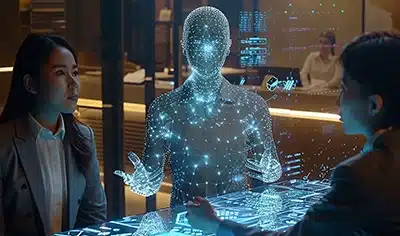

As the insurance industry is on the stage of technological disruption, the path forward requires leaders of the industry to gain timely as well as informed insights in every transaction while improving the customer experience. Since the uncertainty in the atmosphere around cannot be overpowered that easily, there is a need for mobile connectivity solutions for insurers to engage with the users and the intermediaries. Connectivity via mobile by insurance agent apps enables insurers to be efficient, agile and evolve their business paradigms in the dynamic industry ecosystem.

The goal of insurers is to perform with better quality promptly and manage opportunities with the emerging competition in the market. The mobile applications enable insurers to streamline their internal business processes with an automated technological push that mine insights and enable collaboration in real-time.

The insurance agent mobile app can configure easy mechanisms to better various processes in Insurance transactions. Here’s how!

1. Speeding up Login and Issuance Process

The insurers strive to be the preferred carrier over the competition to improve their sales and protect themselves from the non-traditional competition. Insurers that serves a large geography, might not have an accessible office for prospects, agents, and other intermediaries. Here comes the role of the insurance agent, as even the insurance agent cannot possibly engage in to-and-fro if he targets timely results. The insurance agent application provides a mechanism to fast-track the insurance login and issuance process of the customers with the accessibility of submitting the required customer documents on the mobile app. The mobile app reliably aids process automation, enable greater collaboration and reduce costs for the insurers.

2. Simplifying Claims Processing

The task of the insurer is made easier by the Insurance agent application as the process of claims assessment, processing and settlement is simplified and digitized by making information available on a single platform. This even lessens the time taken by the insurers in claims settlement which further leads to satisfied customers. For example, if the customer is amidst an emergency, he/ she can access the policy on the mobile application platform and can fulfil the requirements of claim processing by an informed approach.

3. Enable Frictionless Customer Experience

The loopholes of customer engagement can be mitigated with better satisfaction of the customer by leveraging Insurance agent apps. The customers can have a better experience by triggering their claims through these apps rather than the other lengthy process of issuing claims with physical barriers. Virtual claim management is extremely effective in critical cases such as where there is an option to upload pictures of the damage done to a property or a car or in the case of health insurance, it can be leveraged for triggering claims for planned hospitalization.

4. Increasing Revenue Opportunities

The management of already existing customers and the prospects to thrive on the available opportunities adequately is well-managed with a mobile app that has the feasibility of all the policies available on a single platform and easy premium payment options. The right schemes to target the right audience via the application can gear better results even with the natural barriers at place.

Conclusion

The insurance industry is at a turning point for its processes to evolve with the digital magic around. Insurance Agent apps are playing a key role in this progress by streamlining major insurance processes within the crucial limits of time and with meeting quality goals in pacing revenue and enhancing brand value.