In the intricate world of insurance, where timely and accurate claims processing is paramount, the significance of streamlining this complex procedure cannot be overstated. The heartbeat of this efficiency lies in robust business management software. As such, efficient claims processing forms the crux of a successful insurance operation, and modern insurance solutions play a crucial role in achieving this. Powered by automation and advanced analytics capabilities, these solutions expedite claims assessment, ensuring a prompt and accurate response to policyholders. This acceleration not only improves customer satisfaction but also allows insurers to adapt swiftly to evolving market demands. In this blog, we delve into the pivotal role played by these systems in transforming claims processing and explore the myriad benefits they bring to the table.

Table of Contents

Benefits of Streamlining Claims Processing

Today’s insurance companies have to navigate through a complex matrix of challenges. Inflation pressures and market turmoil have only exacerbated the challenges faced by insurers. As such, streamlining insurance claims processing can help insurers overcome these challenges. Here’s how:

I. Improved Efficiency

Picture this: an accurate, seamless, and quick insurance software that streamlines the entire claims journey, right from the reporting of loss or damage to settlement. Insurance management systems with claims processing modules are designed to improve claims efficiency and speed. Automating manual claims processing and enabling customer self-service helps insurers fast-track claims processing and offers swift resolutions to policyholders.

II. Improved Accuracy

One of the most glaring challenges in claims processing is the potential for errors. Investing in the best insurance management systems can bring a breath of fresh air by incorporating advanced algorithms and automation that minimize human errors. The result? Increased accuracy in claim assessments, ensuring that policyholders receive fair and precise settlements.

III. Lower Claims Processing Cost

Efficiency often leads to cost-effectiveness. By automating repetitive tasks and optimizing workflows, insurance software helps insurers cut down on operational costs. This resource optimization not only translates to financial savings but also allows insurance professionals to focus on more complex aspects of claims management, enhancing overall productivity.

IV. Better Policyholder Experience

In today’s digital era, where technological innovations and market dynamics continually redefine the insurance landscape, customer satisfaction stands as the cornerstone of success. Furthermore, modern customers expect convenience, efficiency, flexibility, and speed. As such, insurance management systems can help insurers elevate the customer experience to drive customer satisfaction and retention. Quick resolutions, accurate assessments, and omnichannel communication lead to satisfied customers, thereby fostering long-term relationships.

How Insurance Management Software Streamlines Claims Processing?

Rather than investing in multiple technologies to optimize different stages of claims journey including FNOL, triaging, fraudulent claim detection, etc, insurers can go for a comprehensive insurance management system. Such systems act as a holistic solution to the different aspects of insurance operations. Here is how it improves claims processing:

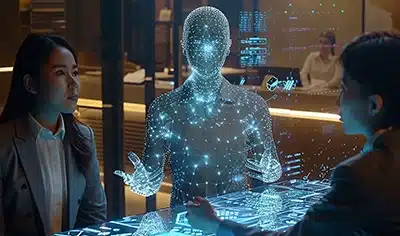

1. AI-Driven Claims Management

Insurance management systems, driven by Artificial Intelligence (AI) and automation technologies, can optimize the entire insurance value chain. These systems can effectively automate routine tasks like data entry, data extraction, document verification, and claim assessment to expedite claims processing while ensuring accuracy, customer-centricity, and consistency. AI-driven claims management, facilitated by the best insurance management software, also improves risk management and fraud detection. For example, the AI-powered intelligent document processing (IDP) capability in some of the insurance management systems can reduce the processing time by extracting meaningful data for further processing in seconds.

2. Real-time Communication and Collaboration

The integration of the latest insurance technologies such as Artificial Intelligence, data analytics, IoT, mobile applications, etc has transformed how claims are processed in the industry. For one, modern management systems for insurance businesses offer self-service capabilities. This gives customer autonomy and simplifies the claims reporting process. Customers can use the portal to file claims, fill out forms, and track the status of claims. Insurance systems also enable real-time data sharing. As a result, various stakeholders such as insurers, agents, brokers, etc can easily exchange information, and collaborate among themselves.

Accelerate Claims Processing With Our Insurance Management Software

3. Advanced Data Analytics and Reporting

The best insurance management software systems are equipped with advanced data analytics tools. It helps insurers process and analyze volumes of data to identify trends, assess risk factors for claims, measure operational efficiency, and optimize claims processes. Data analytics coupled with predictive modeling helps insurers make informed decisions based on data-driven insights.

4. Fraudulent Claims Detection

Insurance management systems powered by advanced analytics and Machine Learning capabilities can help mitigate fraud. ML algorithms can detect patterns associated with potential fraud or suspicious activity. The system flags such cases easily in the process and enables insurers to investigate and mitigate claims fraud more efficiently and proactively. As a result, there is a significant reduction in financial losses and revenue leakage.

5. Workflow Optimization

Business management software for insurance optimizes the entire claims processing workflow, from initial claim submission to final settlement. By identifying bottlenecks and streamlining processes, insurers can ensure a smooth and efficient journey for each claim. This not only benefits the policyholder but also enhances the overall operational efficiency of the insurance company.

Conclusion

All in all, business management software stands as the linchpin in the realm of claims processing, offering a host of benefits ranging from improved efficiency and accuracy to cost savings and an enhanced customer experience. As technology continues to evolve, the future of claims management holds the promise of even more seamless and sophisticated processes, ensuring that insurers can navigate the complex landscape with agility and precision. Embracing insurance management system software is not just a choice; it’s a strategic imperative in the pursuit of excellence in claims processing.

Case in Focus

A Caribbean-based insurance provider was in dire need of a comprehensive software that would help them run their business operations end-to-end. The insurer’s slow and inefficient legacy system contributed to data silos, delays, and customer dissatisfaction. To combat these challenges, we implemented a custom insurance management system- InsureEdge. It enabled the insurer to build a fully integrated system with all the information in one place. As a result, the insurer was able to achieve consistent data across all systems, ensure seamless integration, automate processes, and simplify workflows. For more signs, refer to the complete case study.