Present-day companies lose a significant portion of their yearly revenue to fraud. This is, in part, due to the traditional rule-based systems that can’t keep up with modern fraud schemes. In such a scenario, AI fraud detection becomes essential.

AI-powered fraud detection systems offer modern businesses an edge. They track transactions around the clock and spot suspicious activity immediately. By learning from global patterns, these systems reduce false alarms and detect emerging threats.

This playbook explains how C-level executives can use AI to proactively detect and prevent fraud. It also discusses the challenges and essential considerations in using AI for detecting fraud.

Table of Contents

What’s Changing in 2025? The Evolving Fraud Landscape

The Role of AI in Fraud Prevention

- 1. From Rule-Based Systems to Machine Learning Models

- 2. How AI Enables Anomaly Detection, Behavioral Analysis, and Cross-Platform Monitoring

Components of an AI-Driven Fraud Detection System

- Data Ingestion

- ML Models for Pattern Recognition

- Real-Time Decision Engine

- Feedback Loops and Model Retraining

Future-Forward Approaches: Autonomous Detection and Multi-Agent Systems

- Use of Agent-Based Systems for Distributed Fraud Detection

- Integration with Generative AI for Identity Verification

Challenges and Considerations in Using AI in Fraud Detection

What’s Changing in 2025? The Evolving Fraud Landscape

The threat landscape is changing faster than ever. What we will deal with in the future makes today’s challenges look simple. Modern organizations face sophisticated threats that blend technological innovation with criminal ingenuity. Conventional security measures are becoming obsolete as fraudsters develop multi-layered approaches that target various vulnerabilities simultaneously.

Synthetic identity fraud stands out as perhaps the most concerning trend. Instead of stealing someone’s complete identity, synthetic fraud mixes real and made-up information to create entirely new identities that pass standard verification checks. These fabricated identities prove especially difficult to spot because they often include legitimate data elements.

Deepfake technology presents another major concern for security professionals. Deepfakes go beyond simple audio and video manipulation. They create highly convincing voice replications, facial movements, and behavioral patterns. The result? Fraudsters can now bypass biometric security measures that once seemed impenetrable.

What makes the 2025 fraud landscape particularly dangerous is how these separate attack methods now work together in coordinated, multi-modal threats. Sophisticated fraud operations simultaneously target:

- Transactional systems through account takeovers

- Biometric safeguards via deepfake technology

- Behavioral patterns through advanced spoofing

What has made matters worse is the democratization of attack tools. Not long ago, sophisticated fraud required specialized knowledge and substantial resources. Not any longer. Today, the dark web offers fraud-as-a-service packages that put advanced attack capabilities into the hands of nearly anyone willing to pay. The technical barrier to entry has collapsed. This has expanded the pool of potential fraudsters dramatically.

Fraud itself has become automated. Machine learning algorithms are now being used against the institutions that pioneered them. These systems learn from historical attempts, refine their methods, and launch increasingly sophisticated attacks. In addition, these algorithms study defenses continuously. They identify weak points and adjust strategies accordingly.

Cross-channel fraud has grown increasingly common. A fraudster might start with a phishing email, follow up with a convincing phone call impersonating your support team, and execute the attack through a mobile app. As the security systems don’t talk to each other, fraud detection becomes difficult.

The modern threat landscape also includes elaborate reconnaissance operations. Many modern fraud attempts now begin with weeks or months of meticulous information gathering. Attackers build detailed user profiles using multiple data sources before making a move.

To combat these threats, organizations must transform their approach from reactive to proactive security postures. AI-powered systems that spot anomalies, learn from emerging patterns, and respond to threats in real time represent the future of fraud prevention. Traditional rule-based systems can’t keep up with attack methods that evolve rapidly. The next section talks about this concept in detail.

Decoding Machine Learning’s Role in Fraud Detection and Prevention

The Role of AI in Fraud Prevention

AI has fundamentally changed traditional fraud prevention. Industries such as finance and banking lose billions to fraud each year. These growing threats need advanced detection methods.

1. From Rule-Based Systems to Machine Learning Models

Organizations have typically relied on rule-based systems to detect fraud. These systems work well with known patterns (e.g., someone making purchases across multiple continents daily). However, they fall flat when confronting unknown patterns or clever variations of existing patterns.

AI and machine learning mark the next step in fraud prevention. Traditional approaches use fixed rules that fraudsters can study and bypass. Machine learning models offer a dynamic solution that learns and adapts continuously. This happens in three phases:

- Rule-Based Systems and Manual Reviews: Traditional fraud prevention using static rules and human analysis

- Machine Learning and Behavioral Analysis: Systems that spot patterns in large datasets and adapt to new fraud tactics

- Advanced AI and Real-Time Prevention: State-of-the-art systems using deep learning and neural networks to detect fraud instantly

2. How AI Enables Anomaly Detection, Behavioral Analysis, and Cross-Platform Monitoring

AI-powered fraud detection can do many things traditional systems cannot. AI helps with anomaly detection. These algorithms are trained on mountains of past data. That’s why they can recognize legitimate transactions and flag unusual patterns or behaviors indicative of fraud.

Behavioral analysis adds another layer of protection. The technology builds detailed user profiles by collecting data from various interaction points. These include typing patterns, mouse movements, screen pressure on mobile devices, and browsing habits. These profiles act like digital fingerprints that help organizations spot potential fraudsters quickly.

AI systems also excel at cross-platform monitoring. Fraudsters often launch attacks across multiple channels. They gather information through phishing emails, verify details by phone, and commit fraud through mobile apps. AI models can connect the dots across these channels to spot coordinated fraud attempts promptly.

Amiram Shachar, CEO of cloud security company Upwind, emphasizes AI’s advantage: “Once you train a model, the speed you can catch things is in milliseconds. It’s incredible.”

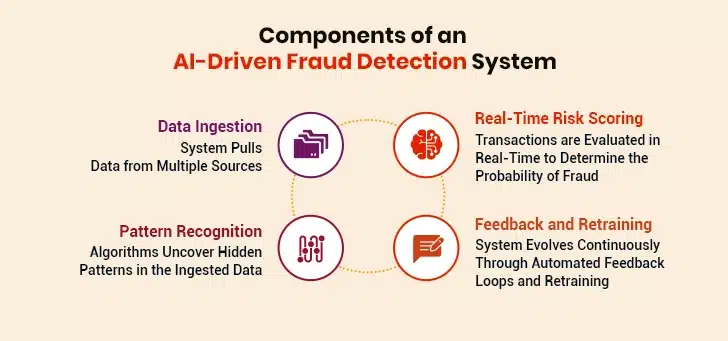

Components of an AI-Driven Fraud Detection System

AI fraud detection needs four connected parts that work together to create a complete system. These elements help spot and stop fraud quickly on digital platforms.

I. Data Ingestion

Every AI-driven fraud detection system starts with a reliable data foundation. These systems need to handle both structured data (transaction records, account information, demographic details) and unstructured data (emails, chat logs, social media interactions).

The accuracy of these systems is directly affected by the quality and diversity of data. Systems pulling data from multiple sources spot fraud more accurately than those relying on a single stream of data. Raw data requires preprocessing through cleaning, normalization, and feature extraction before it can be considered fit for analysis.

II. ML Models for Pattern Recognition

Smart machine learning models are integral to AI fraud detection. These models include:

- Supervised learning algorithms that learn from labeled training data. These usually spot known fraud patterns.

- Unsupervised learning techniques that learn from unlabeled data. They detect anomalies without requiring prior examples.

- Deep learning networks that recognize complex patterns across multiple dimensions

Hybrid systems that combine one or more of these models work better than single-model approaches. They achieve much higher accuracy when spotting complex fraud schemes.

III. Real-Time Decision Engine

Smart decision engines evaluate transactions in milliseconds. They use risk-scoring systems that consider hundreds of variables simultaneously and determine the probability of fraud. Advanced engines balance false positives with missed fraud detection. Too many false positives hurt customer experience, while missed detection directly affects the bottom line.

IV. Feedback Loops and Model Retraining

AI in fraud detection gets better through constant improvement and feedback loops. Models adapt to new fraud patterns through a structured retraining cycle that includes:

- Collection of model performance metrics

- Identification of false positives/negatives

- Integration of new fraud methods

- Periodic model retraining and validation

Future-Forward Approaches: Autonomous Detection and Multi-Agent Systems

The future of fraud prevention isn’t about single AI systems working alone. It is about specialized AI agents working together to create a strong defense network. This shift toward autonomous multi-agent systems marks the next evolution in combating financial fraud.

Use of Agent-Based Systems for Distributed Fraud Detection

Agent-based models mark a vital step in fighting financial fraud. Here, multiple specialized agents work across distributed networks to monitor different aspects of transactions simultaneously. One agent may track user behavior, while another one may report suspicious transactions. This creates a complex detection network that’s far more powerful than any single-system approach.

Integration with Generative AI for Identity Verification

Identity verification systems face new challenges as criminals use generative AI to create increasingly convincing fakes. Multi-layered verification systems have been developed to combat the issue. These systems go beyond validating applicant data; they identify suspicious patterns and detect unusual behaviors that might indicate someone is using a deepfake or other spoofing technique.

In the future, we expect increased collaboration between human analysts and autonomous AI agents to create a far more formidable defense against evolving fraud tactics. Add to it technologies such as Blockchain for verification and IoT for additional data points, and we may develop a security framework that can adapt as quickly as the threats themselves.

Build AI-Powered Systems to Counter Financial Threats

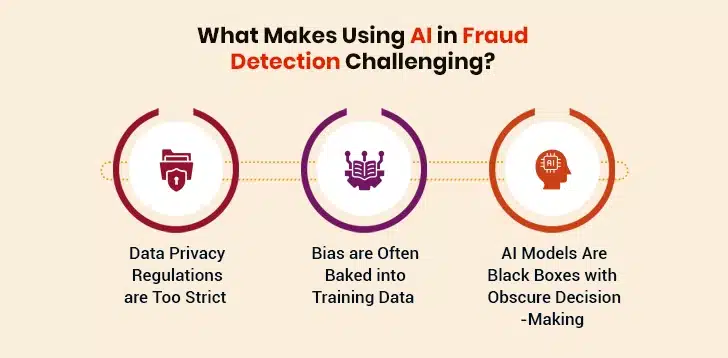

Challenges and Considerations in Using AI in Fraud Detection

AI fraud detection technology has made great strides, yet organizations still face major hurdles with its implementation and management. These challenges need proper solutions to ensure everything works well and stays compliant.

1. Data Privacy and Compliance

Fraud detection requires careful handling of strict data privacy regulations. In Europe, the European Union’s General Data Protection Regulation (GDPR) requires organizations to obtain user consent before processing their data. People have the right to know how and why their data is processed. This need for complete transparency changes how fraud detection systems work and communicate their decisions.

In the USA, there is no single comprehensive law on data privacy yet. Different states have enacted their laws. Among these, the most comprehensive legislation to date is the California Privacy Rights Act (CPRA).

The CPRA strongly protects California residents’ rights. Companies doing business in California must follow these rules if they:

- Make over USD 25 million yearly

- Handle data of more than 100,000 people

- Earn at least 50% of their yearly revenue by selling the personal information of California residents

Violating these rules costs businesses dearly. GDPR violations can lead to fines of up to €20 million or 4% of the yearly worldwide revenue of a business entity. In CPRA, unintentional violations cost USD 2,500 per breach and intentional violations cost USD 7,500 per breach.

2. False Positives and Bias in Models

Finding an equilibrium between catching fraud and avoiding false positives remains a challenge. False positives happen when genuine transactions get wrongly marked as fraud. This creates unnecessary problems, frustrates customers, and wastes resources. On the flip side, missed fraud cases cause revenue losses.

AI models learning from old data might amplify unfair patterns baked into this data. This may lead to biased choices that could favor certain demographic groups unfairly and violate human rights.

3. Model Interpretability for Stakeholders

All too often, modern AI models function as “black boxes”, where their growing complexity obscures their decision-making process. This lack of interpretability becomes a hurdle in this age when transparency matters the most.

Explainable AI (XAI) helps address the issue. Methods in XAI provide a simple, easy-to-follow explanation of the decisions made by AI-based fraud detection models. They help organizations justify marking certain transactions as “anomalous” or “potentially fraudulent”. By embedding a layer of explainability into their models, they can create trustworthy, compliance-ready systems that balance algorithmic precision with regulatory accountability.

Wrapping Up: Preparing for the Next Frontier of Fraud

AI-powered detection systems have become vital safeguards against financial losses as organizations battle sophisticated financial threats. Traditional rule-based systems of yesteryear cannot match the adaptability and precision of artificial intelligence. The shift from simple, rule-based fraud prevention to advanced AI-driven systems, therefore, represents an urgent business imperative.

The future of fraud prevention will be shaped by multiple technologies working in harmony. Next-generation security frameworks will rely on multi-agent systems and generative AI verification methods. Organizations using these comprehensive approaches will see remarkable benefits in the form of improved security postures, bolstered revenue, and higher customer retention.

With Damco’s proven AI expertise, businesses can combat fraud effortlessly while making customer experiences seamless. Our custom AI solutions blend smart detection with real-time adaptability, securing transactions without friction. Trust Damco to empower your operations today and in the future.