More than half of potential borrowers walk away from loan applications before finishing them. The reason? Friction in the user experience drives them away. Traditional lending journeys are painfully slow. They are full of inefficiencies that disappoint applicants and hurt conversions. This gap between what borrowers expect and what they experience has created a major opportunity for financial institutions.

The global lending industry is now seeing rapid modernization. Today, loan origination systems act as central hubs for all lending activities. They reduce manual work and boost efficiency. Financial institutions using this software benefit from automated workflows that speed up approvals and improve teamwork. These systems directly tackle key problems like excessive documentation and the lack of real-time updates.

This blog talks about the common challenges borrowers face during loan origination and how digital platforms help fix them. It also explores the strategies that help create seamless user journeys, reduce dropouts, and boost profits.

Table of Contents

- Understanding the Loan Origination Process

- Why User Journeys in Loan Origination Matter

- Pain Points That Affect Borrower Experience

- The Role of Modern Technology in Optimizing User Journeys

- Strategies for Designing a Seamless Loan Origination Journey

- Measuring Success: Essential Metrics to Track

- The Final Word

Understanding the Loan Origination Process

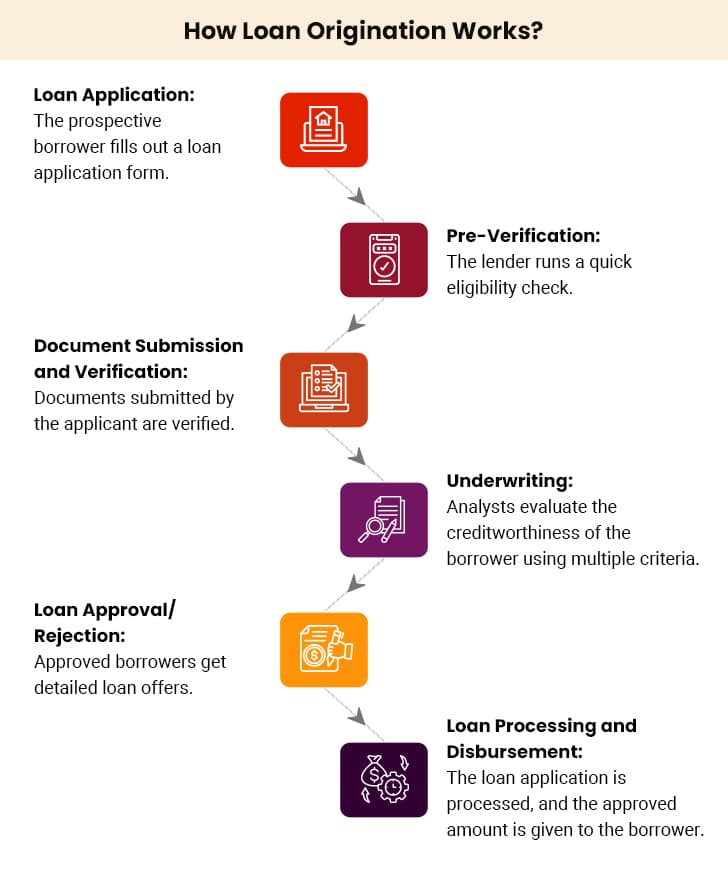

Financial services companies rely on well-laid-out workflows to review potential borrowers and issue loans quickly. A loan origination process covers all steps from the original application through final funding. It forms the foundation for how lending institutions build customer relationships and manage risk.

The journey starts with pre-qualification, where lenders run initial eligibility checks before borrowers submit formal applications. This stage often uses soft credit checks that give preliminary approvals.

Pre-qualification is followed by a formal application process. Applicants submit detailed documentation including income verification, asset statements, and personal information. Financial institutions using loan origination software can cut this documentation burden significantly through automated data collection and verification.

The underwriting phase is an integral part of loan origination. Here, analysts evaluate the creditworthiness of a borrower using multiple factors, including their:

- Credit history

- Income stability

- Debt-to-income ratio

- Collateral availability (for secured loans)

- Risk profile

After underwriting comes the stage where analysts decide whether they should approve or deny the loan application. Approved borrowers get detailed loan offers with interest rates, repayment schedules, and associated fees.

The loan agreement is then finalized through document preparation, verification, and signatures. The final stage, funding, disburses approved loan amounts to borrowers through direct bank transfer or other payment methods.

The technology infrastructure supporting loan origination has come a long way. Modern loan origination software systems streamline the entire lending lifecycle from pre-qualification through disbursement. They deliver measurable business benefits to financial institutions: reduced processing costs, faster turnaround times, and improved data integrity. These systems also enhance borrower experiences through transparent processes, consistent communication, and minimal documentation requirements. They address the very pain points that drive application abandonment.

Why User Journeys in Loan Origination Matter

The lending origination process is often the first substantial interaction a borrower has with an organization. A clunky, confusing process can discourage even the most qualified borrowers. On the other hand, a well-designed journey can:

1. Reduce Dropouts

Online loan applications face abandonment rates of 97.5%, which means substantial lost revenue. This happens because a majority of potential borrowers quit if the application takes longer than a few minutes.

Common abandonment triggers include:

- Requirements to download and print forms

- Complex documentation submissions

- Lengthy application forms with several fields

- Rework requests when information is incorrect

Modern loan origination software addresses these issues through streamlined interfaces, mobile-friendly experiences, and automated document collection. These improvements directly affect conversion rates and revenue potential.

2. Build Trust

Trust forms the foundation of successful lending relationships. When borrowers notice transparency and consistency throughout the loan process, they trust their lenders more. One study shows that 78% of mortgage loan officers with an active presence on social media outperform their peers. This shows how building trust through communication impacts business results.

Streamlined processes with real-time updates and clear communication create confidence beyond the first transaction. Borrowers show appreciation for lenders who explain things clearly and show flexibility when financial circumstances change.

3. Improve Brand Perception

An individual’s experience during a loan application process affects how they view a brand. Modern consumers are willing to pay more for exceptional experiences. Many of them leave a brand after experiencing poor service.

Financial institutions that offer smooth user journeys position themselves as customer-focused entities. This perception extends beyond individual transactions; it creates chances for deeper, lasting relationships. Lenders who stand out through better experiences thus have ample room to grow.

Stay Ahead in Lending: The Benefits of SaaS Loan Management Systems

Pain Points That Affect Borrower Experience

Financial institutions need to spot the friction points that make users quit during loan origination. We all know how critical simplicity is to loan origination. Yet, many lenders still use processes that drive potential customers away.

I. Excessive Documentation

Document collection remains one of the biggest hurdles in loan origination. Borrowers quit their applications when they face too many document requests. Traditional loan processing methods leave applicants overwhelmed as they collect financial statements, tax returns, and personal information. The situation becomes worse when documents go missing, forcing borrowers to submit everything again.

II. Lack of Real-Time Updates

Here’s another major pain point: lenders keep borrowers in the dark about their application status. Clear communication forms the backbone of trust in lender-borrower relationships. When lenders fail to provide real-time updates, it creates a communication vacuum. Without visibility into where their application stands, borrowers experience anxiety and frustration that drive higher churn rates.

III. Poor Mobile Experiences

Today, a majority of the web traffic comes from mobile devices. This makes clunky mobile interfaces a serious problem for loan application completion rates. The numbers also support this. Recent studies have shown that a staggering 65% of customers would stop using a financial service provider’s app if they offered a poor mobile experience.

IV. Complicated Navigation

Complex or unclear application processes often lead to user complaints. When navigation becomes confusing, applicants struggle to understand what information they need or how to move to the next step. Rather than continue struggling, they abandon the process entirely. Financial institutions using age-old systems lack cohesion between different stages of loan origination. This creates sub-par experiences that leave borrowers lost or frustrated.

Chief Information Officers can boost conversions by fixing these pain points. Modern loan origination solutions offer an opportunity to turn these frustrating experiences into a competitive advantage.

The Role of Modern Technology in Optimizing User Journeys

Modern technology fixes the loan origination challenges that have plagued financial institutions for years. The right technology solutions make processes smoother. They also boost efficiency and improve the borrower experience.

1. Loan Origination Software

Loan origination software (LOS) changes traditional lending by automating processes that once needed a lot of manual work. These platforms automate financial spreading, where information from the borrower’s financial statements is extracted and mapped into standardized formats for analysis. Such features allow loan officers to assess applicants and make credit decisions within minutes. The result? Faster loan application processing and reduced abandonment rates.

LOS systems also make real-time collaboration between departments possible. Multiple teams can access the same customer information according to their specific needs. This improves overall productivity and boosts customer experience.

LOS software systems also offer analytics and insights about how borrowers behave, allowing lenders to keep improving the lending process. By seeing where exactly borrowers face challenges, they can take steps toward fixing bottlenecks and refining the borrower journey.

These platforms come with strong compliance tools that track regulatory requirements automatically. This helps ensure standardization and keeps documents ready for compliance audits.

2. Loan Servicing Software

The role of technology goes beyond the approval stage. Loan servicing software creates a smooth transition from origination to repayment, managing the entire loan lifecycle.

Loan servicing software solutions offer several user-friendly features. These include:

- Digital document management to safely store applicant’s files

- Repayment management to reduce delays and missed payments

- Self-service portals that allow borrowers to manage accounts outside business hours

These loan origination platforms create an ecosystem that effectively addresses the pain points of borrowers. It also delivers measurable benefits to financial institutions.

Transform Lending Operations with Loansneo – Boost productivity and customer satisfaction effortlessly.

Strategies for Designing a Seamless Loan Origination Journey

Improving loan origination needs well-planned strategies. Many lenders now use practical methods to turn cumbersome origination journeys into a competitive advantage.

I. Adopt a Customer-Centric Mindset

Financial institutions must shift from product-focused to customer-focused lending. They should put borrowers at the center and create personalized experiences based on their specific needs. Digital, optimized processes let borrowers apply, get approval, and receive funds quickly. The focus stays on building relationships instead of just handling transactions. This deepens trust and creates solutions that fit each borrower’s unique requirements.

II. Simplify Documentation Requirements

Paperwork remains the biggest problem in loan origination. Lenders should cut down on paperwork through automation and smart document collection. These days, it is possible to pull financial data directly from accounting software and tax returns to create financial spreads for analysis. The outcome? Analysts have more time to assess risks while applicants face less frustration.

III. Streamline Navigation

Clear navigation through applications affects completion rates. Advanced loan systems use visual progress trackers and intuitive interfaces that guide borrowers through each step. Mobile access is also important, as it allows executives to make lending decisions on the go, which reduces approval delays. User-focused interfaces with streamlined navigation thus eliminate confusion and reduce churn rates.

IV. Offer Real-Time Updates

Transparency builds trust throughout the lending process. Real-time loan processing gives lenders accurate views of customers’ financial status. This enables faster credit decisions. Besides, automated notifications alert borrowers when documentation is missing, or pre-defined criteria aren’t met. This open communication builds confidence that goes beyond initial transactions.

V. Incorporate Self-Service Options

Self-service portals empower borrowers and reduce operational costs. These portals provide round-the-clock account access. This lets borrowers check balances, see payment histories, and make online payments whenever they want. These platforms also include support options with AI chatbots for quick assistance. There are tools like loan calculators to help borrowers make decisions about loan amounts and terms. These features keep customers satisfied.

Measuring Success: Essential Metrics to Track

Lenders need clear standards to review progress and spot areas that need improvement. They must track specific performance indicators that reflect both operational efficiency and customer experience quality. These include:

- Application Completion Rates: Are more borrowers completing the application process?

- Time to Approval: How long does it take from application to decision?

- Customer Satisfaction Scores: What feedback are borrowers providing about their experience?

- Compliance Success Rate: Are compliance checks being completed without delays?

Additionally, tracking metrics such as user engagement on the loan origination platform and the frequency of support requests also proves useful. These provide deeper insights into areas that may need further improvement.

The Final Word

Financial institutions face a turning point as age-old loan processes drive potential borrowers away. Complex paperwork, unclear steps, and poor digital experiences create barriers. These barriers hurt conversion rates and impact how people see a brand.

Smart CIOs understand that transformation of the loan origination process goes beyond just a tech upgrade. It is an important business move that impacts customer acquisition, retention, and competitive positioning. Organizations that implement modern loan origination systems see many benefits. These include automated workflows, stronger compliance safeguards, and better customer experiences.

Success relies on several vital elements. The lending process needs borrowers at its center. Automation should ease paperwork and remove major roadblocks. User-friendly navigation guides applicants through each step smoothly. Immediate updates and clear communication build trust for lasting relationships.

Financial institutions that redesign their loan origination journeys can process their applications much faster. They can also turn what used to frustrate borrowers into their biggest competitive advantage. Today, we have the technology to make this happen. Leadership teams just need to step up and drive meaningful change.