The insurance industry stands in the throes of welcoming a new, digitally advanced era. Whether it is through the introduction of disruptive technologies, higher stakes because of climate change, or changing regulations surrounding data privacy, insurers are continuously feeling the burn to innovate and stay ahead of the curve. Against such a dynamic landscape and an uncertain future, insurance businesses are willing to accept any help they receive to stay in the green.

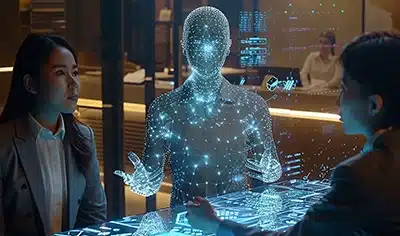

Enter: insurance technology consulting – a potent weapon to future-proof your business. From navigating challenges to unlocking new opportunities, insurance technology companies help maintain relevance. Read on to know how they help.

Uncertainties and Challenges in the Future of Insurance

Here are some challenges and uncertainties that are rocking the boat of the future of insurance:

Effect of Climate Change

The increasing frequency of natural calamities and the severity with which they occur has insurers re-evaluating risk profiles. Even if the incidents do not reach extremes, small but incremental changes like rising sea levels or changing weather patterns could disrupt livelihood or affect food security to increase claims. Given this, insurers must embrace a more sophisticated approach to risk assessment and pricing.Pace of Technological Disruption

Technologies like Artificial Intelligence (AI), Big Data, and automation are revolutionizing the insurance sector. From streamlining claims processing to personalizing insurance policies, these technologies deliver in-depth coverage. The problem? Integrating these technologies into legacy systems and workflows. Not to mention that the cost of developing and maintaining solutions requires skill and expertise.Increasing Data Privacy Regulations

Even if you manage to get onboard digital insurance solutions, you must ensure compliance with the prevailing data privacy regulations and laws. Modern-day data privacy regulations are setting new standards for safeguarding the collection, storage, and usage of customer information and non-compliance may attract strict action.Changing Policyholder Demographics

Policyholder demographics are rapidly changing. With younger generations, like Gen Z and Millennials entering the market, they expect digital and on-demand insurance experiences. This means that insurers have to focus on user-friendliness while also customizing the policies they have to offer. At the same time, they have to brace for any changes that this shift in demographics may bring.Ever Growing Cybersecurity Threats

The growing dependency on digital frameworks may expose insurers to new cybersecurity threats and vulnerabilities. Seeing the rapid rate at which these evolve, it is imperative for insurers to keep up and develop robust cybersecurity protocols to protect sensitive data while maintaining business continuity.

Future-Proof Your Insurance Business with our Technology Services

How Insurance Technology Companies Help Carriers and Brokers

The future of insurance may have some degree of uncertainty about it. But that doesn’t mean that it has to be daunting. Insurance IT consulting can lend a helping hand and empower insurers in the following ways:

1. Effective Risk Management

Insurance technology companies help insurers leverage digital solutions to perform advanced data analytics to develop innovative parametric insurance products, personalize policies, evaluate risks holistically, and even promote or reward responsible behavior. Additionally, they can assist in preparing disaster preparedness plans that can streamline claims uptake and processing after unforeseen events.

2. Keeping Up with Digital Transformation

Insurance technology consulting service providers effectively allow insurers to borrow expertise. With a team of skilled consultants at hand, businesses will find it easier to navigate their digital transformation journey, prepare strategic roadmaps for long- and short-term goals, and future-proof operations. They might even share insights on broader objectives, such as building user-friendly platforms, extending reach through mobile applications, and developing an omnichannel presence.

3. Incorporating Next-Gen Technologies

With readily available and curated technology services, insurance companies can finally step outside the basics. This goes beyond the previously mentioned technologies like AI, big data, and automation, which are gradually becoming mainstream, and transcends into usage-based insurance models, peer-to-peer insurance, the Internet of Things (IoT) sensors, and beyond. These are bound to make insurance more responsive and resilient to on-the-fly changes or disruptions.

4. Compliance with Latest Regulations

Having to navigate the complex and ever-changing regulatory environment of insurance can be challenging. However, it becomes more manageable with a trusted consultant. They may recommend digital insurance automation solutions that come with built-in auditing tools that check for compliance with prevailing data privacy laws and regulations. At the same time, they could help formulate robust data governance policies to protect customer information and foster trust through transparent data privacy practices.

5. Richer Policyholder and Client Experience

Consultants help insurers to step out from the role of service provider and view the product and the customer experience from the perspective of their policyholders. Whether it is by advocating for accessibility or identifying friction and drop-off points in the customer journeys, they devise strategies to make insurers more inviting, customer-centric, and approachable. Their multidimensional insights help curate rich customer experiences that cultivate loyalty and satisfaction.

6. Unlock Scalable Productivity

Using technology, an insurance company can automate several manual tasks. This frees up resources, particularly the agents, brokers, and support staff to focus on high-value activities and complex tasks such as customer relationship building. However, reaching this stage is only possible by engaging an experienced consultant who can identify areas of automation while proposing appropriate tools and systems to embed such automation at scale. Such interventions not only make businesses scalable but also improve overall efficiency, improve morale, and reduce frustrations.

7. Reinforcing Data Security

Insurers may employ consultants for the deployment of insurance technology solutions to reinforce data security protocols. Some may even conduct tests to identify vulnerabilities in your data infrastructure and implement patches to address them. From conducting security audits to implementing fraud detection systems, consultants may help you achieve your data security goals and protect your business from costly cyberattacks to retain customer trust.

Closing Thoughts

Insurance technology consulting is your magic crystal ball that lends some clarity on the future of insurance. Even when it doesn’t grant businesses this magical ability, it helps them navigate any unforeseen changes. Insurance technology companies help insurers leverage cutting-edge technology, manage risks, comply with the latest regulations, keep up with trends, enrich customer experiences, embrace scalability, and reinforce data security to make businesses more future-proof, resilient, and continuous even in the face of disruptions.

Don’t wait for the future–create it by taking action and get in touch with an experienced insurance technology company today.