The insurance broker industry has become dynamic due to advancements in technology and evolving customer expectations. Offering just the right policies isn’t enough to remain at the top of the competition; instead, it also requires operational excellence. As brokers juggle complex client needs, regulatory demands, and market shifts, having the right tools becomes indispensable.

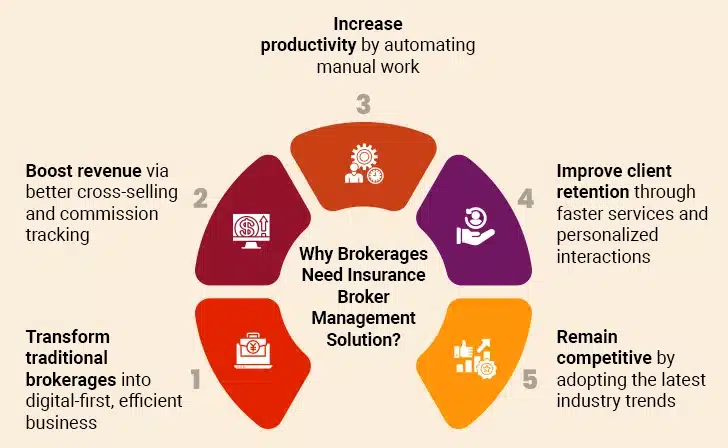

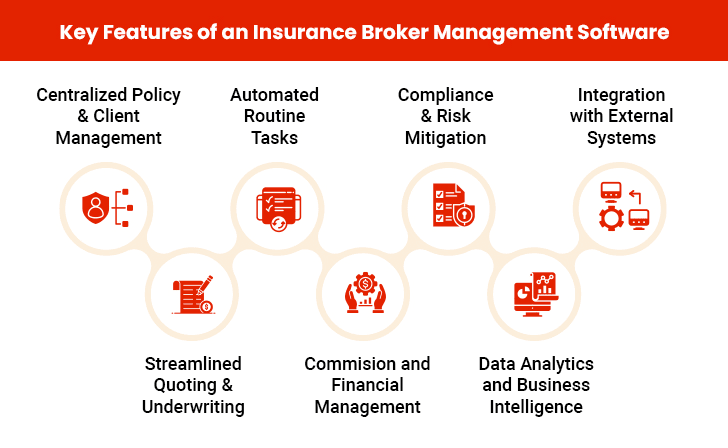

An insurance broker management platform is a valuable tool for individual insurance brokers and intermediaries. It helps improve productivity and efficiency in their daily operations while lowering costs and improving customer experience. An ideal broker operation management software comprises many features and modules to streamline broker operations, foster cohesiveness across stakeholders, increase efficiency, and improve policyholder experience.

According to the latest reports, the global insurance brokers’ tools market size is projected to reach USD 552.86 billion by 2032, growing at a CAGR of about 9.2%. As the figures state, the insurance broking software solutions are an asset to the cross-functional insurance value chain. Moreover, it makes the business framework resilient and future-proof to sustain long-term profitability and seamless collaboration.

Table of Contents

How to Choose the Right Insurance Broker Management Platform?

How to Ensure Seamless Implementation of Broker Management Solution?

However, to gain such tangible benefits, insurance brokers must identify the right broker management system for the task. Further, they must follow the right implementation practices to maximize time-to-value. On that note, here is a detailed guide on how to select and implement insurance brokerage management software for maximum value. The first half of this guide talks about choosing the right broking software system, while the latter deals with its implementation.

How to Choose the Right Insurance Broker Management Platform?

There are several broker software solutions available in the insurance technology marketplace; each trying to outdo the other. If making a choice between them sounds overwhelming, here’s how to choose the right insurance brokerage management software:

Identify Key Requirements

Understanding key business requirements and goals serves as an excellent starting point in the journey of selecting the right insurance broker management solution. Take into account factors like the size of the brokerage firm, number of users, level of authorization, regulatory compliance requirements, and more. Also, consider additional features like commission tracking, integration with third-party solutions, reporting and analytics, etc. Do not forget to analyze the potential for AI-powered tools to simplify complex operations. Sort these into “must-have” and “nice-to-have” lists to assign priorities. Most importantly, set aside a practical budget that you want to dedicate to such a solution.

Conduct Market Research

Now that you have a basic skeleton of the kind of insurance broker management software you need, commence detailed market research. Look for well-established broker management systems from reliable and reputable firms. Read about them on forums, branded blogs, user reviews, etc., to get second-hand exposure to the customer experience. You might even want to tap into your professional networks and seek recommendations from peers.

Compare System Features

By this point, you might have a list of compulsory and desirable features of your ideal broker management software. At the same time, you would have a list of the features and specifications of the shortlisted options available in the market. Compare the two to identify the best fit to narrow down the list even more. You may also compare unmeasurable qualities, such as customization capabilities, scalability, and ease of use.

Check the Scope for Integrations

The broker management system needs to run in tandem with other insurance technology tools, solutions, and platforms, like an insurance CRM system, claims processing platform, accounting software, and more. As such, you should test the API-led integration capabilities of the available options so that the chosen brokerage software works harmoniously with the entire digital ecosystem.

Consider Data Security and Privacy

Insurance broking software solutions handle confidential and identifiable customer data as well as sensitive financial information. Therefore, these should be backed by a robust data security and privacy framework. Features like access control, periodic data backup, end-to-end encryption, etc., are a testament to the insurance brokerage management system’s ability to withstand malicious attacks and security lapses. It also ensures that the setup is compliant with the legal and regulatory norms as per the defined industry standards.

Request Product Demos and Trials

Product demos and trials offer a real-world feel of what to expect when you commit to the insurance broker management systems. It also validates your decision and offers a first-hand account of the usability of the solution for your specific needs. Furthermore, it serves as a window to experience customer support and technical assistance during product usage.

Negotiate Terms

By this point, your list of options may have been whittled down to a selected few options. Take this opportunity to negotiate terms with the vendor. Whether it is a one-time payment model or subscription-based, vendors often throw in additional features or SLAs that offer you more value for your money.

After careful consideration, you have the ideal broker management system that aligns with your budget, requirements, and organizational goals. However, choosing merely the right brokerage software doesn’t help. It must be implemented successfully to streamline operations and realize the benefits. That said, let’s explore the implementation roadmap.

Simplify Your Broker Operations. Drive More Profits and Improve Customer Experience Now!

How to Ensure Seamless Implementation of Broker Management Solution?

Now that we’ve gone over the selection part, let’s get down to the implementation of the insurance broking software solution of choice. That’s because if the implementation is not right, then the investment will turn into a resource drain. And we’re pretty sure that no insurance company can bear such losses. So, here’s how to go about it:

1. Set Aside a Dedicated Implementation Team

Moving to a broker management system involves a procedural overhaul that might affect the entire organization. As a result, building a dedicated team to handle the implementation process is a great way to centralize such operations. Make sure to put together a cross-functional team that includes representatives from all key stakeholders, including sales, marketing, operations, compliance, and IT, to cover all fronts at once. Appoint a project manager to lead this team. You may also outsource the technology implementation project to leading technology service providers to save cost, time, and risk.

2. Audit the Existing Business Process Flows

While implementing insurance broker software solutions will trigger a wave of change, it is impossible to carry it out in one swift motion. As such, the implementation would have to be introduced incrementally, depending on business goals and organizational priorities. To facilitate this, you should take stock of your existing processes, workflows, and data structures to identify issues and the gravity of these problems. Doing so allows you to proceed with implementation in a structured and organized format.

3. Create an Implementation Roadmap

Now that you have an idea of the expected changes, record them on an implementation roadmap. This document contains the various activities, steps, timelines, milestones, and stakeholders as the broker management solution implementation plan progresses.

4. Develop a Change Management Plan

While the implementation roadmap is a great way to plan and envision successful implementation, things may go awry at any stage. The timelines may lag, or you may observe cost overheads. For this reason, it should be complemented with a practical and scalable change management plan. Think of it as your plan B that manages planned and unplanned changes to the implementation strategies.

5. Configure and Set-Up the System

By this point, you would have laid the foundation for the successful implementation of your insurance broker management system. Now is the time when you work closely with your vendor to configure, customize, and set up the system. You should test the system for integration, different scenarios, and features to ensure that it aligns with your business objectives before rollout.

6. Train and Onboard Employees

Once you are familiar with the functioning of the insurance broking software, it is time to impart the same knowledge to the actual end-users and your employees. Conduct thorough training sessions and workshops to increase the adoption rate amongst your staff. You may want to set up evergreen knowledge bases that offer sustained support.

“Digital transformation is not a project — it’s a company philosophy.”

– Katherine Kostereva, CEO, Creatio

7. Track, Measure, and Pivot

While implementation is a one-time exercise, it is always a good practice to track and measure the impact and usability of the insurance broking software systems to identify any bottlenecks or areas of improvement. Re-engineer workflows for greater efficiency or discard redundant processes. Either way, it will set you on the path to continuous improvement.

In a nutshell, setting up a dedicated implementation team, assessing existing processes, and creating an implementation roadmap with realistic goals and timelines will help reap assured profits. Another important phase is to have a change management strategy ready at hand to help users adopt the new business model easily. And the insurance companies following these steps will surely succeed.

Closing Thoughts

An insurance broker management software is a must-have tool for agencies to streamline their brokerage operations. It helps boost efficiency and productivity so that brokers and agencies can remain competitive. However, all these benefits can be reaped only when they choose the right software.

At the same time, choosing and implementing a broker management system is a complex process, and the payoff is very much worth the effort. With the right insurance brokerage software and an equally competent implementation program, businesses optimize processes, automate critical workflows, improve insurer-customer relationships, and gain meaningful insights. In short, it is a powerful driver for growth and success in the hyper-competitive world of insurance brokerage.

Case in Focus

A multi-line insurer struggled with legacy systems and obsolete processes. The organization made the decision to transition to cloud-based insurance broker software to address these issues. Soon enough, this move resulted in improved business agility and scalability that made the operations more profitable. Read the detailed case study on our website.