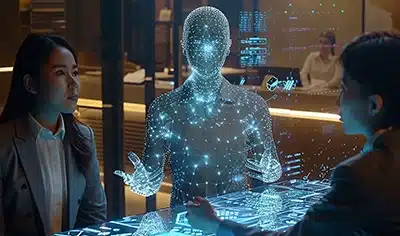

InsurTech is not merely a buzzword or an upcoming trend; it represents a paradigm shift in the way insurance operates. Unlike traditional insurance, which is considerably limited in its scope, InsureTech harnesses the power of technology to become virtually unlimited. It unlocks new business models, channels, and processes to deliver higher degrees of efficiency, personalization, real-time accessibility, data security and privacy, compliance, sustainability, continuity, and resilience.

However, the tech-driven nature of InsurTech presents unique challenges. For starters, the industry demands not only highly proficient tech specialists but also those who understand the nuanced requirements of the insurance sector. Such hybridization of skill and talent becomes crucial throughout the development of cutting-edge solutions in the InsurTech domain – from the requirement-gathering stage to project management to compliance testing.

In this blog, we dive into the world of InsurTech to explore how the blend of technology and talent plays a pivotal role in the transformation of the insurance industry. We also explore how InsurTech firms can navigate talent gaps and outsource reliable partners to keep business running and thriving smoothly!

Understanding the Talent Gap in InsurTech

The innovations at the intersection of insurance and technology have paved the way for rapid digital transformation. From Artificial Intelligence and Blockchain to Big Data Analytics and Chatbots, InsurTech has overhauled traditional processes. As a result, the demand for a skilled workforce with expertise in these emerging technologies is growing rapidly, thereby creating a talent gap in the industry.

Unfortunately, the evolving needs of the industry are far ahead of the resources and capabilities of the educational and professional sectors, which leads to a severe shortage of talent and specialists. Such a skill gap has far-reaching effects that inhibit InsurTech firms from innovating and developing new solutions, especially when they need to be executed in a time-bound manner. Losing out on this front can impede development, thereby adversely affecting the business’ competitive advantage while rolling out proprietary technology or platform. To prevent such a fiasco, companies must explore alternative solutions that grant access to expertise with minimum friction and roadblocks.

Unlock New Possibilities Through Digital Transformation

Outsourcing as a Strategic Solution

Historically, insurance process outsourcing was limited to administrative processes. However, it has now emerged as a strategic way to shorten the skill gap. Hiring a third party for performing specific services or job functions unlocks a range of benefits and can effectively address talent gaps in the insurance industry. The key insurance outsourcing benefits are:

1. Access to Global, Specialized Talent

Outsourcing allows companies to tap into global talent pools as the experts are no longer limited by their geographic location. Moreover, businesses get to cherry-pick individuals with the right skill set and capabilities depending on their immediate requirements. InsurTech firms can get experts from any field, be it Data Science, UX design, Machine Learning, you name it.

2. Cost Efficiency

It is often more time and cost-extensive to hire, train and retain specialized in-house teams. Small and medium-sized insurance companies with limited budgets may find it hard to maintain a skilled in-house team. Insurance outsourcing emerges as a cost-effective solution wherein insurers only have to pay for the skills they require on a project basis, thereby minimizing overhead expenses.

3. Faster Time-to-Market

With seasoned veterans on the team, building a solution from scratch or configuring a pre-existing one is a piece of cake. They can offer companies value from day one and require minimal training. Such a headstart ensures faster time-to-market and grants businesses a competitive advantage.

4. Flexibility and Scalability

The qualities of scalability and flexibility make outsourced teams easier to handle. Insurers can comfortably add or subtract from their team as per project requirements. At the same time, the terms and period of engagement can be finetuned on the fly to optimize resource availability.

5. Risk Mitigation

Partnering with a trusted and experienced outsourced talent provider cuts down the risk of project failure. These partners take the time to understand business requirements and connect businesses with appropriately experienced talent. As such, insurers can consider underwriting outsourcing and delegate risk assessment to experts.

6. Global Perspective

As mentioned, outsourcing grants companies global exposure through talent. By engaging multinational talent, InsurTech firms obtain second-hand multinational experience. Such diversity adds more insight, detail, and innovation from different regions (and sometimes even industries) to solve problems creatively.

7. Digital Transformation

The emerging insurance outsourcing trends, including digital transformation outsourcing and modern insurance outsourcing solutions, enable insurers to navigate the digital shift and adapt to the latest technologies.

Concluding Thoughts

InsurTech’s potential is vast, but talent shortages threaten to hinder progress. Outsourcing emerges as a strategic solution to bridge the skill gap, offering access to specialized skills, cost-efficiency, and a quicker path to innovation. With a well-defined strategy and effective execution, InsurTech firms can harness the power of outsourcing to overcome talent gaps and achieve their growth objectives in this rapidly evolving industry. As InsurTech continues to redefine insurance, the collaborative approach of outsourcing provides the missing piece of the puzzle, enabling companies to embrace innovation and secure a competitive edge.

Case in Focus

In a leading, Dominica-based insurance company, outdated, disconnected systems, and manual processes hindered operational efficiency, leading to resource wastage and revenue loss. We transformed their outdated systems into an efficient powerhouse. Our solution, InsureEdge, streamlined core processes, eliminated errors and enhanced customer service. To learn more, you can read the detailed case study.