The insurance industry stands at an inflection point, placing the sector in a constant flux. Given this dynamic and disruptive nature, insurance businesses must maintain flexibility to adapt to the changing market conditions and customer demands. The ability to pivot to changing circumstances offers a competitive edge to such insurance businesses while also refining their product offerings. Whether you plan on tailoring the policyholder’s experience or rolling out individualistic products and services, insurers must work with large volumes of data to meet their objectives. The problem is that insurance data is often heavily distributed, inconsistent, and unstructured. Further, managing high volumes of data and processing it to meet business objectives is impossible, if attempted without the requisite insurance management systems.

Enter insurance policy administration systems.

These modern solutions offer the required customizations to adapt to the varying insurance sector needs. They empower insurers to make strategic decisions and transform operations to make them more efficient.

Here’s a deeper look at the role of custom enhancements in insurance policy administration systems, and how they transform business.

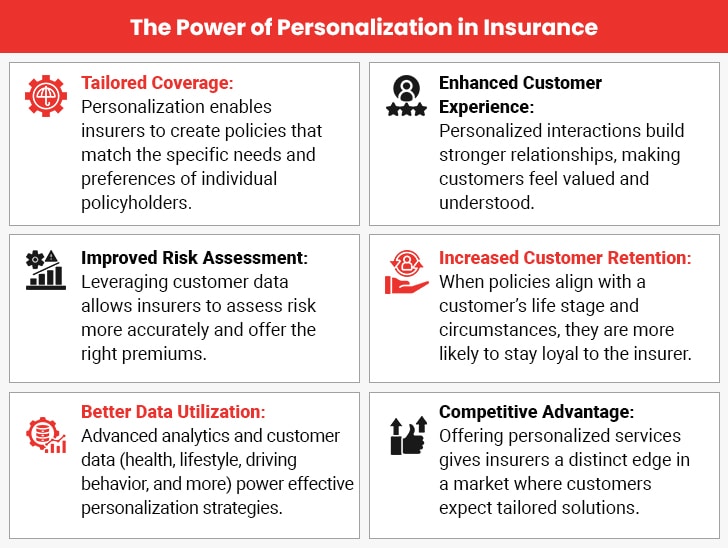

The Significance of Personalization in Insurance

At one point, personalization was a competitive differentiator that helped businesses stand out. However, since the last decade, it has become an imperative customer-driven demand.

According to a 2024 survey, about 8 out of 10 customers prefer companies that offer personalization. In fact, customers are open to switching loyalty and choosing your competitors if you don’t deliver personalized products, services, and experiences.

This trend has also seeped into insurance. Policyholders are no longer satisfied with cookie-cutter insurance coverage and want something that takes shape according to their requirements and expectations. As a matter of fact, an impressive 95% of policyholders are willing to share their personal data and additional information to benefit from personalized insurance policies. Such data could be health and fitness tests, smart home devices, and wearable tech.

In a no-trust environment, such as the one prevailing now, sharing personal data is the highest trust indicator form. Insurance businesses must leap at this opportunity and leverage advanced technologies and data analytics to develop bespoke solutions that cater to the unique requirements of their client base.

To stay competitive, insurers must embrace the shift towards personalization. With increasing customer expectations, offering tailored products is no longer optional—it’s a necessity. Personalization builds trust, an essential factor in today’s market. By leveraging data, insurers create meaningful, customer-centric policies. This approach not only improves satisfaction but also boosts customer loyalty. In a rapidly changing insurance landscape, personalized offerings help businesses stand out and maintain relevance.

Benefits of Custom Insurance Policy Administration System

The demand for personalization is apparent. However, insurers require customizable insurance management systems to plug this market gap. Here’s a look at the role of a custom insurance policy administration system in improving insurance workflows and operations:

1. Unique Policies

Insurance policy administration system transformation involves consolidating customer data in a centralized location. The insurance policy administration sources data from these reserves to obtain customer information, behavioral insights, preferences, and other variables that help personalize policies. Based on such inputs, insurers craft unique coverage options that align closely with the policyholder’s requirements and also factor in their individual risk profile. Such a two-fold approach delivers adequate insurance protection while shielding the insurer from the risk of under or over-insurance.

2. Seamless Buyer’s Journey

Insurance policy administration systems sport intuitive interfaces with customizable options. This makes insurance shopping easier for prospective customers. Potential customers can explore the options available, share relevant data to visualize the degree of personalization, and then make an informed and educated decision. Transferring the power and control into the hands of the policyholder reduces the likelihood of errors and misunderstandings while also boosting the overall customer experience. The smooth buyer’s journey also minimizes customer drop-offs.

3. Operational Efficiency

Implementing custom insurance policy administration system introduces a data-driven framework. Such a data-first ecosystem eliminates the possibility of errors from manual activities like data entry and computations. It allows the automation of routine and repetitive tasks. As a result, insurers streamline internal processes and allocate resources smartly. By conserving resources, businesses focus more on high-value tasks like nurturing stronger customer relationships or improving their value-added services.

Elevate Your Policy Administration with Tailored Enhancements

4. Business Resilience and Agility

Monitoring and analyzing customer data, industry trends, and market shifts allow insurers to detect emerging needs and preferences. Such foresight positions them at a vantage point to recalibrate strategies and stay ahead of the competition. The resulting agility makes insurance businesses resilient, even in the face of rampant changes while maintaining consistency in the customer experience. This helps insurers cultivate long-term customer loyalty while enjoying stability in their market and brand positioning.

5. Data Security and Privacy

Given the highly regulated nature of the insurance industry, insurers have to adhere to the highest standards of data security and privacy while handling sensitive and confidential customer data. Customizable insurance policy administration systems often focus on these aspects and put insurers in control of their data. Using these, insurers easily comply with regulations like the GDPR and CCPA by maintaining transparency regarding data collection, storage, and usage. Plus, these systems generate detailed reports for routine audits that strengthen compliance measures.

6. Enhanced Scalability

A custom insurance policy administration system offers unmatched scalability, enabling insurers to adapt to changing demands. As businesses grow, they often encounter challenges such as expanding product lines or increasing customer bases. Off-the-shelf solutions might struggle to accommodate these changes, leading to inefficiencies. However, custom systems are designed with flexibility in mind, allowing insurers to add or modify features as needed. These systems help insurers better navigate insurance policy administration.

For example, if an insurer decides to introduce specialized coverage plans or enter new markets, the system can be configured to support these objectives without major disruptions. Insurers may also scale infrastructure to handle larger volumes of data, ensuring seamless performance even during peak periods.

Additionally, scalable systems facilitate integrations with emerging technologies, such as AI and machine learning, to improve decision-making and operations. This adaptability not only meets current needs but also prepares businesses for future challenges.

7. Improved Claims Management

Custom insurance policy administration systems revolutionize claims management by simplifying and automating processes. Claims processing often involves multiple steps, from data validation to final settlement. Manual workflows slow down operations and increase the risk of errors. Custom systems address these issues with tailored automation and centralized data management.

Insurers benefit from streamlined workflows that reduce the time needed to process claims. Policyholder data, claim history, and policy details are readily accessible, ensuring quick and accurate validations. Automated checks further enhance accuracy, minimizing the chances of fraudulent or erroneous claims being approved.

Faster claims settlement directly improves customer satisfaction. Policyholders appreciate transparency and efficiency, fostering trust and loyalty. Moreover, efficient claims management reduces operational costs, as fewer resources are needed for manual tasks.

Conclusion

To sum up, a custom insurance policy administration system promises immense value to modern-day insurers. It helps them stand out in a highly competitive and saturated industry segment and allows them to cement lasting customer relationships. It directly caters to the customer demands for personalization and drives satisfaction levels through a seamless buyer’s journey. The strategic application of such a solution drives sustainable growth by unlocking avenues for technological integration and innovation, which generates value and paves the way for the future of insurance.

Case in Focus

The core operations of a multi-line insurer based in the Caribbean region were impacted due to their slow and inefficient legacy system. After assessing their unique requirements, we kickstarted the digital transformation process. To that end, we implemented a centralized insurance management system and seamlessly integrated it across the organization. This enables the insurer to unify customer information, policy data, and other information all in a single system. This success story exemplifies how targeted technology upgrades revolutionize operations.