Insurers are grappling with the inherent pressure of declining profitability due to rising claim cost inflation. Indemnity spend is the largest contributor to the Insurer’s claim cost. Insurers have been unable to raise premiums in tandem due to high price competition in the market. The claims function remains a critical moment of truth in the insurance value chain. Therefore, it is imperative for insurers to spend significant efforts in reducing the claims leakage that have the largest impact on their claim performance.

Similarly, no matter how much effort an insurance company puts into attracting customers and simplifying underwriting, a beneficiary’s claims experience plays a clinching role in governing the overall customer experience (CX).

So, how can insurers ensure that policyholders are not left with a bitter taste while trying to reduce their indemnity spend in claims? Here’s where effective claims management systems enter the picture.

A well-thought-out optimized insurance claim management process could drive simplification of the processes, minimize risks, increase customer loyalty, and lower indemnity costs in claims.

Here’s a look at why and how insurers should transform the claims processes and demystify complexities underpinned by a claims management system.

The Importance of Insurance Claims Management

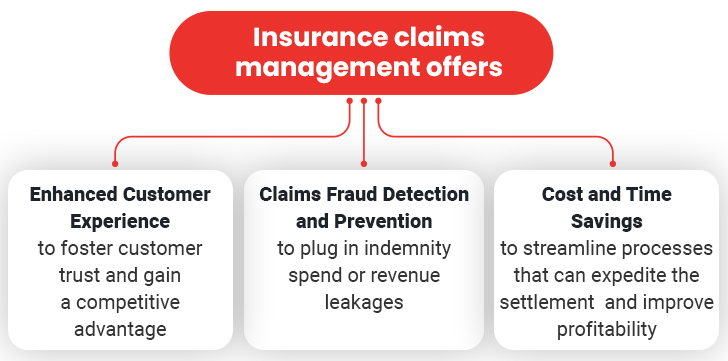

Here is a detailed overview of the key benefits of prudent claims management:

1. Enhanced Customer Experience

The insurance claims process is a highly challenging operation that involves various stages and stakeholders. Manual processing and settlement of claims across such disparate channels can take an inordinate amount of time and make the process vulnerable to errors. The delayed turn-around-time (TAT) plus the occasional slip-ups are detrimental to the interest of all parties involved, thereby impacting their customer experience.

Ideally, claims settlement should be efficient, accurate, and time-bound, with the last factor being the most determining one.

Speedy services make for a great customer experience. A survey reveals that almost 87%: policyholders believe the insurance claims experience impacts their decision to remain with insurer. It is evident that high customer satisfaction rates allow insurers to outperform the competition.

Moreover, settling claims expeditiously is also a logical way of minimizing customer complaints, preventing churn, and establishing your company as a brand. Such proactive action could have bearing on fringe benefits in certain sectors. For instance, efficient health insurance claims management is crucial to the quality of service as well as its accessibility through affordable health care premiums for customers, employers, workers, and taxpayers.

Leveraging next-generation technologies such as automation, artificial intelligence (AI) and analytics can increasingly impact every single touchpoint in the claims journey – expediting the overall process and improving customer experience while reducing the dependence on staff. Accordingly, by investing in claims modernization, insurers can free up the workforce from mundane, unproductive, and time-consuming tasks while drawing their attention to value-generating activities.

2. Claims Fraud Detection and Prevention

While settling insurance claims quickly is largely beneficial to all involved parties, it comes with certain risks and challenges. For instance, fraudulent or inflated claims may go unnoticed and thereby be settled disproportionately. Such instances cause insurers to lose about $30 billion annually to claims fraud – and that figure is just for P&C insurance!

Clearly, insurance claims fraud is a serious issue that is plaguing the insurance industry and causing its rapid deterioration.

Not only does paying fraudulent claims erode the profit margins of insurance companies, but these losses are ultimately passed to genuine customers in the form of higher premiums. There is also the challenge of the impact on customer satisfaction through delayed payouts or prolonged investigation during a period of stress. In short, it creates a lose-lose situation for all. Hence the insurance industry has an urgent need to develop a capability that can help identify potential frauds with a high degree of accuracy so that other claims can be cleared rapidly while identified cases can be scrutinized in detail.

Digital solutions aimed at insurance claims fraud detection diligently follow a comprehensive checklist of indicators including historical data, payment trends, etc. This real-time claims assessment allows insurance companies to nip the fraud right in the bud and plug in one of the greatest drains of their revenue. AI-powered solutions for claims can give rise to an early warning system that processes claims.

Digital tools like insurance claims management systems are an example of such a solution that can simplify and fast-track the entire process and yet ensure accurate settlement of claims. Small businesses, unlike their larger counterparts, cannot afford minor losses resulting from fraud. Such instances would not only eat into their profits but cause an imminent shutdown of business!

3. Cost and Time Savings

After a customer provides the first notice of loss (FNOL) in a traditional claims processing setting, the manual process-driven acknowledgment and triaging of the claim to an adjuster takes several days, significantly delaying the settlement process.

While delays in claims settlements are common, they can have some troubling ramifications. For example, health and life insurance businesses may have to pay a considerable sum as interest for such delays. Similarly, the stretched-out timelines will attract administrative costs, which will also claim a stake in the policyholder’s premium or profits, causing a budget creep for customers and businesses. As a result, claims management in life insurance must be speedy. Such repercussions where delays give rise to losses apply to every segment of the insurance industry.

Businesses across the insurance industry can transform their claims operations to reduce operational costs, losses due to procedural inefficiencies, and costs in the form of salaries and wages. Leveraging new-age tools and technologies for digitizing processes enable insurers to cut down claims regulation costs by up to 30 percent. Along the same lines, automating core claims processes allows insurance agencies of all sizes to cut down operational costs even further.

As an illustration, consider how manual investigations are highly prone to inaccuracies, inefficiencies, and costly mistakes which takes more time and adds to claims processing expenses. So, how can an insurer transform its existing claims value chain processes into a more integrated, transparent, and seamless function? The answer lies with insurance claim management processing tools which can enable insurers to drive efficiency by reducing the scope of errors, detecting fraud automatically, and cutting down the time taken to process and settle claims. These gains will correspond to fatter profit margins.

Uncover the Power of Modern Insurance Claims Management

The Role of Claims Management Systems

Managing claims becomes progressively cumbersome (and complicated) as the company scales and grows. In order to streamline the process, businesses may leverage claims management systems – a specialized software solution that helps with claim processing. Let’s have a look at how claims systems assist insurance businesses:

I. Workflow Automation

One of the key benefits of new-age insurance claims processing systems is that they are fully digital. These digital tools offer the obvious by-product and the greatest competitive advantage – automation. Hence, insurance claims processing automation systems leave room for identifying and locating bottlenecks and inefficiencies that can be fine-tuned and automated.

As a result, it offers ample scope to identify key areas that can undergo automation and yield exponential results. Quite often, businesses will have them streamline claims entry processes, generate sales orders, and complete time-taking workflows with efficiency and accuracy.

II. Process Standardization

As highlighted earlier, the claims process involves various parties. While the claimant and insurers are on different ends of the spectrum, a number of parties such as brokers, agents, banks, etc. are also involved in the process. Digital claims systems serve as a common thread that weaves through these parties and introduces consistent SOPs throughout.

III. Information Security

The traditional ways of storing claims data and documents are not only inconvenient but are also more vulnerable to theft or loss. With claims management systems for insurance companies, all the information and documents can be stored and accessed digitally – in most cases, even on the cloud! These highly secure systems use end-to-end encryption techniques and access limits to protect data from internal and external threats.

IV. Data Analytics and Reporting

Modern claims management systems are equipped with advanced data analytics and reporting capabilities that help insurers analyze claim trends, identify patterns indicative of fraud and make strategic decisions. With the help of real-time dashboards and comprehensive reports, insurers can gain actionable insights into claims performance and accordingly optimize their operations.

V. Customer Communication

Effective communication is a vital component of claims transformation. As such, claims management solutions help facilitate timely and transparent communication with policyholders. Automated notifications, reminders, status updates, and communication logs ensure that customers are informed at each stage of their claim. This helps in enhancing the overall experience and satisfaction.

In Conclusion

From the above, it is evident that technology-driven claims transformation is instrumental to the growth of an insurance agency. As it touches upon a range of benefits – from smooth-running operations to customer retention to cost-efficiency – it revitalizes the entire insurance value chain to benefit everyone who is involved. With this promise of positive outcomes, there is only one decision-making necessary – which insurance claims management system should you buy?