles, from applications to claims and renewals.

- Integration Capabilities: Make sure the system connects with the existing tools and databases.

- Performance Under Load: See how the software works when processing many policies at once.

- Set up and Controls: Look for straightforward configuration options and clear permission settings.

Insurance Underwriting Automation: Benefits, Challenges, and Trends