Try to envision the challenge of manually handling thousands of insurance policies. Doesn’t it seem like a terrible dream? It is a nightmare as traditional policy administration and management methods negatively hamper customer experiences, compromise compliance, and impact operational expenditures. Thanks to the digital transformation wave, the insurance sector is being creatively disrupted. Insurers are moving from the time of paper documents and manual data input to new-age tech solutions.

Modern firms strongly rely on robust policy administration systems in insurance to simplify all processes, from policy issuance to claims management and renewals. By streamlining the core insurance policy operations, these systems are a sigh of relief for insurers looking to balance compliance, customer experiences, and costs. Let’s take a closer look at the evolution of insurance technology, from legacy to modern solutions.

Table of Contents

A Detailed Look at the Evolution of Insurance Technology

Understanding Modern Insurance Policy Admin Operations and Technology and Technology Solutions

The Strategic Value of Advanced Insurance Policy Admin Systems

Selecting the Right Policy Administration Solution for Your Business

Strategies to Modernize Policy Administration Operations

KPIs to Measure the Success of New-Age Policy Administration Solutions

To Sum Up: Is Your Policy Administration Solution Ready for the Future?

A Detailed Look at the Evolution of Insurance Technology

The insurance industry has undergone a remarkable transformation over the past two decades. Traditional systems, once the backbone of insurance operations, prove inefficient today. These systems usually operate in silos, making data integration difficult and creating inefficiencies that cost a company both time and money. They fail to handle large streams of policyholder data, detect sophisticated risks, and provide “personalized” premiums and coverage.

Moreover, they often lack the scalability needed to accommodate growing business demands and changing regulatory requirements. That’s where advanced, cloud-based solutions come to the rescue, offering flexibility and functionality like never before. Modern policy administration solutions address these challenges by providing:

- Cloud-based architecture that ensures accessibility from anywhere

- API-first design enabling seamless integration with third-party applications

- Real-time processing capabilities for instant policy updates and claims handling

- Advanced analytics and reporting for data-driven decision making

- Mobile-responsive interfaces for both agents and policyholders

This technological evolution empowers insurance companies to transform operations, ensure compliance, and improve customer experiences. Above all, they can remain competitive in a saturated insurance marketplace. Given these immense benefits, the value of capital invested in Insurtech companies worldwide currently is USD 4.7 billion. That said, let’s understand policy administration operations and how new-age technological solutions are transforming them.

Understanding Modern Insurance Policy Admin Operations and Technology Solutions

The policy administration function is the foundation of the insurance industry. It includes policy creation, underwriting, issuance, modifications, renewals, and handling claims. In other words, it is the backbone of insurance operations, ensuring accurate and efficient handling of policies and customer interactions.

When a client buys a policy, the insurance policy administration solution gathers their information, checks that it meets underwriting standards, computes the premium, and provides the policy. Over time, the system monitors updates such as changes in premiums, renewals, and policyholder modifications. If a claim is made, the system seamlessly links all pertinent information and stores it in a single location.

Simply put, a robust insurance policy admin system ensures no details are overlooked and that every policyholder receives uninterrupted service from start to end. The policy administration solutions generally offer these key features:

- Claims Processing: Assistance with claims from submission to resolution

- Customer Service Tools: Quick access to policy information for better service

- Premium Billing and Collection: Seamless management of billing and collections

- Underwriting Support: Access to risk assessment tools

- Policy Data Management: An efficient process to input, store, and retrieve policy data

The Strategic Value of Advanced Insurance Policy Admin Systems

Think of the insurance policy admin solution as the nerve center of your business. Without them, processes become fragmented, and data is scattered across multiple systems. This isn’t just inefficient; it leads to mistakes, missed opportunities, and unsatisfied clients. Let’s break down each benefit in detail:

1. Enhanced Efficiency and Automation

One of the primary advantages of using a policy administration software is automation. These systems automate repetitive tasks, such as first notice of loss (FNOL), issuing policy documents and processing renewals, freeing your team to focus on higher-value tasks. Automation ensures that policies are issued faster, updates are executed swiftly, claims are processed smoothly, and every aspect of policy management is handled precisely and with fewer errors.

Imagine this: your customer needs to make some quick adjustments to their policy. With outdated systems, they’d have to call an agent, wait for manual adjustments, and deal with errors. However, with a modern insurance policy administration system, updates can be made in real-time. That means faster service, fewer errors, and a better overall experience for your policyholders.

2. Cost Savings

Automation reduces manual labor, which translates to reduced operational costs. Fewer policy errors also mean lower legal and compliance expenses. On the other hand, the saved resources can be used strategically, improving resource allocation and potentially increasing revenue. Additionally, employees can better focus on higher-value tasks, such as strengthening policyholder relationships and driving growth.

3. Integration with Other Systems

Your policy admin system should not operate in isolation. It must seamlessly connect with other business critical tools such as CRM systems, billing software, and customer portals. This is important to create a single source of truth among departments. As a result, employees can collaborate and communicate effortlessly, which ultimately improves operational effectiveness.

Get a Consolidated View of Policy and Claims Management Processes.

4. Better Compliance and Risk Management

Adherence to regulations is non-negotiable in the insurance industry. Making mistakes is not acceptable, particularly when navigating intricate rules and regulations. The best-in-class policy administration systems keep your company compliant by updating rules and requirements automatically. These systems can identify possible risks as well, ensuring that policies comply with current regulations.

5. Increased Accuracy

The manual methods of policy administration are prone to human error. Identifying and fixing those errors consumes a substantial amount of time and efforts. However, modern insurance policy administration solutions help overcome these challenges. By automating critical tasks such as underwriting and rating, premium billing, and collection, and claims processing, the systems eliminate the chances of human error. This ensures accuracy throughout the process. Besides, this reliability is crucial for maintaining correct policyholder information and coverage details.

6. Increased Policyholder Satisfaction

It is no secret that delivering satisfactory customer experiences is the key to carving a unique niche in the insurance industry. For this, insurers must provide “personalized” coverage and premiums. Moreover, they should provide instant responses to policyholder queries. All this is possible with tech-based policy admin solutions. The systems offer quick access to policy data, allowing customer service teams to respond instantly to inquiries. Efficient claims processing reduces stress for policyholders, enhancing trust and satisfaction.

“The insurance industry will continue to be a target for those looking for a modern day heist.”– Carmine del Guercio, Manager of Cyber Attack and Defense, Mazars.

As is evident, these benefits help insurers accelerate digital transformation. At the same time, the digital marketplace is brimming with a plethora of insurance policy admin solutions and choosing the right one becomes challenging. So, what’s the way out? The answer is provided in the next section.

Selecting the Right Policy Administration Solution for Your Business

Selecting the right policy administration solution may seem like finding your way through a maze, but it doesn’t need to be complex. Keep reading, and we’ll guide you through six key factors to consider while picking the ideal policy management solution:

I. Identify Your Business Needs

Pinpoint your specific requirements before evaluating policy administration solutions. Do you need better integration or a more efficient claims process? Knowing your pain points is an essential step.

II. Prioritize Data Security

Insurance firms handle sensitive information. Choose a provider with strong security measures. Decide between a public or private cloud; a private cloud offers enhanced security and personalized service. On the other hand, public cloud is a more cost-effective option.

III. Real-Time Data Analytics

Data is the lifeblood of insurance operations. Search for policy administration solutions that offers real-time access to data, allowing you to monitor policy trends, customer actions, and operational metrics. This understanding can be utilized for making decisions based on data and improving overall business performance.

IV. Ensure Scalability

Your selected policy administration system in insurance must be able to expand along with your business, handling additional clients, products, locations, and products. It should be customizable enough to accommodate shifting business requirements without causing significant disruptions.

V. Offer Self-Service for Policyholders

Policyholders expect instant access to their information. Self-service features can boost satisfaction by allowing them to view proposals, policy history, and pull reports, reducing the burden on agents.

VII. Demand Excellent Customer Support

Select a provider dedicated to customer success. Look for personalized support that understands your unique goals and needs, ideally with a single point of contact.

Based on these factors, insurance companies can easily find the right policy administration solutions. However, it is important to note that choosing the right solution is just the first step towards modernization. Transforming existing policy administration operations is an altogether different ball game. Following a few tried-and-tested strategies can help insurance companies master the game.

Strategies to Modernize Policy Administration Operations

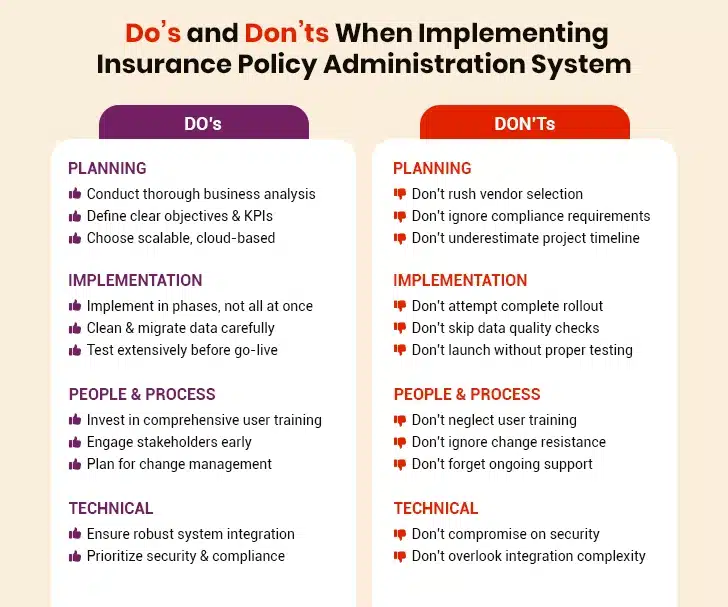

Insurers who are still relying on traditional methods for policy administration and management are missing out on significant benefits. Modernizing policy administration operations is the first step to digital transformation and gaining its benefits. Following the below-listed steps helps insurance companies successfully navigate this wave of modernization:

Phase 1: Assessment and Planning

Before implementing the new policy administration solutions, insurance companies must assess current systems, processes, and capabilities. This assessment should include:

- Technology Audit: Evaluating existing systems for functionality, integration capabilities, and scalability

- Process Mapping: Documenting current workflows to identify inefficiencies and improvement opportunities

- Stakeholder Analysis: Understanding the needs and concerns of various stakeholders, including agents, underwriters, and customers

- Compliance Review: Ensuring any new solutions will meet current and anticipated regulatory requirements

Phase 2: Implementation Strategy

A successful policy management solution implementation strategy involves careful consideration of timing, resources, and change management. Key elements include:

- Phased Rollout: Implementing new solutions slowly and gradually to minimize disruption and allow for adjustments

- Data Migration Planning: Ensuring accurate and complete transfer of existing policy and customer data

- Training Programs: Preparing employees to effectively use new systems and processes

- Communication Strategy: Keeping all stakeholders informed throughout the transformation process

Phase 3: Optimization and Continuous Improvement

Workflow modernization and digital transformation is not a one-time event but an ongoing process. Insurance companies should establish processes for continuous improvement, including:

- Performance Monitoring: Regularly tracking key metrics to measure success and identify areas for improvement

- User Feedback Collection: Gathering input from system users to identify pain points and enhancement opportunities

- Technology Updates: Staying current with policy administration system updates and new feature releases

- Process Refinement: Continuously optimizing workflows based on system capabilities and business needs

By following this stepwise approach, insurers can make the most of their policy administration solutions and get a step closer to digital transformation. And to determine if the investment is really worth the move, insurers can track a few key performance indicators.

KPIs to Measure the Success of New-Age Policy Administration Solutions

Measuring the success of your policy administration solution requires tracking relevant KPIs. These metrics provide insights into operational efficiency, customer satisfaction, and business performance. Take a detailed look at what these indicators are:

I. Operational Efficiency Metrics

- Policy Processing Time: Average time from application to policy issuance

- Claims Processing Duration: Time from claim submission to resolution

- System Uptime: Percentage of time systems are available and functioning

- Error Rates: Frequency of processing errors and data inconsistencies

II. Customer Experience Metrics

- Customer Satisfaction Scores: Ratings from policyholder surveys and feedback

- First Contact Resolution: Percentage of customer inquiries resolved on first contact

- Self-Service Adoption: Usage rates of online portals and mobile applications

- Response Time: Average time to respond to customer inquiries

- Policy Renewal Rates: Percentage of policies renewed at expiration

III. Financial Performance Metrics

- Cost Per Policy: Total operational costs divided by number of policies managed

- Revenue Per Employee: Total revenue divided by number of employees

- Loss Ratio: Claims paid compared to premiums collected

- Expense Ratio: Operating expenses as a percentage of premiums

- Return on Investment: Financial return from technology investments

Regular monitoring of these KPIs enables insurance companies to identify trends, make data-driven decisions, and continuously improve their operations. Consequently, they can carve a unique niche in the industry and remain competitive.

To Sum Up: Is Your Policy Administration Solution Ready for the Future?

After guiding you through the core elements of insurance policy administration, it is now important to evaluate the current state of your business. Does your current policy system streamline processes, reduce risks, and offer real-time data insights? Or are you dealing with sluggish, fragmented systems that are dragging your team down?

The right insurance policy administration solution providing partner can transform your operations-improving customer satisfaction, reducing errors, and boosting compliance. As we’ve seen, investing in advanced policy administration solutions really holds the key to remaining competitive.

Moreover, the path forward requires commitment to digital transformation, strategic planning, and continuous improvement. Insurers that embrace these principles and invest in modern policy admin solutions are well-positioned to survive and thrive in the dynamic insurance market.

After all, the goal isn’t just to implement new technology but to create a foundation for sustainable growth, operational excellence, and superior customer experiences.