Table of Contents

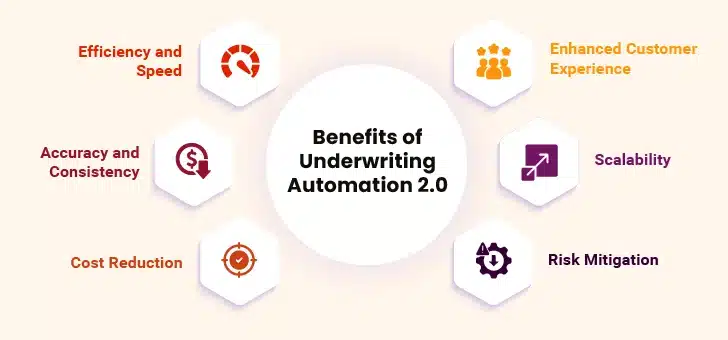

The Evolution of Underwriting Automation Key Technologies Driving Underwriting Automation 2.0 Benefits of Underwriting Automation 2.0- I. Efficiency and Speed

- II. Accuracy and Consistency

- III. Cost Reduction

- IV. Enhanced Customer Experience

- V. Scalability

- VI. Risk Mitigation

The Evolution of Underwriting Automation

Underwriting used to be slow, heavily relied on checking paper files. They used simple methods and basic rules. There was little room for error and mistakes happened quite often. This made it hard to give a fast answer. As time went on, insurers started to use early computer systems. They built basic tools that could follow simple rules. This was the first step toward insurance underwriting automation. It helped cut down on errors and speed up the process a bit. Then came the big shift. New systems used advanced AI and huge amounts of data. This change, sometimes called “Underwriting Automation 2.0”, was a turning point. Modern tools use machine learning to learn from past data. They can spot trends and predict risks more accurately. Today, automated systems work alongside underwriters. They help make better, faster decisions. The move from manual work to high-tech processes has transformed risk evaluation.Key Technologies Driving Underwriting Automation 2.0

A host of new technologies drive the change in underwriting. These tools help make decisions more precise.1. Artificial Intelligence (AI)

AI is at the center of modern underwriting. It sifts through data fast and finds patterns that a human might miss. AI looks at past claims, market trends, and even social signals. This leads to better risk assessment. The use of AI helps cut down on errors and speeds up processing.2. Machine Learning (ML)

Machine learning lets systems learn over time. ML builds models that predict risk based on many factors. Advanced methods like deep learning and reinforcement learning add even more accuracy. Thus, companies can create an effective insurance underwriting automation process using AI tools, which improves with each case.3. Natural Language Processing (NLP)

Underwriting often involves reading and understanding many documents. NLP turns unstructured text into useful data. This can include scanning electronic records, reports, and even social media posts. By using NLP, systems gather insights from places that were hard to use before.4. Big Data Analytics

Today, data is everywhere. Big data analytics helps insurers use this data well. With so much information at hand, companies can spot trends and see risks more clearly. This adds another layer of precision to risk evaluation.5. Blockchain Technology

Blockchain is new to underwriting but has great promise. It offers a secure way to share data. Blockchain ensures that records are true and unchanged. This builds trust between all parties involved. Its role is still growing, but it may soon be a key part of an automated underwriting system.Ready for AI-Driven Claims Processing?

Benefits of Underwriting Automation 2.0

Modern tools bring many advantages to underwriting. Let’s look at the benefits.

Modern tools bring many advantages to underwriting. Let’s look at the benefits.

I. Efficiency and Speed

Automation cuts down processing time. Tasks that once took days now take minutes. Faster decisions mean policies can be issued quickly. Insurers can handle more applications in less time. This is a clear win for everyone.II. Accuracy and Consistency

Automated systems reduce human error. With clear data and objective models, risk evaluations are more consistent. Decisions come from data rather than gut feelings. This means that every customer gets a fairer look at their risk.III. Cost Reduction

Automation saves money. When tasks are handled by computers, fewer staff hours are needed. This cuts operational costs. Insurers can then reinvest savings into better services for customers.IV. Enhanced Customer Experience

A quick response is a big plus for customers. With faster processing, clients get answers sooner. This means fewer delays and a smoother journey from application to policy. Personal data insights also help create more tailored offers. This boosts customer satisfaction.V. Scalability

Automated systems can grow with the business. When more applications come in, the system handles the extra load without a hitch. This means insurers can expand their services without major extra costs.VI. Risk Mitigation

Advanced models predict risks better. They spot potential problems before they grow. This helps insurers adjust their pricing and manage claims more effectively. Better risk management leads to fewer losses and a healthier business.Challenges and Considerations

No new system comes without challenges. Here are some common hurdles in the journey to full automation.1. Integration with Legacy Systems

Many insurers use old systems that do not mix well with new tech. Integrating modern tools into these systems can be tough. Companies must invest in smooth data flow to make new systems work alongside old ones.2. Change Management

Changing the way people work is hard. Employees must learn newer tools and adjust their working styles. Clear training and support are needed. A good plan helps everyone transition to the new process.3. Bias in AI Models

AI systems learn from past data. If that data has bias, the AI may repeat it. Insurers need to check models carefully. They must work to remove bias and ensure fairness.4. Data Privacy and Security

Using lots of data means keeping it safe. Insurers must protect customer information. This involves following strict rules and regulations. Data privacy and security are vital to maintaining trust.5. Ethical and Regulatory Issues

Automated systems raise ethical questions. How do we ensure decisions are fair? How do we balance tech with human touch? Regulators are still figuring out these issues. Insurers must work with them to create fair systems.6. The Human Element

Automation helps, but human skills still matter. Experienced underwriters provide empathy and judgment that machines cannot match. A hybrid approach is best. This means using tech to support, not replace, human insight.Leading Players and Underwriting Automation

From life insurance to property and casualty, top companies are using automation to tackle unique challenges. Each segment benefits from faster, more accurate risk assessment. Many top insurers are already using new technology in their underwriting. Let’s look at some prime examples.- Swiss Re: Swiss Re is a leader in reinsurance. They use AI and data analytics to increase the speed of their underwriting. Their automation system cuts down on manual work and reduces errors. They use smart tools to review what customers tell them and other evidence like lab reports and data from phones and health watches, with permission. This saves time and helps them understand risks better.

- RGA: Reinsurance Group of America (RGA) uses predictive analytics in underwriting. Their models improve risk evaluation and speed up the process. They use Big Data tools like NLP and OCR to read and sort important information from many pages of medical reports. These tools summarize the info so systems can quickly understand the risks, reducing mistakes and saving time for underwriters. Clearly, RGA’s work with automated insurance underwriting is a good example of progress.

- Hitachi Solutions: Hitachi Solutions offers technology-driven systems for insurers. Their vision includes a blend of AI, big data, and digital tools. Their work shows how automation in insurance underwriting leads to scalable and efficient processes. Hitachi’s solutions are paving the way for a new era in risk evaluation. They are quickly bringing all data sources into one data platform. This makes it easy for underwriters to access, combine, and understand data from many sources.

Cut Down Operational Costs with Insurance Automation Solutions