The P&C insurance is primed for substantial growth. However, the changing customer behavior, digital disruption, regulatory pressures, and competitive marketplace are forcing property and casualty insurers to redefine their current strategy and operating models. They face various growth-related internal and external challenges that keep their executives on their toes. Low-interest rates, keeping up with technological advancements, and the expectations to deliver profitable and sustainable growth amidst this change are some of the problems facing the insurance industry.

Table of Contents

What Are the Key Trends Transforming the P&C Insurance Landscape?

What Are the Key Challenges Faced by the Property and Casualty Insurance Industry?

How Property and Casualty Insurance Software Can Resolve the Challenges?

What Are the Key Trends Transforming the P&C Insurance Landscape?

The P&C insurance industry is undergoing a seismic shift driven by technological innovation, changing risk profiles, and evolving customer expectations. Understanding these trends is essential for insurers looking to remain competitive and relevant in the modern marketplace. Below, we explore the most significant trends reshaping the industry and their implications for carriers, agents, and policyholders alike.

1. Insurtech Disruption and Strategic Partnerships

The rise of insurtech startups has fundamentally altered the competitive dynamics of the P&C insurance market. These digitally-native companies use cutting-edge technologies to offer streamlined experiences, faster underwriting, and more personalized products.

Rather than viewing insurtechs as pure competitors, growth-focused traditional insurers are partnering with these innovative firms to accelerate their own digital transformation journeys.

Key developments include:

- Digital-first distribution models that eliminate traditional friction points

- API-driven ecosystems enabling seamless integration with third-party platforms

- Collaborative innovation labs where incumbents and startups co-develop solutions

- Acquisition strategies as established carriers buy promising insurtech companies

Established insurance companies aren’t confronting the fact that they need to become technology companies.”– Leon Gauhman, Chief Product and Strategy Officer, Elsewhen

2. Usage-Based Insurance (UBI) and Telematics Revolution

The proliferation of connected devices and IoT sensors has given birth to usage-based insurance models that price policies based on actual behavior and risk exposure rather than generalized demographic factors. Telematics in auto insurance, for example, allows carriers to monitor driving patterns in real-time and reward safe drivers with lower premiums.

This trend is expanding beyond auto insurance to include:

- Home insurance monitoring systems that detect water leaks, fire hazards, and security breaches

- Commercial insurance applications for tracking fleet management and workplace safety

- Pay-as-you-go models that align premium costs with actual usage patterns

- Gamification strategies that encourage policyholders to improve their risk profiles

3. Climate Change and Catastrophic Event Management

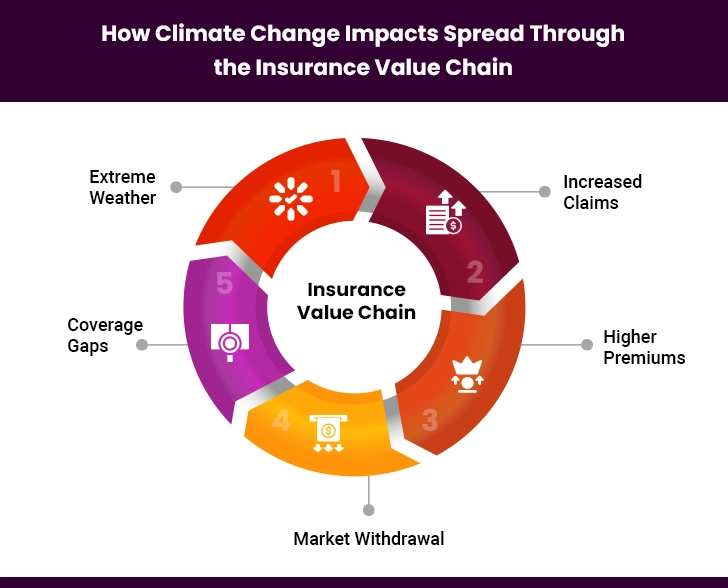

Climate volatility has emerged as one of the most pressing challenges for P&C insurers. The increasing frequency and severity of natural disasters, such as hurricanes, wildfires, floods, and severe storms, are straining loss ratios and forcing carriers to reassess their exposure in high-risk geographies. Insurers must balance accessibility and affordability with actuarial soundness in an era of unprecedented climate uncertainty.

Strategic responses include:

- Advanced catastrophe modeling using AI and machine learning

- Parametric insurance products that trigger automatic payouts based on predefined conditions

- Risk mitigation partnerships with communities and governments

- Portfolio diversification strategies to spread geographic concentration risk

4. ESG Integration and Sustainable Insurance Practices

Environmental, Social, and Governance (ESG) considerations have moved from peripheral concerns to core business imperatives. Investors, regulators, and customers increasingly expect P&C insurers to demonstrate commitment to sustainability, social responsibility, and ethical governance. This trend is influencing everything from investment portfolios to underwriting criteria.

ESG manifestations in P&C insurance include:

- Green insurance products that incentivize sustainable behaviors and renewable energy adoption

- Divesting from high-carbon industries and fossil fuel projects

- Diversity and inclusion initiatives in workforce composition and leadership

- Transparent reporting on climate risk exposure and mitigation strategies

5. Embedded Insurance and Distribution Innovation

Embedded insurance, which is the integration of insurance products directly into the purchase journey of other goods and services, is gaining significant traction. Rather than buying insurance as a standalone product, customers can now secure coverage seamlessly at the point of sale when purchasing a car, booking travel, or renting property.

This trend creates new opportunities:

- Partnership ecosystems with e-commerce platforms, automotive dealers, and real estate agencies

- Micro-insurance products tailored to specific moments or transactions

- Simplified purchasing experiences that reduce abandonment rates

- Access to previously underserved customer segments

6. Blockchain Technology and Smart Contracts

Blockchain’s distributed ledger technology offers promising applications for P&C insurance, particularly in claims processing, fraud prevention, and contract execution. Smart contracts, which are self-executing agreements with terms written directly into code, can automate policy administration and claims settlement, reducing administrative overhead and improving transparency.

Emerging blockchain use cases are as follows:

- Instantaneous claims verification and payment processing

- Immutable record-keeping that prevents fraud and disputes

- Reinsurance contract management and settlement

- Identity verification and Know Your Customer (KYC) compliance

7. Cybersecurity Insurance Growth

As businesses become increasingly digital, cyber risk has evolved into one of the fastest-growing segments of P&C insurance. Ransomware attacks, data breaches, and business interruption from cyber incidents have created unprecedented demand for cyber insurance coverage. However, the evolving threat landscape and difficulty in pricing cyber risk present unique challenges for underwriters.

Market dynamics include:

- Rapid premium growth as coverage becomes essential for businesses of all sizes

- Stringent underwriting requirements demanding robust cybersecurity controls

- Capacity constraints as insurers limit exposure to systemic cyber events

- Regulatory pressure for standardized coverage definitions and reporting

In short, the P&C insurance industry trends mainly focus on three key areas: customer experience, organizational operations, and digital transformation. And, there’s no doubt that the P&C insurance industry is all set to benefit the most from these trends. However, there’s a downside to this: intensifying the already existing challenges, which are discussed in the next section.

What Are the Key Challenges Faced by the Property and Casualty Insurance Industry?

While emerging trends present opportunities, they also compound the challenges facing P&C insurers. The industry must simultaneously manage legacy constraints while adapting to rapidly evolving market conditions. Let’s explore the key P&C insurance industry challenges and how P&C insurance software can help insurers overcome them.

I. Increased Competition

Over the past few years, the P&C carriers’ capacity to insure has steadily grown. This supply-led market will be one of the key P&C insurance trends that will intensify further with time. As the insurance industry continues to add capacity, this can be attributed to new players that offer their services online. These changing dynamics have intensified the price-based competition, driven market expansion into new geographies, and motivated insurers to develop new products.

P&C insurance businesses, both established and emerging, are actively navigating this landscape to secure their positions among the top P&C insurance companies. The need for strategic agility and advanced technological solutions is more crucial than ever in navigating this fiercely competitive landscape.

II. Technology Advancements

Augmented reality, networked devices, and other emerging digital technologies have shown new avenues that can create new revenue opportunities for insurance carriers. It is advantageous for managing industry operations. But the slow pace of transformation is making it one of the most grievous insurance industry problems. Technology advancements are responsible for rapid changes in customers’ behavior and expectations.

However, the insurance industry is struggling to keep up with this technological evolution. Investment in digital platforms and solutions has become essential to enhance operational efficiency and reduce risk exposures.

III. Outdated Technology Infrastructure

Outdated P&C insurance technology infrastructure (legacy policy and underwriting systems) is obstructing the insurer’s growth and ability to regulate operational costs, business demands, and customer requirements. At the same time, it is weighing down the overall efficiency of organizations by eating into the profit margins since the maintenance and upkeep of outdated and obsolete technologies and processes far outweigh their value.

With advanced analytics, robotic process automation, and other emerging applications, insurers today have the possibility to streamline core operational processes such as sales and P&C underwriting. Moreover, it lends a certain degree of resilience and scalability to insurance businesses, allowing them to respond to overnight changes with minimum downtime.

Overcome Common P&C Industry Challenges and Stay Ahead of the Curve

IV. Rising Costs of Operations

Another issue that tops the list of insurance industry problems is the rising cost of operations. With outdated software, one has to dedicate more resources to do the job, which could be done quickly and efficiently by a comprehensive modern system. There are many statutory reports and mandatory audit reports that are to be shared with government agencies and regulatory bodies.

Companies spend a lot of human resources and time to get these reports prepared and reviewed, but with an electronic system, these reports can be quickly generated, reviewed, and even shared.

V. Customer Engagements

The digital disruption has put the spotlight back on the customer. Customer engagement demands ongoing customer focus, operational efficiency, process and people’s excellence, product-service innovation, agility, and organizational alignment.

With the changing digital landscape, P&C companies need to reassess their business model with a greater focus on customers and a customized value proposition. Implementing advanced CRM solutions and leveraging data analytics for personalized offerings can further enhance the insurer’s ability to connect with customers in a rapidly evolving market.

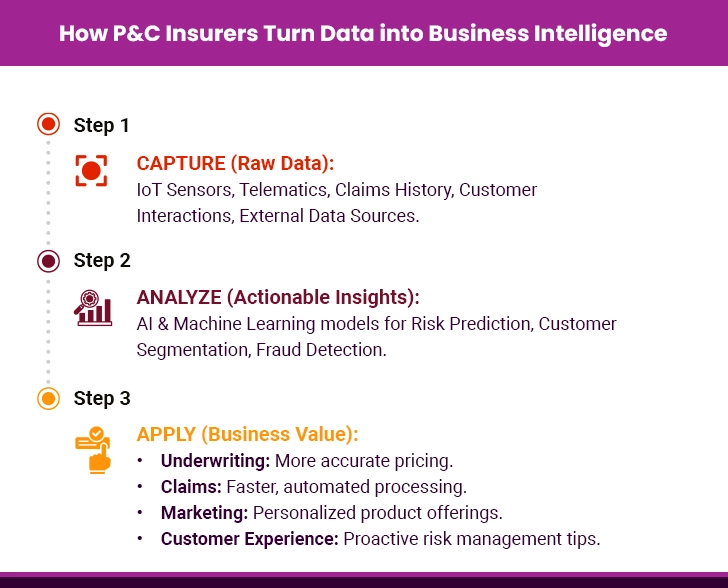

VII. Business Intelligence

Customers don’t just expect businesses to cater to their demands; they wish for it to be done intelligently. As a result, businesses have to work with high volumes of data to extract meaning and value from it – aka actionable and strategic business intelligence. A new era of business intelligence is upon us, which focuses on leveraging data to make informed decisions and gain a competitive advantage through customer-centricity.

While data is an asset, it needs to be managed appropriately, which cannot be done using outdated methods or technologies. Data captured from various digital sources helps carriers mitigate loss, improve P&C underwriting and claims management, manage pricing, personalize products, and enrich the customer experience.

How Property and Casualty Insurance Software Can Resolve the Challenges?

Property and Casualty insurers need to be more prudent and precise in addressing the above problems in the insurance industry. Damco’s proprietary solution, InsureEdge, is a leading product aimed at solving some of the most pressing problems that insurers face – increased competition, consumerization, shifting consumer behavior, increasing use of electronic channels, major catastrophic events, and regulatory changes.

InsureEdge is an integrated, scalable P&C insurance software solution that can be deployed on-premise or in the cloud, enabling easy implementation. As execution is the key element for delivering success, insurers should first restructure their execution engines based on the business models, resources, and internal parameters, before making heavy technological investments. InsureEdge is a Microsoft-based policy administration software with the industry’s most comprehensive insurance processing functions that bring an end to all insurance industry problems.

In Summary

The P&C insurance sector faces its fair share of challenges, such as growing competition, the ever-increasing cost of operations, dwindling customer engagement, a lack of business intelligence, etc. However, a significant chunk of these can be overcome with technological intervention. Insurers who have the right set of tools, platforms, and technologies will coast toward sustainable growth without worrying too much about the obstacles that come their way.

In the highly competitive landscape, being among the largest P&C insurance companies calls for strategic adoption of tools such as P&C insurance systems. Top P&C insurance companies are those that navigate these challenges adeptly, leveraging technology to propel themselves to the forefront of innovation and trends.

Case in Focus

A multinational, multi-line insurer observed various issues in its P&C segment. Whether it was the management of the outdated technological infrastructure or the unstructured data stemming from multiple disparate systems, such challenges were acting as impediments to the insurance business’s growth. Upon consulting Damco, the insurer gained insight into the underlying problems plaguing the business model. The experts at Damco reinvented the entire tech stack and modernized it to match the latest insurance trends. You can read about this case study in detail on our website.