Let’s look at the seven key lessons any FinTech Solutions Provider must keep in mind.

-

1.System performance and compliance are mission-critical

In the FinTech sectors, system performance is crucial to delivery excellence and service quality. If you’re building an Algo Trading Operation or a payments processing service, time is measured in milli or even nanoseconds, and system performance is literally, a game-changer. Similarly, a lot of focus has to be on security and compliance aspects while developing the financial applications to take care of all statutory requirements.The challenge is this: often, developers create software products without considering performance as a vital component; they don’t think of the end-to-end impact and aren’t as efficient when it comes to multi-threading. Clearly, as FinTech product developers, system performance cannot be ignored and must be optimized.

-

2.Quality, Security, and Service Levels are the difference between success and failure

At its most granular level, any financial transaction is built on ‘trust, faith, and reliability’. The technology could straddle diverse areas, but any FinTech product must offer robust security protocols, compliance, and quality of service. In fact, a PWC survey found 56% of respondents peg security concerns as the number one deterrent to the rise of FinTech. Any breach of these above-mentioned factors or even an error could put your product out of business.This is why, beyond the introduction of additional testers, FinTech providers have to think differently and adopt a “quality model” of product development that includes quality of all aspects of the product development rather than testing.

-

3.Why you can’t do without ‘DevOps’

The simple truth behind a DevOps approach is to have seem-less collaboration between the development, release and the continuous deployment processes of the product.Traditionally, any FinTech product will require frequent releases, with several rounds of testing for non- functional requirements such as stability and performance. Often, larger projects have teams split into developers, testers, release managers, and system administrators, all working in silos. Learn more about Damco’s Software Testing procedure!As a FinTech product provider, a DevOps mindset will place all these varied requirements in the hands of the core team, enhancing availability, reliability, and offering a faster time-to-market. Finally, by automating several tasks, one can unravel massive savings in time and costs incurred.

-

4.Learn from Data; be informed by analytics

Every day approximately 2.5 quintillion bytes of data are generated across the world, offering new-age companies the opportunity to glean valuable insights into their customers, products, and market positio ning. Combined with advanced algorithms and tools like predictive analytics and deep learning, raw data could prove to be a storehouse of valuable information. FinTech players are already leveraging predictive analytics as part of their product toolkit. Using historical data, FinTech companies could improve:

There are a number of startups exploring use-cases for data analytics in FinTech. Newer platforms assign a risk score to processed data, flagging high-risk transactions. Another platform combines weather information with a borrower’s financial details to determine creditworthiness in the agricultural industry. Powered by data-driven modules such as these, FinTech products have become more effective, accurate, and future-ready. -

5. New technologies and its manifold implications

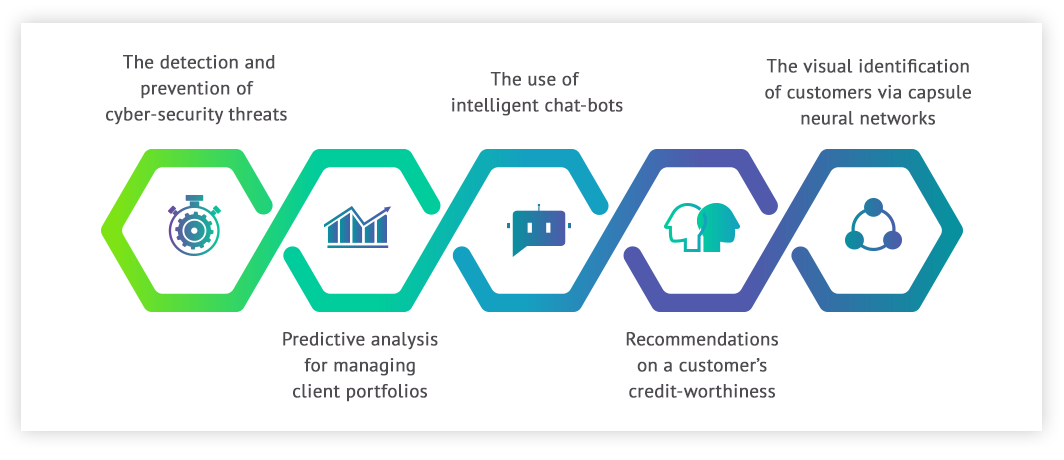

In FinTech, the number of available tools, technologies, and solutions is wide and diverse. Clearly, product providers must look at this ever-growing ambit, and link the selected technology to the nature of the project, while also considering other aspects, such as multi-device, and multi-platform utilization.AI is now a pan-industry buzzword and its application in FinTech is slated to hit extraordinary numbers. Research suggests that the AI market in FinTech will grow from $ 1,337.7 million in 2017 to $ 7,305.6 million by 2022, at a CAGR of 40.4%. Briefly, the four areas of principal impact will be spread across:

‘Blockchain’ is another technology that’s making waves across the FinTech space. A PwC research opines that around 77% of financial services industry leaders are eager to adopt Blockchain technology, by 2020. -

6. The ‘Agility’ Factor

Today, any software product must be created in line with agile methodologies: implying rapid and brief iterations, frequent and customer-sensitive delivery, and consistent feedback. In fact, whether you’re building the product in-house or are working with a consultant, Agile is the way forward. You can choose from a wide array of agile methodologies such as Scrum and Kanban, which aid the building of smarter software solutions, reducing project risks and enhancing business value creation.

-

7. Experience is the Key

FinTech product development is different. A powerful FinTech product should be stable and secure, built on optimized algorithms and of high performance. It requires experienced developers who can build systems that are optimized for performance and stability. And most critically it requires teams with years of FinTech development experience so that you are prepared for the road and challenges ahead.

In case the in-house development team does not possess the required experience, finding and aligning with a mature FinTech development partner could be a prudent alternative for leveraging experienced craftsmanship. Now, when selecting an outsourcing partner, there are certain considerations, one must look into. First, look across your ecosystem and beyond to find a company whose primary product development capacities are directly in-sync with what you need. Finally, search for a team with robust financial domain expertise and capability to handle remote agile projects. Remember, the technology partner must work in close coordination with the business and most important member of your internal team – the product owner. Across the board, research reveals that staff turnover expenses are a vital cog in this entire system.

Generally, turnover rates for software developers vary from 25% to 35%, meaning every third or fourth developer you hire, train, and induct into the development process, will have left you in a year’s time. So focus needs to be on staff attrition within the in-house as well as technology partner teams.

To sum up experience is the key; whether you build the product development team in-house or decide to partner.