Table of Contents

What Is Alternative Data in Private Equity? What Are Alternative Data Sources in Private Equity? How Does Data Collection Services Help Improve Investment Decisions? What Are the Challenges and Considerations in Data Collection for Private Equity? What Are the Best Practices to Leverage Alternate Data in PE Firms? Wrapping UpWhat Is Alternative Data in Private Equity?

Alternative data is changing the game in finance. Moving leaps ahead from traditional financial metrics, decision-makers can now utilize information that was previously inaccessible or underutilized in investment decisions. And that’s why the alternative data market has experienced remarkable growth. Previously valued at $11.65 billion in 2024, it is projected to reach $135.72 billion by 2030, growing at a CAGR of 63.4%. One thing is very clear from this explosive growth. It reflects the increasing recognition among investment professionals that traditional data sources alone cannot provide.What Are Alternative Data Sources in Private Equity?

Alternative data includes a wide range of information that goes beyond traditional financial metrics. It provides a more holistic understanding of a company’s operations, market position, and competitive landscape. This data can be derived from various sources, including:- 1. Web-Based Data: Tracking online activities, such as website traffic, social media engagement, and ecommerce transactions provide insights into consumer behavior, brand sentiment, and market trends.

- 2. Satellite Imagery: Analyzing satellite images of industrial facilities, retail locations, and agricultural land reveal changes in production levels, inventory levels, and crop yields.

- 3. Sensor Data: Monitoring sensor data from IoT devices, such as those used in manufacturing plants or transportation networks, provide real-time insights into operational efficiency and supply chain disruptions.

- 4. Transactional Data: Analyzing transactional data from credit card purchases, travel bookings, and online payments reveal consumer spending patterns, market share trends, and emerging competitors.

- 5. ESG Data: Assessing environmental, social, and governance data, such as sustainability ratings, carbon footprint analysis, and social impact.

“Alternative data is now table stakes. If you’re not using it, you’re at a competitive disadvantage.”

– Michael Recce, Chief Data Scientist, Neuberger Berman

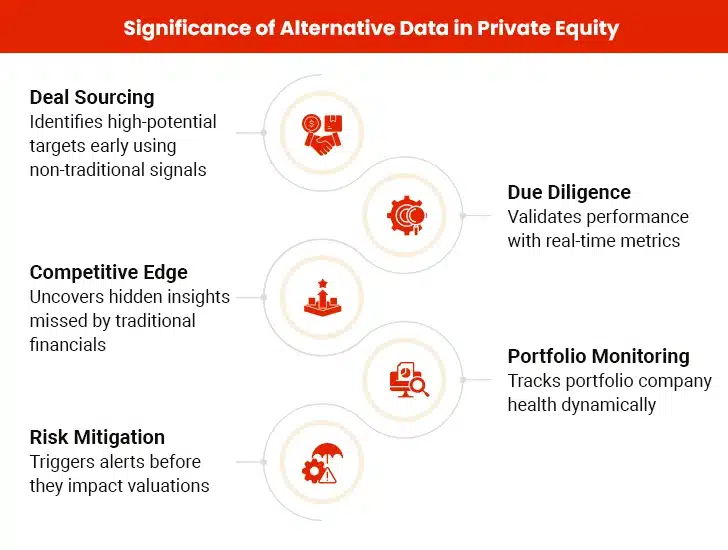

How Does Data Collection Services Help Improve Investment Decisions?

Even though alternative data has expanded paradigms for private equity firms, gathering it is an intricate job. It requires dedicated time and effort. Experienced data collection companies play a crucial role in empowering private equity firms to make informed investment decisions. They provide access to a wider range of data, including alternative data, and expertise in data handling. Other than this, there are various other compelling reasons to invest in outsourced data collection service, some of which are listed below:I. Improving Due Diligence

Private equity professionals have traditionally relied on financial statements, market trends, and historical performance metrics to inform their investment decisions. However, the advent of alternative data has opened up new dimensions. Data collection specialists leverage sophisticated tools to gather information from a diverse array of online sources, including social media, news articles, and industry reports. This holistic approach enables investors to paint a comprehensive picture of a target company, gaining insights beyond what traditional financial data offers.II. Unveiling Hidden Trends

Investing in AI data collection solutions allows private equity firms and investors to leverage advanced analytical capabilities. AI algorithms sift through vast amounts of unstructured data, identifying patterns, sentiments, and correlations that might be excluded from human analysis. This enables investors to make data-driven decisions with a higher degree of accuracy and speed. As a result, data collection solutions that incorporate AI technologies are becoming indispensable tools for investors seeking a competitive advantage in the fast-paced private equity landscape. Designed to address the unique needs of private equity investors, these solutions can be customized to focus on specific industries, geographies, and types of data, allowing investors to tailor their strategies based on the nuances of their investment thesis.III. Supporting Portfolio Monitoring

Web-based data collection enables private equity firms to access real-time information about potential investment targets. In an era where market conditions can change rapidly, having access to the latest data is crucial for making timely and well-informed investment decisions. And, there’s no better way than web data collection to begin with. Continuous monitoring of alternative data can help identify potential issues early, allowing for timely interventions and proactive portfolio management. Investors can stay ahead of market trends, emerging risks, and opportunities, positioning themselves to capitalize on dynamic market conditions. In a nutshell, it is through monitoring portfolios and providing in-depth insights that alternative data supports investors’ decisions. But, just as a coin has two sides; along with benefits come challenges and considerations of using this private equity data. The good news is that challenges can be easily addressed. So, let’s explore these in detail in the next section.What Are the Challenges and Considerations in Data Collection for Private Equity?

While the benefits of alternative data are evident, navigating the landscape of data collection in private equity is not without challenges. Understanding and addressing these challenges is crucial for ensuring the reliability and effectiveness of the data used in investment decision-making.I) Data Quality and Accuracy: The Cornerstones of Reliable Insights

One of the primary challenges in gathering alternate data is ensuring its quality and accuracy. Inaccurate or outdated data leads to flawed analyses and misguided investment decisions. Top data collection companies prioritize rigorous quality control measures and validation processes to mitigate this risk. At the same time, investors must remain vigilant in assessing the reliability of the data they leverage.II) Privacy and Compliance: Navigating Regulatory Complexities

With the increasing emphasis on data privacy and compliance, private equity firms must navigate a complex web of regulations when collecting and utilizing alternative data. Ensuring that data collection service provider adheres to legal and ethical standards is paramount. Rigorous due diligence is essential to verify that the chosen data collection solutions comply with relevant data protection laws and industry regulations.III) Overcoming Data Silos: Integration for Comprehensive Insights

Private equity professionals often encounter challenges related to the integration of data from diverse sources. Data silos, where information is compartmentalized and not easily accessible across the organization, often hinder the ability to gain comprehensive insights. Data collection service providers must offer solutions that facilitate seamless integration, allowing investors to derive maximum value from the amalgamation of various data streams.IV) Interpreting Unstructured Data: Extracting Meaningful Insights

As investors increasingly focus on gathering unstructured data from sources like social media and news articles, interpreting this information poses a unique challenge. The inherent complexity of unstructured data requires advanced analytical tools, including natural language processing and sentiment analysis to extract meaningful insights. Private equity professionals must be equipped to navigate this complexity to derive actionable intelligence from a diverse array of data sources. These are some of the challenges and considerations of collecting alternate data in private equity context. Moving on to the next, its time to explore the best practices to make the most of this valuable asset.Mastering Data Collection Techniques in Research for Accurate Insights

What Are the Best Practices to Leverage Alternate Data in PE Firms?

Alternative data can transform private equity investing if implemented thoughtfully. It is about building a strategy that aligns with the team, tools, and goals. Here’s how to go ahead with this:A. Start with a Reality Check

This is important as not every dataset is useful. PE firms should assess gaps in tech, skills, and budget, then prioritize high-impact use cases. Moreover, smart move is to pilot small before scaling. For example, testing satellite data on one portfolio company first.B. Pick Partners like You’re Hiring

PE firms should always choose quality over quantity. A niche provider with clean, compliant data beats a flashy vendor with noise. Also, it is better to take the test before committing. For that, it is good to run a three-month pilot to see if their data drives actionable insights. Also analyze if their data will flow smoothly into the systems or create headaches.C. Build Tech That Grows with You

Avoid “Frankenstein” systems, instead choose flexible platforms that won’t need replacement every two years. Regarding security, lock down sensitive data. For instance, employee/consumer info to avoid regulatory fires. In short, alternative data succeeds when it’s woven into the business process, not when treated as a magic bullet. So, the best advice is to start small, stay practical, and focus on insights that move the needle.Best Practices for Ensuring Data Privacy in Data Collection Services