Differentiation in the insurance industry is largely driven by understanding customer requirements and earning their loyalty. To gain an edge in this highly competitive environment, Insurance CRM Software is used by insurers for gauging needs and enhancing the customer experience- thereby streamlining the complete insurance cycle.

Accordingly, insurance CRM systems can be an excellent addition to the tech stack for insurance companies aiming to accelerate growth. In this post, we will look at the value insurance CRM software brings to the table and how insurers can leverage it to enhance their core offerings.

The Importance of CRM in the Insurance Industry

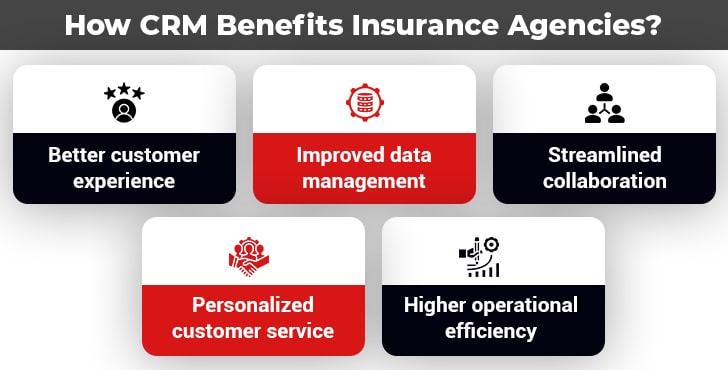

A majority of future-looking insurance carriers opt for Insurance CRM to deliver a superior and differentiated experience while engaging with customers at their preferred channel. Moreover, it enables them to manage and keep a real-time tab on the interactions during the customer’s journey with the business.

Further, a next-gen CRM system structures the sales process by organizing the customer interactions chronologically to gather relevant insights at every touch-point. The possibility of conversion is increased with effective communication between insurers and potential buyers. Another merit of insurance CRM Software is that it centralizes insurance data for analytics and facilitates better decision-making throughout the insurance processes.

Key Drivers for CRM Adoption in Insurance Sector

There are two key drivers for the adoption of Insurance CRM Software.

1. Need for Personalization

First, insurers want to personalize the customers’ experience and cater to their demands for lasting satisfaction. Personalization is enabled by a 360-degree view gained from omnichannel communication that harnesses vast customer interaction data for setting up the perfect sales pitch.

Using CRM software, Insurance carriers leverage data points such as communication channel preferences, social networks, and location attributes to integrate them with information characteristics like products and contact numbers to improve customer understanding.

2. Need for Automation

Secondly, insurers are looking for efficient automated solutions for lead generation and conversion to improve time and cost-efficiency. However, such a business objective cannot be met if insurance agencies resort to capturing and maintaining data in the offline environment.

CRM transforms processes into the digital ecosystem, which makes data collection, maintenance, transfer, and computation seamless. Resultantly, automation can be achieved by the digital transformation of business processes and workflows followed by the full tracking of the sales activities and customer interactions.

5 Key Features of Next-Gen Insurance CRM Software

Modern CRM systems must have the following characteristics:

1. Mobility

Mobility pertains to the accessibility of CRM through mobile devices. Customer-facing employees can use it to retrieve and update the database with relevant information even while they are on the move. As the world moves towards a disparate organizational structure, mobility will be of prime importance for future-forward insurance agencies.

2. Integration

As the heart of any customer-centric organization, CRM cannot function in a vacuum. This is where integration is required to enable it to harmonize with other digital tools and technologies. Integration fosters smooth communication and channels relevant information in real-time so that employees do not have to waste their time looking for information.

3. Analytics

Modern-day insurance CRM solutions leverage the power of insurance data analytics tools to provide on-demand insights to front-line staff for making informed decisions. These deep insights empower the sales staff to take strategic decisions based on the stage a prospect policyholder is in on their buyer journey.

4. Cloud

Cloud computing capabilities make data accessible between agents, experts, and customers regardless of their geographical location. Apart from centralizing data and forming a single source of truth, cloud technologies also ensure that the data is up-to-date across all terminals in real-time.

5. Collaboration

The insurance industry requires frictionless collaboration between various fragmented entities. Whether it is collating customer information or updating policy details, every action is orchestrated through the coordination of multiple individuals or teams. By standardizing and unifying processes using a collaborative platform, businesses can address various bottlenecks that can be hampering productivity.

Conclusion

The next-generation Insurance CRM Software that can reinvent the outlook of the insurance industry, through reimagining customer experiences, works on 5 key functionalities: analytics, mobility, cloud, collaboration, and integration. CRM systems envision the future of customer interaction with intelligent automation in the collection and analysis of various aspects of customer behavior thereby offering an enriched experience.