The $5 trillion insurance industry today faces multiple challenges including stricter regulations, increasing cost of capital, mounting competition from nimble technology upstarts, and lower returns generated from invested assets. And, as the convergence of the physical and digital spheres accelerates, insurers also have to contend with rapidly evolving customer expectations around personalized products and services, omni-channel engagement, etc.

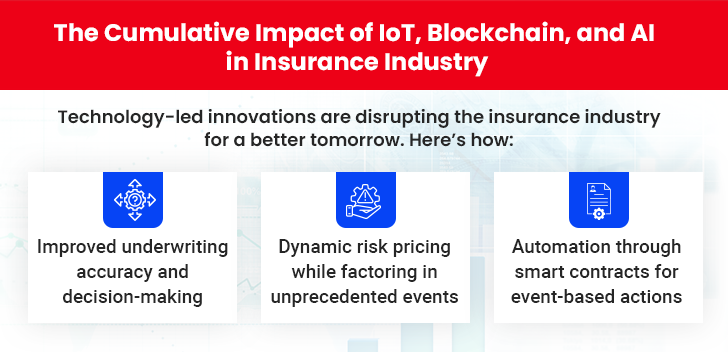

Given these challenges, the industry must aggressively pursue digital transformation to remain relevant and viable in a fast-evolving marketplace. Conventional business and operating models, spanning key functions such as underwriting, claim settlement, and customer service, need to be reimagined. Three disruptive technologies–artificial intelligence (AI), Internet of Things (IoT), and Blockchain–in particular, can help insurers do so.

The Effects of the Convergence of AI, IoT, Blockchain and Insurance

-

1. Cognitive AI Enabling Agile and Scalable Underwriting

Insurers have historically relied on mathematicians to measure risk and formulate premium rates for policy underwriting that would ensure rational levels of payouts without endangering the company’s financials. That is now changing, with different facets of AI–including machine learning, natural language processing (NLP) and text analytics, and audio, image, and video analysis–effectively handling mathematical, logical, or repeatable tasks.

Many leading insurers are harnessing machine learning (ML) algorithms and advanced data analytics to mine huge volumes of information collected from various sources, for improving the precision of risk calculation. ML tools, which swiftly aggregate and analyze massive datasets collected via telematics, IoT, social media, drones, as well as MIB, DMV, and other conventional third-party external systems, are also enabling effective fraud detection and cross-selling.

Meanwhile, text analytics and NLP are empowering insurers to redefine customer engagement by embedding rich self-service functionalities within customer portals and mobile apps. NLP is also driving next-generation customer service, with robotic conversational agents, or chatbots leveraging AI-driven insights to address individual client queries.

The third significant way artificial intelligence in insurance is transforming the industry is through audio, image, and video analysis, wherein insurers can now process and settle claims accurately–and quickly–for increased customer satisfaction. For instance, someone having a car insurance policy can file an instant claim in the event of an accident via their mobile app, by uploading pictures of the mishap. Self-learning algorithms, which have been programmed to curate relevant claims-related data from images, can then accurately gauge the extent of damage, and automate the claims assessment process.

-

2. IoT driving dynamic risk pricing

In a hyperconnected world, the volume of data that can be analyzed to price risks is being generated at an unprecedented pace. As sensor-based smartphones, wearables, and “smart” home devices proliferate, the ever-expanding IoT landscape presents insurers with multiple business opportunities.

By gleaning actionable insights from multidimensional consumer data, payers can build more accurate actuarial models to personalize underwriting. For example, they could use real-time behavioral and contextual customer data–instead of proxy indicators such as credit scores–to develop high-quality, dynamic risk profiles.

Another use case of IoT in insurance can be in creating personalized products and services. Auto insurers could launch tailored products, based on a usage-based insurance (UBI) model, wherein individuals’ driving patterns will influence premium discounts. So, if a policyholder drives recklessly, sensors placed in the car would swiftly detect and transmit the same to the insurer’s IoT platform for a corresponding increase in the premium

Matt Poll, the chief executive of U.K.-based home insurer Neos, says his firm is leveraging IoT to monitor connected devices for major threats to the home such as fire and theft in real-time, and alert customers immediately in case of any incident.

Finally, insurers could leverage IoT to innovate around their business models, by building new services such as vehicle maintenance alerts, vehicle recovery, and emergency roadside aid.

-

3. Blockchain making contracts “smarter”

While AI and IoT are already delivering business outcomes for insurers, Blockchain applications in the industry are at their initial stage. However, the potential of distributed ledger technology to foster end-to-end transparency, accountability, and robust data security is huge.

Industry executives intend to more than double their investments in Blockchain by 2019, according to the recently published SAP Digital Transformation Executive Study. And, major players such as Allianz, Swiss Re, and Aegon have teamed up to roll out the Blockchain Insurance Industry Initiative, B3i, to figure out new use cases.

One tangible application of Blockchain that has emerged is “Smart Contracts”. WorldCover, a U.S.-based payer, has created Blockchain-driven “smart” crop insurance policies for poor farmers in Ghana, Kenya, and Uganda. Under the so-called “parametric” insurance scheme, the system uses third-party sources such as high-resolution satellite images and ground sensors to detect rainfall and plant growth data in real-time. In case of specific conditions like a pre-defined number of days of drought being met, payout to the farmers is triggered automatically without the need for any manual evaluation, paperwork, or decision making. And, to make the payment processing frictionless for the customer, the claim is settled through mobile money transfer services.

Christopher Sheehan, founder and CEO of WorldCover, says his firm has harnessed Machine Learning and Blockchain to foster “very cheap” processing of data and deliver a “really simple” crop insurance product with affordable premiums.

Another significant application of Blockchain in the insurance industry could be in detecting and managing fraudulent claims. Insurers and other stakeholders could use distributed ledgers to swiftly access and update relevant data across claim evidence, third-party review reports and police reports, for robust risk mitigation.

Leverage Smarter Technologies to Transform your Insurance Business Models.

Conclusion

Digital transformation is no longer a choice for insurers. Business imperatives and dynamic customer demands make it critical for them to embrace disruptive technologies such as AI, IoT and blockchain, and use them intelligently across the value chain for superior brand differentiation and profitability. Those who will demonstrate agility and a willingness to unlearn and learn continuously along the digital transformation journey will reap rich dividends. Those who decide to remain cautious and bide their time risk being left behind.