Getting loans approved quickly matters to both lenders and borrowers. When the loan origination process takes too long, both lenders and borrowers get frustrated. The good news? There are easy ways to fix this. You don’t need expensive loan origination software or technical skills to streamline your loan origination workflow.

Whether you’re a community lender, credit union, or digital lending startup, there are strategies that help you remove unnecessary steps, reduce waiting times, and create a better customer experience. Many lenders have used these same strategies to save time, lower costs, and keep their customers happy. Let’s look at these key strategies that work.

Table of Contents

Key Strategies to Streamline Your Lending Process

- 1. Use Simple Online Forms

- 2. Automate Document Collection

- 3. Quick Credit Checks

- 4. Instant Approvals for Simple Loans

- 5. Mobile-Friendly Process

- 6. Easy Repayment Plans

- 7. 24/7 Customer Support

- 8. Transparent Fees & Terms

- 9. Learn from Feedback

Technological Advancements Empowering DIY Loan Origination

Benefits of Streamlining the Lending Process

- 1. Faster Approvals

- 2. Fewer Mistakes

- 3. More Loans Processed

- 4. Better Repayment Rates

- 5. Lower Costs

- 6. Happier Customers

- 7. Stronger Business Reputation

- 8. Easier Compliance

Key Strategies to Streamline Your Lending Process

A good lending process should be fast and simple. These key strategies help remove unwanted delays and confusion. They make applying for loans easier for customers while saving your team time. The methods work for small and large lenders alike. Try them to see improvements in your daily operations.

1. Use Simple Online Forms

A complicated loan application scares people away. Keep your loan application forms short, simple, and easy to fill out. Ask only for the most important details. This could be the name, income, loan amount, and purpose. Use checkboxes and drop-down menus instead of long text boxes. This reduces mistakes and makes the loan origination process faster than ever.

Save progress so users can complete the form later if they get interrupted. Add clear instructions at each step. For example, explain why you need specific documents. A simple, well-designed form keeps borrowers engaged, and increases completed applications.

Test your forms with real users to find confusing parts. Fix anything that makes people stop halfway. The easier it is to apply, the more loans you’ll process smoothly.

2. Automate Document Collection

Manually collecting and checking documents takes too much time. Instead, let borrowers upload files directly through your website or app.

Use smart tools like loan origination software that scan documents for completeness. For example, the system can check if an ID is clear and matches the applicant’s name. Automatically sort files into the right categories like “Income Proof” or “Address Verification.”

This reduces back-and-forth emails and lost paperwork. Borrowers appreciate the convenience, and your team spends less time organizing files. A smooth document process speeds up approvals.

3. Quick Credit Checks

Waiting days for a credit check frustrates borrowers. Connect directly to credit bureaus for instant reports.

Show loan options based on the credit score of an applicant. If their score is low, suggest smaller loans or co-signer options. Fast credit reviews help you make decisions without delays.

Automated checks also reduce human errors. The system pulls the latest data, so you don’t rely on outdated reports. Quick loan approvals keep borrowers interested instead of looking for other lenders.

4. Instant Approvals for Simple Loans

People want quick answers when they apply for loans. For small, straightforward loans, give instant approvals if the applicant meets basic requirements. Check their income, credit score, and documents automatically.

If the loan is too big for instant approval, at least give a quick “maybe” or “likely approved” message with the next steps. Waiting days for an answer makes borrowers go to other lenders. Quick decisions keep them interested and most likely improve your conversion rate.

5. Mobile-Friendly Process

Most people use phones for everything, including loans. In fact, the global digital lending market is projected to reach 20.5 billion USD by 2026. Therefore, your application must work perfectly on mobile screens. Buttons should be big enough to tap easily, forms should adjust to small screens, and pages must load fast.

Test the lending process on multiple devices to fix any issues. Let borrowers save progress and finish later if needed. A smooth mobile experience means more completed applications and happier customers.

6. Easy Repayment Plans

Make paying back loans as simple as borrowing them. Offer flexible payment dates like weekly, biweekly, or monthly to match when borrowers get paid. Let them choose autopay from their bank account so they never miss a due date.

Send polite reminders a couple of days before the loan payment due date. Show a clear schedule of all upcoming payments in their account. If someone struggles to pay, offer options like extending the duration. The easier it is to repay; there will be fewer problems with late payments.

7. 24/7 Customer Support

People need help at all hours, not just during business hours. Set up systems that can answer common questions at any time of day. Use chatbots for simple issues like “What documents do I need?” Make sure real people are available for harder questions during normal working hours. Have clear contact options like phone, email, and live chat. Train your support team to be patient and explain things clearly. Fast and relevant make customers feel valued and keep the loan origination process moving effortlessly.

8. Transparent Fees & Terms

Nobody likes surprise costs. Show all fees transparently before someone applies for a loan. Explain the interest rate, any extra charges, and what happens if a payment is late. Use simple examples like: “If you borrow 1000 for one year, you’ll pay back 1100.” Put this information where it’s easy to find, not hidden in small print. Clear explanations help people trust your company and understand what they’re agreeing to. This reduces problems later when it’s time to repay the loan.

9. Learn from Feedback

Ask customers how you can improve after they complete the loan process. Send short surveys or just ask one simple question: “How can we make this better?” Listen to complaints and suggestions carefully. If many people say the application is too long, make it shorter. If they get confused at certain steps, make those parts clearer. Fixing problems quickly shows customers you care. Regular small improvements add up to make your lending process much better over time. Happy customers will surely come back and even tell others about your lending services.

How Loan Management Software Is Revolutionizing Small Business Lending

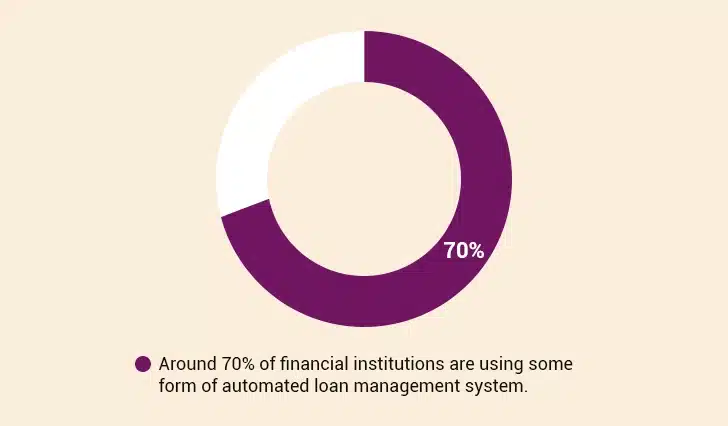

Technological Advancements Empowering DIY Loan Origination

Borrowers now have more control over their loan process thanks to smart technology. Recent tech improvements make applications faster and easier to complete without extra help.

| Technology | How It Helps | Example |

|---|---|---|

| Online Platforms | Lets you apply for loans from home without visiting a bank. | Websites where you fill in forms and upload documents. |

| Mobile Apps | Helps track loan applications, payments, and updates on your phone. | Apps that send reminders for due payments. |

| AI & Chatbots | Answers your loan questions instantly, like an assistant available 24/7. | Chatbots that explain loan terms in simple words. |

| E-Signatures | Allows signing loan papers online without printing or scanning. | Signing loan agreements with just a click. |

| Blockchain | Keeps loan records safe and unchangeable, reducing fraud. | Secure digital records of your loan history. |

| Big Data | Uses your financial history to offer better loan options. | Apps suggesting loans based on your spending habits. |

Benefits of Streamlining the Lending Process

A better lending process brings many benefits. It helps your company work smarter and keeps customers satisfied. These benefits explain why streamlining the lending process matters. You’ll save time, reduce errors, and make borrowers happier. Good systems create wins for everyone involved.

1. Faster Approvals

When you make your lending process smoother, people get loans much faster. Instead of waiting for days or weeks, borrowers can find out if their applications are approved. This happens because you remove unnecessary steps and use technology to check applications quickly. Customers don’t have to keep calling to ask about their status. Quick approvals allow people to solve their money problems sooner, which makes them happy. Your staff also saves time because they don’t have to manually check every single detail. The whole system works better when things move faster from application to approval.

2. Fewer Mistakes

A streamlined lending process leads to fewer errors. When you use clear forms and automated checks, the right information gets collected the first time. No more missing documents or wrong numbers that slow everything down. Computers can spot simple mistakes like blank fields or mismatched details instantly. This saves your team from wasting time fixing errors later. Borrowers also make fewer mistakes when the process is easy to understand. Fewer mistakes mean less frustration for everyone and loans that get processed correctly from the start. Your records stay clean and accurate too.

3. More Loans Processed

When your lending system works smoothly, you can help more people without working harder. The same staff can handle more applications because everything moves faster. Automated steps do some of the work, so your team can focus on important decisions. You don’t get stuck with piles of unfinished applications. More loans translate to more business for your company. Even busy times become easier to manage when the process is efficient. You won’t need to hire lots of extra people just because more customers want loans. The system scales up nicely when it’s well organized from the start.

4. Better Repayment Rates

Simple, clear lending leads to more on-time payments. When borrowers fully understand the terms, they’re more likely to pay as agreed. By offering automatic payment options, lenders make it easy for borrowers to stay on track. Furthermore, sending gentle reminders prevents honest forgetfulness. Lastly, flexible repayment choices let borrowers pick plans that fit their pay schedule. All this indicates you get your money back more reliably. Fewer late payments mean less work chasing people down. Your cash flow stays steady when payments come in regularly. Happy borrowers who can manage their payments well often come back for future loans too, growing your business.

5. Lower Costs

A smooth lending process saves money in multiple ways. For instance, when you use loan origination software instead of paper, you spend less on printing and storage. Automated checks also reduce the need for extra staff to fix errors. Furthermore, faster approvals let employees spend less time on each loan. All these small savings add up. Your business saves more money instead of spending it on slow, messy processes. Lower costs can mean better rates for borrowers or higher profits for your company.

6. Happier Customers

When lending processes work smoothly, people enjoy doing business with you. Customers feel relieved when they can apply without confusion and get quick answers. Borrowers also appreciate knowing exactly what to expect with no hidden surprises. These good experiences create trust and loyalty. Satisfied customers often return when they need another loan. They also recommend your services to friends and family. A simple, respectful lending process shows customers you value their time and business. This positive relationship helps your company grow through word-of-mouth.

7. Stronger Business Reputation

When you treat borrowers well and make loans simple, people notice. Good experiences lead to positive reviews and recommendations. A reputation for fair, fast service makes your company stand out. More people will choose you over competitors with slower, confusing processes. A strong reputation brings in new customers without expensive advertising. It also helps during tough times—people stick with lenders they trust.

8. Easier Compliance

Organized digital records make following the rules simpler. You can quickly find loan details if regulators have questions. Automated loan origination software helps ensure you don’t miss important steps like identity checks. Clear audit trails also show you did everything properly. This reduces stress during inspections. Furthermore, better compliance prevents fines and keeps your business running effortlessly. It also protects borrowers, which builds more trust in your lending services.

How to Choose the Right Loan Management Software

LoansNeo by Damco: Smarter Lending Made Simple

LoansNeo by Damco helps lenders approve loans faster and easier. This loan origination software handles everything from applications to approvals in one place, cutting paperwork and reducing errors. Whether you’re a bank, credit union, or online lender, this loan origination software makes lending smooth and hassle-free.

| Feature | How It Helps |

|---|---|

| Online Applications | Borrowers can apply anytime from any device |

| Automatic Checks | Verifies income, identity and credit quickly |

| Custom Workflows | Set your own rules for approving loans |

| Document Management | Keeps all loan papers organized digitally |

| Real-Time Tracking | See where each loan is in the process |

Why Choose LoansNeo?

- Approves loans faster: No more waiting weeks

- Reduces paperwork: Everything stays digital

- Fits your business: Works how you want it to

- Grows with you: Good for small or big lenders

- Easy to use: Simple enough for anyone

With this loan origination software, lending becomes quick, smart, and stress-free. Let’s make loans easier for you and your customers.

Summing Up

The above-mentioned strategies showcase how simple changes can make your loan origination process better. When you remove unnecessary steps and keep things clear, everyone wins. Borrowers get faster answers, and your team spends less time fixing problems.

You don’t need fancy loan origination solutions or big changes to start seeing results. Begin with one improvement that seems easiest, maybe simpler forms or quick credit checks. When that works well, try another idea. Small steps add up to big improvements over time.

The goal is to make loans stress-free for both sides. When applications move smoothly from start to finish, more people get the help they need. Happy customers will remember the good experience and come back.

These strategies have worked for many lenders. They can work for you too. Take what makes sense for your business and give it a try to loan origination software. You might be surprised how much difference a few simple changes can make.