At times, running a business with traditional banks and middlemen can be frustrating. Slow transactions, high fees, and endless paperwork eat up time and money. What if there was a way to cut out the middleman and let money move directly, safely, and instantly? That’s where DeFi comes in.

DeFi, or decentralized finance runs on smart contracts that work without banks or brokers. Need loans, payments, or investments? Smart contracts can handle it automatically, 24/7, with no delays or extra costs. But building these contracts isn’t easy. One coding mistake can lead to hacks or lost funds. That’s why secure DeFi smart contract development matters a lot. When done right, it gives businesses faster transactions, lower costs, and complete control over their finances without the risks.

This ultimate guide will walk you through the simple steps for secure DeFi smart contract development. The post also explores the role of composability in DeFi and smart contracts, types of smart contracts in DeFi, and key challenges and solutions. Lastly, it delves into the real-life use cases and the future of DeFi smart contract development in a multi-chain world.

Whether you’re just curious about how DeFi works or thinking of building your own smart contract, this guide will give you the foundation you need. Let’s begin our journey into the world of DeFi smart contract development.

Table of Contents

Understanding the Role of Composability in DeFi and Smart Contracts

- 1. Enables Interoperability and Integration

- 2. Supports Unbundling Monoliths

- 3. Reduces Barriers to Entry

- 4. Enables Complex Financial Strategies

Types of Smart Contracts in DeFi

Key Challenges and Solutions of Smart Contracts in DeFi

- Security Vulnerabilities

- Scalability Problems

- Privacy Issues

- Legal Uncertainty in DeFi

- Composability Risks in DeFi

Developing Smart Contracts with Solidity: Follow These Simple Steps

Use Cases for Smart Contracts in the Defi Ecosystem

The Future of DeFi Smart Contract Development in a Multi-Chain World

Understanding the Role of Composability in DeFi and Smart Contracts

“The future of DeFi lies in composability- smart contracts that seamlessly interact without sacrificing security.” – Stani Kulechov, Founder and CEO of Aave.

Composability enables different protocols and contracts to connect and work together easily. It allows new projects to use existing tools instead of building everything from zero. This makes the whole system more flexible and useful for everyone. Here’s why composability matters:

1. Enables Interoperability and Integration

Composability allows different systems to work together. When systems can communicate smoothly, they create more possibilities. Different DeFi protocols and smart contracts can share data and functions without the middlemen. This connection makes the network stronger as more services join and work together.

2. Supports Unbundling Monoliths

Large, complicated systems often attempt to handle everything together. Breaking them into smaller pieces makes each part work better. These pieces then combine in different ways as needed, giving users more choices and better results. This flexible arrangement quickly adapts as needs change over time. In other words, simple building blocks create more possibilities than rigid structures.

3. Reduces Barriers to Entry

New projects don’t need to build everything from the ground up. Instead, they can integrate with established protocols for liquidity, oracles, or governance, lowering development costs and time-to-market.

4. Enables Complex Financial Strategies

Flash loans, arbitrage, and cross-protocol leveraged farming are only possible because smart contracts can interact permissionlessly. Traders can borrow, swap, and repay in a single transaction, something unique to DeFi.

Composability keeps the door open for progress. It lets people build on what already works instead of starting over. This approach makes the space more open, useful, and ready for whatever comes next. The ability to work together is what makes this technology different from older systems.

Types of Smart Contracts in DeFi

From exchanges to lenders, DeFi uses various smart contract designs. These main types power the different financial services you can access without traditional banks.

| Type of Smart Contract | What It Does | Example | Key Benefit |

|---|---|---|---|

| Lending and Borrowing Contracts | Lets people lend their money or borrow money by using other assets as security | Aave, Compound | Earn interest or get loans without banks |

| Decentralized Exchange (DEX) | Helps people trade cryptocurrencies without a middleman | Uniswap, SushiSwap, PancakeSwap | No sign-up needed, fast trades, open anytime, low fees |

| Automated Market Maker (AMM) | Automatically sets prices and helps trade using pools of assets | Uniswap, Balancer | Easy trading, always available |

| Insurance Contracts | Automatically pays out insurance claims when specific conditions are fulfilled | DeFi insurance platforms such as Nexus Mutual, InsurAce, Opium Insurance, etc. | Reduces fraud and speeds up payouts |

| Payment Contracts | Moves money between people automatically when rules are followed | Crypto payments | Makes payments fast and secure |

| Escrow Contracts | Holds money safely until both sides complete their part of a deal | Real estate deals | Adds safety to transactions, protects both buyer and seller |

| Options and Futures | Allows traders to buy or sell assets at a particular price in the future | Opyn, dYdX | Helps traders plan for price changes |

| Staking Pools | Secures crypto assets to support blockchain and get rewards | Lido, Rocket Pool | Earns rewards with low effort |

| Synthetic Assets | Tracks real-world assets (like gold) using crypto | Synthetix | Trade real assets on blockchain |

Key Challenges and Solutions of Smart Contracts in DeFi

Smart contracts in DeFi aren’t always perfect. While they automate finance well, some problems can pop up anytime. The good news? For every challenge, there are practical fixes that keep things running safely.

I. Security Vulnerabilities

In DeFi, smart contracts act like digital agreements that handle money automatically. If there’s a mistake in the code, hackers could take advantage of it and steal funds. Since these contracts can’t be changed once they’re live, fixing errors is tough. Even small coding issues can lead to big problems, making security a major concern.

How to Fix It

Before launching, smart contracts should be checked multiple times by different experts. Automated tools can also scan for common errors. Writing simple, clean code lowers the possibility of mistakes.

II. Scalability Problems

Sometimes, DeFi platforms using smart contracts struggle when too many people use them at once. The network gets slow, and transaction fees rise. This happens because blockchain networks have limits on how many transactions they can handle quickly.

How to Fix It

Improving blockchain technology with faster networks and layer-2 solutions can help. Splitting transactions across multiple chains or using more efficient systems can reduce delays and costs.

III. Privacy Issues

Most blockchain transactions are open and visible to everyone. While this keeps things fair, it also means people can track what others are doing. For those who want privacy, this can be a problem, especially if they don’t want their financial moves exposed.

How to Fix It

Some blockchains now offer features that hide transaction details. Special encryption methods can keep data private while still ensuring security.

IV. Legal Uncertainty in DeFi

Laws around DeFi and smart contracts are still unclear in many places. This makes it hard for projects to know what’s allowed. Users might also accidentally break rules without realizing it, leading to risks.

How to Fix It

DeFi platforms should try to follow existing financial rules where possible. Working with regulators to create clear guidelines can help avoid future problems.

V. Composability Risks in DeFi

Smart contracts in DeFi are often designed to work together. When one contract interacts with another, problems in one can spread to others. This interconnectedness means a single weak contract can affect many apps at once. Since these systems depend on each other, failures can quickly become widespread, putting user funds at risk.

How to Fix It

Developers must test how contracts interact before releasing them. Setting clear limits on how much contracts can affect each other helps prevent problems if something goes wrong.

How Smart Contracts are Streamlining Processes and Reshaping Industries

Developing Smart Contracts with Solidity: Follow These Simple Steps

Creating smart contracts that can grow with your needs doesn’t have to be complicated. By following these simple steps, you can build contracts that work smoothly even as more people start using them.

1. Define Clear Requirements and Objectives

First things first, write down what the smart contract needs to do. Be specific about its purpose and functions. List all the features it should have and how users will interact. Consider what problems it solves and who will use it. Keep this simple and direct. Clear goals prevent confusion later and help you stay on track. This step ensures your contract does only what’s needed without extra complexity. Writing it down makes it easier to check progress. Conversely, skipping this leads to wasted time and unclear results.

2. Choose the Right Blockchain Platform

Different platforms have different strengths. Some handle transactions faster, while others cost less to use. Security levels also vary between them. Pick one that matches your contract’s needs. Also, consider where users are and what they expect. Since this decision affects how well the contract performs. It also impacts costs for users. That’s why it’s crucial to research options before deciding. The wrong platform causes problems later. The decision can’t easily be changed once implemented.

3. Set Up the Development Environment

Install the basic tools needed to write smart contracts. You will require a code programmer to write your Solidity code. Next, install Node.js to run JS tools. Then, add frameworks like Hardhat or Truffle to help build and test contracts. Also, set up a local blockchain simulator such as Ganache for testing contracts in a controlled environment without incurring real costs. Furthermore, install Metamask to establish a connection to blockchain networks. Configure everything to work together smoothly. Check that all tools can communicate properly. This setup lets you write, test, and debug contracts before deploying them. Having everything ready makes development faster and prevents problems later.

4. Design the Smart Contract Architecture

Plan how your contract will be structured before writing code. Decide what parts need to be separated and how they connect. Keep important functions simple and organized. Make sure data storage is efficient to save costs. Also, think about future changes that might be needed. A good structure makes the contract easier to maintain. However, poor design leads to problems when adding features later. This step helps avoid rewriting code multiple times. Write down the plan clearly before starting. The architecture should match the requirements defined earlier.

5. Write the Smart Contract Code in Solidity

Start coding using the planned structure. Write clear and short functions that do one thing each. Follow standard practices to make the code readable. Avoid unnecessary complexity that could cause errors. Check each part works as intended before moving forward. Keep security in mind throughout the process. Leverage comments to clearly define what the code does. This helps others understand it later. Writing good code takes time, but it prevents issues. Mistakes here can be costly to fix after deployment.

6. Test Rigorously

Testing is about checking every part of the smart contract to make sure it works correctly. Start by testing normal situations, like what happens when users do what they’re supposed to do. Then test edge cases like what happens when something unexpected occurs, like wrong inputs or unusual behavior. Use automated tests using frameworks like Hardhat or Foundry to run checks quickly and repeatedly. Fix any problems before moving forward. Testing helps catch mistakes early, saving time and money later. The more you test, the more reliable your contract will be.

7. Compile and Deploy the Contract

When your code is ready and tested, put it on the blockchain network, such as Ethereum mainnet or a layer-2 solution for better scalability and lower fees. First, connect to the network you chose. Use tools, such as Remix or Hardhat to make your contract go live. You’ll need some cryptocurrency to pay the deployment fee. Wait for the network to confirm your contract. Check that it appears where it should. Save the contract address and verify that people can find and use it properly. Write down details about when and where you deployed it. Deployment makes your contract available for use. This step requires careful attention to details. Mistakes here can’t be undone. Once live, users can start interacting with your contract.

8. Monitor and Maintain Post-Deployment

After your contract is live, keep watching how it works. Check for any unexpected behavior or errors. Look at transaction records to spot problems. Also, be ready to fix issues if they come up. Even small changes in network conditions can affect performance. Regular checks help catch problems early. Furthermore, maintenance keeps your contract working smoothly over time. Update documentation when changes are made and stay aware of any updates needed for security. Good monitoring prevents bigger issues later. This ongoing work is just as important as building the contract.

9. Document and Share

Write clear instructions about how your contract works. Explain what each part does in simple terms. Include how to use it and what to expect. Share this information with users and developers. Good documentation helps others understand and trust the work. It also makes troubleshooting easier when needed. Keep the documents updated with any changes. This step is often skipped but is indispensable. Clear documents save time and prevent confusion for everyone involved.

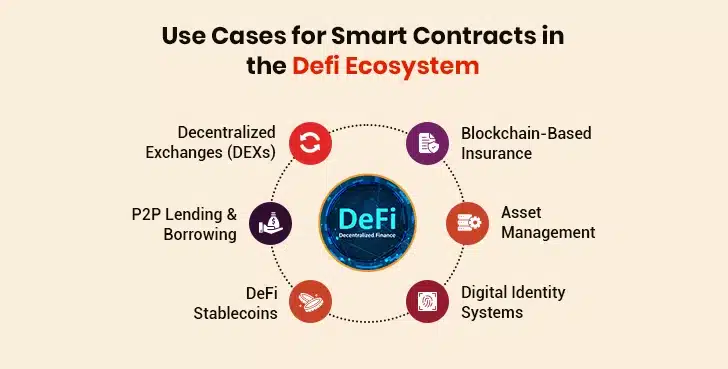

Use Cases for Smart Contracts in the Defi Ecosystem

Smart contracts are changing how DeFi works. These real examples show how they handle money matters automatically, making services faster and more secure without middlemen. Here’s where they’re making the biggest difference today.

I. Decentralized Exchanges (DEXs)

People need a way to trade digital money directly with each other without going through a bank or company. DeFi smart contract development makes this possible by creating open marketplaces that run automatically. These contracts hold everyone’s money safely while trades happen, making sure no one cheats. They set fair prices based on how much people want to buy or sell. Anyone can join in trading or even help provide money for others to trade with, earning small fees in return. The best part is that these exchanges never close. They keep working all the time without anyone controlling them.

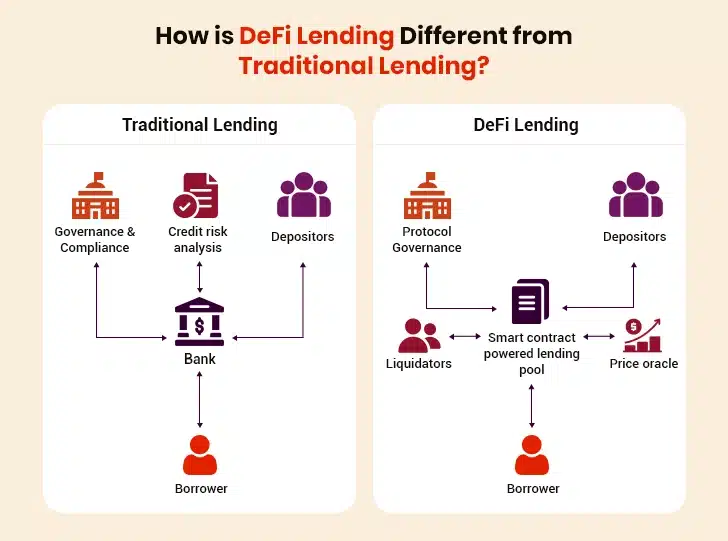

II. P2P Lending & Borrowing

Sometimes people have extra money they want to earn interest, while others need to borrow. Smart contracts connect these people directly. The contracts check if borrowers put up enough collateral to secure their loans. They set interest rates that change automatically based on how many people want to borrow. When loan payments are due, the contracts handle everything without reminders. If someone doesn’t pay back, the contract manages the collateral fairly. Lenders don’t need to know who they’re lending to. They just earn interest automatically based on the clear rules in the contract. This could be the reason behind the rise of the P2P lending market, which is projected to hit $1.02T by 2032.

III. DeFi Stablecoins

Regular digital money often changes value too quickly for everyday use. Stablecoins solve this by staying at a steady value, usually matching the dollar. Smart contracts manage this stability automatically. They hold reserves of other money to back up each stablecoin created. When you want your money back, the contract unlocks these reserves. The system constantly checks prices and adjusts to keep the value stable. This lets people use digital money without worrying about sudden price jumps. Stablecoins move easily between different services in the digital money world, making them useful for everything from shopping to getting paid.

IV. Blockchain-Based Insurance

DeFi smart contract development makes insurance simpler and more transparent. The terms get written directly into code so everyone can see them clearly. When someone needs to make a claim, the contract checks if it meets the conditions automatically. If everything matches, the payment happens right away without waiting for approval. This removes delays and arguments about whether a claim should be paid. Premiums from many users get pooled together securely. Since the rules can’t be changed later, people trust the system more. It works the same way every time without anyone interfering.

V. Asset Management

Managing investments becomes easier with smart contracts handling the work. They follow the exact instructions given to them when buying or selling assets. The contracts spread money across different options to keep things balanced and reduce risk. They keep track of all transactions clearly on the blockchain, where anyone can verify them. Users don’t need to rely on human managers who might make mistakes or charge high fees. Everything operates by the preset rules at all times. When market conditions shift, the adjustments happen immediately according to the plan.

VI. Digital Identity Systems

Personal information can be stored securely using smart contracts and DeFi. They give users control over who sees their data and when. Instead of sharing full details, people can prove things about themselves without revealing everything. The contracts check requests for information against what the user allows. This reduces fraud while keeping privacy intact. Organizations can trust that the data is real without holding copies themselves. If changes need to be made, the owner updates their information directly. The system works without a central authority managing everyone’s identities.

Simplifying Real Estate Transactions with Smart Contracts and AI

The Future of DeFi Smart Contract Development in a Multi-Chain World

The future of DeFi smart contracts will focus on working smoothly across different blockchains. As more networks emerge, contracts will need to move assets and data between them without friction. Developers will build tools that let contracts communicate across chains while keeping everything secure. Costs will matter too, since contracts must stay affordable no matter which chain they’re on. Security will get stronger to handle risks that come with cross-chain interactions. Standards will develop so that contracts on different networks can understand each other. The user experience will also improve, making it simpler for people to use DeFi across multiple chains without technical know-how. Over time, contracts will automatically choose the best chain for each task while working together behind the scenes. This multi-chain approach will make DeFi more flexible and open to everyone.

Drive Business Impact with Damco’s Expertise

To sum it up, smart contracts are like digital rulebooks that power the DeFi world. They cut out the middleman, making financial deals faster, cheaper, and more secure. Whether it’s lending, borrowing, or trading, these self-executing contracts handle everything automatically once the conditions are met.

The best part? DeFi opens up finance to anyone with an internet connection. As DeFi grows, smart contracts will keep making finance more open and efficient. Overall, smart contracts are the backbone of DeFi. These contracts have made it possible to build a financial system that is transparent, efficient, and available to all. If you are planning for DeFi smart contract development, you may follow the best practices listed above or seek consultation from a reliable Blockchain expert like Damco that has delivered 1000+ products, applications, and solutions.