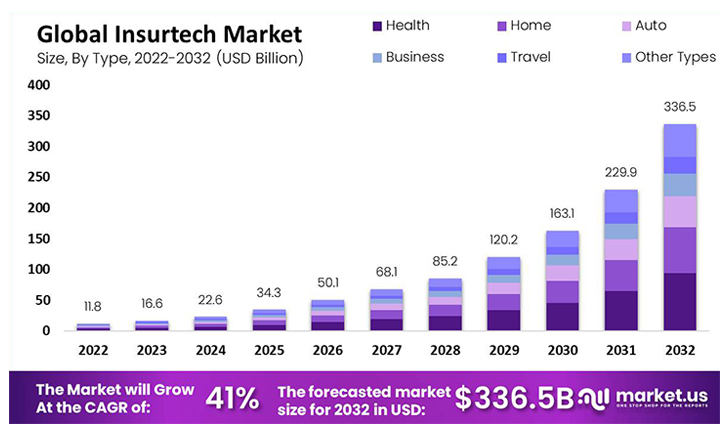

With the proliferation of advanced digital tools in the insurance market, customers seek swift and rapid service from insurers. They want offerings that are smart, and customized to their needs along with a channel-agnostic experience. Middle East insurance market is not immune to these changes. With the challenges posed by rapid digital transformation in the Middle East and as insurers reconsider how to build differentiation, equity, and loyalty, traditional operating models have metamorphosed, thereby driving insurance leaders to re-evaluate their core business. There has been a systematic shift from disconnected technology struggles to innovation and adoption of digital technologies. Figure (1) clearly shows the global increase in usage of insurance technology over the years. Thus, it is evident that insurers are harnessing the power of technology to understand their customers better, improve ROI, and make their enterprise ready for a digital future.

Our research shows that top players in the Middle East like Adnic, Bupa Arabia, Tawuniya, Wafa Assurance, Abu Dhabi National Insurance are innovating across the value chain. They have successfully implemented digital transformation in insurance and made a move towards amplifying their digital strategy by deploying new technologies in the insurance industry such as AI, the Internet of Things (IoT), drones, and Blockchain to generate more value in the market. These new technologies, popularized by insurance digitization, cut across the insurance business value chain, impacting customer engagements, and optimizing activities from policy sign-up to claims processing.

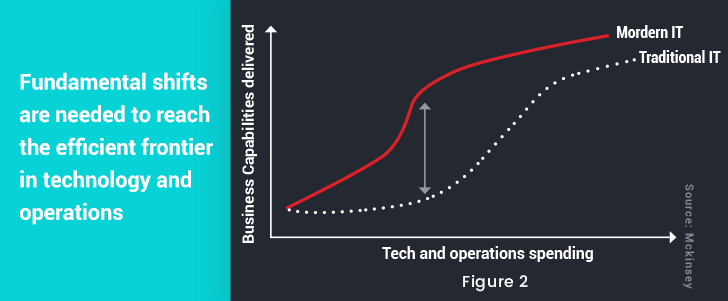

But before maximizing the impact of these initiatives, insurers need to work on reframing their core operations to gear them up for seamless integration and alignment with the new technologies resulting from insurance digitization. The “new normal” of core technology has already started seeing insurers leaping from traditional to modern IT Infrastructure. This digital transformation in the Middle East is driven by a focus on:

- Reimagining the role of technology in collaboration with other business functions

- Reinventing ways in which technology function delivers products and services to internal and end-users

- Future-proofing the quality and scalability of the existing technology systems

Legacy Modernization

The disruptions in the last few years have pushed customers out of their normal, comfortable routines and led to a major shift in customer preferences and behavior. As a result, insurance agencies also had to transform their traditional systems and way of serving the customers. Thanks to digitalization in insurance and the rapid penetration of insurtech, the primitive, deep-rooted models in the insurance industry have changed.

With tailored legacy systems deterring innovation, leading insurance players are seeking industry platforms that are often powered by entrepreneurial Insurtech providers. Digital transformation in insurance helps reduce cost, enhance flexibility, and most importantly, improve customer experience and engagement.

Migrating to Cloud

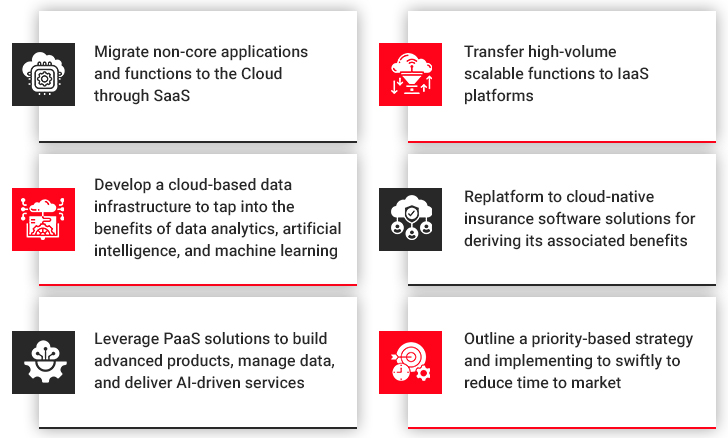

Whether you wish to address customer fraud or broker fraud, predictive analytics in insurance can seamlessly prevent both. The Middle East insurance market, characterized by critical applications and complex workloads, needs a comprehensive business transformation strategy. Cloud migration is one such approach that is considered a shift that goes far beyond technology. While making a move to cloud insurance platforms, insurers need to tailor their transformation strategy, which is driven by their current architecture of mainframe technologies and the extent of its modernization.

Some of the best practices for cloud migration in the Middle East insurance market include:

Investing in Data Analytics and AI

Leveraging new-age technologies such as data analytics and Artificial Intelligence (AI) helps in adapting to disruption in Middle East insurance market. As it is, insurers of today are sitting on a treasure trove of data, be it demographics, client information, claims history, risk profiles, loss runs, etc. By leveraging modern data analytics and AI-powered tools, insurers can unlock the true potential of available data. For one, AI can be used for automating risk assessments, improving fraud detection, and enabling 24/7 customer service through chatbots. On the other hand, data analytics enables better product development, and enables insurers to create targeted offerings that cater to specific customer segments and their varying needs.

Embrace AI-Powered Insurance Software to Drive Growth

Fostering an Innovative Culture

Digital transformation in the Middle East thrives on a culture that embraces new ideas and fosters collaboration. Middle Eastern insurers can achieve this by:

Encouraging experimentationEmpowering the staff to test new concepts and solutions is a great way to inspire them to be more innovative. To achieve this, give them a safe space for calculated risks and learning from failure.

Breaking down silosDepartmental silos not only hamper productivity but also impact innovation. By breaking down the silos and encouraging collaboration across departments, insurers can bring together individuals with diverse perspectives and foster cross-functional teams to drive creativity and innovation. A single source of truth can be obtained by investing in modern insurance software.

InsurTech partnershipsLeveraging the agility and expertise of Insurtech startups will enable insurers to implement cutting-edge technologies and accelerate digital transformation.

All in all, by fostering an environment that celebrates innovation, insurers can stay ahead of the curve.

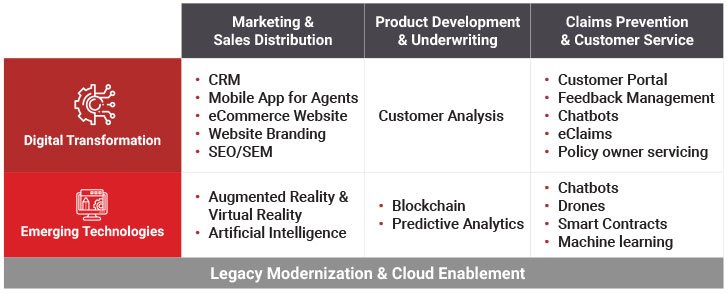

Technology Landscape Across Insurance Value Chain

The Way Forward

The rampant shifts in the industry trends were a wake-up call for insurers to seek technology as a solution to maintain business continuity and sustainable growth in the face of disruption in the Middle East insurance market. This momentum is set to continue going forward. Technology has played a vital role in helping insurers keep up with the rapid digitalization in insurance. Insurance technologies and legacy modernization practices will continue to be an integral production factor in growing markets like the Middle East. The rising Insurtech wave will dominate the market by supplying cutting-edge digital technologies and generating significant improvements in its core system. Stay ahead of the curve by involving leading Insurtech experts, such as Damco, to make insurance digitization seamless and successful.