Imagine this scenario: a broker logs into a platform and sees everything they need, including client portfolios, policy renewals, pending tasks, and live updates from insurance carriers. There are no scattered spreadsheets or back-and-forth emails. Task reminders are automated. Client information is organized. Carrier quotes are just a click away. Everything works in sync whether the broker is in the office or on the move. Sounds like a dream? This is a reality!

Instead of spending hours on manual processes, brokers can focus on building relationships and closing deals. What’s more? Data accuracy improves, compliance risks drop, and productivity rises. All thanks to the insurance broker management system that makes all this possible.

Let’s build up the case by exploring the challenges of using traditional brokerage systems that prevent insurers from streamlining processes and remaining competitive. Other than the challenges, this blog also highlights the seven powerful ways an insurance broker management solution helps. It also provides a checklist for selecting the right broker management solution. Here we go!

Table of Contents

What Are the Challenges of Traditional Brokerage Systems?

Right from collecting client information and preparing quotes to managing renewals and handling claims, traditional brokerage workflows are largely manual. These require repeated data entry and document handling, which slows down operations and increases the chances of errors. Moreover, such time lags often frustrate clients and diminish broker productivity.

The pain doesn’t end here for insurance brokers. In addition to being time-intensive, traditional insurance brokerage processes pose various other challenges, some of which are listed below:

I. Limited Scalability

One of the greatest drawbacks of most legacy systems is that these are not designed to support insurance business growth. As brokers onboard more clients or expand into new markets, managing the increased workload on outdated tools becomes a tricky job. Without automation or integration capabilities, scaling operations efficiently is next to impossible. This leads to delayed service delivery and missed growth opportunities. We’re sure no insurance business can afford this roadblock.

II. Poor Client Experience

Traditional systems lack the ability to offer real-time updates, self-service portals, or multichannel support. Besides, these features are the baseline expectations for clients today. The absence of these features results in longer wait times, delayed responses, and poor visibility into policy or claims status. Ultimately, brokers risk losing clients to more tech-enabled competitors who can deliver faster, more transparent services.

III. Data Silos and Inconsistent Records

In older systems, client data often lives in separate spreadsheets, email threads, and disparate databases. This fragmentation makes it hard to maintain consistent records and gain a complete view of client interactions. What’s even worse is that insurance brokers struggle to provide personalized recommendations or predict what a client wants without unified data.

IV. Limited Reporting and Analytics

Traditional systems offer minimal to no reporting capabilities. Connecting the dots further, brokers often find it difficult to track policy renewals, monitor sales performance, and analyze customer behavior when there are no dashboards and reports. Above all, this lack of insights hinders decision-making and weakens competitive positioning in a data-first insurance landscape.

V. Compliance and Risk Exposure

Insurance regulations evolve regularly, and manual processes often fail to keep up. Traditional systems usually don’t offer built-in compliance checks, audit trails, and data encryption. The result? Increased risk of regulatory non-compliance and potential fines. They also make it harder to securely manage client data, especially with rising concerns around data privacy and cybersecurity.

VI. High Operational Costs

Traditional insurance brokerage processes rely on paperwork and human intervention. This automatically translates to higher operational costs. Or, let’s put it this way that resources are drained in such repetitive admin tasks, which could otherwise be easily automated. And in the longer run, this inefficiency becomes a financial burden that affects the broker’s bottom line. So, the next time you think of saving costs, think of automating repetitive insurance broker tasks!

VII. Lack of Integration with Insurer Systems

Traditional platforms generally don’t integrate with insurer portals and third-party services, such as payment gateways, CRMs, and document management tools. This lack of connectivity results in double work wherein brokers have to manually enter the same information across systems. And as a ripple effect, this also delays policy issuance, updates, and claims management.

VIII. Inadequate Disaster Recovery and Backups

Traditional setups often rely on local servers and physical records. This makes them vulnerable to data loss due to hardware failures, cyberattacks, and natural disasters. In the absence of automated backups and cloud-based continuity plans, brokers risk losing business information and facing longer than usual downtimes.

As the insurance sector becomes more dynamic, brokers play an even more pivotal role in ensuring last-mile delivery. And one thing is for sure, the traditional processes no longer prove helpful. Such growing importance compels insurance brokers to harness the latest and best tools and technologies to maintain effectiveness and efficiency in their day-to-day activities.

That’s where insurance broker systems come to the rescue. These are a part of such a solution set that can streamline and improve business operations. Modern-day cloud-based insurance broker software allows brokers to handle day-to-day tasks with ease. The fact that the global insurance broker tools market size is expected to reach USD 552.86 billion by 2032, growing at a CAGR of about 9.2% itself highlights the dire need of such solutions.

“Established insurance companies aren’t confronting the fact that they need to become technology companies.”– Leon Gauhman, Chief Product and Strategy Officer, Elsewhen

What Is the Role of Management Solutions Designed for Modern Insurance Brokers?

To overcome the challenges of traditional processes, it is necessary for businesses to adopt modern insurance broker solutions. Having all the advanced capabilities, these platforms help brokers to streamline their processes and reap a plethora of other benefits as listed here:

1. Automated Workflow and Task Management

Insurance brokers usually end up concentrating on administrative activities when they should be ideally spending more time on customer-facing activities. That said, it’s imperative for them to have a solution which can efficiently perform these activities. This is where the right broker management solution helps. Workflow automation and task management are two leading benefits of using a broker management system.

Insurance brokerage management systems can increase efficiency by streamlining and automating repetitive tasks, like client onboarding, claims processing, policy renewals, and commission calculations. Such automated workflows allow brokers to save up on valuable time while reducing the risk of human or clerical errors. Similarly, users can define tasks, their respective workflows, and any other dependencies or conditions. This ensures that no task falls through the cracks and that everything goes as per schedule.

2. Centralize Policy and Policyholder Data

Insurance is a data-heavy industry with multiple touchpoints. As such, it has data trickling in and out of multiple systems. Against this backdrop, handling customer and policy data across multiple, disparate sources often becomes cumbersome, resource-intensive, and error-prone. Fortunately, a well-chosen and implemented broker management solution cuts through organizational siloes by establishing a centralized repository for all the policy and policyholder data.

Brokers can even configure it to automate the storage, organization, and accessibility of such critical information. It can also authenticate and validate data, eliminate duplication, and resolve data conflicts to enhance data quality, which in turn improves processes and their outcomes.

3. Enable Cross-Functional Collaboration

Collaboration with stakeholders, including carriers and customers, is the backbone of successful broker operations. A broker management solution can sustain seamless and cross-functional collaboration by resting it on the bedrock of communication. Most broker management software solutions come equipped with a variety of synchronous and asynchronous forms of communication, which allows all-time availability.

The platforms make it easy for brokers to communicate with clients as they can settle on the channel of their choice. Similarly, it facilitates real-time data sharing as it is possible to share documents securely through broker management systems. In doing so, broker management tools bring brokers, underwriters, and customer support teams on the same page; ultimately empowering them to function like a well-oiled machine.

Unlock Growth and Seamless Operations with BrokerEdge

4. Provide Insights Through Powerful Reporting and Analytics

Insurers have a lot to learn from brokers’ performance data. In other words, brokerage data helps insurers formulate new strategies and discard obsolete and non-performing ones. It also works as an auditable and immutable basis for computing appropriate brokerage. However, a lot of this structured and unstructured data goes unutilized.

Fortunately, broker management systems can demystify performance, minimize guesswork, and recommend strategies to get everything on track. As such, the reporting and analytics module of a broker management solution plays a pivotal role in shaping the present and the future of business operations. Thus, insurers can use it to generate customizable reports on commissions, policy performance, sales, and any other metrics or KPIs of importance. Broker management software not only generates such data but also processes it to identify trends, analyze profitability, estimate revenue, track profitability, and boost productivity.

5. Ensure Seamless Connectivity with Insurance Carriers

Brokers require systems, tools, and technologies that are cohesive with that used by insurance carriers. Such universal integration ensures seamless workflows, efficient policy processing, and frictionless data sharing, even if the organizational environment changes. In short, a broker management solution is that piece that fits into the jigsaw of tools, platforms, systems, and technologies.

Besides, the seamless integration with insurance carriers makes it easier for brokers to access carrier portals, generate and retrieve quotes, compare coverage options, and submit policy applications directly. Such a borderless architecture ensures real-time data transfer that minimizes manual data entry, expedites procedural timelines, boosts operational efficiency and employee productivity. It also improves customer service and increases profitability.

6. On-The-Go Availability and Accessibility

Modern-day customers prefer digital interactions and insurance is no exception. Further, in the tech-driven world, enabling remote work and offering mobile accessibility is essential. A mobile insurance broker platform offers a secure access to important information, helping brokers to collaborate online and complete work even when they are on the go. Even when working remotely, brokers can deliver the same level of knowledge and expertise to the customers that they could deliver while working on-site.

7. Assured Legal and Regulatory Compliance

Insurance is a highly-regulated industry. As such, insurance carriers and their subsidiaries are expected to comply with the latest guidelines prescribed for the sector. Ensuring compliance with such norms is a major responsibility when it comes to broker operations. Any lapses can attract fines, penalties, and even a loss of reputation.

Fortunately, broker management software can keep such troubles at bay by automating compliance checks and balances and maintaining an auditable record of data. Such a two-pronged approach cements regulatory compliance with the pervasive guidelines. Even if the rules and regulations were to change any time in the future, broker management solutions can analyze and effect its changes in just a single click. Such convenience comes as a great relief for brokers and insurance carriers alike.

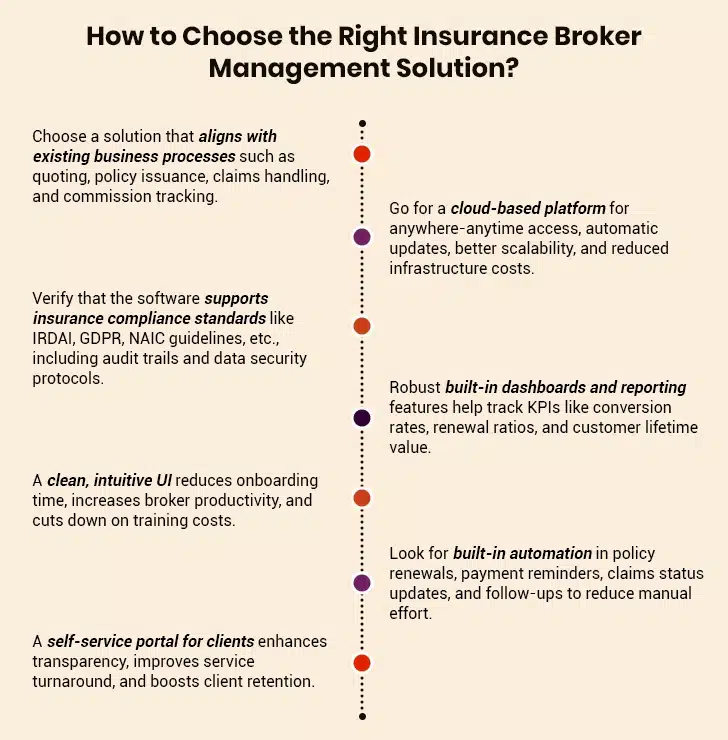

Given these benefits, adopting broker management software becomes obligatory for insurance brokers. At the same time, choosing the right solution is no easy feat, especially when the market is flooded with multiple brokerage management options. What further complicates the process is that each software claims to be the best. In such scenarios, leaders must consider a few factors:

BrokerEdge by Damco as a Purpose-Built Solution for Modern Brokers

While broker management systems offer widespread advantages, not all platforms are created equal. BrokerEdge by Damco is designed specifically to meet the operational needs of insurance brokers. It combines efficiency, compliance, and client-centric capabilities.

| Feature | What is it used for? |

|---|---|

| All-In-One Dashboards | For real-time views of clients and policies |

| Pre-Built Carrier Integrations | To eliminate double data entry |

| Workflow Customization | To align with business Model |

| Mobile Access | For brokers on the move |

| Automated Audit Trails | To ensure compliance |

In a nutshell, BrokerEdge by Damco helps brokers operate more productively, serve clients more responsively, and grow more confidently.

Final Words

In today’s competitive insurance broker market, embracing digital transformation is crucial for staying ahead and driving growth. Upgrading the business models and modernizing legacy systems enables insurers to achieve agility and data-centricity. Digital tools such as insurance broker systems optimize brokerage processes to enhance productivity, profitability, customer retention, and more. All in all, a robust insurance broker platform is an investment you need to unleash business growth.

Case in Focus

A multinational insurance organization used an outdated, in-house system with manual processes. It contributed to delays, lower productivity, and increased costs. We helped the insurance organization migrate its large database to the cloud. The organization was able to leverage a single insurance management platform for all operations and improve efficiency, as this case study explains.