Insurance businesses of today grapple with an array of challenges ranging from cumbersome administrative processes to claims fraud. Amidst these challenges, new-age technologies offer a glimmer of hope. As such, insurance companies are increasingly adopting Blockchain technology to improve their operations and provide better services to their customers. While many in the industry are still exploring the potential benefits of this emerging technology, there is already a lot that can be done with it. From streamlining claims administration to enhancing policy underwriting, Blockchain for the insurance industry offers a multitude of opportunities. Also, by decentralizing data storage, enabling transparency in transactions, and automating workflows, Blockchain can also mitigate several challenges faced by insurance businesses. In this blog, we will be exploring the use of Blockchain in insurance, along with some practical applications of implementing the same.

Why do Insurance Companies Need Blockchain Technology?

The core benefit of Blockchain in the insurance industry is that it builds trust between parties sharing information. In simple words, Blockchain is a distributed ledger technology that is used to record and store transactions in a secured manner as an electronic list of records or blocks. These blocks cannot be erased, which helps to ensure trust between users involved in a transaction.

Blockchain works by creating an immutable shared database that is constantly updated in real-time to reflect all changes made to each data block within its network. Such a zero-trust architecture makes it impossible for any single entity or user on the network to modify previous records without being detected first. If they try, they will be flagged by other users who can take action against those attempting to fraudulently change the entries. It also means there’s no central authority controlling this process – it’s all peer-to-peer instead!

How is Blockchain Important to the Insurance Industry?

The total cost of insurance fraud (excluding health insurance) in the US is estimated to exceed more than $40B a year, according to the FBI. In addition to this gigantic statistics, Insurance itself comprises complex processes involving multiple stakeholders to collaborate in order to process a claim or issue a policy. Each step in this collaborative process represents a potential point of failure in the overall system, where critical information can be lost, policies misinterpreted, and settlement times lengthened. Therefore, looking at the accuracy and security aspect of this trust-building technology, it’s one of many possible solutions for the ever-increasing transaction fraud related problems plaguing the current global financial markets including insurance. The application of Blockchain in insurance has the potential to transform the industry by improving data security, introducing transparency, lowering costs, and speeding up processes.

In this blog, we have tried to capture the benefits of Blockchain technology that Insurers can harness on supported by some use cases.

6 Benefits of Blockchain in Insurance

By leveraging Blockchain, insurance businesses can pave the way for stronger security, reduced costs, increased trust, and real-time data accessibility. The key benefits of Blockchain in insurance are:

I. Reduced Costs

Blockchain technology can reduce the cost of insurance by enabling more efficient distribution of data and payments. This is because it allows for real-time tracking of claims, which is typically done manually. It also reduces the need for intermediaries and other third parties involved in insurance claims handling.

II. Fraud Detection

It’s becoming more and more common for insurers to use Blockchain for insurance claims fraud detection and risk management. Blockchain provides a secure and efficient way for businesses of all sizes to verify documents, such as insurance policies, medical records, etc. Leveraging Blockchain for insurance fraud detection helps ensure that you’re getting accurate information about your customer or policyholder so that you’re fully protected against any fraudulent claims or actions taken by them (like identity theft).

III. Data Integrity

There are many ways Blockchain can help insurers maintain data integrity, but one of the most important is by verifying the authenticity of claims. This is especially true for insurance companies that use big data to generate insights into their customers’ risk profiles.

IV. Better Customer Service

Blockchain allows insurers to improve the customer service experience. It enables them to securely record and track policyholder information such as claims history, premiums paid, rewards earned, and more. It also allows insurers to collect real-time data about customers’ behavior to better serve them.

V. Enhanced Transparency

By leveraging Blockchain technology in insurance, businesses can enhance transparency across insurance processes. Blockchain functions as a share, immutable ledger wherein all transactions are recorded. Any stakeholder can view and verify the transactions and contracts.

VI. Streamlined Claims Processing

By leveraging Blockchain for insurance claims processing, insurers can streamline end-to-end claims processing workflows. Smart contracts can be executed to cut down claims management costs, reduce claims fraud, and automate claims verification.

Develop Blockchain-powered Insurance Solutions to Modernize Operations

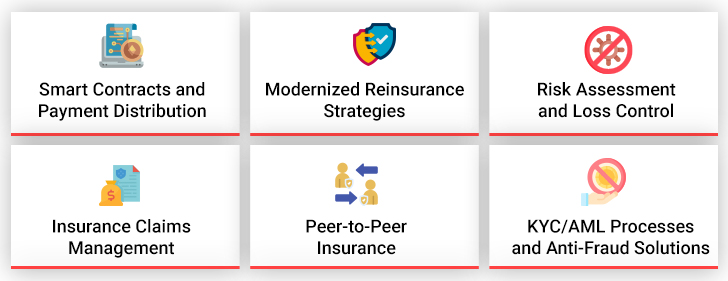

Insurance players are increasingly exploring the potential of Blockchain and insurance technologies like Artificial Intelligence and Machine Learning. The application of Blockchain for insurance enables insurers to manage payments and claims on a distributed ledger. It allows them to gain efficiency in their processes by removing intermediaries from the chain. This is especially useful for insurance companies because they often deal with large volumes of data, making it harder to verify the information and detect fraud. By using Blockchain, insurance businesses can significantly improve their efficiency and reduce costs as well. While there are several emerging applications of Blockchain in insurance, certain use cases that are most popular are:

1. Smart Contracts and Payment Distribution

Smart contracts are a type of Blockchain contract that triggers automatically once the conditions of the contract are fulfilled. They can be used for peer-to-peer insurance, KYC/AML processes, and even escrow services. They also pave the way for the creation of a trustless insurance marketplace. This means that there is no need for an insurance agency or middleman. The buyer and seller can both agree on the terms of their contract, which will be enforced by Blockchain technology. A smart contract could also be used to automatically pay claims in cases where an accident occurs, speeding up the process considerably.

2. Insurance Claims Management

Claims management is the process of identifying, assessing, and resolving claims. The application of Blockchain for insurance claims processing streamlines the process by creating a distributed ledger that records every transaction made on it. The ledger can be used to track the progress of claims processing from initiation/FNOL until they are settled in court or otherwise resolved by an insurance company, making it easier for all parties involved to keep track of their progress through each stage of the process.

3. Modernized Reinsurance Strategies

Reinsurance is a method of transferring risks between two or more insurance companies. It can be used to mitigate risk and increase capacity, and it’s a way to spread risk across multiple insurers. Blockchain technology in insurance has the potential to streamline reinsurance by allowing users to make claims in the same way they would with traditional insurance policies—but on an immutable ledger that has no chance of being changed once recorded on the Blockchain.

4. Peer-to-Peer Insurance

As the name suggests, peer-to-peer (P2P) insurance is a type of insurance that’s sold directly between consumers. This model can be used for everything from car insurance to homeowner’s coverage and even life and health insurance.

Some companies are already using Blockchain technology in their P2P models, which can enhance their services by providing transparency and trustworthiness for both sides of the transaction. P2P insurance using Blockchain makes it easier for customers to compare quotes from different providers without having to worry about hidden fees or other surprises when buying or renewing policies from an individual seller or broker. With Blockchain technology at its core, transactions will be recorded as they happen, and each stage of payment processing will be recorded. This helps prevent fraudulent claims against either party because all records created during those transactions are stored securely on multiple computers around the world simultaneously.

5. Risk Assessment and Loss Control

Blockchain can be used to monitor risk and loss control, which is important if you want to prevent fraud. Insurance Blockchain solutions have a lot of potential for insurance companies because they help them with their processes, including:

- The collection of information about insured individuals

- The calculation of premiums based on that information

- The management of claims files in order to make sure that there will never be any disputes between parties involved

6. KYC/AML Processes and Anti-Fraud Solutions

Know-your-customer / Anti-money Laundering (KYC/AML) processes are used to verify the identity of customers and the source of funds. They help prevent fraud, which is an important consideration in an industry that faces a constant threat from hackers and criminals looking to steal money or personal information.

Blockchain in insurance can be used to automate some KYC/AML processes, such as verifying bank accounts. Moreover, Blockchain records can be verified by multiple parties at once. This will save both time and money since there won’t be any need for duplicate work when dealing with new clients who may not yet understand how things work within insurance claims departments.

Conclusion

In conclusion, Blockchain technology offers new ways to improve the inefficiencies in the insurance industry. It can help insurers by creating a more secure environment, reducing costs, and boosting trust. Blockchain in the insurance industry also provides real-time data which can be used in various ways such as risk scoring, claims settlement, and much more.

If you are looking to witness real-life applications of Blockchain in insurance, you can explore Blockchain-powered Life Settlement solution that enables live policy tracking, infuses transparency and security in policy transactions, and automates the entire life settlement lifecycle.