Rampant digitalization is indubitably transforming insurance to emerge as a “people-centric business.” While new-age technologies are profoundly impacting various facets of insurance, they have a particularly revolutionizing effect on underwriting. Underwriting, which once relied on intuition and experience, is becoming more reliable and accurate. Underwriters no longer have to face the challenges of manual risk assessment that result in errors, delays, and inefficiencies. Data-driven frameworks help insurers perform a comprehensive risk assessment and deliver personalized experiences. Incorporating Artificial Intelligence (AI) in insurance underwriting further fuels growth through automation and transparency.

AI-powered underwriting solutions are more intuitive, as they collect information from various sources to make smarter decisions. They are also more agile in handling the complexities of underwriting while maintaining customer-centricity. Here’s a deeper look at how to retain a humanized experience while utilizing AI in underwriting.

The Importance of AI in Insurance Underwriting

Before delving into the strategies of balancing AI technology and human experience to transform underwriting, here’s an overview of the significance of AI in underwriting.

1. Streamlined Underwriting Process

AI engines sift through the entire IT infrastructure to centralize data, effectively capturing data from diverse sources and in inconsistent formats to standardize it. As a result, all the internal and external data, ranging from claims history to market trends, is consolidated in a single hub. Once such a unified repository is ready, it performs routine data validation and updates the information periodically. The blend of AI & automation in underwriting monitors data quality while cleaning and updating it to ensure integrity and reliability. Such streamlined data hygiene and management practices ensure that your insurance business works with high-quality data that feeds higher accuracy in the underwriting workflows.

2. Dynamic Pricing of Insurance Products

AI in insurance underwriting makes dynamic pricing of insurance products a reality. It becomes possible by combining the capabilities of data analysis, predictive modeling, and automation in insurance underwriting. Using these, insurers deploy automated underwriting in insurance that factors in market trends, customer behavior, risk factors, and other influential variables in real time to suggest appropriate pricing. It takes into account the current state of these factors, and also anticipates any future trends, patterns, and risks for proactive pricing adjustment. Further, in case of any changes to these variables, the AI in underwriting updates the price dynamically to maintain profitability and competitiveness. Such a driven approach to underwriting boosts customer satisfaction through personalization and competitive pricing for a richer experience.

3. Sharper Risk Assessment

AI in underwriting has transformed risk assessment by harnessing its capacity to process vast amounts of data rapidly and accurately. This approach offsets manual data analysis using limited resources as AI promises thoroughness and scalability while accessing comprehensive datasets from diverse sources. Then, using advanced algorithms and machine learning techniques, AI-automated insurance underwriting analyzes data to detect patterns, correlations, and emerging trends impacting insurance outcomes. Based on these insights, the algorithm assigns a weighted score indicating the associated risk. This quantitative analysis empowers risk assessment by making it holistic and data-driven. Intelligent data processing in insurance underwriting also helps insurers understand the risks associated with customers and products while ensuring the right data is available for risk assessment as efficiently as possible.

4. Enhanced Productivity

Manual underwriting is a resource-intensive task. Whether it is running multiple risk simulations or consolidating data, the simplest of tasks may require dedicated resources. AI-powered automated insurance underwriting offloads all these resources by automating repetitive tasks, streamlining processes, and finetuning decision-making efficiency. AI and automation in underwriting processes high volumes of data using advanced algorithms and machine learning techniques to derive actionable insights in record time. Such elimination of manual workload and administrative overheads allows underwriters to focus on more complex cases requiring strategic initiatives. Using AI in insurance underwriting also lends visibility to any patterns, trends, or insights that may otherwise go unnoticed in the traditional methods. The resulting productivity boost quickens turnaround times, improves operational efficiency, and increases employee satisfaction too.

5. Fraud Detection and Prevention

When it comes to insurance underwriting, AI is crucial in identifying fraudulent claims and mitigating financial losses. AI-powered models analyze historical data to identify anomalies, inconsistencies, or suspicious activities. Automated underwriting in insurance enables insurers to flag potentially fraudulent applications in real time, reducing the chances of human oversight. By using AI in insurance underwriting, insurers establish advanced fraud prevention mechanisms, ensuring that only legitimate policyholders receive coverage. This enhances the credibility of underwriting processes and reduces unnecessary payouts, improving overall financial sustainability.

6. Faster Decision-Making and Turnaround Time

AI underwriting in insurance significantly speeds up decision-making by reducing dependency on manual assessments. As such, AI-powered systems process applications in minutes, offering instant approvals or flagging cases that require human review. Also, AI for insurance underwriting ensures that insurers assess complex cases efficiently, leading to faster policy issuance and claims processing. This reduction in underwriting time not only enhances customer experience but also helps insurance companies manage higher volumes of applications with improved accuracy and efficiency.

7. Compliance and Regulatory Adherence

AI insurance underwriting solutions assist insurers in maintaining compliance with ever-changing regulatory requirements. These systems continuously analyze underwriting processes to ensure adherence to industry standards and legal guidelines. AI-driven automation in underwriting maintains audit trails, reduces human errors, and ensures that transparent and well-documented data back all policy decisions. With AI underwriting in insurance, insurers remained visionary in regulatory compliance, minimizing risks associated with non-compliance, and enhancing operational integrity.

Stay Ahead of the Curve with Our Next-Gen Underwriting Platform

The Role of Human Expertise in Insurance Underwriting

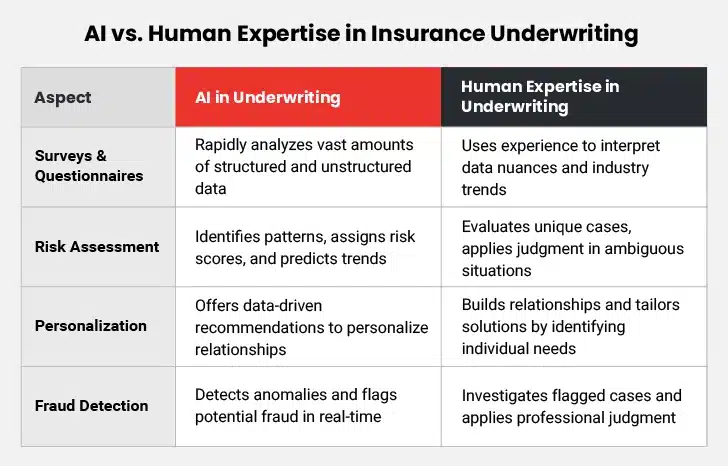

We’ve seen the impact of AI in underwriting. Now let’s focus on what human expertise brings to the table:

I. Contextual Awareness

Human underwriters possess a deep understanding of the broader context surrounding insurance policies. This contextual understanding spans regulatory frameworks, customer behavior, and market dynamics. Such insights complement the capabilities of any technology, including AI, in making hyper-relevant and informed decisions based on specific situations by considering factors that data may not explicitly capture. Think of it as an additional reinforcement for data-driven technologies.

II. Policyholder Relationship Personalization

While AI helps agents strike personal connections with policyholders, 64% of customers express no interest in accepting AI-based recommendations. Also, only 17% of agents trust AI technology, and 27% view AI as a threat. In such a scenario, human underwriters can act as an interface between customers and technology. After all, it combines the best of both worlds. The customers get a personalized and human touch while interacting with the insurer, while the insurance business enjoys the bouquet of advantages offered by AI in insurance underwriting. Further, human underwriters understand clients’ unique needs, preferences, and concerns, and input these into AI engines to generate tailored solutions that foster trust and loyalty.

III. Judgment and Discretion

Human expertise accounts for complexities that may not fully be captured by data alone. Experienced underwriters apply their professional judgment, intuition, industry knowledge, and discretion, especially in ambiguous situations. Such diverse perspectives also refine the capabilities of AI and automation in insurance underwriting by making it multi-dimensional and adding to the thoroughness of the algorithms. They may even innovate and develop new approaches to underwriting or suggest product or service innovations to keep up with the changing market dynamics. Automated underwriting in insurance then be trained along these lines to harness the capabilities of AI.

IV. Handling Complex Cases

Not all underwriting cases fit neatly into predefined models or historical patterns. Complex or unusual cases, such as niche business risks, emerging industries, or policyholders with unique circumstances, require human expertise. Underwriters step in to analyze such cases, considering factors beyond available datasets to arrive at well-rounded decisions. Their ability to think critically and assess non-standard risks ensures that insurers don’t overlook potential opportunities or unfairly reject applicants simply because they don’t fit into AI-driven risk models.

Balancing Human Experience and AI in Insurance Underwriting

Human expertise injects contextual understanding, professional judgment, and personalized relationships into underwriting. These qualities complement the AI’s capabilities to analyze data, automate underwriting, and make decisions backed by data. Human expertise adds more layers of insight to complex risks, adds discretion in ambiguous situations, and nurtures trust among clients and brokers. Meanwhile, AI powers productivity, streamlines underwriting workflows, and improves risk assessment accuracy.

From this discourse, it is evident that AI and human underwriters have distinct qualities that contribute to the well-rounded development of the process. As such, rather than viewing it as an either-or situation, insurers must look to amalgamate the two to compound their respective benefits and mitigate any limitations.

The best approach to balancing human experience with AI in underwriting is through the integration of the two in underwriting workflows. Human expertise validates AI-powered decisions while maintaining a human touch in customer relationships. Such a collaborative environment helps capitalize on the strengths of both for a more efficient, accurate, and customer-centric underwriting experience. Leveraging AI insurance software streamlines this process and enhances overall performance.

Closing Thoughts

The combination of human expertise and AI in insurance underwriting unlocks several opportunities for efficiency, innovation, and customer satisfaction. As such, striking the balance between AI and human experience grants insurers a competitive advantage in speed, accuracy, and risk management while upholding the concept of “people business” in insurance.