Think of a scenario where a pipe burst damages an apartment. This destroys furniture, electronics, and other belongings. Exhausted and overwhelmed, the person dreads the lengthy claims process ahead of them. However, this time the experience is different. Within minutes of filing the claim through a mobile app, the policyholder receives a personalized message acknowledging the situation.

An AI assistant further eases the stressful situation by guiding through photo submission and documentation. What was expected to be weeks of back-and-forth communication was resolved in just three days. All thanks to the AI-powered insurance claims management system, which automatically estimated damages and connected the policyholder with local contractors.

Had the insurer relied on traditional processes, the policyholder would have had to struggle alone in such a distressing time. One thing is very clear from this scenario: the vital role of AI in reshaping claims processing during policyholders’ most vulnerable moments. And this is what distinguishes successful insurance businesses from laggards.

Table of Contents

Why AI in Claims Processing Matters for Insurers

How AI Transforms Traditional Claims Processing

Building Policyholder Trust Through AI-Driven Personalization

Exploring AI Applications Across Different Lines of Business in Insurance

AI-Powered Insurance Claims Management Software by Damco

Why AI in Claims Processing Matters for Insurers

The insurance claims experience can make or break an insurer. The process, which typically follows an emergency, accident, or even natural calamity, can be distressing. Handling such a situation with care and concern instills confidence that converts a policyholder into an advocate.

Given the criticality of this process, insurers should put in the effort to build robust workflows to empower policyholders. One approach to go about this would be through claims modernization, particularly by embedding cutting-edge technology, such as artificial intelligence (AI), into the processes. Doing so not only caters to the instant needs but also future-proofs how insurers interact with policyholders and vice versa.

If one were to list the various benefits offered by AI solutions in claims experiences, personalization would be right at the top. In fact, AI is ushering in the era of hyper-personalization that significantly improves customer experiences. Let’s take a closer look at this in the next section.

How AI Transforms Traditional Claims Processing

Traditional claims filing is nothing short of navigating a labyrinth. However, AI is the glowing marker that dots the path to solving this maze with ease and efficiency. It converts frustrating experiences into streamlined, efficient workflows that benefit both insurers and policyholders. Here’s how:

Automated Data Collection and Analysis

AI automatically captures data from multiple sources and in various formats to make it more consistent, structured, and usable. As such, policyholders can submit a variety of documents, from scanned copies of handwritten documents to photos and diagnostics to digital reports, and more. It makes data usable and accessible, increasing accuracy by eliminating manual data entry errors.Managing Complexity at Scale

The use of AI not only fast-tracks insurance claims processing but also makes it adept at handling intricate claims. AI algorithms perform accurately and reliably even during peak events like natural disasters, after which claims volumes may surge. These models can autonomously analyze complex situations, detect patterns within large datasets, and automate segments of claims processing to ensure that each claim receives equal attention even during overwhelming situations.Conversational AI Assistants

Conversational AI bots are virtual claims adjusters. Powered by natural language processing (NLP), these AI assistants are impartial, accurate, patient, and available 24/7. They can answer claimants’ queries, walk them through the process, schedule appointments with repair personnel, share updates on the claims status, and even conduct preliminary assessment and estimation. All this is done in a manner that feels natural and is personalized.Tailored Communication for Every Customer

Impersonal messaging using templates is an ancient relic. AI goes beyond personalizing the message, tweaking the notification or update to match the individual policyholder’s preference of voice, tonality, and communication channel. Personalizing the policyholder experience to this degree develops one-on-one relationships and ensures a clear understanding throughout the claims process. As a result, customers feel valued during stressful situations.

Leverage AI to Personalize Policyholder Experiences

Building Policyholder Trust Through AI-Driven Personalization

Making the claims process frictionless is just one aspect of how AI adds efficiency to the insurance value chain. However, personalizing the policyholder experience is where AI truly shines in the following ways:

1. Enhanced Customer Satisfaction

A more accurate, efficient, and faster claims process, coupled with value-loaded communication, lays the foundation of trust and loyalty. Policyholders feel heard, valued, and supported during distressing times, and most importantly, acknowledged as an individual, which they will appreciate. Besides, this individual recognition creates lasting positive impressions that drive retention.

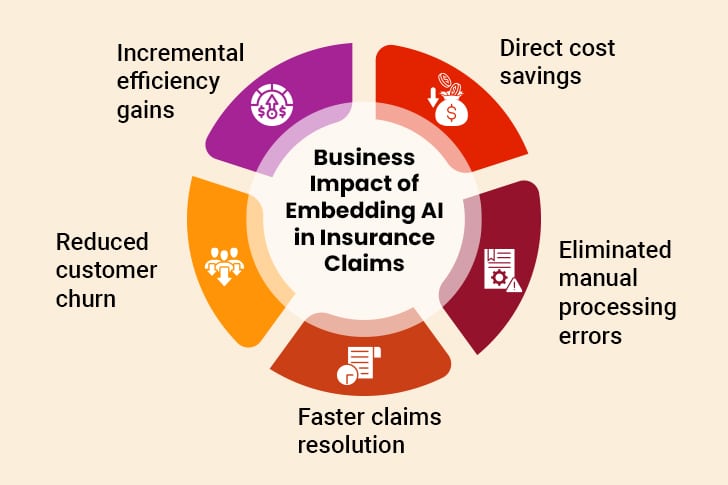

2. Reduced Costs for Insurers

AI-powered automation, facilitated by insurance claims management software, minimizes manual work and associated errors. This enables insurers to process claims faster and at a lower cost. The resulting resource savings translate into cost-effective operations that benefit both the insurer as well as the policyholder. As a result, insurers can accurately personalize policy pricing to match the policyholder’s risks and requirements.

3. Improved Risk Management

AI algorithms can perform cross-functional and in-depth data-driven analysis, allowing insurers to anticipate risks and mitigate potential losses. Such a proactive approach to risk management results in a fair and accurate pricing structure. At the same time, insurers can incentivize good or responsible behavior depending on the policyholder’s profile to minimize risks.

4. Integrated Empathy and Emotional Intelligence

While AI does not innately possess the qualities of empathy or emotional intelligence, it can be trained to identify and respond to the policyholder’s emotional state. Generative AI models can populate empathetic language that offers support beyond the technical aspects of the claim and handle customer queries or requests in a supportive manner. Systems also recognize when human intervention is required and ensure smooth handoffs. This ensures that policyholders receive appropriate support levels in times of distress.

5. Assured Omnichannel Support

A seamless claims experience transcends communication channels. AI delivers consistent and personalized support across various touchpoints, be it live chat, mobile app, or phone call. At the same time, insurers must strike a balance between accessibility and personalization to ensure that they interact with the policyholder through their preferred channel. For this, AI retains “memory” of such customer preferences to ensure that no critical communication slips through the cracks. This comprehensive approach creates a truly cohesive experience that literally says, “meant especially for you”.

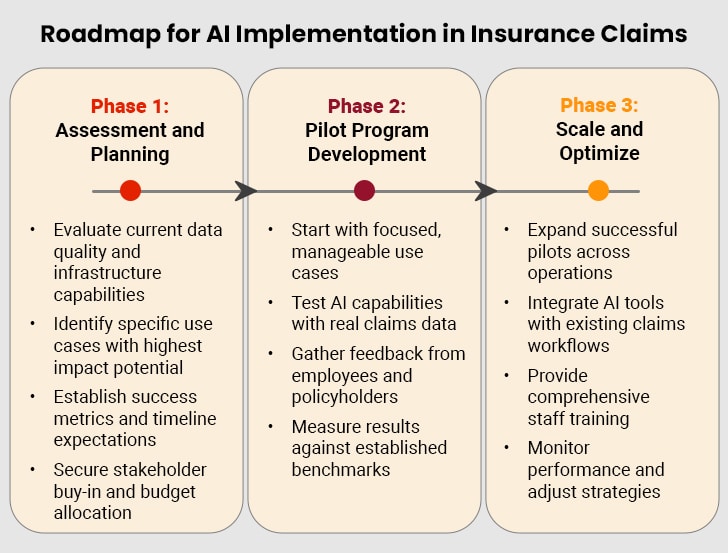

So, that’s how AI helps insurers build policyholder trust. But to achieve this level of personalization and reap other benefits of AI, insurance businesses must first implement the technology. Let’s explore how to get started.

Exploring AI Applications Across Different Lines of Business in Insurance

Different insurance sectors require specialized AI approaches to maximize effectiveness and ROI. Understanding these distinctions enables more targeted and successful implementations. Here’s a closer look at these:

I. Property & Casualty (P&C) Insurance

Weather-related claims usually spike during natural disasters such as forest fires and floods. As such, P&C insurance businesses find it difficult to assess property damage claims, whether it is genuine or fraudulent. Moreover, they often have to coordinate with multiple contractors and adjusters to settle the claim.

Thanks to AI solutions, P&C carriers can combine claims data with external data to identify new risk factors, such as climate-related damage estimates. Computer vision technology analyzes photos and videos to assess property damage automatically, reducing the need for on-site inspections. As per the latest research, P&C insurers implementing comprehensive AI solutions report 40% faster claim resolution times.

II. Life Insurance Claims

Life insurance involves sensitive emotional circumstances that require empathetic handling. Medical record analysis and cause-of-death verification, beneficiary identification and communication, and regulatory compliance for death benefit processing are some of the concerning issues for insurers.

The good news is that AI enhances life insurance claims management by reducing manual work and offering decision support. NLP analysis of medical documents helps identify relevant information, while the death certificate can be verified via automated validation against multiple databases. Life insurers can deliver personalized and empathetic messages adapted to the family environment. To ensure regulatory compliance, the latest software have AI-powered automated checks for state and federal requirements.

The latest reports show that insurers utilizing AI experience a 50-70% reduction in claim processing time. This speed is important, especially during the period of grief.

III. Health Insurance Claims

Ensuring HIPAA compliance and patient privacy are mandatory for health insurance providers. However, adhering to compliance becomes challenging, particularly when high-volume, frequent claims require rapid processing. Managing the provider network and reimbursement is again an uphill task.

That’s where AI-powered claims software comes to the rescue. These solutions analyze medical procedures, diagnoses, and treatment patterns to identify appropriate coverage and detect potential fraud or errors. This level of personalization strengthens the policyholder’s trust in the organization, and they readily seek help when required.

IV. Commercial Insurance Claims

Commercial insurance providers deal with complex business interruption calculations and perform multi-party liability assessments. The process becomes complicated when there’s a combination of large-scale property and casualty.

Traditional systems often fail here, but AI outshines. Advanced analytical models handle complex commercial risks, multi-faceted coverage analyses, and specialized industry requirements.

These models analyze revenue patterns, market conditions, and downstream effects on the entire supply chain. AI also helps with multi-party analysis for complex commercial situations. Commercial insurers report 35-45% improvement in complex claim accuracy and 40-60% reduction in investigation time.

This is how AI impacts different lines of business across the insurance industry. Let’s move on to the next and explore the solution that integrates seamlessly with the existing workflows.

AI-Powered Insurance Claims Management Software by Damco

Today’s insurance leaders need solutions that combine AI capabilities with proven claims management functionality. Damco’s claims management software aptly provides these capabilities, helping insurers take their personalization efforts to the next level. Let’s explore the features of this platform:

Centralized Management Interface

Centralized data storage and management is the least that insurers expect. The claims management platform provides a single-screen access to policies, customer details, and claim information, helping them streamline operations. Its intuitive design reduces training time and improves productivity.Intelligent Task Automation

Intelligent automation is the need of the hour for insurance. Having advanced automation capabilities, the management platform easily handles routine processes while maintaining accuracy and compliance. Thus, employees can focus on complex cases that actually require human expertise.Real-Time Analytics Dashboard

Real-time analytics is necessary to make informed decisions and stay at the top in the industry as intense as insurance. That said, the platform’s interactive dashboards provide instant insights. Furthermore, its one-click reporting simplifies management oversight and compliance requirements.

Transform Your Claim Operations with Intelligent Solutions

A Closer Look at the Future of Insurance Powered by AI

While the integration of AI in the insurance industry is still in its nascent stages, it is expected to be in full swing soon. After all, the push for personalization is no new news.

As AI technology continues to develop and mature at breakneck speeds, policyholders can expect rich claims experience in the years to come. It won’t be long until the industry witnesses AI-powered chatbots negotiating repair costs with service providers to offer policyholders the best possible deal. Or, the advent of smart contracts that will automatically disburse claims settlements based on preset parameters to eliminate delays and redundancies. Or, how AI-powered fraud detection systems can identify and prevent fraudulent claims in real time, protecting honest policyholders from bearing the brunt of increased premiums.

Whichever way one sees it, harnessing the power of AI in insurance has become an imminent reality. It is only a matter of time until AI fully penetrates claims processes to make them more personalized, optimized, and customer-centric.

Insurers embracing AI will build stronger customer relationships and achieve lasting competitive advantages. But those who delay risk falling behind in an increasingly demanding insurance marketplace. So, you know where to start with!

Case in Focus

A leading independent insurance adjusting firm based in the US was facing issues with the assessment of claim loss reports. The client’s legacy property claims estimation system was inefficient and often powered by incorrect data. To combat this, we integrated AI technologies such as OCR, ML, PyTorch, and Fast AI into the client’s existing software. As a result, the insurance adjusting firm eliminated human errors, improved claims management productivity, and expedited the processing of claim loss reports.