Customers no longer tolerate delays. Today’s customers expect swift delivery of goods and services. This expectation extends strongly to the loan management industry. Customers now want fast, effortless solutions to their lending requirements, be it loan application, processing, or sanctioning. Thus, it becomes vital for financial institutions to improve their services and provide simplified solutions.

To fulfill this demand, many of them are turning to cloud-based solutions such as Loan Management Systems (LMS). These LMS platforms provide configurable modules for different types of loans. This ensures flexibility and efficiency across the lending lifecycle. Delivered by Software-as-a-Service (SaaS) providers, these solutions offer many benefits: faster loan delivery cycles, reduced repetitive requests for documentation, and improved focus on customer relationships.

Table of Contents

Understanding a SaaS-Based Loan Management System and its Benefits

SaaS companies enable financial institutions to leverage a cloud-based banking system, eliminating the need for expensive software integrations and complex server maintenance. SaaS lending platforms such as loan origination and loan servicing software provide a one-stop solution to borrowers when it comes to creating and managing loans. These cloud-based platforms streamline the entire loan cycle, from application to disbursement, while ensuring easy access tor all stakeholders within the organization.

A loan management system provides a comprehensive perspective and control over the entire process. While loan origination software concentrates on the start of the loan process, loan servicing software focuses on the post-disbursement phase. The important benefits of these systems include the following:

1. Automated Customer Onboarding Processes

The process of securing loans, be it auto, home, or personal, can be a tiring one for both borrowers and lenders. With the help of SaaS-based loan automation software, one can pre-fill form fields, automate verification processes, aggregate data from sources like payroll forms, tax returns, and flag any issues automatically. This helps customers avoid lengthy paperwork and cut down on loan cycle times.

2. Personalized Lending Products Integrating

A SaaS lending platform into business processes enhances financial institutions’ ability to adopt a proactive approach, backed by comprehensive data. By providing personalized and timely recommendations at critical stages of the lending journey, SaaS-based loan management solutions deliver more value to customers.

These platforms play a key role in translating the credit scores, financial history, income, and assets of customers into relevant and proactive offers that meet their present and future needs.

3. Enhanced Customer Relationships

SaaS loan management software goes beyond creating enriched customer experiences. By personalizing customer journeys, customers feel appreciated and valued-they get the confidence to make better financial decisions. For example, a customer who freshly took out a loan might require advice on the best repayment strategies tailored to their specific financial situation.

A cloud-based SaaS lending solution simplifies the loan provision process, demonstrating a commitment to meeting customer needs while ensuring convenience.

4. Cost Savings with Reduced Overhead

Traditional lending operations are expensive to run due to infrastructure upkeep, software updates, and security compliance. SaaS commercial lending platforms cut these expenses through their subscription-based model. The money saved is substantial. Organizations reduce their total ownership costs, as they:

- Get rid of server maintenance and hardware costs

- Require fewer IT staff to run operations

- Get automatic software updates without disruption

- Pay predictable monthly fees instead of big one-time expenses

Loan automation software also cuts costs related to manual processes. Document handling expenses drop considerably. Fixing errors costs far less when workflows become digital and standardized.

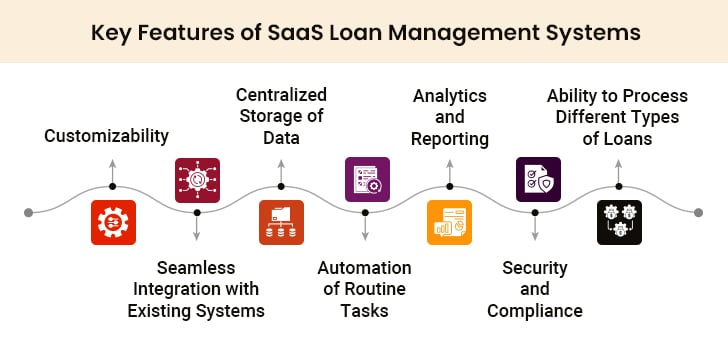

Features of a Quality Loan Management System

Choosing the right loan management solution is important. Here are some key features that organizations might consider:

I. Customizability

Depending on the unique needs, an organization might need various customizations inside the loan origination software. It’s crucial to choose software that is flexible and capable of accommodating the specific needs of the organization. Additional features like a document vault, document templates, and helpline portal can be added to the software as the organization evolves.

Get Started with Smarter Saas Lending

II. Accessibility

Training employees is important to ensure optimized usage of the loan origination software. This will ensure a smooth transition from traditional paperwork to a digital and paperless environment. A software solution that is intuitive and needs minimum training for employees will be helpful. A system that has a straightforward and simple interface guarantees easy onboarding. You can also consider free trials or demo sessions before investing in a loan management system. This approach will provide insight into the functioning of different platforms.

III. Seamless Integration

It is important to select loan management and loan origination software that easily integrates with third-party solutions. This will ensure that businesses don’t end up wasting time on manual import or export of data. With the help of integration, it will be easier to connect the software with the finance department.

IV. Accuracy

Collecting accurate information about their clients is pivotal for financial institutions. The information includes not only the personal data of clients but also other data such as past income, job history, credit history, etc. Accurate information about clients will help you build personalized solutions to meet their requirements effectively. Also, this accuracy helps prevent funds from being tied up due to incorrect client information.

V. Scalability

To ensure the future expansion of your organization, it is essential to select scalable loan management and loan servicing software. Reliable software will evolve alongside your organization and offer modular capabilities, allowing for the addition of new features as your organization grows.

VI. Security

Security is a critical feature to select when choosing your SaaS lending software. Since the software will house sensitive financial information about your clients, it is important to invest in a solution that offers robust security features. This will offer protection from identity theft and cyber hacks.

VII. Transparency

To satisfy your customers, it’s important to choose a transparent, seamless, and easy-to-deploy loan disbursal system. Customers look forward to a solution that allows them to quickly and transparently access capital resources. Choose loan management solutions that can fortify the lending process and keep your customers informed about the progress of their loans with prompt creditworthiness assessment.

VIII. Analytics

Reliable loan automation software systems generate analytical reports, streamline the lending process, and boost workforce productivity. Selecting such software helps you monitor market trends and modify your services if needed. Quality loan management solutions allow users to createthorough reports on portfolio trends, loan performance, and risk exposure. By using these reports, businesses make smarterdecisions and work more efficiently

How to Choose Your SaaS Lending Partner

Setting up a cloud-based lending platform isn’t something you want to go wrong with. The right solution brings a noticeable difference in your lending operations: efficiency improves, operating costs go down, and brand perception gets better.

The process requires you to understand what your organization needs, assess potential partners, and verify the chosen solution before rolling it out completely.

1. Evaluate Your Needs

Financial institutions must identify their specific business requirements before they start looking for a loan management solution. This significant first step ensures the system they pick solves their unique lending challenges. It is important to think about:

- Current and Projected Loan Volumes: The solution should handle current requirements and future growth without slowing down.

- Loan Product Diversity: Every lending product (e.g., consumer loans or complex commercial financing) needs different workflows and documentation.

- Integration Requirements: The product should be able to connect with existing systems. These may include core banking software and CRM solutions.

A detailed requirement assessment allows you to pick a solution that fulfills the expectations of your customers and employees. It also helps avoid costly mistakes.

2. What to Look for in a Vendor

Once you know what you need, it’s time to separate the serious vendors from the ones just trying to make a sale. Here are the key criteria one should think about:

- Security Standards: Security is non-negotiable in today’s world. Businesses should look for vendors that:

- Implement solid encryption and multi-factor authentication

- Follow industry regulations such as SOC 2, ISO 27001

- Adhere to data privacy laws

- Share security audit results on a regular basis

- Hold ISO 27001 certification that proves they take information security seriously

- Have reliable backup and recovery plans

- Customization Capabilities: Every lender works differently. The platform should:

- Allow you to configure workflows to match your processes

- Offer customizable dashboards and reporting features

- Adapt to how you work instead of forcing you to change your way of working

- Support Quality: The vendor-buyer relationship doesn’t end when you sign the contract. One should check:

- How fast the vendor responds to support requests

- Whether they help with the implementation

- Quality of their training programs

- Their track record of ongoing support

- Vendor Reputation: Businesses should spend considerable time conducting due diligence on potential vendors. Reading customer reviews, going through their past projects, and getting a sense of how others perceive the vendor are a few steps one cannot afford to skip.

3. Pilot Testing

Testing with a pilot program is a smart way to verify your chosen solution works well. Financial institutions should:

- Ask for demonstrations or free trials to get hands-on experience with the platform. This approach is a great way to get experience with different solutions before making a big investment.

- Get key stakeholders from different departments involved during testing. Their feedback helps spot potential issues and ensures the system works for everyone.

- Begin with a small implementation that includes a limited user group and specific loan types. This lets you check the platform’s performance and collect feedback before expanding it to your whole operation.

- Set clear success metrics for the pilot phase, such as faster processing time or better data accuracy. These measurements help you assess the system’s performance objectively.

Modern loan origination systems should take weeks, not months, to demonstrate value. Cloud-based solutions are usually faster to implement than on-premises options. This helps you see returns on your investment much sooner.

The Ultimate Guide to Choosing the Right Next-Gen Loan Management Software

Future Outlook: Trends to Expect in SaaS Lending

Lending technology moves fast. Innovative SaaS companies are testing many innovations that will become standard in the next few years. Understanding these trends can help financial institutions stay ahead in a fast-changing world.

I. AI-Driven Risk Scoring

Traditional credit scoring analyzes payment history and debt levels. That works fine for borrowers with established credit files. But there are millions of people with thin or nonexistent credit histories.

AI changes this completely. These systems analyze hundreds of variables at once. These include:

- Credit history

- Payment history

- Transaction patterns

- Past inquiries

Machine learning algorithms thus spot patterns that are imperceptible to human underwriters.

Lenders that use AI-powered risk scoring see default rates drop to a considerable degree. They process the loans much faster as the probability of loan repayment becomes much easier to predict. Plus, they can safely extend credit to segments they could not serve before.

Interestingly, AI doesn’t stop working after the loan has been approved. It tracks portfolios continuously. It also flags accounts that show warning signs. This means lenders can reach out to borrowers to modify existing loan terms and avoid default.

II. Blockchain for Secure Document Storage

Document fraud costs lenders billions each year. Document forgery, statement manipulation, and identity theft have become common in existing setups. Blockchain technology solves these problems by creating tamper-proof records.

Once a document goes on the Blockchain, it can’t be changed without detection. The result? Lenders don’t need to worry about altered or counterfeit statements. Borrower’s information can be verified directly from the ledger-no need to ask for additional documentation.

Smart contracts simplify lenders’ work even more. They execute precoded actions automatically when conditions are met. To cite an instance, loan funds are released when all documentation requirements are satisfied. Or, insurance claims are processed when damage reports are filed.

Organizations that have adopted Blockchain-based solutions have reported dramatically reduced loan processing times. They have been able to fast-track complex commercial deals that involve multiple parties. This is because everyone has access to the same verified information. There is no dispute over which version of a document is the most up-to-date.

The Final Word

Good quality SaaS loan management software can help your organization revolutionize its lending processes and promote customer satisfaction. Such software provides a range of features to help you in the effective execution of your loan sanction process. It also allows you to organize your data efficiently.

When searching for a SaaS-based loan management solution, make sure it is equipped with the right features as mentioned above. By doing so, you’ll be able to guarantee the security of your client data, ensure better customer experience, and improve overall operational efficiency.