Insurers would agree that insurance fraud is a persistent and costly challenge. Every year, billions of dollars go down the drain. Legacy fraud detection methods struggle to keep pace with the increasingly sophisticated tactics used by fraudsters. Thankfully, AI offers answers to this problem. With AI-powered multimodal technologies like advanced machine learning, natural language processing (NLP), and predictive analytics, insurers can sniff out fraudulent behavior across the claim lifecycle. It empowers insurers to effectively mitigate potential financial losses.

In this blog, we will talk about how AI comes in handy in insurance fraud detection. We’ll walk you through the advantages of having AI on your side, the implementation challenges, industry trends, and some real success stories. So, let’s begin.

First Things First: What Is Insurance Fraud?

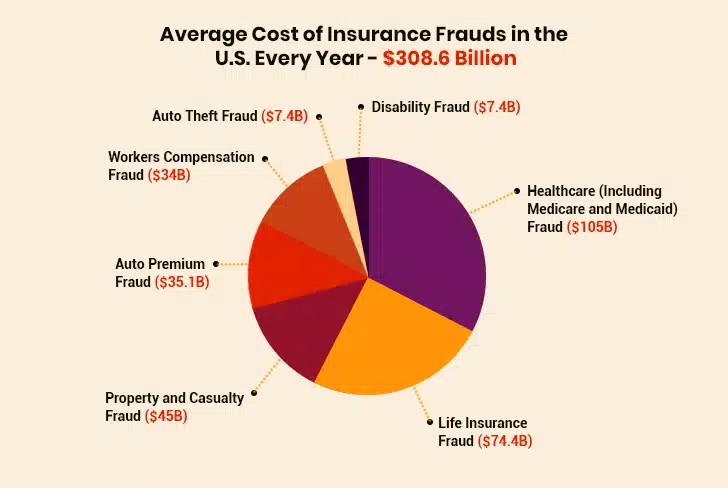

Insurance fraud happens when someone lies or tricks an insurance company for financial gain. In fact, the U.S. alone incurs a loss of $308.6 billion across health, property, casualty, and auto insurance sectors.

Insurance fraud can occur at any stage. Whether you’re buying a policy, filing a claim, or even after a claim is settled. Here are some of the most common types:

I. False Claims

Sometimes, people make up fake accidents or damage that never happened. They might report real events but claim that the damage was worse than it actually was, just to get more money from the insurer.

II. Fake Insurance Policies

Some scammers pretend to be legitimate agents and sell fake insurance plans. This is risky when exploring policies online. On top of that, people try to make claims on policies they never actually bought.

III. Employee or Agent Fraud

As interesting as it sounds, at times, employees or agents approve fake claims or get involved with fraudsters to steal money from their own business/companies.

IV. Cybercrime and Online Scams

With already a thousand insurance selling platforms available online, cybercriminals have started making the most out of this opportunity. They hack into systems, steal personal data, and use phishing emails to file fake claims or cause system disruptions.

Now, you might say that some insurance companies already have fraud detection systems in place. Then, why use AI? Read along.

How AI Saves Billions by Detecting & Preventing Insurance Fraud?

Traditional fraud detection methods may be in use, but they rely heavily on manual reviews and static rules. They often struggle to keep pace with the sophisticated tactics employed by modern fraudsters. AI emerges as a transformative solution, offering insurers the ability to detect and prevent fraudulent activities with greater accuracy and efficiency. The best thing about AI is that it learns and adapts over time. Plus, it’s much faster compared to legacy fraud detection systems.

Research by Deloitte predicts that the fraud detection tech market is projected to reach $32 billion by 2032, with AI playing a major role. Around 35% insurers say that fraud detection is one of the top five reasons for implementing Gen AI applications. Insurers that embrace AI alongside skilled human oversight are expected to unlock 20%–40% in potential savings by sensing frauds in advance and taking actions on time.

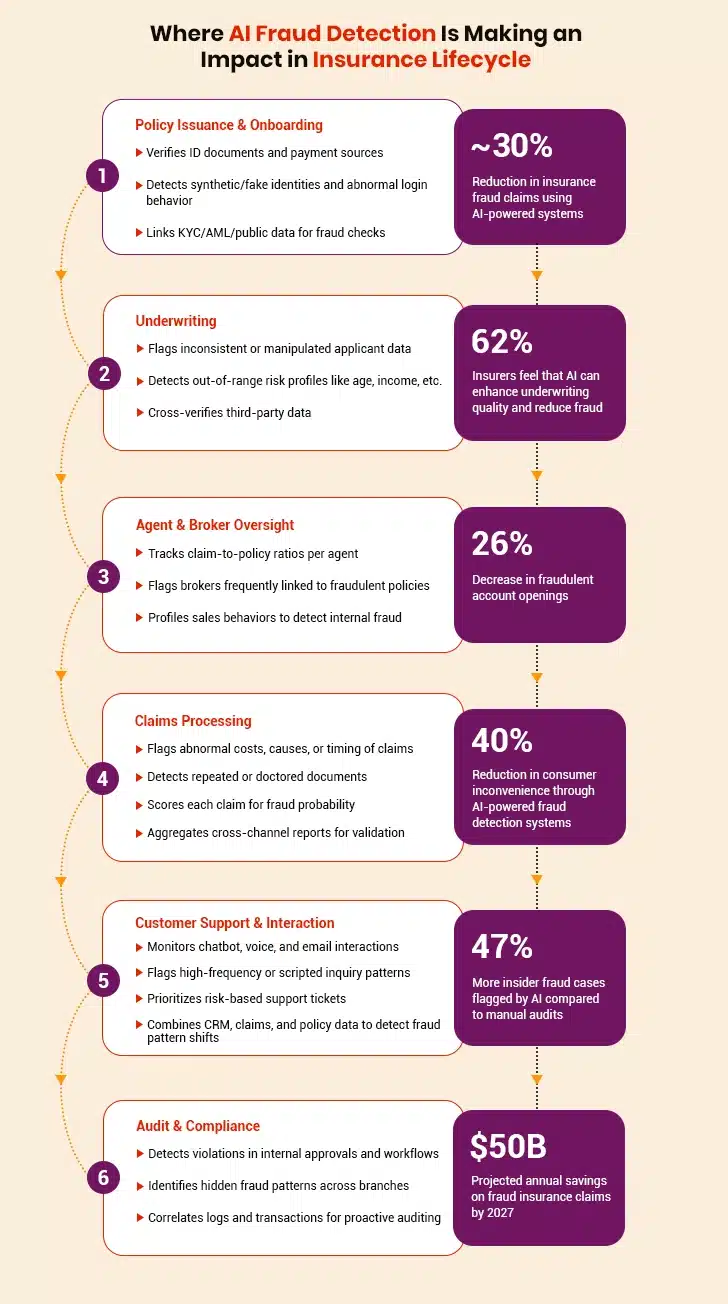

Here’s a breakdown of how AI fraud detection comes in handy, and where exactly in your insurance operations.

Data sources: PWC, Deloitte, Experian, Capgemini & SNS Insider Report

Now, let’s understand what powers AI to detect and prevent fraud in the insurance industry.

1. Real-Time Fraud Monitoring: Spotting Suspicious Behavior as It Happens

AI-powered fraud detection systems analyze large insurance datasets including incoming claims, policy updates, and customer interactions. Unlike manual audits, which happen post-facto, these AI systems can identify suspicious activities in real time. For example, imagine a newly activated life insurance policy where the first claim comes in within 24 hours of activation, flagged as a high-value accidental death filed from a high-risk geography. A rule-based system might not be able to detect the issue instantly. But an AI system can verify the policyholder’s digital footprint, application data, and historical behavior. And then it can escalate it within seconds.

This level of proactive intelligence allows insurers to halt payments before they’re issued, reduce manual investigation time, and focus resources where they matter the most. Given our experience in designing AI-powered fraud detection systems, we have seen insurers benefit from reduced investigation cycles with real-time monitoring.

2. Pattern Recognition: Learning from the Past to Protect the Future

AI models are trained on thousands of past fraud cases (including synthetic data) to understand what “fraud” typically means. The system considers variables such as treatment patterns, repair costs, claimant history, geolocation anomalies, and even the structure of submitted documents.

Take coordinated auto accident fraud as an example. Over time, machine learning models may detect that a specific cluster of claims repeatedly involve similar vehicle types, identical chiropractors, or the same repair shops inflating damage estimates. By learning these patterns, AI can flag incoming claims that bear similarities before the payout is issued.

Unlike static fraud rules, which require manual updates, pattern recognition models update regularly so that new scam variants can be detected. So, there’s no margin for error even if fraud tactics change.

3. Anomaly Detection: Spotting the Outliers That Humans Might Miss

An AI system designed for anomaly detection is different from its pattern recognition counterpart. It doesn’t rely on historical fraud cases. Instead, it builds a behavior baseline from genuine customer data and flags anything that’s different from that baseline. These models are especially powerful in detecting first-party fraud or internal conspiracies, where historical markers do not exist.

For example, consider a home insurance policyholder. Let’s say this person has a history of small, infrequent claims. Suddenly, they file three large-value claims within six weeks, each involving expensive electronics with receipts showing sequential serial numbers. Or multiple claims from different policyholders, with each using the same repair contractor with identical invoice templates. These subtle cues are picked up by AI through unsupervised learning.

4. Predictive Analytics: Checking Fraud Chances Before Processing Claims

AI-powered predictive analytics can be used to generate fraud probability for each incoming claim. This score is generated using multiple data points…past claims frequency, value discrepancies, lack of supporting documentation, policyholder behavior, and more.

For example, a travel insurance claim for stolen electronics may raise flags if filed with no police report, includes multiple high-end gadgets, and originates from a policy purchased just days before departure. Even if all documents seem correct, a high fraud-risk score would automatically route the claim to a special investigation unit (SIU) for further verification. This capability makes sure that your investigators focus on the riskiest claims, rather than wasting time on routine, low-risk ones. It improves efficiency, reduces false positives, and boosts overall fraud detection rates.

5. Advanced Data Integration: Connecting the Dots Across Channels

Fraudsters often operate across multiple identities, policies, or sometimes even insurers. AI systems equipped with data integration capabilities can ingest and correlate data from a wide range of sources including claim histories, social media behavior, email domains, device IDs, geolocation tags, third-party databases, and more.

Consider a case where multiple auto claims are submitted from different individuals, all tied to the same IP address, using slightly different versions of the same home address and banking details. A manual review might treat these as isolated incidents. However, an AI-enabled fraud detection system can easily connect the dots across data silos and identify the network behind the scenes. In fact, it prevents future fraud attempts by placing fraudsters on watchlists or flagging associated entities.

?By combining speed, scale, and adaptability, AI is enabling insurers to outpace fraudsters. But the real impact comes when AI works in tandem with trained investigators. By pairing technology’s reach with human judgment, you’ll be able to create a fraud defense strategy that’s both intelligent and resilient.

Applying AI for Fraud Detection Across Insurance Lines

As fraud claims continue to rise, many insurers are choosing AI-based fraud detection systems over regular methods. It’s not a surprise as AI-powered fraud detection is already helping insurers act faster and smarter across the insurance value chain. In the table below, we have shown how AI’s capabilities (the ones we discussed above) are helping insurers across different lines fight frauds.

| Insurance Type | Real-Time Monitoring | Pattern Recognition | Anomaly Detection | Predictive Analytics | Advanced Data Integration |

|---|---|---|---|---|---|

| Health Insurance | Flags duplicate claims or suspicious billing | Detects fraudulent provider billing or upcoding patterns | Identifies spikes in claims from specific clinics | Scores claims before approval to reduce losses | Combines EMRs, pharmacy records & claims for inconsistencies |

| Auto Insurance | Detects staged accidents or duplicate claims | Recognizes phantom damage or repeated fraud tactics | Spots claims immediately after policy activation | Scores new claims using driver history and location data | Correlates telematics, repair bills, and police reports |

| Property & Casualty | Alerts on large or clustered loss reports | Identifies inflated repair estimates or fake weather claims | Flags mismatches in photos, timing, or narratives | Uses historical data to pre-score claim risk | Merges satellite imagery, maintenance logs & claim history |

| Life Insurance | Catches mismatched IDs or repeated applications | Detects multi-region application fraud tactics | Flags last-minute policy changes before claims | Scores applications for data inconsistencies | Cross-verifies death records, hospital data & beneficiary details |

| Travel Insurance | Flags multi-location claims within short spans | Spots repeated lost baggage or emergency patterns | Detects claims outside typical trip patterns | Flags risky profiles based on trip history | Links passport data, airline logs, and incident reports |

| Workers’ Compensation | Catches claims filed soon after hiring | Recognizes common exaggeration fraud (e.g., recovery time) | Flags working another job while on leave | Uses injury type & history to assess fraud risk | Combines HR records, medical reports & surveillance footage |

| Commercial & Business | Detects claims from dormant or new entities | Identifies arson-for-profit or staged theft patterns | Flags mismatches in claim value vs. business scale | Detects fraud in liability or business interruption claims | Cross-analyzes financials, tax records & claim history |

With that said, let’s explore how leading insurers are taking advantage of AI-powered fraud detection.

The Real Impact of AI Fraud Detection for Leading Global Insurers

Leading insurers have reported that they are eventually turning to AI fraud detection systems amidst rising fraudulent claims to protect customer trust (their main motive). Here’s how four global insurance companies have successfully implemented artificial intelligence to transform their fraud detection capabilities:

I. Progressive Insurance

Progressive uses machine learning to analyze thousands of claims daily, flagging suspicious patterns for further investigation. This proactive approach has significantly reduced their fraudulent payouts. It also made their claims process faster, helping them maintain customer trust and financial integrity.

II. Allstate

Allstate has deployed real-time fraud scoring, enabling faster and more precise claim assessments. This AI-driven system accelerates claims processing and also reduces operational costs by minimizing the resources needed to investigate false claims.

III. Zurich Insurance

Zurich enhanced its fraud detection accuracy by 45% by implementing AI-driven decision trees and gradient boosting algorithms. By combining internal and external data sources, Zurich’s system identifies complex fraud networks and improves decision-making across property, casualty, and motor insurance lines.

IV. UnitedHealth Group

UnitedHealth Group tackled the challenge of high false positive rates in fraud detection by using natural language processing (NLP) to analyze unstructured claims data. In return, they achieved a 35% reduction in false positives and significantly improved identification of potentially fraudulent activity across its vast healthcare network.

These results translate into millions of dollars in savings annually, with some insurers reporting more than $30 million in prevented losses each year. AI’s ability to minimize false positives also means fewer legitimate claims are delayed, enhancing customer satisfaction and trust.

How Technology Solutions Are Solving Claims Adjusters’ Biggest Challenges

Leveraging AI in Insurance for Underwriting and Policy Management

If you thought that AI in insurance fraud detection could only be used for post-claim interventions, then you’re mistaken. The true potential of AI begins much earlier in the insurance operations—in underwriting and policy management. Fraudulent policy detection can prevent significant financial losses down the line and improve the overall portfolio risk quality.

AI-powered insurance fraud detection solutions analyze a wide array of data points. Application forms, behavioral patterns, and even third-party sources (credit reports, social media activity, and public records) come into the picture. Using these, insurers are able to detect inconsistencies and patterns that indicate first-party fraud at the underwriting stage.

For example, an AI model can cross-reference an applicant’s stated occupation with their digital footprint to flag discrepancies or detect cases where the same identity is used across multiple applications in different geographies. In property insurance, AI can match submitted property details with satellite imagery or geolocation data to ensure accuracy. In health insurance, AI can flag abnormal conditions in declared medical histories when compared against known risk factors and historical claims behavior.

Moreover, AI can monitor in-force policies by analyzing billing behavior, policy changes, and customer communications. If a policyholder frequently updates their address or modifies coverage suspiciously close to a claim, the system can trigger alerts for human review. These early interventions allow insurers to take preemptive action…either by declining risky policies or applying closer scrutiny, thus reducing exposure to potential fraud before it even reaches the claims stage.

Facing the Challenges of Today and Preparing for Tomorrow

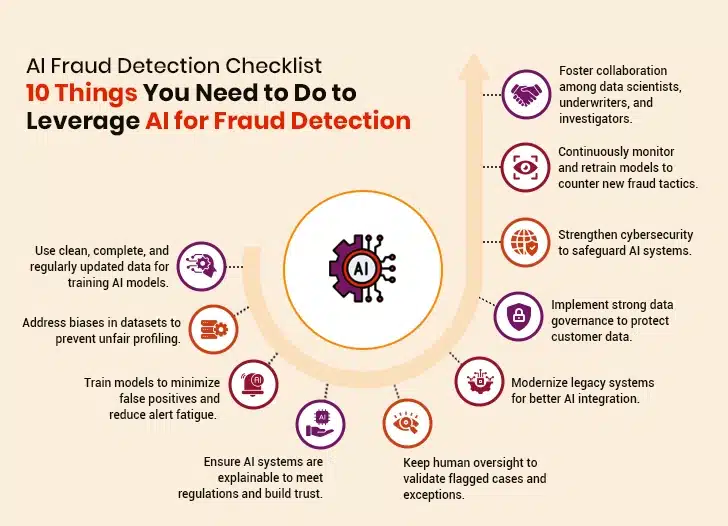

Despite the promising advantages, deploying AI in insurance fraud detection comes with its share of challenges. We have compiled a list of considerations that you might want to look at before using AI.

1. Data Quality and Bias

AI models rely heavily on clean, diverse, and unbiased insurance data sets.

- Incomplete or outdated data reduces model accuracy.

- Historical data might reflect legacy biases, leading to unfair profiling.

2. False Positives and Operational Efficiency

High false positives can overwhelm fraud teams and disrupt customer experience.

- Over-sensitive models flag too many non-fraudulent cases.

- You must fine-tune models to balance fraud detection with customer satisfaction.

3. Transparency and Explainability

As AI becomes integral to decision-making, regulatory scrutiny increases.

- “Black box” algorithms are often not explainable.

- Look to build AI systems that provide clear, auditable reasoning for decisions.

4. Integration and Human Alignment

Deploying AI effectively requires alignment across systems and teams.

- Legacy systems may lack compatibility with modern AI tools.

- Human-in-the-loop models are essential to verify edge cases and continuously improve outcomes.

5. Cybersecurity and Data Governance

AI systems handle massive volumes of sensitive personal data.

- Enforce strict data governance policies.

- Cybersecurity protocols must evolve alongside AI adoption.

Yet, the road ahead is promising. AI models are becoming more sophisticated with each iteration, learning from past patterns and refining their accuracy. As insurers adopt multimodal AI—combining structured and unstructured data, machine learning, and human-in-the-loop review—they are poised to detect fraud with greater nuance and speed than ever before.

Insurers that invest in building strong AI ecosystems today are laying the groundwork for smarter, safer, and more customer-centric operations in the long run.

Ending Notes

As we have seen in this piece, fighting insurance fraud means acting faster, smarter, and more proactively than ever before. That’s what AI is best at doing. With capabilities like real-time monitoring, pattern recognition, and predictive analytics, insurers might want to prevent frauds rather than ending up on the other side of it.

From underwriting and policy issuance to post-claim analysis, AI is helping insurers identify hidden risks and stay ahead of fraudsters. But it’s also about knowing where to start and how to scale. With the right AI fraud detection solution and strategy, AI can become an insurer’s best ally, keeping fraudsters at bay and safeguarding your digital landscape.