Consider a scenario where the healthcare provider delivered excellent care to a patient. They leave the facility satisfied, grateful, and ready to recommend the healthcare provider to others. But behind the scenes, the billing team does a lot of back and forth dealing with payers to get the payment, only to realize that the claim is denied over a minor error. Amid all this chaos, the revenue that should support staff and services remains trapped in limbo. Thankfully, advanced healthcare claims management solutions help healthcare providers overcome such issues and optimize their revenue cycles.

Table of Contents

Revenue Cycle Management as the Lifeline for Healthcare Organizations

How Do Inefficiencies Impact Healthcare Claims Management?

What Are the Key Strategies for Optimizing the Revenue Cycle in Healthcare?

The healthcare industry is facing one of the worst financial challenges that directly affects patient care delivery. Medical claim denials drain cash flow, coding errors create operational bottlenecks, and delayed reimbursements stretch already thin resources in a healthcare organization. What’s even worse is that all these inefficiencies consume valuable time of a healthcare professional, which could be dedicated to patient care.

Moreover, clinical excellence alone is not enough to get contract renewals or renew partnership opportunities. Instead, insurance partners, health systems, and corporate clients scrutinize operational performance with the same intensity they once reserved for quality scores. So, even if the healthcare provider has a 99% patient satisfaction rating and stellar clinical outcomes, they may still lose to the competition if their claims denial rate is 20% and revenue cycle stretches beyond 60 days.

That’s because payers seek healthcare providers who are clinically skilled as well as operationally efficient and profitable. Thus, an optimized revenue cycle is important for healthcare providers, and the best way to do so is by adopting the latest healthcare claims management systems.

Revenue Cycle Management as the Lifeline for Healthcare Organizations

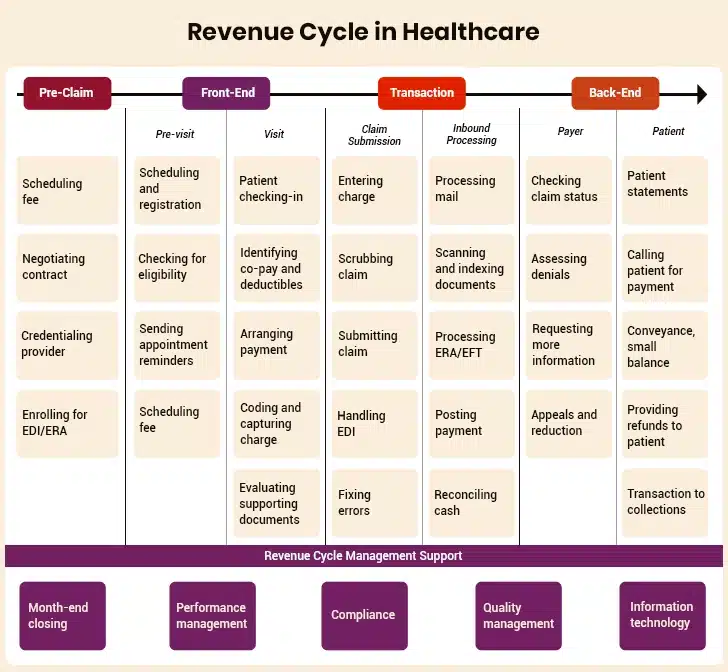

Revenue cycle management (RCM) is a process used by healthcare providers to manage patient payments and includes all the related steps from patient eligibility verification and claim submission to final payment collection. In essence, an effective revenue cycle converts care delivery into sustainable revenue streams for healthcare providers, ensuring they continue to operate and serve the communities better. And that’s why revenue cycle management is called the lifeline of healthcare organizations.

As healthcare costs rise and reimbursement models evolve, effective RCM is necessary for healthcare institutions, as it directly impacts their organizational survival and patient experience. Contrarily, an inefficient revenue cycle in healthcare claims management does a lot more than cause administrative inconvenience. Let’s explore the ill effects of an ineffective revenue cycle in healthcare in the following section.

“You want to get every dollar you’re entitled to. You want to receive payment as fast as possible. And, you want to make sure you’re doing it in a legal manner. That’s the core of a revenue cycle.”– Catherine O’Leary, Managing Director of KPMG (Chicago)

How Do Inefficiencies Impact Healthcare Claims Management?

A suboptimal revenue cycle creates ripple effects that negatively impact almost every aspect of healthcare delivery, threatening healthcare organizations at their core. Let’s figure out how a poor and inefficient revenue cycle affects claims management in the healthcare sector:

I. Lost Revenue Streams

Denied medical claims delay payments that translate to permanent financial losses for healthcare providers. This creates a financial hemorrhage situation for hospitals and clinics. As per the industry research, nearly 38% of healthcare providers report that at least one in ten claims is denied. Another industry report states that each denied claim costs providers around $43.84, which is $19.7 billion annually.

The same report states that nearly 15% of medical claims submitted to private payers were initially denied. Simply put, denied medical claims and delayed payments create cash flow gaps for healthcare providers. Instead, the payment could be used to upgrade medical facilities and deliver better care to patients.

II. Increasing Administrative Costs and Resource Drain

Other than financial loss, every denied medical claim increases the admins’ burden within the healthcare provider organization. The healthcare provider has to allocate more resources to appeal processes and claim resubmissions to get its payment. Even worse, this follow-up communication with insurance companies is done on a loop at times, which is very frustrating for healthcare providers.

Not to forget the plight of compliance officers and specialists who spend their days fixing preventable errors in mediclaims. So, instead of focusing on improving the healthcare claims processing cycle, staff are tied up in endless cycles of exception handling. And the problem doesn’t end here!

Complexity further increases manifold when healthcare providers work across multiple payer systems, where each payer has different submission rules, documentation standards, and approval processes. This creates unnecessary stress for staff, and healthcare organizations have to bear the overhead costs of such administrative resources, which in turn reduce profit margins.

III. Physician Burnout and Workforce Sustainability Issues

Revenue cycle inefficiencies drain the finances of healthcare providers and erode the morale of their employees. That’s because physicians and nurses, who are ideally meant to provide patient care, are redirected to handling administrative tasks in healthcare claims management. This distraction leaves the physicians agitated, resulting in early burnout.

Given this picture, there’s no doubt why 43.2% of physicians in the US experience at least one symptom of burnout. Digging deeper, this also creates a vicious cycle: burnout rises, turnover increases, and recruitment becomes harder. Imagine being a physician who spends hours with patients, only to learn that a medical claim is denied due to missing pre-authorization.

IV. Compliance Risks and Regulatory Exposure

Compliance is mandatory in the healthcare industry, and inefficient revenue cycle management results in regulatory non-compliance. Even a minute coding error or a missing document during medical claim submission can trigger audits from government payers and regulatory bodies for the healthcare provider.

Moreover, as billing regulations evolve, manual claims management processes in healthcare are becoming more prone to failure. And when healthcare providers can’t maintain accurate documentation trails, they struggle to defend their billing practices during audits. The result? Financial penalties and reputational damage that often strain payer relationships.

V. Patient Experience Degradation

What’s even worse than financial loss and administrative burden for a healthcare provider? Degraded patient satisfaction and their trust in the system. That’s very true! A patient loses confidence in the healthcare provider when they get unexpected bills and have to face lengthy appeals processes. This erosion of trust from the patient’s end leads to delayed care-seeking behavior and poorer health outcomes on the whole.

As is evident, there’s no room for inefficiencies in claims management in healthcare. Understanding these after-effects helps build up the case for why healthcare leaders should focus on revenue cycle optimization strategies. Let’s explore the key revenue optimization strategies in healthcare claims management in the next section.

Turn Denials into Revenue with Healthcare Claims Management Solution

What Are the Key Strategies for Optimizing the Revenue Cycle in Healthcare?

No healthcare provider can afford to incur financial losses, compliance risks, patient dissatisfaction, or physician burnout. Therefore, the best way for a healthcare provider to avoid such issues is by implementing revenue cycle optimization strategies. These strategies strengthen every touchpoint in the claims management process, from front-end patient registration to final payment collection. Let’s dig deeper into different aspects of the revenue cycle in healthcare and subsequent strategies to optimize those parts one by one:

A. Streamlining Front-End Processes

- Patient Eligibility Verification

Real-time insurance verification is the first line of defense against denials for healthcare providers, which can be done using the latest claims management systems. These claims management solutions integrate directly with payer databases to verify coverage, benefits, and authorization requirements before care is delivered to the patient.

Advanced patient eligibility verification systems can also identify secondary insurance coverage and coordinate benefits appropriately. They can also flag potential eligibility issues that require additional documentation. By identifying coverage gaps and expired policies upfront, providers can prevent downstream billing surprises and improve their financial predictability.

- Accurate Patient Data Collection

The accuracy and quality of data are the foundation of successful claims submission and processing. Even a minute error, such as a misspelled name, wrong birth date, or inaccurate insurance ID detail, results in automated claim denial, derailing and prolonging the entire reimbursement process. Fortunately, providers can reduce risks by using automated validation tools, insurance card scanning, and standardized data protocols.

Further, training front-desk staff in best practices ensures that the human element maintains the same precision as automated systems. And to prevent such issues from recurring in the future, leaders should establish data quality audits and implement corrective measures before they impact claim submissions.

- Pre-Authorization Automation

Pre-authorization of claims is usually one of the most frustrating steps for healthcare providers. Until now, it has required manual phone calls, lengthy hold times, and paper-based documentation, which have delayed care delivery for days and weeks. Luckily, AI has now changed this process.

Automated systems can identify which services need prior approval, generate authorization requests, and even predict approval likelihood based on historical data. For patients, this means fewer treatment delays. And for healthcare providers, it means less back-and-forth and fewer denials due to missing authorizations.

B. Enhancing Coding and Documentation Accuracy

- Clean Claims Submission

Clean claims are those accepted without the need for corrections and are the gold standard in healthcare billing. And for a claim to be clean, ICD-10 diagnostic coding and CPT procedural coding standards, supported by robust documentation, are required. That’s why many providers are turning to healthcare claim management software with real-time coding validation. These systems act like a “spell check” for claims, flagging potential errors before submission.

- AI-Powered Computer-Assisted Coding (CAC)

Computer-assisted coding platforms use natural language processing techniques to analyze clinical notes and suggest accurate codes based on medical terminology and context. A step ahead, these AI-powered CAC tools also flag potential discrepancies in medical documentation that require human review.

Like a second set of eyes, CAC reduces cognitive burden on coders and increases accuracy. Over time, these systems learn and improve, catching subtle issues that might otherwise slip through. For clinicians, this also means less time spent revisiting records to clarify missing details, which reduces frustration and speeds up workflows.

- Continuous Auditing and Staff Development

More than being about compliance, audits focus on continuous improvement of the claims management process in healthcare. Regular reviews help healthcare providers identify trends and training needs to ensure coding practices are up-to-date with regulations and industry standards.

Besides, organizations that invest in ongoing staff development programs, including mentorship between experienced and newer coders, preserve institutional knowledge and stay ahead of regulatory changes in the healthcare sector.

C. Leveraging Technology to Transform Claims Management

- AI and ML for Predictive Denial Management

AI and ML have changed the way healthcare providers approach claims management. AI and ML-based tools can analyze historical claim patterns to predict which claims are most likely to be denied, based on factors such as documentation quality, payer history, and patient demographics, etc. This predictive capability enables providers to identify and fix issues before submission, thereby improving first-pass acceptance rates.

- Comprehensive Claims Management Solutions

Modern claims management platforms in healthcare provide end-to-end visibility from submission to adjudication. Additionally, their features like automated alerts, intelligent routing, and integration with EHRs help create smoother claims management workflows and reduce manual effort.

- Blockchain for Secure Claims Processing

Blockchain is no longer futuristic, and its benefits are very much evident in the healthcare industry. By creating immutable transaction records of claims-related transactions, blockchain prevents fraud, improves transparency, and accelerates payment cycles. This technology also creates audit trails to help healthcare providers be audit-ready. Smart contracts can even automate payment once conditions are met, reducing administrative overhead.

D. Proactive Denial Management and Appeals

- Root Cause Analysis for Systematic Improvement

Instead of treating each claim denial as an isolated event, successful healthcare providers look at patterns, such as whether denials are linked to a particular payer, a specific service line, duplicate submissions, missing documentation, eligibility issues, or a lack of prior authorization. Or is this denied claim case a recurring coding error? This approach enables healthcare providers to address the significant reasons for denials first rather than wasting resources on firefighting individual claims.

- Automated Denial Prevention Workflows

Automated denial prevention workflows can flag denial risks before submission. So, if a claim is missing documentation or doesn’t meet payer criteria, automated systems can route it for review. Whatever the reason for denial is, such proactive prevention saves time and reduces the likelihood of claim rejection.

- Strategic Appeals Management

Claim denials are bound to happen. In such scenarios, healthcare providers should take a strategic approach to appeals and claims resubmission. This includes correct documentation, timely resubmission, and proper communication with insurance payers. Healthcare providers should set up dedicated appeals teams that understand specific payer requirements, maintain detailed documentation to support medical necessity, and submit appeals within the designated time frames. Thus, they can prioritize mediclaim cases based on financial impact and likelihood of success.

E. Improving Patient Financial Engagement

- Transparent Price Estimation Tools

From the patients’ perspective, nothing erodes their trust in the healthcare system like a surprise bill. Advanced cost estimation tools provide patients with clarity by considering deductibles, copays, and coverage limitations before they begin their treatment. Similarly, transparency in price estimation reduces billing disputes and empowers patients to make informed decisions about their care.

- Flexible Payment Solutions

Patients expect convenient, digital-first payment options in healthcare insurance as well. Therefore, it is not wrong to say that online claim submission portals, mobile apps, interest-free payment plans, and digital wallet integration are becoming the standard. Healthcare providers that offer flexible payment options to payers improve collection rates while boosting patient satisfaction.

- Patient Education and Insurance Literacy

Not having a proper understanding of what is covered in the insurance policy is one of the major causes of delayed claim payments. To avoid such scenarios, healthcare providers should invest in education programs, either through digital platforms, workshops, or one-on-one guidance. This education helps patients understand their benefits and responsibilities mentioned in the mediclaim.

And when patients are well-informed of their benefits and responsibilities, they’re less likely to delay payments and more likely to trust their healthcare providers. Having explored the strategies to streamline claims processing and optimize revenue cycles, it is now time to see what the future holds for this critical function in healthcare.

The Future of Revenue Cycle in Healthcare Claims Management

The revenue cycle in healthcare is changing quickly due to technological advancements and shifting payment models. That said, the healthcare providers who keep pace with these advancements will certainly improve their revenue cycle and strengthen relationships with patients and payers alike. Let’s quickly run through these emerging trends:

1. Forecasting Financial Performance with Predictive Analytics

With predictive analytics, healthcare providers can uncover revenue trends, denial rates, and cash flow variations. Based on these insights, they can adjust staffing, negotiate payer contracts, and make smarter decisions.

2. Redefining Reimbursement with Value-Based Care Models

Payments have shifted from fee-for-service to value-based care, thus changing how revenue cycles function within the healthcare organizations. Instead of billing for volume, healthcare providers must track outcomes, patient satisfaction, and quality indicators. However, to achieve this, healthcare providers need a new level of integration between clinical data and financial systems, which is yet another challenge for them. Looking on the brighter side, connecting clinical data and financial systems is itself an opportunity to demonstrate value.

3. Creating Seamless Ecosystems with Interoperability and Data Sharing

The future of claims management in healthcare depends on how effortlessly the data is exchanged. That’s because interoperability enables healthcare providers, payers, and patients to share data securely and efficiently. The global RCM market reflects this momentum. Valued at $343.78 billion in 2024, it is projected to reach $656.7 billion by 2030, growing at a CAGR of 11.29%. Investment is flowing into technologies that make healthcare finance more transparent, connected, and resilient.

Closing Lines

Gone are the days when revenue cycle management was a back-office task for healthcare organizations. Today, it is a key factor that ensures sustainable care delivery and profitability for the provider. Therefore, ensuring that the revenue cycle is optimized at all times is necessary for healthcare organizations. Not to forget, an optimized revenue cycle helps reduce medical claim denials.

That’s why, nearly 84% of healthcare organizations are focusing on reducing denied medical claims, as it is vital for their financial health and ability to deliver improved patient care.

To sum up, the true goal of revenue cycle optimization in healthcare is to keep the focus on patients, and the best way to do so is by implementing a robust healthcare claims management solution. These tools do the heavy lifting by maintaining optimal cash flow and revenue cycle so that professionals can deliver quality and compassionate care.