Financial institutions handle millions of transactions every day. Among these legitimate payments lurk complex fraud attempts that slip past traditional systems. Banks that succeed in this battle have learned that their edge comes not just from smarter algorithms but from better training data. Thus, the need for dedicated data annotation for fraud detection arises.

Banking, financial services, and insurance fraud have moved beyond simple card skimming and check forgery. It includes account takeovers, business email compromise (BEC) scams, cryptocurrency laundering, and AI-generated phishing attacks. Scammers use advanced technologies such as AI, deepfakes, and synthetic identity creation.

In fact, recent stats tell a grim story: the Federal Trade Commission reported that consumer fraud losses rose to $12.5 billion in 2024, a 25% increase from the year before. Another report states that 57% of financial organizations had direct fraud losses exceeding $500,000 in 2024.

Table of Contents

What Is Data Annotation in the Context of BFSI Fraud Detection?

What Are the Different Types of Annotation for Fraud Detection?

How Does Quality Financial Data Annotation Help Build Reliable Fraud Detection Models?

What Are the Key BFSI-Specific Annotation Challenges and Associated Solutions?

What Are the Best Practices for Data Annotation in BFSI Fraud Detection?

While credit card fraud tops the list of concerns, insurance scams and banking sector vulnerabilities have increased dramatically. Synthetic identity theft is one of the fastest-growing types of fraud, costing billions annually. These fake identities combine real and fabricated information, making detection extremely difficult for traditional systems.

Factors like crypto exchanges and digital payment systems have made money laundering operations more complex. What further worsens the situation are intricate layering strategies. On the other hand, the insurance industry suffers from exaggerated medical bills and staged accidents, often performed using an organized criminal network. Moreover, the BFSI sector operates in a heavily regulated environment.

Given this scenario, the BFSI sector requires a trustworthy AI fraud detection system that is powered by high-quality, annotated data.

“You need an AI tool to precisely combat fraud. It is a must now.”

– Philippe Fleury, Head of Regulatory, Compliance, and Forensic, KPMG Geneva

What Is Data Annotation in the Context of BFSI Fraud Detection?

Fraud has always been a constant threat to the financial services industry. What worsens the situation is the easy availability of GPT-3 AI tools. Fraudsters are using this technology for deepfakes and business email compromises on a large scale. Thus, it is not surprising that the global market for deepfake detection is projected to reach US$15.7 billion in 2026. This is just one case that highlights the need for AI in fraud detection. BFSI businesses need advanced solutions to balance the prevention effectiveness with customer experience and compliance. At the core of these systems is data annotation.

Data annotation is the process of tagging data, such as images, audio, videos, and text, to train machine learning algorithms. The AI-based fraud detection systems use this input to differentiate between real and fake activities. In fraud detection, tagging involves specialized approaches tailored to unique financial data traits.

That said, financial data annotation requires subject matter expertise. Financial transactions have hidden patterns that only experienced fraud investigators can identify. These patterns become the basis for AI models that can detect fraud across millions of transactions. Having understood data annotation in BFSI and its role in detecting fraud, it’s time to explore the different types of annotation.

What Are the Different Types of Annotation for Fraud Detection?

The BFSI sector generates and stores overwhelming amounts of data; however, not all is created equal. Some of this data is structured, including transaction history, account number, and credit scores, among others. Information, such as KYC forms, contracts, customer emails, and voice recordings from customer service calls, is unstructured. Given this variation, different techniques are used to tag different types of data:

1. Transaction Labeling

Transaction labeling uses expert analysis and historical data to tag each transaction as fraud or legitimate. This binary classification helps AI to understand what constitutes fraud. Nonetheless, the challenge lies in tagging tricky cases where fraud signs are subtle. Annotators should understand transaction details, customer behavior, and merchant patterns to make the right call.

2. Entity Annotation

Banking data annotation involves tagging customer, merchant, and geographical data. That said, having a thorough understanding of business relationship patterns, geographic risk factors, and social network analysis is advantageous.

So, to detect fraudulent activities, annotators use entities, such as geographical locations, behavioral patterns, and relational networks. Entity annotation enables graph-based fraud detection models to effectively analyze the relationship between entities. Importantly, these entities must be accurately annotated, as this directly impacts the model’s ability to identify fraud.

3. Behavioral Pattern Annotation

Behavioral pattern annotation focuses on time-based sequences and user interaction patterns. These include unusual login times, browsing behaviors, and spending habits. Annotators track and label these characteristics, and the model immediately raises concern if there’s any deviation from usual patterns. That’s how account takeover attempts and insider threats are detected and prevented.

Nonetheless, temporal behavior tracking is no easy feat. Annotators must be able to distinguish between legitimate behavioral changes and fraudulent activities. Not to forget the impact of seasonal variations and life events on user behavior.

4. Document Verification Annotation

Document verification annotation helps meet KYC (Know Your Customer) rules. For this process, annotators verify ID documents, look for altered images, and flag odd documentation patterns. This fuels computer vision models that automate document verification processes. As deepfakes and intelligent document forgery become increasingly common, this kind of annotation needs regular updates to stay ahead of emerging threats.

How Does Quality Financial Data Annotation Help Build Reliable Fraud Detection Models?

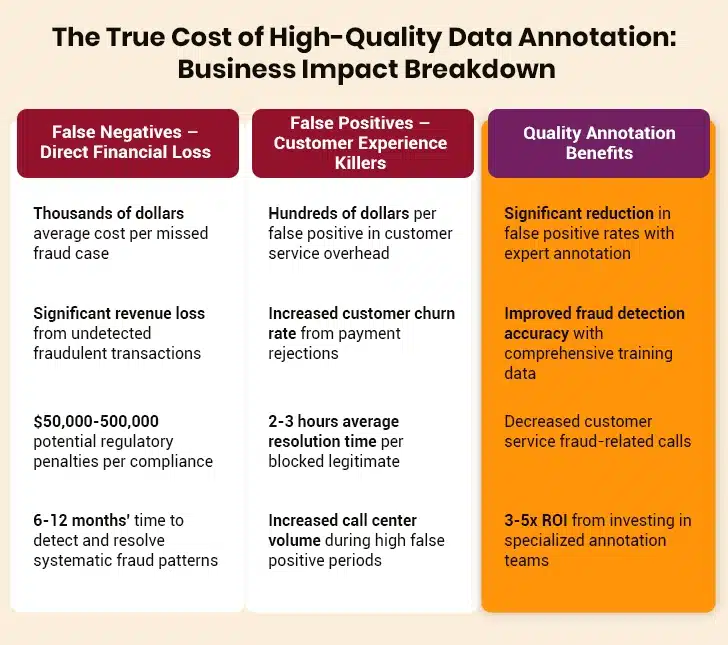

The quality of financial data annotation directly impacts the performance of the fraud detection model. This relationship determines whether AI systems protect banks and other financial institutions or let them down. When annotations are top-notch, models learn precise boundaries for deciding between fraudulent and legitimate transactions. Inaccurate annotations can lead to misclassifications, false positives, and missed fraud instances.

Moreover, understanding this is crucial in fraud detection because of the class imbalance. As a matter of fact, fraudulent transactions account for less than 1% of all transactions. The class imbalance is one of the biggest challenges in fraud detection annotation. Traditional sampling methods often fall short in capturing the range of fraud patterns while maintaining model stability.

Smart ways to annotate data include oversampling rare fraud cases and synthetic data generation for underrepresented fraud types. That’s where dedicated data annotation services in the finance industry help. They ensure that fraud patterns are well-represented without the model becoming too focused on specific examples.

What more can be done is that annotators can actively learn approaches that focus on uncertain cases. Thus, models can detect various fraud patterns without raising too many false positives. And when financial institutions understand this connection, they can build truly reliable fraud prevention capabilities.

The influence on false positive and false negative rates shows how annotation quality matters for business. False positives lead to customer frustration and additional work. False negatives result in direct financial losses and legal risks. However, quality annotation allows models to achieve the accuracy required for effective fraud detection while ensuring customer satisfaction.

Annotating financial datasets is not without its challenges. Many companies often give up on their plans to build robust fraud detection models due to these. The good thing is that all of these can be resolved, as discussed in the next section.

What Are the Key BFSI-Specific Annotation Challenges and Associated Solutions?

Given the sensitive nature of financial data and the regulated environment of the industry, data annotation becomes challenging. Issues such as privacy concerns, legal risks, and domain expertise, among others, become roadblocks on the way to developing smart fraud detection models. However, all these can be resolved. Here’s how:

I. Regulatory Compliance Requirements

Banks and financial institutions face unique labeling challenges due to regulatory rules, sensitive data, and domain complexity. Frameworks like GDPR and PCI DSS govern the industry and influence how data is handled, which impacts labeling processes.

Data annotation services in the finance industry must navigate complex privacy laws while maintaining annotation quality. They use advanced methods to anonymize data, secure tagging environment, and keep detailed audit trails.

II. Privacy and Data Sensitivity

Finance annotators must know how to strike a balance between model training needs and customer data protection. This helps address the concerns about data privacy and sensitivity. Traditional approaches of sharing customer data with external companies are no longer valid today.

In such instances, data anonymization techniques help fulfil both purposes, including safeguarding customer identity and detecting fraud patterns. Businesses can also opt for synthetic data generation that creates realistic training scenarios without requiring real customer data. Another option is to opt for federated learning methods that allow model training without centralizing sensitive information.

Role of Data Annotation in Training AI and Machine Learning Models

III. Domain Expertise Requirements

Domain expertise requirements create labeling bottlenecks that many companies find hard to solve. To detect financial frauds, annotators should understand banking operations, regulatory frameworks, and criminal tactics thoroughly. Owing to this understanding, annotators can add accurate labels to help fraud detection models identify fraud patterns.

However, many annotation companies do not possess this specialized knowledge, leading to inconsistent labeling quality. While training general annotators may sound nice, it is not economically viable. Instead, a cost-friendly way is to hire subject matter experts who know what it takes to annotate financial data accurately.

IV. Multilingual and Multi-Jurisdictional Complexity

There are multiple languages and legal systems spread across the world, each having its own nuances. Similarly, fraud patterns and regulatory environments also vary across cultures and countries. What works for one financial firm operating in the US may not work for one operating in India. In such scenarios, annotators having a detailed understanding of different cultures can help. They balance local nuances with global consistency standards.

However, this challenge goes beyond the simple language translation. It is a must for financial annotators to understand different business operations, spending habits, as well as associated risks and threats across the world.

V. Time-Sensitive Pattern Evolution

The time-sensitive nature of fraud patterns requires a dynamic annotation approach. New fraud tricks emerge rapidly, rendering historical annotations less useful. Constant updates to annotations help models remain effective against new threats.

Effective solutions to address all these challenges include building specialized annotation teams with a financial services background. Additionally, firms can utilize automated pre-labeling systems that are validated by human experts and build active learning systems that focus on annotating uncertain cases. Another smart way is to invest in AI data annotation tools that learn from input data and improve over time.

These approaches strike a balance between quality, productivity, and cost while addressing the unique issues of financial services annotation. Getting through these challenges needs strategic thinking and annotation as a key skill rather than just a necessary task.

| Aspect | Traditional Data Annotation | AI-Based Data Annotation |

|---|---|---|

| Security | Manual data handling, higher breach risk | Automated anonymization, secure environments |

| Compliance | Manual audit trails, inconsistent documentation | Automated compliance tracking, comprehensive logs |

| Efficiency | Time-intensive, limited scalability | Rapid processing, scalable automation |

| Accuracy | Variable quality, annotator-dependent | Consistent quality with expert validation |

| Cost | High-labor costs, ongoing training expenses | Lower pre-annotation cost, reduced overhead |

| Adaptability | Slow response to new fraud patterns | Real-time adaptation to emerging threats |

What Are the Best Practices for Data Annotation in BFSI Fraud Detection?

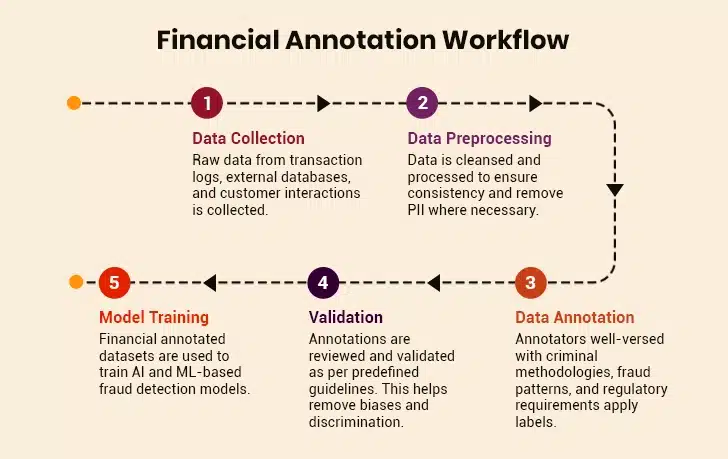

Effective annotation requires careful planning and step-by-step action. These proven methods ensure quality and operational efficiency when developing fraud detection models. Here’s the right way to move forward:

1. Building Expert Annotation Teams

Successful fraud detection annotation requires a structured approach that ensures quality, consistency, and adherence to compliance standards. In other words, the key to success lies in building teams of expert annotators who know the field inside out.

These annotation teams should include former fraud investigators, compliance specialists, and data scientists who understand technical needs and the business context. This blend of expertise ensures they cover all aspects of fraud scenarios and regulatory issues.

Investing in specialized talent pays off by improving the quality of annotations and eliminating training needs. Expert annotators can identify subtle signs of fraud that automated systems or general annotators might overlook.

2. Multi-Tier Validation Processes

Using multi-tier annotation and validation processes provides quality assurance to prevent expensive labeling errors from propagating through training datasets. Domain experts perform the initial annotation. Once done, the tags are validated independently. This creates a safety net that easily catches inconsistencies if any. Such a layered approach ensures that difficult annotation decisions receive the right expertise without impacting routine cases.

3. Establishing Consistency Protocols

Clear annotation guidelines and consistency steps help prevent labeling variations that degrade model performance. These guidelines should address edge cases, provide decisions for ambiguous situations, and include examples of proper annotation techniques.

Regular training ensures all the annotators are on the same page and maintain consistency standards as fraud evolves. Importantly, these sessions should use feedback from model performance and new fraud intelligence.

Explore the Comprehensive Guide to Finding the Right Data Annotation Outsourcing Partner

4. Continuous Improvement Cycles

Financial data annotation teams must utilize continuous feedback loops that incorporate model performance data into their annotation improvement processes. Models that often misclassify certain patterns highlight annotation gaps that need attention. This creates ongoing improvement cycles that boost quality and model performance.

5. Quality Assurance Measures

Blind annotation exercises, statistical analysis of labeling patterns, and inter-annotator agreement computations are examples of quality assurance methods. These metrics identify training needs and maintain annotation quality standards. Additionally, regular quality checks provide early warning of performance issues by identifying drift in annotation standards.

6. Audit Trails and Governance

Data versioning and audit trails empower businesses to stick to rules and govern their AI models. Annotation histories allow companies to enable model explainability and meet regulatory reporting needs. These governance steps are crucial when regulatory authorities investigate fraud detection decisions or when legal issues arise.

Closing Thoughts

Data annotation lays the foundation for trustworthy fraud detection models in BFSI. Companies that invest in comprehensive annotation services get better fraud detection results. Banks and financial firms that understand quality data annotation as a core competency in enabling reliable AI fraud detection models remain competitive.

And as fraudsters leverage advanced technology to scam people, now’s the time to get moving. Banks and other financial institutions that recognize data annotation as a smart investment in improving their fraud detection capabilities are better positioned to prevent fraud and protect customers.