Let’s face it—getting an insurance quote is a hassle. Long forms, slow responses, and confusing prices are all part of the deal. But things are changing fast.

AI and data analytics are rewriting the rules. What once took days now takes seconds. Quotes that were once one-size-fits-all are tailored to fit the customers perfectly. From auto and life to health insurance, the experience is becoming faster, wiser, and more transparent.

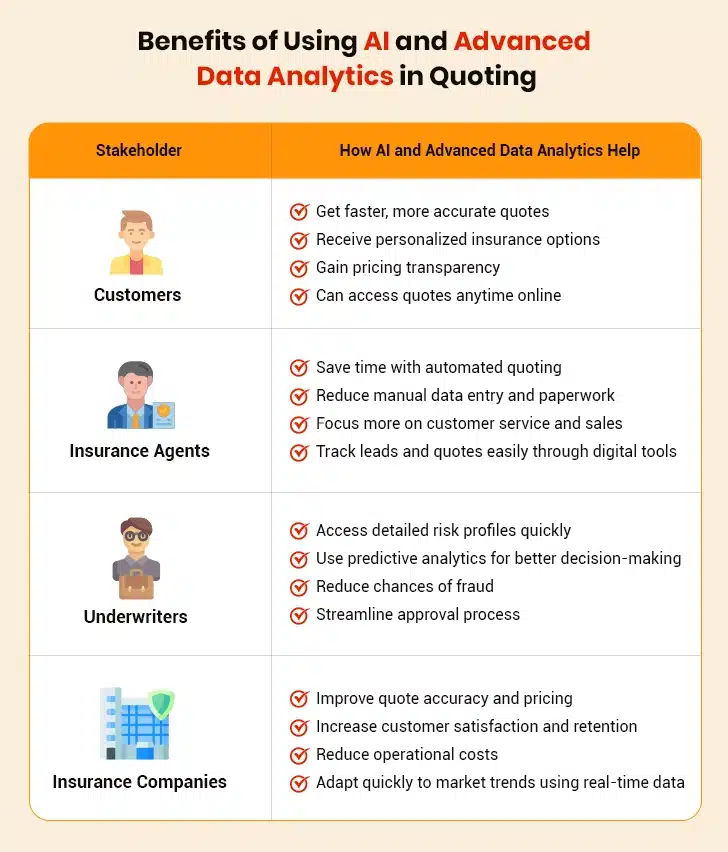

This isn’t just good news for customers. Agents, underwriters, and insurance companies benefit from more efficient, accurate, personalized quoting tools. With advanced quoting software for insurance leading the way, the industry is moving toward a better future, one quote at a time.

Table of Contents

Limitations of the Traditional Insurance Quoting Process

The Impact of AI and Advanced Data Analytics on Insurance Quoting

The Role of Gen AI in Transforming Insurance Quoting Across Sectors

Limitations of the Traditional Insurance Quoting Process

Before AI and advanced technology, getting an insurance quote was long and often frustrating. Most processes were manual, which made everything slower and less accurate. Insurance agents had to gather information from customers by phone or in person. Then, they filled out paper forms or used outdated systems to calculate quotes.

This method created several challenges, including:

- Time-consuming steps: Providing a quote could take hours or even days

- Manual errors: Mistakes in data entry or calculations were common

- Limited personalization: Everyone received similar quotes, even if their needs differed

- Lack of transparency: Customers didn’t always understand how the quote was calculated

- Difficult updates: Changing a quote or policy took more time and effort

The problems were bigger in health insurance. Patient data had to be collected from different places, and reviewing someone’s full medical history or lifestyle choices quickly wasn’t easy. This led to general estimates that didn’t match real risks.

The traditional process also didn’t work well for people wanting quick online answers. It relied too much on face-to-face meetings and paperwork.

Because of these limitations, customers and insurance providers needed a better way. That’s where AI-powered quoting software makes a big difference.

The Impact of AI and Advanced Data Analytics on Insurance Quoting

AI and advanced analytics are transforming the insurance quoting process like never before. Insurers can now offer their customers faster, more accurate, and highly personalized quotes. This shift helps companies stay competitive while enhancing the overall customer experience. Let’s explore the key benefits in detail.

1. Faster Quote Generation with AI-Powered Software

AI has made it possible to generate insurance quotes in seconds as opposed to traditional quote generation that involved manual data entry, paperwork, and long waiting periods. Today, insurance quoting software uses AI to automate these tasks, drastically reducing time. These solutions can deliver accurate quotes almost instantly by analyzing real-time customer inputs, past claims, and risk factors.

This speed helps insurers respond faster to customer inquiries and improves user satisfaction. For example, a customer looking for a health policy doesn’t need to wait for days. With quoting software powered by AI, they get tailored quotes immediately. AI also reduces human errors in calculations and data interpretation, which ensures more accurate pricing.

Moreover, AI can process large data volumes simultaneously, making it ideal for scenarios involving multiple applicants or group policies. Insurers using modern quoting systems experience improved efficiency and better resource management. Time saved on quoting can be invested in customer support or marketing.

In short, AI speeds up quote generation and boosts accuracy. This benefits insurers and creates a seamless customer experience, encouraging them to complete the policy purchase faster.

2. Improved Accuracy in Risk Assessment

AI and data analytics have transformed how insurance companies assess risk. Instead of relying only on general categories like age or income, modern quoting software analyzes deeper, more specific data. This includes medical history, lifestyle choices, and even wearable device data. By processing such detailed inputs, AI can produce a more personalized risk profile for each individual.

For instance, health insurance quoting software can examine health records, fitness tracker data, and prior claims to determine how likely a person is to need future medical care. Based on this, the system generates a fair and precise quote. Quoting software for insurance doesn’t just guess—it calculates using real data patterns and predictions.

This means customers who care for their health may receive lower premiums. It also helps insurers avoid underpricing high-risk individuals, resulting in a more balanced and sustainable insurance model. AI-driven quoting reduces guesswork and increases transparency in pricing.

By improving the accuracy of risk assessment, insurance companies can offer better pricing, and customers can clearly understand how their quote was calculated. It’s a win-win for both sides.

3. Real-Time Data Use for Up-to-Date Quotes

One of the most significant benefits of AI-powered insurance quoting solution is its ability to use real-time data. In the past, quotes were based on outdated or static information. But now, quoting software for insurance can connect to live data sources—such as credit reports, driving records, and health databases—to instantly pull in the latest updates.

This means a person who recently improved their credit score or stopped smoking can immediately see those changes reflected in their insurance quote. Health insurance quoting software can even factor in recent doctor visits or lab results when estimating medical insurance costs.

With real-time data, insurers can ensure that quotes are accurate, fair, and current. Customers benefit by getting personalized rates that reflect their present situation, not their past. Insurers benefit by avoiding risks that may have developed suddenly, like a significant health event or a change in employment.

In today’s fast-paced world, outdated data just doesn’t cut it. AI makes quoting dynamic, flexible, and immediate, giving insurers and customers confidence that the information is correct at purchase.

4. Predictive Analytics for Smarter Pricing

Predictive analytics is a key part of how AI is improving insurance quoting. Instead of only reacting to current data, AI can look at patterns in historical data to forecast future behavior. Quoting software uses these forecasts to generate more innovative, accurate pricing models.

For example, quoting software for insurance can predict which applicants are more likely to make a claim based on similar profiles from the past. The software can also estimate how much coverage someone with a history of frequent doctor visits or specific conditions might need in the coming years.

These predictions help insurers avoid pricing too low or too high. It also allows them to design better insurance plans with appropriate coverage levels. Customers get quotes based on realistic assumptions, not averages or guesswork.

Predictive analytics transforms quoting from a reactive process to a proactive one. This improves profitability for insurers and builds trust with customers who want fair pricing. AI enables smarter decisions that benefit everyone involved.

5. Enhanced Personalization of Quotes

AI enables a new level of personalization in insurance. Instead of giving everyone the same plan, quoting software tailors options based on individual needs. AI creates custom quotes using age, location, family history, occupation, and lifestyle.

Quoting software for insurance companies can also offer personalized recommendations. For example, if the system sees someone as a frequent traveler, it might suggest plans with international coverage. Health insurance quoting software can suggest add-ons like maternity or wellness benefits if it detects relevant medical history.

This personalized approach makes customers feel understood. They’re more likely to trust the system and make the purchase. It also helps insurance companies stand out by offering more value.

The days of one-size-fits-all insurance are over. AI ensures that each quote fits the person receiving it, improving customer satisfaction and retention in the long run. Personalized quoting is not just a trend—it’s the future of insurance.

Discover the Future of Insurance Quoting with AI Solutions

6. Automation of Manual Quoting Processes

Before AI, insurance quoting was a manual, time-consuming process. Agents had to collect customer information, fill out forms, check guidelines, and calculate premiums by hand or with outdated tools. Today, quoting software automates almost all of this.

AI takes in customer inputs through simple online forms and automatically pulls data from various sources, such as government records, medical histories, or credit scores. Quoting software for insurance then uses built-in algorithms to process this data and create a quote without human involvement.

In health insurance, this automation is especially valuable. The quoting software can quickly evaluate a person’s age, health status, and prior claims to suggest a suitable plan. It even automates policy comparisons and benefit breakdowns, so the customer doesn’t have to do the math.

This automation reduces the chance of human errors, speeds up operations, and allows insurance agents to focus on customer relationships instead of paperwork. The quoting process becomes more efficient and consistent.

By removing the need for repetitive manual work, AI-powered systems make quoting smarter, faster, and more reliable. This is a significant upgrade from traditional methods and a big win for providers and customers.

7. Better Fraud Detection in Quote Generation

AI and data analytics are excellent tools for spotting fraud in quoting. In traditional systems, fraudulent applicants can easily provide false information. However, modern quoting software uses data cross-checks and pattern analysis to detect inconsistencies.

For instance, quoting software for insurance can instantly verify income, vehicle history, or past claims using connected databases. If someone reports perfect health but has a history of major illnesses in their medical records, health insurance quoting software flags it. This alerts the insurer to double-check the information before finalizing the quote.

AI can also learn from past fraud cases. It identifies suspicious behaviors like entering mismatched data, requesting unusually high coverage, or applying multiple times under different names. Over time, the system becomes more intelligent and precise in detecting fraud.

This protects insurance companies from losses and ensures honest applicants don’t end up paying higher premiums due to the risks posed by fraudsters. It also improves trust in the insurance process overall.

In a world where online fraud can happen in a fraction of seconds, AI must monitor and validate quotes. It makes the entire quoting process safer and more trustworthy.8. More Transparent Pricing Structures

One big complaint policyholders have about insurance is not knowing how their quote was calculated. AI is changing that by making pricing more transparent. Modern quoting software shows exactly how each piece of data affects the final price. When a customer enters their details, quoting software for insurance breaks them down step by step. For example, it shows how factors like age, location, and other inputs contribute to the final premium. Health insurance quoting software can show how medical history or lifestyle choices impact the quote. This transparency helps customers trust the process, reduces their likelihood of feeling confused or cheated. It also allows insurance providers to stand out from competitors who offer vague or overly complex pricing. AI doesn’t just crunch numbers—it explains them in a way that’s easy to understand. With clear visual summaries and explanations, people can make better decisions and choose plans that fit their needs and budget. In short, AI makes pricing less mysterious. It puts the customer in control and builds a stronger relationship with the insurer. Transparency is becoming a key selling point, and AI-driven quoting software effectively delivers it.9. Easy Integration with Digital Platforms

AI-enabled quoting systems are built to integrate with websites, mobile apps, and other digital platforms. This makes it easy for customers to get quotes wherever they are. Modern quoting software works smoothly with CRMs, agency portals, and online marketing tools.

In other words, when someone visits a health insurance provider’s website, quoting software can offer a personalized quote right on the homepage. There is no need to visit a branch or call an agent. The software can also connect with chatbots, allowing customers to ask questions and get answers instantly.

Having a quoting system that works across platforms ensures a consistent user experience. Whether the customer is on a phone, tablet, or computer, they receive the same smooth interaction.

In today’s digital world, convenience is key. AI and data analytics make it easier for insurance quoting to fit into the daily lives of both customers and agents, wherever and whenever it’s needed.

10. Continuous Learning and System Updates

AI-powered quoting systems don’t stay the same—they improve over time. Every time someone requests a quote, the system learns from that interaction. Quoting software, powered by AI, collects feedback, analyzes user behavior, and updates its models to improve with each use.

This continuous learning means that insurance quoting system becomes more accurate and efficient the more it’s used. It adapts to market trends, new regulations, and customer preferences. For example, health insurance quoting software may notice a rise in demand for mental health coverage and start offering plans highlighting those benefits.

AI also helps insurers test new pricing strategies or coverage bundles. Based on real-time results, they can adjust offerings to better meet demand. Manual systems could never achieve this constant evolution.

The result is a quoting platform that stays up-to-date, competitive, and customer-focused. Companies that use AI tools have a significant edge because their software doesn’t just work—it learns and grows.

Continuous learning ensures that insurance quoting stays relevant in a fast-changing world. It’s not just about keeping up—it’s about staying ahead.

The Role of Gen AI in Transforming Insurance Quoting Across Sectors

Generative AI (GenAI), an advanced subset of AI, makes insurance quoting faster, more innovative, and more personalized across health, life, and auto insurance. It improves the customer experience and supports better risk management for insurers. Here’s how Generative AI enhances insurance quoting across different insurance types:

- Health Insurance: Gen AI powers health insurance quoting software by analyzing medical histories, lifestyle choices, and wearable data. This leads to highly personalized and accurate health insurance quotes.

- Life Insurance: Life insurance quoting software uses Gen AI to assess family history, health patterns, and financial background. It creates customized quotes that better reflect an individual’s long-term risk.

- Auto Insurance: Auto insurance quoting software applies Gen AI to driving records, vehicle data, and real-time traffic trends. It delivers fast, precise auto insurance quotes that adjust if circumstances change.

- Insurance Brokers: Insurance broker quoting software uses Gen AI to manage quotes across multiple insurance types. It helps brokers offer faster, more accurate options without switching platforms.

Conclusion

Insurance quoting is no longer the slow, confusing process it once was. Thanks to AI and advanced data analytics, today’s insurance quoting system is faster, wiser, and more customer-friendly. Whether health, life, or auto insurance, AI-driven quoting tools provide personalized, accurate results in seconds.

For insurers and brokers, modern quoting software means better efficiency, fewer errors, and happier clients. For customers, it means transparent, fair, and tailored quotes that truly match their needs. As technology evolves, embracing AI-powered quoting solutions isn’t just an advantage—it’s the insurance industry’s future.