Remember the old days when we used to stand in the bank queue to make deposits, encash a cheque, get a demand draft issue, and process loans? While some of these practices continue even today, the modern banking sector has evolved exponentially to launch several new verticals — fraud detection, fraud mitigation, recovery, and credit card, among others. Each of these departments involves a slew of transactional processes that are time-sensitive, repetitive, and mundane.

Features of Modern Banking

- Online Banking

- Mobile Banking

- Wide Range of New services- Credit cards, international debit cards, etc.

- Para-banking Activities like insurance, Digital Gold bonds, Mutual funds, etc.

- Local Service through Global Standards

The banking and financial services professionals have to be on their toes while performing their duties since even a minor error can incur significant losses. That’s why many banks and financial institutions are constantly looking for an automation tool that can help eliminate manual errors and improve operational efficiency, offer 100% accuracy, and reduce costs.

This is where RPA can help. In fact, RPA in finance can automate some of the most time-intensive tasks such as mortgage processing, claims processing, transactional data management, collections, billings, compliance, and to name a few, giving businesses ample opportunities and time to explore and tap into important and evolving market avenues. This may be the reason why nearly 80% of finance leaders have already implemented or are planning to implement Robotic Process Automation.

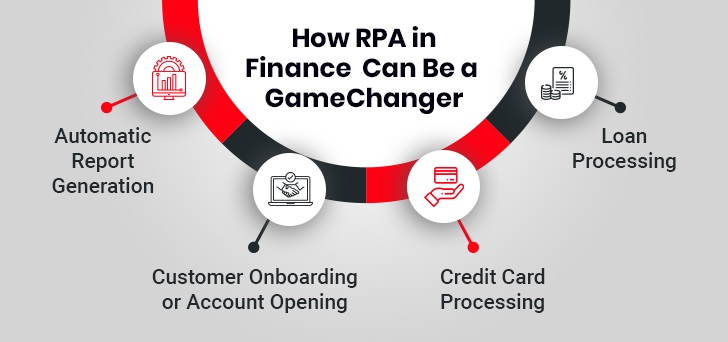

4 Promising RPA Use Cases in Finance

1. Automatic Report Generation

Regularly, banking and financial institutions have to prepare compliance reports for all fraudulent transactions in the form of SARs (suspicious activity reports). Earlier, compliance officers read such detailed reports manually to fill out the pertinent details in the questionable activity report form. This extremely laborious and mundane task demands an enormous amount of effort and time. However, this cumbersome task is now done in a quick turnaround time, thanks to RPA. In other words, the digital workforce would skim all those lengthy compliance documents and extract the precise information that needs to be filled in a SAR form. This will cut operational costs and save a significant amount of time.

How to Automate Complex Business Processes With RPA

2. Customer Onboarding or Account Opening

Opening a new bank account is lengthy since many documents need manual verification. However, this protracted customer onboarding process can be automated with Robotic Process Automation (RPA). The tools designed using this technology would help extract the relevant data of customers from the KYC documents- leveraging the popular OCR (optical character recognition) technique. The extracted data can further be validated with the data given by customers in the account opening form. If there is no discrepancy found post-data validation, the same data can be automatically fetched into the CRM portal of banking and financial institutions. In a nutshell, RPA for financial services can reduce manual errors and save a lot of productive hours and effort invested by banking staff.

Exploring the Feasibility and Benefits of RPA in Banking and Finance

3. Credit Card Processing

Credit card processing is also a lengthy and cumbersome process like account opening or customer onboarding because of multiple validation checks conducted by banks. However, with Robotic Process Automation (RPA), banks can quickly approve or disapprove the request of an applicant by simply using a rule-based approach. There are multiple other roles that RPA can play in the finance sector- one of which is in loan processing.

4. Loan Processing

It’s another tedious process that eats up most of an employee’s productive time. Though many banks have embraced intelligent automation in financial services and automated the cumbersome loan process to a certain extent, however, with RPA implementation, they can further automate it and bring it down to barely 10-15 minutes. That’s a difference-maker.

Explore the Game-changing Benefits of RPA in Banking

I. Integration With Existing Legacy Systems

Integrating emerging technologies with existing systems is one of the common challenges faced by banking institutions. The good news is that RPA offers seamless integration capabilities with legacy systems, allowing banks to harness the benefits of automation without the need for extensive system overhauls.

II. Real-time Reporting and Data Analytics

Access to real-time data and analytics is critical for making informed decisions in the banking sector. RPA facilitates the generation of reports in real-time by automating data collection, analysis, and reporting processes. This in turn, empowers banking institutions to stay agile, competitive, and responsive to customer trends, regulatory requirements, and market dynamics.

III. Cost-effective Solution

The banking industry is also emphasizing cost savings- critical to every business domain. While some perceive that Robotic Process Automation (RPA) doesn’t help cost savings but is applicable only in operational efficiency, various survey reports suggest otherwise. Incorporating this technology in the banking system can save around 25-50% of the overall costs.

IV. Higher Adaptability Towards Changes

In business, adaptability towards something new requires a reasonable amount of time. When you have a rigid system in place, it becomes pretty challenging to implement the suggested changes in a process; however, in the case of RPA, software bots are flexible enough to integrate any difference, and that too, in a lesser period.

V. Rapid Implementation

It’s quick and easy to implement in the baking industry. The software bots could be tested in short-cycle iterations. Thus, banks can save a significant amount of time for implementation.

Wrapping Up

The key takeaway here is that RPA in financial services holds immense potential. If appropriately implemented, it can help banking and financial institutions increase productivity, improve work efficiency, cost-saving, and customer satisfaction. In short, RPA would help transform banking and the financial industry. Don’t get left behind. Seek the proper guidance from our seasoned RPA professionals starting today.