The insurance claims experience can make or break an insurer. The process, which typically follows an emergency, accident, or even natural calamity, can be distressing. Handling such a situation with care and concern instills confidence that converts a policyholder into an advocate.

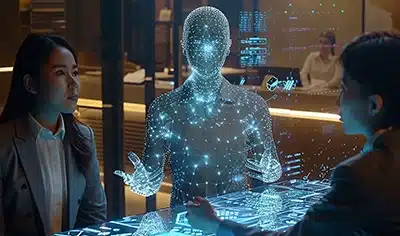

Given the criticality of this process, insurers should put in the effort to build robust workflows to empower policyholders. One approach to go about this would be through claims modernization, particularly by embedding cutting-edge technology, such as Artificial Intelligence (AI), into the processes. Doing so not only caters to the instant needs but also future-proofs how insurers interact with policyholders and vice versa.

If one were to list the various benefits offered by AI solutions in claims experiences, personalization would be right at the top. In fact, AI is ushering in the era of hyper-personalization that significantly improves customer experiences. This article takes a deeper look at this.

From Frustration to Frictionless: How AI Streamlines the Claims Process

Traditional claims filing is nothing short of navigating a labyrinth. But AI is the glowing marker that dots the path of solving this maze with ease and efficiency. Here’s how:

Automated Data Collection and Analysis

AI automatically captures data from multiple sources and in various formats to make it more consistent, structured, and usable. As such, policyholders can submit anything, from scanned copies of handwritten documents to photos and diagnostics to digital reports, and more. It not only makes data usable and accessible but also increases accuracy by eliminating manual data entry errors.Managing Complexity at Scale

The use of AI not only fast-tracks insurance claims processing but also makes it adept at handling intricate claims. AI algorithms perform accurately and reliably even during peak events like natural disasters, after which claims volumes may surge. These models can autonomously analyze complex situations, detect patterns within large datasets, and automate segments of claims processing to ensure that each claim receives equal attention even during overwhelming situations.Conversational AI Assistants

Conversational AI bots are virtual claims adjusters. Powered by natural language processing (NLP), these AI assistants are impartial, accurate, patient, and available 24/7. They can answer claimants’ queries, walk them through the process, schedule appointments with repair personnel, share updates on the claims status, and even conduct preliminary assessment and estimation – all in a manner that is natural and personalized.Tailored Communication for Every Customer

Impersonal messaging using templates is an ancient relic of the past. AI goes beyond personalizing the message and tweaks the notification or update to match the policyholder’s preference of voice, tonality, and communication channel. Personalizing the policyholder experience to this degree develops one-on-one relationships and ensures clear understanding throughout the claims process.

Make Your Policyholders Feel Valued with AI Personalization

Beyond Efficiency: Building Trust Through Personalization

Making the claims process frictionless is just one aspect of how AI adds a touch of efficiency to the insurance value chain. However, personalizing the policyholder experience is where AI truly shines in the following ways:

1. Enhancing Customer Satisfaction

A more accurate, efficient, and faster claims process, coupled with value-loaded communication, lays the foundation of trust and loyalty. Policyholders feel heard, valued, and supported in distressing times, and most importantly, acknowledged as an individual, which they will appreciate.

2. Reducing Costs for Insurers

AI-powered automation, facilitated by insurance claims management software, minimizes manual work and associated errors. This enables insurers to process claims faster and at a lower cost. The resulting cost and operational savings translate into cost-effective operations that neither the insurer nor the policyholder should bear. As a result, insurers can personalize policy pricing to match the policyholder’s risks and requirements accurately.

3. Improved Risk Management

AI algorithms can perform cross-functional and in-depth data-driven analysis, allowing insurers to anticipate risks and mitigate potential losses. Such a proactive approach to risk management results in a fair and accurate pricing structure. At the same time, insurers can incentivize good or responsible behavior depending on the policyholder’s profile to minimize risks.

4. Empathy and Emotional Intelligence

While AI does not innately possess the qualities of empathy or emotional intelligence, it can be trained to identify and respond to the policyholder’s emotional state. Generative AI models can populate empathetic language that offers support beyond the technical aspects of the claim and handle customer queries or requests in a supportive manner.

5. Omnichannel Support

A seamless claims experience transcends communication channels. AI delivers consistent and personalized support across various touchpoints, be it live chat, mobile app, or phone call. At the same time, insurers must balance accessibility with personalization to ensure that they interact with the policyholder through their preferred channel. For this, AI retains “memory” of such customer preferences to ensure that no critical communication slips through the cracks.

The Road Ahead: A Future Powered by AI

While the integration of AI in the insurance industry is still in its nascent stages, it is expected to be in full swing soon. After all, the push for personalization is no new news.

As AI technology continues to develop and mature at breakneck speeds, policyholders can expect rich claims experience in the years to come. It won’t be long until the industry witnesses AI-powered chatbots negotiating repair costs with service providers to offer policyholders the best possible deal. Or the advent of Smart Contracts that will automatically disburse claims settlements based on preset parameters to eliminate delays and redundancies. Or how AI-powered fraud detection systems can identify and prevent fraudulent claims in real time, protecting honest policyholders from bearing the brunt of increased premiums.

Whichever way one sees it, harnessing the power of AI in insurance has become an imminent reality. It is only a matter of time until AI fully penetrates claims processes to make them more personalized, optimized, and customer centric.

Case in Focus

A leading independent insurance adjusting firm based in the US was facing issues with the assessment of claim loss reports. The client’s legacy property claims estimation system was inefficient and often powered by incorrect data. To combat this, we integrated AI technologies such as OCR, ML, PyTorch, and Fast AI into the client’s existing software. As a result, the insurance adjusting firm eliminated human errors, improved claims management productivity, and expedited the processing of claim loss reports.