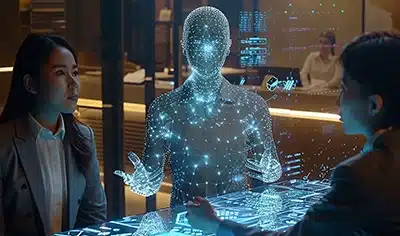

Insurance is one such sector that has been slow in embracing process transformation widely to restructure traditional practices and create new possibilities. One of the most potential advancements for insurers is the incorporation of newer and smarter technologies, especially Generative AI. It refers to a class of Artificial Intelligence systems that are designed to produce content, often in the form of text, images, audio, or other data types. In short, deep learning models are capable of creating new data that is similar to existing data from a range of sources.

This pioneering technology has the potential to redefine the way insurance processes are organized, offering enhancements in efficiency, precision, and user experience. It enables insurers to harness the power of data and automation and launch more innovative product offerings. However, it’s crucial to ensure that the use of Gen AI in insurance complies with regulations, maintains privacy, and addresses ethical considerations.

Software powered by the transformative technology can be employed by insurers to automate underwriting, determine appropriate coverage and premiums, and generate simplified summaries or explanations of policies. Similarly, Generative Artificial Intelligence in insurance helps customers analyze and understand complex insurance policies, making it easier for them to comprehend the terms and conditions.

Table of Contents

Advantages of Using Gen AI in Insurance

- Improved Risk Assessment

- Data-Driven Product Development

- Cost Reduction

- Data Analysis and Insights

- Higher Customer Retention

Common Gen AI Use Cases in Insurance

- Automated Underwriting

- Customer Experience Enhancement

- Accelerated Claims Processing

- Fraud Detection

- Predictive Analytics

Challenges and Ethical Considerations

The Future of Generative AI in Insurance

Advantages of Using Gen AI in Insurance

Since the technological strengths of Generative AI are abundant, it can enhance every facet of the insurance industry’s operations. Here are some key advantages:

- Improved Risk Assessment

Systems fortified with this revolutionary technology can analyze vast datasets to provide insurers with a more accurate assessment of risk. This leads to better underwriting decisions, allowing insurers to price policies more precisely and reduce the likelihood of underwriting losses. - Data-Driven Product Development

Generative AI can analyze market data and consumer preferences to inform the development of new insurance products. This leads to more innovative and competitive offerings in the market. - Cost Reduction

By automating various processes, insurers can significantly reduce operational costs, including claims processing, underwriting, and customer support. - Data Analysis and Insights

With access to neural networks, insurers can extract valuable insights from unstructured data sources, such as social media and news articles. This data can help them proactively manage risks and adapt to changing market conditions. - Higher Customer Retention

By delivering personalized services, efficient claims processing, and responsive support, this technology can help insurers retain customers and reduce churn.

Common Gen AI Use Cases in Insurance

Based on recent industry initiatives, the following are some popular Gen AI use cases in insurance:

1. Automated Underwriting

Automated underwriting involves using technology to assess risk and make decisions without the need for extensive manual intervention. Generative AI can help in this regard!

Generative AI for insurance underwriting can build predictive models that take into account a wide range of variables from applicants’ documents to determine the risk. These models can assess factors like age, health history, occupation, and more, providing a comprehensive view of the applicant’s risk. Digital underwriting powered by Generative AI models can make risk calculations and decisions much faster than traditional processes. This is especially valuable for complex insurance products where the risk assessment is relatively straightforward. On the whole, Gen AI in insurance underwriting ensures that decisions are made consistently while reducing bias or human errors.

2. Customer Experience Enhancement

Generative AI can analyze customer data and market trends to provide customers with personalized communications. This includes tailoring marketing messages, policy information, and customer service interactions to individual customers, making them feel valued and understood.

Generative adversarial networks and virtual assistants can provide immediate assistance to customers 24/7. They can answer queries, provide information about policies, and guide customers through the claims process, resulting in faster response times and improved accessibility. Moreover, Generative AI in Insurance can analyze customer feedback and social media sentiment to identify areas for improvement and address customer concerns promptly. This technology adds value to customer satisfaction and relationships beyond policy coverage.

3. Accelerated Claims Processing

Insurers can use Gen AI for insurance claims processing. It can automatically extract and process data from various user-supporting documents (claim forms, medical records, and receipts). This minimizes the need for inputting data manually, thereby reducing the errors. Hence, simple claims can be processed quickly, while complex claims can be flagged for human review.

Artificial Intelligence-powered systems can provide real-time tracking of the claims process, offering transparency and peace of mind to policyholders. They can see where their claim is in the process and when to expect a resolution. Similarly, Generative AI can address existing challenges within the field of service management. Field service management tools augmented with Gen AI can help insurers calculate losses precisely and speed up claims processing.

4. Fraud Detection

GAN systems can monitor claims in real time and trigger alerts when they detect suspicious patterns or deviations from expected behavior. This allows insurers to investigate potential fraud when it occurs. In cases involving visual evidence, Gen AI systems can analyze images and photos to detect any manipulation, alteration, or inconsistencies.

These systems can employ Machine Learning algorithms to continuously adapt to new fraud schemes and evolving tactics used by fraudsters. This adaptive approach ensures ongoing effectiveness in fraud detection. By automating much of the fraud detection process, insurance companies can reduce operational costs associated with manual investigations.

5. Predictive Analytics

Leveraging Generative AI for predictive analytics can help insurers stay competitive. They can identify the most promising target demographics for specific products and marketing campaigns. This allows insurance firms to perform effective customer acquisition and retention strategies. By assessing market trends and user preferences, insurers can develop innovative products that are aligned with consumer needs. Overall, Artificial General Intelligence allows insurers to leverage predictive analytics and deliver highly personalized services.

Elevate Your Insurance Services with Gen AI

Challenges and Ethical Considerations

Here are some key challenges and ethical considerations associated with Generative AI in the insurance industry:

I. Data Privacy Concerns

Insurance companies are entrusted with vast amounts of sensitive user data, medical records, and financial information. Storing and processing this data using advanced Artificial Intelligence solutions requires insurers to implement stringent security measures. If business systems or databases are compromised, it can lead to exposure of user data and reputational damage.

That’s why, insurers must obtain informed consent from policyholders and customers for collecting, storing, and processing their data. Transparency in data practices is essential, and customers should be aware of how their data will be used. Insurers should only collect and retain data using AI models that are necessary for legitimate business processes. Excessive data collection using automated models can increase privacy risks.

II. Training Bias in AI

Training data used by insurers for Gen AI models often comes from a range of sources. These sources can carry inherent biases, reflecting societal, cultural, or historical prejudices present in the data. Training bias can also emerge due to the algorithmic structures of AI models themselves.

To mitigate training bias in Generative AI, insurers can curate diverse datasets and offer a more balanced input. Regularly auditing and assessing Gen AI systems for biases is essential. Insurers can employ techniques such as re-weighting training data, adversarial training, and de-biasing algorithms to reduce biases in Gen AI models.

III. Technological Limitations

Generative AI models require high-quality, diverse, and comprehensive data to make accurate predictions. Insurance companies may not always have access to such data. Similarly, Integrating Gen AI models with existing insurance systems and scaling them can be challenging.

Insurers can work on improving data quality by investing in data collection, cleaning, and enrichment processes. Collaborating with data providers, leveraging external data sources, and utilizing data analytics tools can also help. Insurers should also invest in flexible and modular AI architectures that can be integrated with their existing systems. Collaborating with technology partners or InsurTech firms can help address scalability and integration issues.

IV. Regulatory Compliance

Emerging technologies such as Generative AI are advancing at a rapid pace, and insurers may struggle to keep up with these developments. New and complex Gen AI systems might not fit precisely into existing regulatory frameworks. In many cases, insurance firms may not have established clear guidelines or standards for Gen AI-powered systems. This makes it challenging for them to understand how to comply with evolving regulatory requirements.

For seamless execution, insurers should work closely with regulatory authorities to implement best practices and drive success. Regulatory compliance experts ensure that Gen AI systems and practices align with regulatory requirements.

The Future of Generative AI in Insurance

While it’s true that Gen AI poses some challenges, many insurers believe that the gains derived from this technology can drive economic growth. Besides, by considering Generative AI as a digital extension, insurers can democratize services at large. Here are some potential future scopes of AI in insurance:

- Cybersecurity Insurance

Since the importance of cybersecurity grows, Gen AI can play a crucial role in assessing and mitigating cyber risks and providing secure services - Blockchain for Transparency

Blockchain and Gen AI integration can enhance transparency and security in insurance contracts and claims processing. - Climate Risk Assessment

With increasing concerns about climate change, Gen AI solutions can be used to assess and model climate-related risks. This helps insurers prepare for and mitigate the impact of environmental changes.

The list of trends goes on! It’s important to note that though Generative AI offers numerous opportunities, it also presents challenges that insurers need to carefully manage.

Conclusion

The effective implementation of Generative AI in the insurance value chain offers substantial benefits to insurers and policyholders alike. From tailored marketing campaigns to automated claims processing and risk management, Gen AI-powered solutions improve the insurance enterprise’s performance and user satisfaction.

Case in Focus

A top-tier insurance firm wanted to modernize its core insurance systems by integrating Generative AI to meet varying business and policyholder needs. We associated closely with the firm and implemented versatile and advanced solutions powered by the Gen AI tool. Our solutions aided the insurers in adapting to the ever-changing regulatory dynamics while providing sophisticated customer experiences. For more details, read the complete case study.