Customer acquisition and retention have always been some of the greatest challenges for Chief Marketing Officers (CMOs) at insurance companies. In a hypercompetitive industry that is beginning to transition from being product-centric to one focused on consumers, you need to reimagine your customer engagement strategy.

Why? Because brand differentiation remains a major business goal across the insurance industry since customers no longer consider price as the only attribute to consider during the purchase decision of a commoditized product. In fact, it is influenced by a bouquet of factors, such as brand awareness, simplicity of decision making, customer experience, advocacy, feedback/reviews, and more. The task of managing all these variables is compounded further by the fact that many people are now purchasing insurance via aggregator websites, instead of reaching out to your company directly or your agents. Almost 50% of customers in developed markets hardly had any interaction with their insurers over the annual policy term!

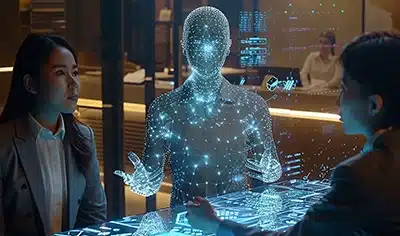

Given this context, how can you transform the way you market insurance products and services to digitally empowered buyers, who are increasingly seeking high-touch, personalized experiences? The answer to that is CRM and marketing automation.

How Can CRM and Marketing Automation Drive Customer Engagement?

-

1. Embrace Insurance Marketing Automation

Before elaborating on the impact of this option, let’s first understand what is marketing automation in CRM? As the name indicates, insurance agency marketing automation through CRM allows insurers to set up rule-based actions that are triggered through inputs like customer behavior.

For example, consider a situation where a user downloads an insurance policy document from your website after filling up the contact form. You can then send them welcome emails and share a list of similar products that may interest them.

In the same manner, you can use CRM for insurance agents to tailor communication for individual prospects and existing customers. The fact that 52% of consumers would consider changing brands if a company fails to personalize communication is a push in this direction. It’s high time your agency migrates from using manual business processes for this purpose and adopts automation tools for scalable customer outreach initiatives, lead generation programs, etc.

Similarly, you can leverage automation to adapt your marketing programs to the respective stage of the buyer journey and deliver customized content. With predictive data analytics tools, you can now extract tangible insights from internal and external customer data – both structured and unstructured – quickly, and build bespoke paths for individual leads. Moreover, adaptive marketing can be applied to various engagement channels including email, SMS, mobile apps, social media, and websites.

Boost your Lead, Customer, and Campaign Management

-

2. Implement Next-Gen CRM

Many of your peers are overhauling their customer relationship management (CRM) systems to transform the customer experience (CX). According to research, CRM can improve customer satisfaction by over 50%.

Insurance CRM software solutions are designed to address specific business needs and include niche features along with core general CRM capabilities. The new-age, industry-specific CRM can help you understand each of your policyholders in a granular manner, and equip your staff with the requisite contextual insights to help anticipate customer requirements, and proactively address the same. A versatile CRM for Insurance Agents increases the efficiency of the existing workflows by automating mundane tasks such as lead follow-up and tracking about-to-expire policies.

Conclusion

As marketing, like other business functions, undergoes a fundamental transformation in the 21st century, you need to leverage disruptive technologies effectively, if you are to deliver on your core mandate. Be it boosting product awareness, enhancing lead generation and nurturing, or maximizing customer lifetime value (CLV), you will be able to achieve these goals only by orienting marketing around data-driven insights and scalable, flexible processes.

Case in Focus

A leading full-service life insurance company was struggling with disparate systems and databases that contributed to inconsistent customer experience, poor data visibility, and decreased productivity. To combat these challenges, we used our suite of technology services – InsuranceNXT – for analyzing the insurer’s business processes, data quality, and IT infrastructure. After gathering the requirements and understanding the workflows, we developed an integration strategy to seamlessly connect all the legacy systems. This resulted in seamless data flow, improved customer experience, and increased efficiency. This client success story covers the case in detail.