In this digital-first era, the insurance industry faces a pivot or perish situation. Businesses either have to bite the bullet and modernize their IT infrastructure or lose a chunk of their business. The latter would be due to inflexible operations, failure to scale, sluggish innovation, and unsustainable operational costs.

While the choice is a no-brainer, there may be slight confusion on how to proceed with the former. Fortunately, this journey of a thousand miles starts with a few teetering steps of digital transformation – more specifically by moving to cloud-based operations.

Cloud-based insurance solutions have emerged as a transformative force promising to usher in a new insurance age. New-age digital insurance businesses including InsurTechs leverage cloud infrastructure for rapid scaling of operations up or down based on demand, optimize costs through its pay-as-you-go pricing model, and access data in real-time from anywhere anytime to work together seamlessly. These qualities of agility, scalability, and security unlock a new plane of customer-centricity, growth, and efficiency. If you wish to enjoy such outcomes, then this blog is your trusted guide. Here’s a roadmap for cloud computing in the insurance industry.

The Value Proposition of Cloud Adoption in the Insurance Industry

First things first, what do cloud-based insurance solutions bring to the table? Here’s a quick overview:

Scalability and agility

Insurance businesses can scale up or down depending on immediate or long-term requirements. This ability makes insurers highly responsive to fluctuating needs without acting as a drain on resources.Enhanced security

Vendors offering cloud services for insurance make it an intentional point to incorporate top-notch data security and privacy measures. As a result, businesses can delegate such critical operations to cybersecurity experts and stay protected.Cost efficiency

Investing in cloud solutions for insurance agents proves to be a financially prudent decision in more than one way. First, it eliminates the need for upfront hardware and IT infrastructure investments. Next, insurers can pick a suitable pay-as-you-use model. Finally, the compounding returns would greatly overshadow the initial investment.Data-driven framework

Cloud-based insurance solutions harness real-time data and analytics to draw meaningful insights and deploy smart strategies across the insurance value chain. As a result, insurers can make informed decisions regarding everything – from underwriting to claims processing.Faster innovation

Cloud services for insurance act as fertile grounds for businesses to incorporate new-age technologies like Artificial Intelligence (AI), Machine Learning (ML), Big Data, Internet of Things (IoT), Robotic Process Automation (RPA), and more. As a result, insurers will find it easier to innovate and keep up with the changing trends.

Nuanced Benefits of Cloud Adoption in Insurance

Beyond the well-known advantages of scalability, security, cost efficiency, and innovation, cloud adoption in the insurance industry introduces several nuanced benefits:

- Cloud-based platforms allow teams to access data and applications from anywhere worldwide. This level of connectivity fosters seamless collaboration among distributed teams, enhances productivity, and supports the growing trend of remote work.

- Almost 40% of insurance CEOs globally believe that the greatest impact of ESG strategy on the insurance sector will be in building customer relationships and fostering positive brand association. Transitioning to the cloud helps reduce the insurance industry’s carbon footprint by optimizing resource usage. With fewer physical servers to maintain, energy consumption decreases, making cloud adoption an environmentally responsible choice.

- Real-time data access empowers insurers to offer personalized, timely solutions to their customers. From dynamic pricing models to proactive claims processing, cloud-based systems place customers at the center of operations, boosting satisfaction and loyalty.

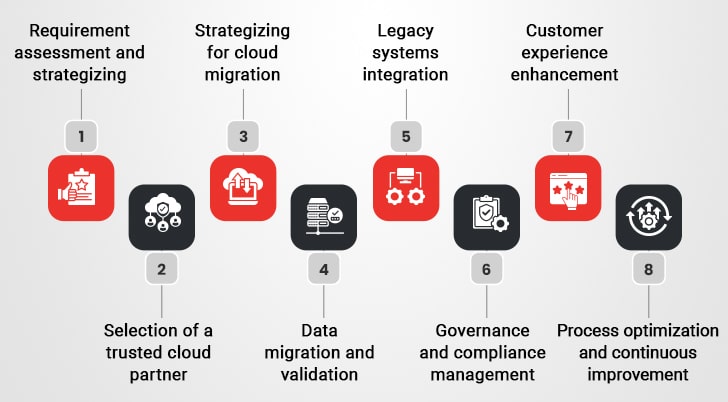

Migrating to Cloud-Based Insurance Solutions: A Step-by-Step Guide

Now, here’s the promised roadmap for insurance businesses looking to migrate to the cloud:

Step 1: Requirement Assessment and Strategizing

The success of cloud adoption in insurance companies begins with a thorough requirement assessment. This step ensures that the migration process aligns with organizational goals.

During this stage, you must:

- Analyze existing IT infrastructure, such as security protocols and data storage needs. Test the compatibility of these existing systems with cloud-based operations.

- Determine which cloud migration strategy is suitable, a lift-and-shift approach or an absolute re-engineering of workflows.

- Identify the processes that would be largely impacted by this migration, and how the revamped version of it would look on the cloud. For instance, paperwork may be replaced with digital forms.

- List cloud migration goals – ideally, define them using SMART parameters. For example, 10% cost savings in Q3 or a 20-point increase in the Customer Satisfaction score (CSAT).

- Define their short-term and long-term requirements, along with the corresponding features and specifications. For instance, you would need a private financial services cloud for insurance for granular data control and security.

Step 2: Selecting a Trusted Cloud Partner

Choosing the right cloud partner is a cornerstone of successful cloud adoption in insurance companies. The right provider ensures a smooth transition, ongoing support, and optimal performance. Here’s where you conduct market-wide research to select a reputable cloud provider. This involves:

- Evaluating major cloud service providers and assessing their industry experience, security compliance, scalability, etc. based on organizational requirements.

- Connecting with existing or past customers of the shortlisted options and acquiring lived-in experience to get a realistic idea.

- Building a Request for Proposal (RFP) that templatizes the selection criteria for potential cloud partners.

- Signing up for a demo to check how the cloud infrastructure would support business processes.

Empower Your Insurance Business with Cloud

Step 3: Strategizing Cloud Migration

In this stage, you will work out the specific details of the cloud migration process. This phase ensures minimal disruption to existing operations while setting the foundation for long-term success in the cloud environment. Key actions include:

- Begin the migration process with non-critical applications to build experience and minimize potential risk.

- Work with the cloud service partner to prepare a detailed migration plan with well-defined timelines, resource allocation, and rollback procedures.

- Assign responsibilities to internal and external stakeholders to streamline change management.

- Allocate resources for the training and onboarding of employees to work in the cloud environment.

Step 4: Data Migration and Validation

Data migration is one of the most critical steps in cloud adoption in the insurance industry. It requires careful planning and execution to ensure seamless operations and prevent data loss or corruption. This stage involves analyzing existing data, organizing it based on priority, and securely transferring it to the cloud environment. Accuracy and security are paramount, as errors can lead to operational disruptions or compliance issues.

- Conduct a thorough analysis of existing data repositories.

- Categorize data into critical (policyholder information, claims) and non-critical.

- Develop a data migration strategy, prioritizing sensitive and essential datasets.

- Ensure encryption protocols safeguard data during transit and at rest.

- Use tools like ETL (Extract, Transform, Load) to clean and format data.

- Remove outdated, redundant, or duplicate entries for a streamlined dataset.

Step 5: Legacy Systems Integration

Many insurance businesses rely on legacy systems that are crucial in daily operations. Instead of replacing these systems immediately, integration with cloud solutions allows for a smoother transition and uninterrupted workflows. This step ensures the old systems coexist with the new cloud-based environment while maintaining efficiency and security.

- Identify legacy systems critical to business continuity and customer satisfaction.

- Assess these systems for compatibility with cloud platforms and tools.

- Plan seamless integrations to ensure consistent workflows across systems.

- Leverage middleware or APIs to bridge gaps between disconnected environments.

- Perform iterative testing to resolve integration issues, ensuring smooth operation.

- Train staff on managing hybrid setups combining legacy and cloud systems.

- Implement a phased integration strategy to minimize operational disruptions.

- Monitor integrated systems for performance, ensuring secure data exchanges.

- Update legacy systems regularly to address security vulnerabilities.

Step 6: Governance and Compliance Management

Governance and compliance are key considerations in cloud adoption in insurance, as it is a highly regulated industry. This step involves creating a governance framework that aligns with industry regulations and ensures secure, ethical cloud usage. Implementing proactive monitoring and review mechanisms enables businesses to maintain compliance while optimizing cloud performance.

- Develop a robust governance framework tailored to cloud operations.

- Include guidelines for data access, storage, and usage by employees.

- Ensure the framework aligns with insurance regulations like GDPR or HIPAA.

- Set role-based access controls to safeguard sensitive customer information.

- Monitor compliance through automated tools that flag policy violations.

- Establish a review process to update governance policies periodically.

- Maintain regular audits to identify and rectify compliance gaps.

- Work closely with your cloud provider to meet regional and industry standards.

- Develop an incident response plan for data breaches or compliance failures.

Step 7: Customer Experience Enhancement

- Cloud technology is a powerful tool for transforming customer experiences. By leveraging its capabilities, insurance companies can provide faster, more personalized, and transparent services. This step focuses on integrating customer-centric features into the cloud ecosystem to build trust and enhance satisfaction.

- Use cloud capabilities to create seamless digital touchpoints for customers.

- Introduce self-service portals for policy management, renewals, and claims.

- Enable AI-powered chatbots to assist customers with quick, accurate responses.

- Streamline claims processing with automated workflows for faster resolutions.

- Provide real-time updates to customers through cloud-based tracking systems.

- Analyze customer interactions to uncover insights for personalized services.

- Offer mobile-friendly platforms to ensure accessibility across devices.

- Integrate omnichannel communication to improve customer support experiences.

- Monitor feedback regularly and make iterative improvements to digital services.

Step 8: Process Optimization and Continuous Improvement

Cloud migration is never a set-it-and-forget-it thing. Instead, it demands ongoing attention and refinement to maximize its benefits. Continuous improvement helps you stay ahead of competition, align with the latest cloud adoption in insurance trends, and respond effectively to changing regulations. To ensure that you get the most out of this business decision you must:

- Monitor and analyze cloud performance to identify areas of cost optimization or resource allocation.

- Refine and automate business processes in the cloud ecosystem to offer an additional push to operational efficiency.

- Update and adapt security protocols to keep up with ever-evolving threats or regulatory requirements.

- Track and adopt emerging cloud adoption in insurance trends to expand capabilities and reduce latency in critical operations.

Challenges in Cloud Adoption and Ways to Overcome Them

1. Data Security

Insurance companies handle sensitive personal and financial data, making security paramount. While cloud providers implement robust security measures, insurers must take additional precautions.

Solution: Use data encryption, implement strict access controls, and conduct regular security audits to identify and mitigate potential threats.

2. Reliability

Insurance operations demand uninterrupted access to data. Service outages can disrupt claims processing, customer service, and risk assessments.

Solution: Partner with cloud providers known for reliable services and consider a multi-cloud approach for redundancy. Regular backups and a solid disaster recovery plan ensure business continuity.

3. Legacy Systems

Outdated legacy systems often have architectures incompatible with modern cloud platforms, complicating migration.

Solution: Adopt a phased migration strategy, gradually moving operations to the cloud. Use APIs and adapters to integrate legacy systems with cloud platforms. Work with experienced cloud providers for smoother transitions.

4. Resistance to Change

Employees often resist adopting new technology due to comfort with existing systems and fear of disruption.

Solution: Communicate the benefits of cloud adoption in the insurance industry and provide training programs to familiarize staff with new systems. Involving employees in the process and addressing their concerns can ease the transition.

5. Compliance

The heavily regulated insurance industry must ensure cloud operations adhere to laws, including data protection and industry-specific regulations.

Solution: Work with cloud providers offering compliance tools. Conduct regular audits and involve legal teams to maintain adherence to regulations throughout the migration process.

The Future of Cloud-Based Insurance Solutions

Cloud computing in the insurance industry is laying a stable foundation for the future of the sector. It allows insurers to unlock a new era of agility, efficiency, and innovation.

Plus, the advancements in data analytics and the refinement of technologies like AI and ML will empower insurers to harness the true power and potential of cloud-based insurance. From infusing efficiency to expanding outreach to making insurance collaborative – the sky is the limit for cloud-based insurance solutions. Of course, insurers should stay mindful of certain challenges revolving around data security, legal and regulatory compliance, legacy systems integration, and vendor lock-in. However, most of these concerns can be assuaged by choosing the right cloud partner.

So, use the above roadmap to get your insurance business in the cloud!

Case in Focus

In a cloud success story, a leading financial services provider struggled with disconnected legacy systems. We helped them migrate to a cloud-based, unified customer experience portal. This not only streamlined operations and enhanced customer satisfaction but also delivered millions in cost savings.