What if insurers expanded their vision instead of viewing AI as just a way to cut corners?

This article shows how insurance companies can move beyond cost-cutting with AI. It explores how this technology can be used for creating new value streams, building better customer experiences, and designing insurance products that meet market needs.

What if insurers expanded their vision instead of viewing AI as just a way to cut corners?

This article shows how insurance companies can move beyond cost-cutting with AI. It explores how this technology can be used for creating new value streams, building better customer experiences, and designing insurance products that meet market needs.

Table of Contents

Summing Up: AI as a Strategic Imperative for Future Competitiveness1. Reimagining Insurance Products Through AI

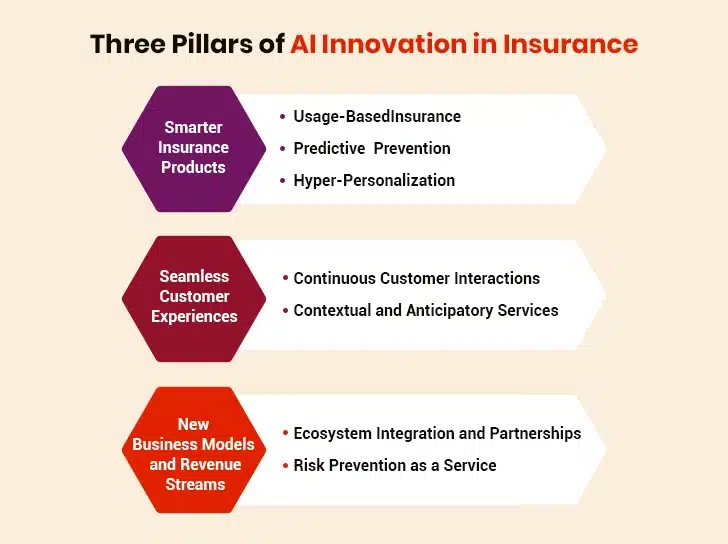

AI is changing what insurance products can be and how they work in today’s digital world. Smart insurers don’t just improve existing products; they use AI to completely rethink what insurance means.

1.1. From Static to Dynamic: Usage-Based Insurance Products

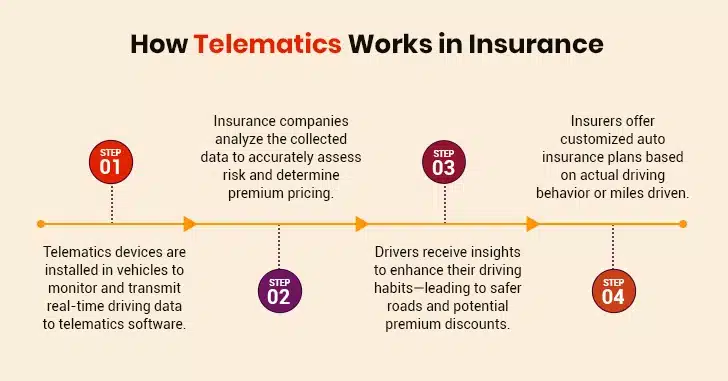

Traditional insurance has always classified policyholders into broad groups based on demographics. This practice worked for decades, but it was never truly accurate. Usage-Based Insurance (UBI) upends this model by dynamically pricing coverage based on actual user behavior, not assumptions. To cite an example, auto insurance companies now use telematics devices in cars to gather data about speed, braking habits, acceleration patterns, and miles driven. AI processes this information to spot driving patterns and measure risk with unprecedented precision. Put another way, premiums now depend on how an individual behaves in real life, rather than on broad assumptions about their age or location.

The approach creates a win-win for both insurers and customers. Insurance companies can assess risk and set prices more accurately, leading to better profits. Policyholders enjoy much lower premiums, which gives them a good reason to reduce risky behavior.

AI processes this information to spot driving patterns and measure risk with unprecedented precision. Put another way, premiums now depend on how an individual behaves in real life, rather than on broad assumptions about their age or location.

The approach creates a win-win for both insurers and customers. Insurance companies can assess risk and set prices more accurately, leading to better profits. Policyholders enjoy much lower premiums, which gives them a good reason to reduce risky behavior.

1.2. Predictive Protection: From “Detect and Repair” to “Predict and Prevent”

The most powerful shift in insurance might be the move from “detect and repair” to “predict and prevent”. Traditional insurance waits for a mishap to happen, then pays to compensate for it. AI-powered insurance monitors risk factors and triggers proactive intervention when AI-defined thresholds have been crossed. McKinsey says AI could bring $1.10 trillion in yearly value to insurance companies of all sizes. Much of this comes from prediction capabilities that weren’t possible before. Today, property insurers often use IoT sensors with AI analysis to spot subtle changes in electrical systems, water pressure, or environmental conditions that might signal equipment problems. Health insurers use AI to process data from wearable devices and spot early signs of chronic health conditions. Pete Miller, chairman of the Institute for Global Insurance Education, has put it well: “The best loss is the one that never happens“. This philosophy drives the new Predict & Prevent model, which’ll be shaped by three key enablers:- Connected devices to continuously supply risk-related data

- Open-source ecosystems for sharing data across industries

- Cognitive technologies to process massive data streams

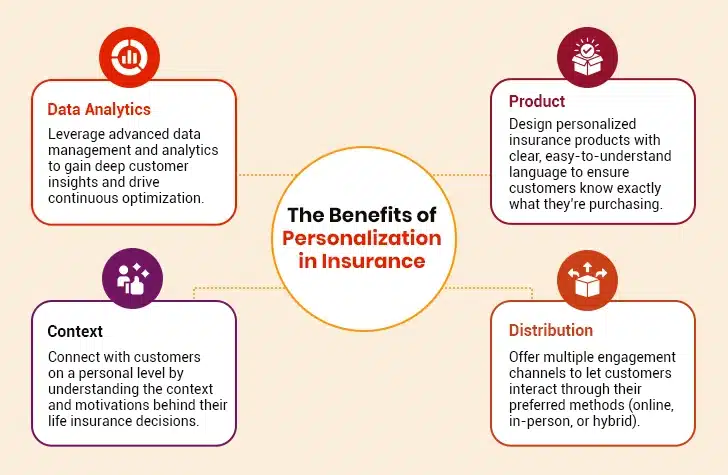

1.3. Personalization at Scale: Tailoring Insurance to Individual Needs

The third major shift takes us from standard insurance packages toward coverage that fits each individual’s specific needs. AI makes this possible by analyzing huge amounts of data to create detailed policyholder risk profiles. Today, several insurance products are available as modular components that customers can mix and match. Instead of a standard homeowner’s policy, they can select coverage for specific appliances, weather risks, or valuables.

AI also recommends coverage changes based on life events. When someone moves to a hurricane-prone area, the system suggests flood and wind coverage. Similarly, when driving habits change, car insurance premium adjusts automatically without requiring new paperwork.

This precision drives results. Customer satisfaction jumps 15-30% when insurers use AI to personalize their services. This personal touch helps customers feel valued. It also creates stronger bonds between them and their insurers.

Today, several insurance products are available as modular components that customers can mix and match. Instead of a standard homeowner’s policy, they can select coverage for specific appliances, weather risks, or valuables.

AI also recommends coverage changes based on life events. When someone moves to a hurricane-prone area, the system suggests flood and wind coverage. Similarly, when driving habits change, car insurance premium adjusts automatically without requiring new paperwork.

This precision drives results. Customer satisfaction jumps 15-30% when insurers use AI to personalize their services. This personal touch helps customers feel valued. It also creates stronger bonds between them and their insurers.

Supercharge Your Insurance Business with AI

2. Creating New Customer Experiences

Insurance customers once endured endless forms and weeks of waiting. Not anymore. Today’s policyholders want insurers to solve problems instantly and offer personalized service. As traditional experiences defined by mountains of paperwork and glacial response times become unacceptable, AI steps in to create new ways for insurers to engage with customers.2.1. Continuous Connection and Immediate Insurance Interactions

AI has changed traditional customer interaction completely. The days of slow processes and delayed claim payments are gone. Modern policyholders demand smooth experiences at every touchpoint—from the first quote to the final claim. AI-powered chatbots and virtual assistants are now the new heroes of customer service operations. They offer 24-hour support and handle routine inquiries efficiently. These systems do more than answer questions. They collect valuable data, learn from every conversation, and get better over time.

Additionally, modern AI algorithms quickly assess risks and create suitable coverage options. This way, policies can be issued in minutes. Claims processing—once the most frustrating part of insurance—has also undergone an overhaul through AI. Advanced algorithms now:

AI-powered chatbots and virtual assistants are now the new heroes of customer service operations. They offer 24-hour support and handle routine inquiries efficiently. These systems do more than answer questions. They collect valuable data, learn from every conversation, and get better over time.

Additionally, modern AI algorithms quickly assess risks and create suitable coverage options. This way, policies can be issued in minutes. Claims processing—once the most frustrating part of insurance—has also undergone an overhaul through AI. Advanced algorithms now:

- Review claims using policy data and external information

- Detect potential fraud through anomaly identification

- Predict optimal settlement amounts based on historical data

- Route claims automatically depending on their complexity

2.2. Contextual and Anticipatory Insurance Services

What if an insurer doesn’t just respond to requests but actually anticipates user needs? AI makes this shift from reactive service to anticipatory engagement possible. Contextual AI analyzes vast amounts of customer data, including demographics, behavior patterns, and external factors to deliver highly personalized experiences. This technology helps insurers understand each customer’s unique situation and provide relevant suggestions exactly when needed. Now, picture this. An AI-embedded system notices someone has booked a flight and proactively suggests appropriate travel insurance options. Anticipatory insurance pushes this idea further by using AI to forecast potential risks before they happen. Instead of waiting for claims, AI-powered systems can:- Analyze patterns in claims data to identify emerging risks

- Send real-time alerts about weather events, driving conditions, or home maintenance issues

- Recommend preventive measures to avoid losses entirely

3. Developing New Business Models and Revenue Streams

AI creates new business models and revenue streams for forward-thinking insurers. Companies now see AI as more than just a cost-cutting tool. Leading insurers are using it as a ‘growth enabler’ to expand their market presence and generate value.3.1. Ecosystem Integration and Partnership Opportunities

The insurance industry is moving toward interconnected digital ecosystems, where AI-driven platforms bring together insurers and external partners. This change enables real-time data exchange, decision automation, and unprecedented opportunities for collaboration. An essential first step for insurers in this direction is modernizing their legacy infrastructure: centralizing fragmented data into cloud-based platforms and implementing open APIs. This technical foundation enables real-time data exchange with partners, from automotive telematics providers to healthcare wearables developers. Of late, strategic collaborations between insurers and technology providers have yielded remarkable results. Many insurers now collaborate with climate analytics firms to refine flood risk models. Others adopt blockchain platforms to securely share claims data across their networks. These partnerships benefit insurers in several ways:- Access to specialized AI capabilities without massive internal investment

- New distribution channels for insurance products

- Real-time information about customer behaviors

- Knowing how to embed insurance offerings into non-insurance platforms

3.2. Risk Prevention as a Service

The insurance industry is moving from post-loss compensation to proactive risk prevention. With the help of data and AI, insurers will now be able to provide services that reduce hazards for customers while opening new revenue streams. AI and data analytics are central to this change. By mining data from various sources, insurers can predict mishaps like equipment failures or climate-related damage. These insights allow them to warn customers early and recommend preventative actions. For example:

AI and data analytics are central to this change. By mining data from various sources, insurers can predict mishaps like equipment failures or climate-related damage. These insights allow them to warn customers early and recommend preventative actions. For example:

- Home insurers use smart sensors to detect faults. This alerts homeowners to tackle issues before major damage occurs.

- Auto insurers leverage telematics data to coach drivers on safer habits. This reduces the probability of accidents.

- Health insurers process wearable data to flag signs of chronic conditions and suggest lifestyle changes.

- Discounted smart home devices that lower property risks

- Wellness programs linked to fitness tracker data

- Predictive maintenance alerts for business clients

4. Implementation Strategies for Value Creation

Insurance companies just need more than advanced technology to successfully implement AI. They must transform their organization and plan strategically to create value beyond just saving costs.4.1. Building AI Capabilities Beyond Efficiency Applications

Insurance companies should stop seeing AI as just a cost-cutting tool. They should view it as a strategic asset that creates value. Companies should build internal tools that make AI adoption smoother while implementing complete data governance frameworks. Here’s the truth: even the most advanced AI models will underperform without analytics-ready data sets. Leading insurers take a different approach. They apply AI strategically to change core business processes instead of working on isolated use cases. This creates a bigger effect than standalone, siloed initiatives.4.2. Balancing Short-Term Efficiency Gains with Long-Term Value Creation

Many insurance leaders worry that AI investments made today could become outdated in the near future. It’s a reasonable concern. Yet, waiting for the perfect moment leaves companies watching their competitors race ahead. A balanced approach proves useful here. It incorporates:- Quick-win projects that deliver immediate efficiency benefits

- Strategic long-term investments in data infrastructure and capabilities

4.3. Organizational and Cultural Considerations

People resist change. It’s human nature. This resistance represents one of the biggest hurdles to successful AI adoption in insurance. The process isn’t complicated, but it demands discipline. It requires:- Readiness assessment before project implementation

- Impact identification on teams and workflows

- Clear communication with stakeholders