Every C-suite conversation now includes one question: ‘How do we scale without proportionally increasing headcount?’ For insurance brokers, technology is the only viable answer.

This challenge is no longer just theoretical. It is a grave concern in boardrooms across the insurance industry right now. Traditional brokerage models require additional staff for every inch of growth scaled. Moreover, this crushes profit margins and creates operational complexity. But forward-thinking brokers are discovering a different path.

With comprehensive broker platforms, automated workflows, and digital client portals, successful brokerage firms are achieving measurable growth without expanding their teams proportionally. The technology solutions help brokerages transform their operation from a labor-intensive service business into a scalable, profitable enterprise that grows efficiently. Let’s explore the “how” aspect through this blog.

Table of Contents

What Is the Current State of Insurance Brokerage?

How to Overcome Common Insurance Broking Problems

How Do Advanced Solutions Help Insurance Brokers?

Why Is BrokerEdge by Damco an Ultimate Solution for Insurance Brokers?

What Is the Current State of Insurance Brokerage?

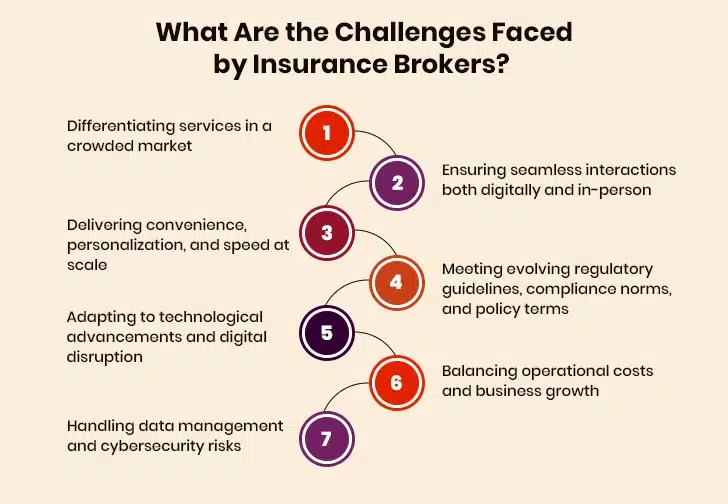

Insurance brokers face a multitude of challenges that impede their ability to manage clients and drive growth effectively. From navigating complex regulations to grappling with cumbersome paperwork and disparate data sources, brokers encounter obstacles at every turn.

Legacy insurance brokerage systems create operational issues that hamper productivity. Manual processes consume valuable time, which could be dedicated to customer-facing broker activities in insurance. Paper-based workflows and data silos prevent comprehensive client views, slowing decision-making. Even worse is that these issues compound during peak periods, increasing the risk of errors and compliance violations.

As such, the insurance industry presents a flood of new opportunities for brokers. They need an advanced brokerage platform in insurance, with the basics of client management, to overcome these challenges. According to Statista, the global insurance industry is expected to reach approximately 8.4 trillion USD by 2026, thereby making it clear that brokers need innovative tools to stay ahead of the competition.

From driving operational efficiency and reducing costs to enhancing customer experience and improving revenue growth, insurance broking systems offer several benefits. In an era marked by change and disruption, adopting this innovative tool is crucial for forward-looking brokers.

And as digital-first competitors take a central space in the insurance broker market, customer expectations shift toward instant service and transparency. These changes create both pressure and opportunity. Brokers who adapt early and implement the new solutions gain significant advantages. Those who delay risk losing market share. That said, let’s first explore the challenges faced by insurers in detail in the next section.

How to Overcome Common Insurance Broking Problems

Owing to rapid technological advancements, market disruptions, changing customer behavior, and strict regulations, brokers face a number of challenges on a day-to-day basis. The good news is that the insurance brokers can mitigate a majority of these challenges by adopting digital solutions, such as a comprehensive insurance broker platform. It enables them to transform their core processes by leveraging the capabilities of automation. These solutions allow brokers to eliminate unnecessary complexities, automate mundane tasks, connect offices, and discover opportunities.

The technological upheaval has worked well for the insurance brokers as it completes insurance analytical data handling requirements with a capable broker insurance management system. It acts as a user-friendly and customer-oriented system that helps the insurance brokers generate maximum leads with better management of the required resources and data. The all-in-one system arms farsighted and proactive brokers with the ammunition they require to conquer challenges and achieve goals.

By now, it is clear that adopting a robust insurance platform is the need of the hour for brokers. So, moving on to the next, let’s see how advanced solutions help insurance brokers.

“Leveraging data and technology will remain key to driving business impact and bottom-line growth. As AI-powered tools are being implemented across the insurance value chain, we’ll increasingly see efficiency gains, improved risk management, and enhanced customer experiences.”– Pravina Ladva, Chief Digital & Officer, Swiss Re

How Do Advanced Solutions Help Insurance Brokers?

Advanced solutions have everything necessary to address the challenges of insurance brokers. With features like automation and document repository, the tools help brokers streamline their operations and scale growth. Let’s explore all the important features and benefits one by one here:

1. Technology That Drives CRM with Ease and Care

Customer relationship management is of utmost importance for insurers, so it must be secured with maximum efficiency. Insurance brokers find it difficult to keep up with a wide client base and their varied requirements. The solution is well-implemented with CRM boosters that enable brokers to manage administration, client services, and quote processing effectively. It also offers a customer portal and configurable mobile app for automated help.

Insurance broker solutions help manage multiple lines of Insurance, such as property & casualty, life, and health, while offering flexibility to easily manage employee benefits Additionally, brokers can also automate the premium entry process.

2. Digital Document Repository for Easy Data Handling

Surpassing the conventional forms of cumbersome data storage techniques, modern technology tools for brokers have digital document repositories. These repositories are easy to use and can be scaled to manage and balance the load of millions of documents.

They store all kinds of files and organize the stored documents along with the ones uploaded from outside the system, linked to specific transactions. This provides an easy and handy way for organizations to improve security, increase compliance, and streamline operations. Additionally, they can reducing the use of paper and save both time and money.

3. Mobile Application to Fast Track Business Communications

Ditching the old ways of reaching out to brokers and agents in person, customers prefer digital-first interactions. Thus, the need of the hour is a mobile-friendly app that supports insurance broker operations.

The mobile application brings the client and policy information from the insurance broker system to mobile devices and lets the brokers be well-connected even when they are on the go. This eliminates the informational gap between the insurance broker and the customers as the synchronization enables the insurance broker to keep customer and policy information current and safe across systems.

Streamline Your Brokerage with Intelligent Digital Solutions

4. Automation That Supports Business Growth Prospects

The insurance broker automation software shapes the path forward for insurance brokers for generating leads and helping their businesses in all possible ways. It offers automated solutions with different modules for a single, unified customer view. These automation capabilities and various modules simplify the difficult and complex tasks that are a part of insurance brokerage management. Brokers can, thus, achieve higher operational efficiency in their daily business processes with less effort.

5. Audit Trails for Enhanced Security and Compliance Management

When it comes to insurance brokerage, the path to digitalization can be complex. It is marked by the need to balance tech adoption with regulatory compliance. Modern technology solutions come equipped with robust data security features such as encryption, access controls, and audit trails. This not only bolsters data privacy but also ensures compliance with the regulations governing the industry.

By centralizing data within a secure environment, insurance broking software further minimizes the risks associated with manual data handling. Moreover, by investing in broker software that automates compliance monitoring, brokers can adhere to ever-changing regulatory standards with ease.

6. Advanced Analytics for Informed Decisions

Insurance brokers can identify risks and renewal opportunities with the new AI-powered brokerage management platforms. The machine learning algorithms help optimize pricing accuracy by analyzing historical data. Intelligent chatbots can handle routine inquiries, freeing staff for complex client needs. What’s more is that risk assessment becomes more precise through data-driven insights, improving profitability and client satisfaction greatly.

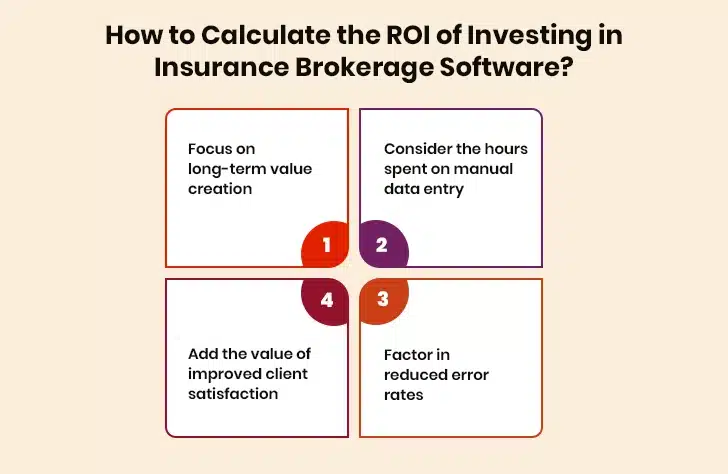

However, there are a plethora of insurance broker management tools. Or, let’s put it this way, the market is flooding with brokerage management solutions, where each of these solutions claims to be the best. So, how to find the right solution?

For this, insurance brokers should start with their core business needs: Does the system handle their primary insurance lines? Can it scale with their growth? Will it integrate with existing tools? If not, it is highly likely that the systems might fail due to poor adoption.

Another important aspect is integration. Make sure the new management system for insurance brokers works well with the existing infrastructure. Further, check the solution’s compatibility with carriers and ensure accounting system connections are seamless.

Do not forget data migration, as it is often the biggest challenge. Plan for this process carefully and test thoroughly before going live. That said, let’s talk about BrokerEdge, an ultimate solution for brokers and insurers to help them streamline operations and reap more profits.

Why Is BrokerEdge by Damco an Ultimate Solution for Insurance Brokers?

BrokerEdge by Damco is an insurance broker software specially designed to address the challenges of insurance brokers. These include managing operations, clients, and policies across multiple lines of business. The software helps brokers and agents streamline various tasks, including product and policy administration, client servicing, claims processing, and accounting for both fronting and co-brokering scenarios.

Key Features of BrokerEdge

| Feature | What Is It Used For? |

|---|---|

| All-In-One Dashboards | Offers a centralized view for real-time monitoring of clients and policies. |

| Pre-Built Carrier Integrations | Eliminates the need for manual double data entry, enhancing efficiency and accuracy. |

| Mobile Access | Provides on-the-go access for brokers, enabling them to manage tasks and communicate with clients from anywhere. |

| Automated Audit Trails | Ensures compliance and maintains detailed records of all activities for regulatory and internal purposes. |

| 360-Degree Customer View | Supports personalized customer experiences and services by providing a detailed overview of customer data. |

| Process Automation | Automates repetitive tasks, such as policy reminders, claim updates, and renewal communications, saving time and reducing administrative burdens. |

| SMS/Email Marketing | Supports bulk communication with leads and potential clients to improve lead conversion rates. |

| Centralized Policy Tracking | Ensures easy access and management of all active and historical policies from a single location. |

Benefits for Businesses

- Increased Efficiency: Automates workflows and integrates with carriers, which increases the efficiency of the broker operations and reduces manual effort.

- Enhanced Client Servicing: Enables brokers to provide instant updates on claims, personalize communication, and offer tailored experiences through features like the dedicated client portal.

- Reduced Costs: By reducing manual efforts, BrokerEdge by Damco helps cut down on costs and reap more profits.

- Faster Approvals and Closures: This software easily connects with insurance carriers and allows for workflow automation. This translates to accelerated policy processing and quicker closures.

- Assured Compliance: BrokerEdge by Damco provides automated audit trails and reporting capabilities that help brokers and insurers to adhere to industry rules and standards.

- Scalability and Flexibility: BrokerEdge is designed to scale with the growth of the brokerage business and can adapt to changing operational needs.

- Better Decision-Making: Real-time analytics and in-depth reporting offer valuable insights into business performance, enabling informed decision-making and strategic adjustments.

In essence, BrokerEdge by Damco helps insurance brokers optimize their operations, enhance customer satisfaction, and drive business growth through a comprehensive and intuitive platform.

Conclusion

Easy-to-configure broker software offers flexibility and scalability to insurance brokers. This makes it capable of working with multiple insurance companies in conjunction. Technologically equipped insurance brokers benefit from the automated mechanisms of broker software systems, which facilitate growth beyond the traditional methods that consume significant time and resources. In today’s time, the right insurance broker software solutions offer endless growth opportunities.