Table of Contents

Hyper-Personalization in Insurance: Moving Beyond Basic Segmentation Key Insurance Software Features Powering Hyper-Personalization Customer-Centric Software Systems for Insurance: Capabilities that Matter Build vs. Buy: Evaluating Software Suites for Personalization Business Impact: How Hyper-Personalization Drives Growth Implementing Hyper-Personalization: Choosing the Right Software Solution The Way Forward: Hyper-Personalization as the New Insurance StandardHyper-Personalization in Insurance: Moving Beyond Basic Segmentation

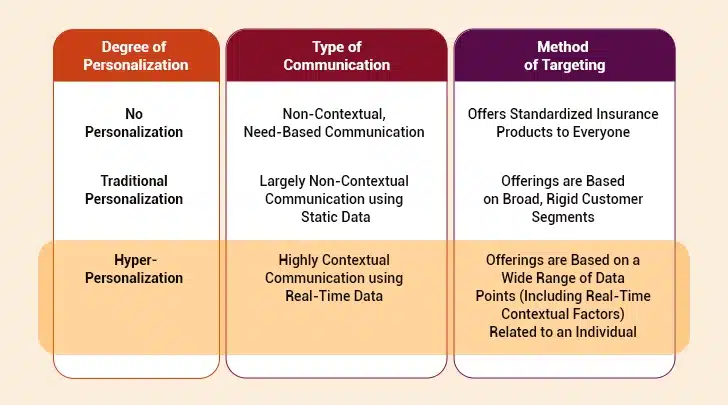

Remember those emails with your name at the top but generic content below? That’s traditional personalization—barely scratching the surface of what’s possible today. Hyper-personalization takes a big leap forward. Instead of just addressing customers by name or using basic demographic groups, it analyzes vast amounts of real-time data to create unique experiences for each policyholder.1. Hyper-Personalization vs Traditional Personalization: The Fundamental Difference

Traditional personalization in insurance typically works with static data and broad, rigid customer segments. An insurer might notice what a customer purchased last year and show them similar products. It’s better than no personalization at all, but still remarkably basic. Hyper-personalization, however, operates on an entirely different level by:

Hyper-personalization, however, operates on an entirely different level by:

- Analyzing real-time behavioral data, contextual information, and dynamic factors

- Using artificial intelligence and machine learning for predictive insights

- Creating strategies that adapt continuously as customer needs evolve

- Delivering the right products at the right time through the right channels

2. Technology Enabling Hyper-Personalization

AI, machine learning, and advanced data analytics power the core features of hyper-personalization in insurance-based software. These systems process data from multiple sources: IoT devices, telematics, wearables, social media, past transactions, and customer interactions. Take driving habits, for instance. Advanced software can analyze patterns captured through telematics to offer safe drivers lower premiums and personalized driving recommendations. Health insurers similarly use data from wearable devices to understand physical activity patterns and tailor policies accordingly.3. Hyper-Personalization: Potential Business Impact

The numbers make a compelling case for hyper-personalization. According to McKinsey & Company, consumers are 78% more likely to make repeat purchases from companies that personalize, as well as refer them to friends and family. Beyond boosting engagement, these sophisticated software features help companies manage risk more effectively. By analyzing individual customer data, insurers can spot potential fraud indicators and develop more accurate risk profiles. This creates a win-win: carriers price more accurately while customers get fairer rates based on their behaviors. Insurers who master hyper-personalization thus stand to win big in an industry with fast-changing customer expectations.How AI is Driving Personalization in Insurance Claims Experience

Key Insurance Software Features Powering Hyper-Personalization

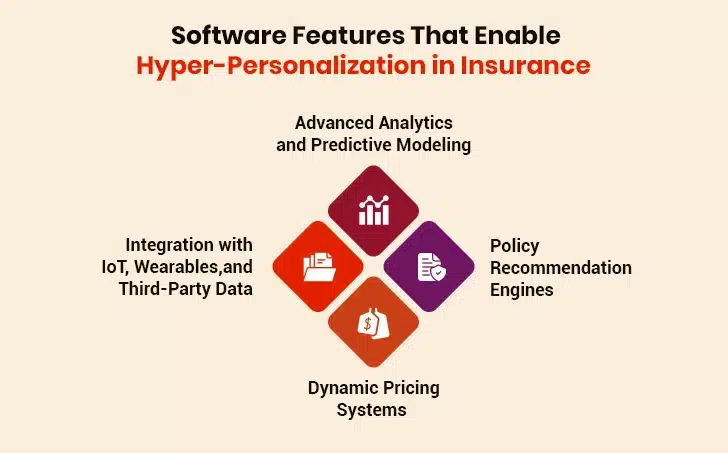

I. Advanced Analytics and Predictive Modeling

Modern insurance software solutions harness machine learning algorithms to process large data volumes that would overwhelm human analysts. These tools spot hidden patterns that transform underwriting from a backward-looking process into a dynamic system that predicts trends. Advanced software systems also come with noteworthy predictive modeling capabilities. These systems process information from thousands of data sources to build sophisticated risk profiles. This helps insurers spot high-risk drivers and set fair premiums. They can also reward responsible customers with discounts.II. Policy Recommendation Engines

AI-powered policy recommendation engines match customers with the best insurance products. These systems analyze customer details like demographics, risk factors, priorities, and past data to suggest tailored policies. AI-driven recommendation engines boost policy sales significantly. These engines also excel at spotting cross-selling opportunities. They uncover unmet customer needs before customers even recognize them. For example, if a customer’s driving data shows they’ve started commuting longer distances daily, the AI might proactively recommend increasing their auto liability coverage.III. Dynamic Pricing Systems

Dynamic pricing represents a shift from traditional actuarial models to real-time, data-driven premium calculations. Instead of relying on rigid demographic categories, these systems adjust premiums based on behavior patterns, market conditions, and individual risk factors. Software with reinforcement learning capabilities evolves continuously. It gets better with every pricing decision and customer interaction. For example, telematics devices track real-time driving data, enabling insurers to reward safe behavior with lower premiums. These also improve the carrier’s loss ratios.IV. Integration with IoT, Wearables, and Third-Party Data

The most transformative aspect of modern software is its ability to connect with external data sources. Modern software platforms process data from telematics, wearables, smart home systems, and third-party sources to build individualized risk profiles. This fundamentally changes how risk gets assessed and managed. Life insurers use wearable device data tracking heart rate, sleep patterns, and activity levels to offer lower premiums to customers maintaining healthy lifestyles. Similarly, property insurers tap into smart home sensors to prevent damage through predictive maintenance and early warning systems. The data makes everything more personalized and profitable for everyone involved.Supercharge Your Insurance Lifecycle with AI

Customer-Centric Software Systems for Insurance: Capabilities that Matter

Present-day customers expect more than policies—they want proactive, personalized service at every touchpoint. Leading carriers are responding by adopting customer-centric insurance software systems offering omnichannel communication tools, real-time engagement, and algorithm-driven claims routing.1. Embedded Omnichannel Communication Tools

Modern insurance demands smooth communication across multiple touchpoints. Leading software solutions provide unified communication platforms that blend chatbots, mobile apps, and agent interfaces to deliver personalized experiences. The outcome? Conversations maintain their context no matter how customers choose to connect. Modern omnichannel platforms often feature AI-powered chatbots that can:- Process policy applications instantly

- Handle the entire policy lifecycle

- Take care of policy changes

- Talk to customers in multiple languages

2. Real-Time Engagement Triggers

Smart software spots important customer life events and reaches out. When someone buys a home, has a child, or relocates, the system detects these signals and triggers appropriate communication. This proactive approach shows customers their insurer is paying attention. Usage-based insurance shows how real-time engagement works. To cite an instance, these programs gather telematics data about users’ driving behavior: speed, acceleration, braking patterns, and distance traveled. This way, carriers assess risk accurately. On the other hand, customers pay based on how they actually drive, not just broad demographic assumptions like age or gender.3. AI-Driven Claims Routing

Claims processing has traditionally been insurance’s biggest headache. Not anymore. Today, AI-based software analyzes unstructured claims data from medical reports, images, and other documents. It then routes claims to the right handlers based on their complexity and priority. This approach doesn’t just cut processing time—it transforms the entire customer experience by letting claims handlers focus on helping people rather than shuffling paperwork.Build vs. Buy: Evaluating Software Suites for Personalization

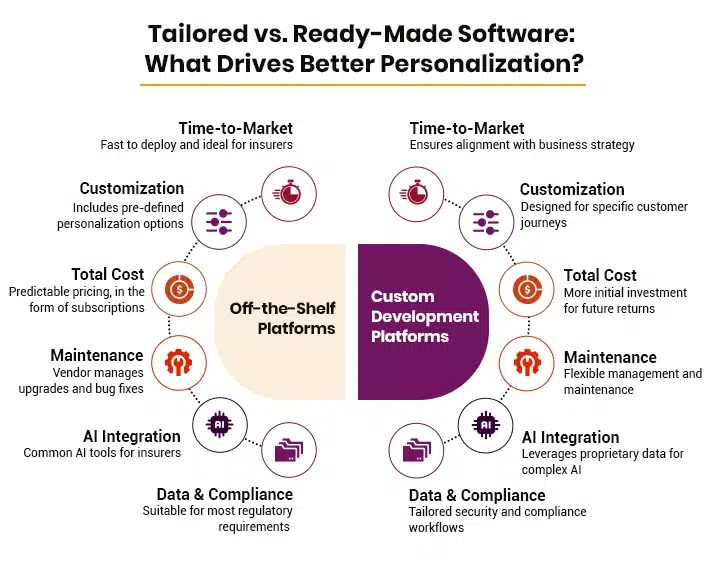

Insurance carriers face a dilemma when planning hyper-personalization strategies: buy off-the-shelf software or build custom solutions? This choice fundamentally shapes how effectively carriers deliver the personalized experiences their customers expect.

Did you Know?

Custom insurance software solutions deliver an average ROI of 122.22%. Organizations using custom software experience 40-60% fewer compliance issues. ➤ Custom Development Start → Strategize → Design → Develop → Test → Optimize → Maintain ➤ Off-the-Shelf Platform Start → Choose Vendor → Deploy → Configure → Train Teams → UseI. Off-the-Shelf Limitations Vs. Customizable Platforms

Pre-packaged software promises quick wins. Faster deployment and lower upfront costs look attractive at first glance. But here’s the problem: these generic platforms often fall short when it comes to advanced hyper-personalization. They can’t handle real-time data processing and advanced analytics needed for effective individualization. Off-the-shelf insurance software suites face limitations due to their standardized architecture. These platforms follow predetermined workflows designed for common scenarios. They cannot handle edge scenarios, even though they offer configuration options. Custom platforms, by contrast, allow insurers to craft personalization capabilities that match their specific business models and customer needs. These solutions enable carriers to:- Build proprietary risk algorithms

- Integrate niche data sources (e.g., IoT devices for niche markets)

- Design adaptive workflows that evolve with customer behavior

- Add new features without waiting for vendor updates

II. Partnering With a Software Development Company: When to Go Custom

The decision to collaborate with an insurance software development company boils down to your strategic priorities. Custom development makes sense when your:- Competitive advantage depends on proprietary algorithms

- Niche insurance products require advanced software capabilities

- Roadmap needs flexibility for expansion and adding new features

Business Impact: How Hyper-Personalization Drives Growth

Advanced software solutions with hyper-personalization bring substantial financial benefits. Research from Bain and Company shows that increasing customer retention rates by just 5% can boost profits by 25% to 95%. These numbers make a strong case for insurance carriers to focus on personalized experiences.

1. Retention: Reducing Churn with Tailored Policy Adjustments

Acquiring new customers costs insurance companies 7-9 times more than keeping existing ones—the highest customer acquisition cost of any industry. This is where smart software makes all the difference. Insurance systems equipped with predictive churn analytics spot at-risk customers early. Companies using these tools see a substantial increase in customer lifetime value. These software systems work through proactive intervention. They spot when customers approach life milestones (e.g., getting married or buying a house) and suggest the right coverage options before customers realize they need them. This proactive approach helps insurers retain more customers in the long term.2. Acquisition: Attracting Niche Markets

Hyper-personalization shines when carriers develop specialized insurance products for segments that traditional offerings ignore. The growing gig economy presents a perfect example. Millions of independent contractors need coverage that traditional employment-based insurance doesn’t provide. To cite an instance, a gig delivery driver might need a policy that provides injury coverage only during active shifts, not 24/7. Hyper-personalized software lets insurers design flexible plans, like coverage that adjusts based on real-time data (e.g., miles driven or hours worked). These targeted solutions draw in customers who’ve long felt ignored by rigid, one-size-fits-all plans.3. Cross-Sell: Leveraging Data to Identify Unmet Customer Needs

Cross-selling to existing customers is a winning strategy. It is always easier to sell to current policyholders than to new prospects because they already trust your brand. Insurance carriers using data-driven cross-selling see many benefits:- Revenue gains

- Reduced customer churn

- Improved renewal rates

Implementing Hyper-Personalization: Choosing the Right Software Solution

Picking the right technology forms the foundation of successful hyper-personalization. But how do you select the right software solution? The decision requires careful planning and assessment.I. Vendor Checklist: AI Capabilities, Scalability, and Compliance Safeguards

Insurance carriers should create a detailed assessment framework to review potential software solutions. Vendors with years of experience in insurance-specific AI implementations deliver better results. The software systems must show these proven capabilities:- AI Sophistication: Does the software support multiple AI models simultaneously? Specialized models will be required for different tasks like claims processing or underwriting.

- Data Analytics Depth: Can the software handle structured, semi-structured, and unstructured data accurately?

- Scalability Architecture: Is the software hosted on a cloud-based infrastructure with dynamic resource allocation? The system needs to perform just as well during peak periods as slow ones.

- Compliance Frameworks: Does the software adhere to regulations through robust data protection measures including encryption and secure access controls?