Deliver The Next-Gen Policyholder Experience with New-Age Insurance Management System: InsureEdge

Insurance companies, often characterized by traditional business frameworks and operational complexities, are now at a crossroads where technological shifts, evolving customer behaviors, and new strategic demands are pushing for significant transformation. They face threats like new competition, legacy technology issues, rising costs, and an increasingly demanding regulatory environment. At the same time, the customer journey is becoming more complex as preferences are shifting to hybrid, multi-channel, and multi-touch interactions. Both insurance agents and buyers across multiple lines of businesses (LoBs) are demanding more transparent and convenient processes from insurance carriers. To meet these demands, Damco —a leading insurance software company— has designed InsureEdge, a comprehensive insurance software solution for policy administration and claims management that retools insurance carriers with the “digital first” approach and drive change rather than be driven by change. We understand the multifaceted challenges that insurers face involving timely processing of claims, renewing existing policies, easy access to policy documents and addressing customer queries efficiently. Our robust insurance management software, InsureEdge, is tailored to address these specific business needs of insurers in the most cost-effective manner.

Developed with in-depth domain understanding and 20+ years of insurance industry software expertise, Damco’s InsureEdge, is a unified insurance management system that helps insurance carriers manage critical operational processes across policy administration, claims processing, and reinsurance processes efficiently and cost-effectively. Fueled by easy to configure and scalable modules, InsureEdge empowers different departments of an insurance firm by driving new business opportunities, manage/renew existing customer policies, timely claims processing, and effective addressal of customer queries while saving time, efforts, and costs.

How Has InsureEdge Helped Our Clients?

20+

Global Insurers as Proud Users

35%

Growth in Policy Sales

70%

Improvement in Customer Satisfaction

23%

Improvement in Conversion Ratio

29%

Improvement in Retention Ratio

Optimize Insurance Operations with InsureEdge’s Flexible, Scalable, and Ready-to-Use Modules

A state-of-the-art, insurance software solution, InsureEdge optimizes end-to-end organizational processes with its predefined functionalities provided as integrated, easy to scale and configure modules.

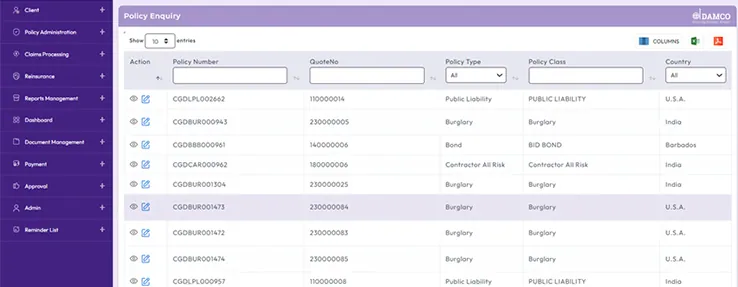

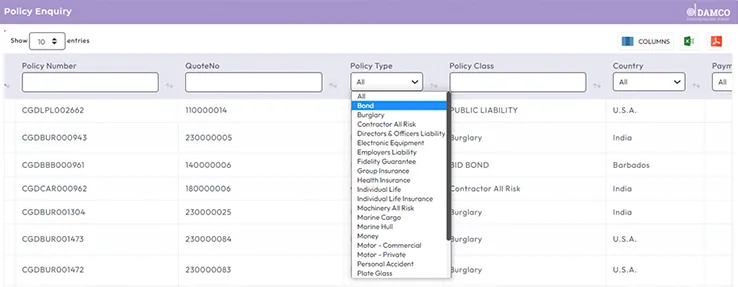

Policy Administration

Fully automated and efficient creation of personalized quotes, endorsements, policy renewals, cancellations and documentation

Claims Processing

End-to-end claims processing from FNOL through settlement, enabled by AI/ML and Intelligent Document Processing (IDP) for speed and precision

CRM

Seamless communication management with clients, brokers, agents, and vendors

Customer Acquisition

Better identification of target customers, collation and conversion of leads from multiple sources

Customer Onboarding & Servicing

Digital onboarding for faster delivery of value to policy holders and map customer journeys

Document Access and Generation

Easy generation and access to policy and claim related documents anywhere and anytime

Product Administration

Ease of system configuration customization, access control, and user management

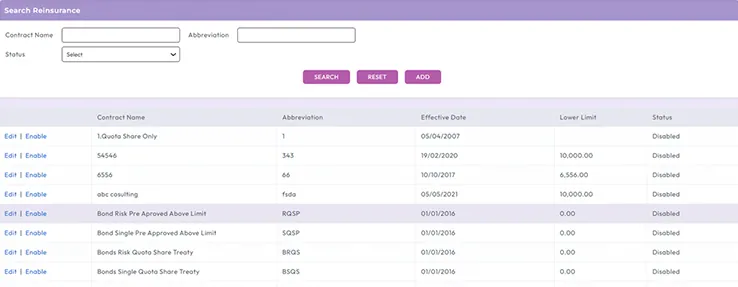

Reinsurance

Configure reinsurance treaties and facultative arrangements, while integrating within policy administration

Agency & Customer Portals

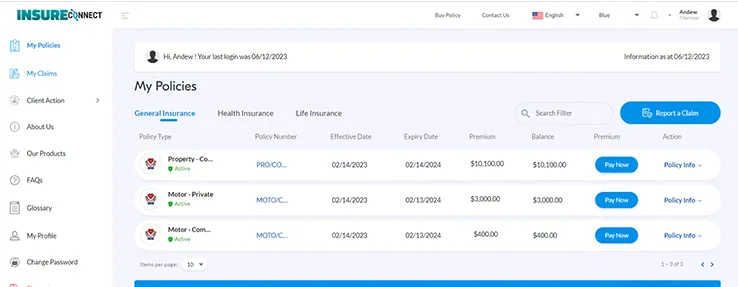

Manage agents with real-time data exchange between brokers/agents and users. An interactive customer portal to improve transparency and reduce repetitive tasks

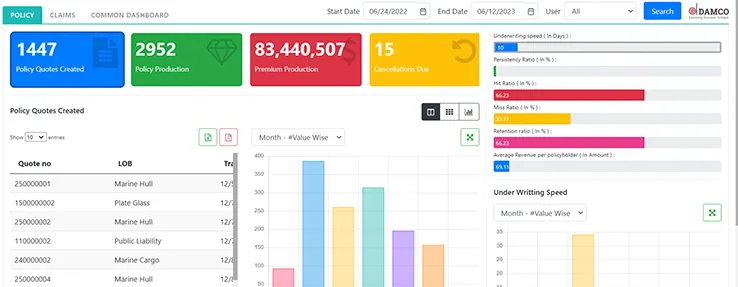

Dashboard & Reporting

80+ standard and statistical reports for quick data access and analysis

Document Management

Ease of uploading and managing multiple policy and claim documents

Mobile App

A customer-centric mobile app for policy management, payments, or raising queries

Elevate Your Insurance Game and Deliver Seamless Customer Experiences with InsureEdge

Download BrochureInsureEdge’s Value Proposition

From ease of compliance and third-party integrations to an expansion-friendly model, InsureEdge brings all functionalities of insurance management software under one ecosystem to deliver seamless services for all players of the insurance value chain.

Innovative & Transformative Functionalities

- An insurance industry-specific product with a detailed future roadmap

- A unique global service delivery model to cater worldwide customers

- Ease of creating different product lines including General, Life, Health, and Pension

- Enabled by an efficient and simpler IT ecosystem

- Multi-level treaty setup model

- Supports facultive (FAC) inward and outward business

- Inclusion of all bordereau reports

- An IFRS 17 compliant system with data points for IFRS reporting

- Easy data access points to push data into Data Lake or Data Warehouse for further reporting

- Improved monitoring with data-driven dashboards and reports

- Integrated, self-service customer portal for self-portfolio management

- Ease of premium payments

- Quick policy documents submission and downloads

Robust & Resilient Technology Functionalities

A Growth-Friendly Licensing Model

- Supports unlimited number of users without any restrictions

- Pre-built integration with license banks for ease of expansion across regions

Multi Country and Multi-Currency Model

- A multi-company and multi-geography supporting setup

- Supports multi-currency setup across different profit centers

- Ease of consolidated reporting at headquarter level

Simple Workflows for Easy Adoption

- Simplistic data flow in UI for quick and easy learning

- Pre-defined local risk definition in policy and claims screen

APIs for Third Party Integrations

- Open API library for easy integrations with loyalty system, accounting system, and regulatory state managed systems, etc.

InsureEdge Lines of Business

Damco, a leading insurance software company, has developed InsureEdge as a one-stop insurance software platform that addresses multivariate needs across multiple lines of business – Life, Health, and General Insurance.

Property & Casualty (P&C) Insurance

Damco’s InsureEdge covers P&C policy details and has automated renewal features and claims workflow management. Insurers can automate and digitize business processes through the unified dashboard of this insurance management system while having access to all facets of P&C insurance such as policy, rating, billing, claims, data analytics, and more.

- Exception-based underwriting by risk, user, policy, and transaction type

- Automation and integration of customer service, underwriting, claims, policy management, and back-end processes via end-to-end integrations

- A highly interactive dashboard that showcases real-time business- critical data with ready regulatory and statutory reports for greater business control

Health Insurance

InsureEdge brings efficiency and digitization to the health insurance space by modernizing systems and strategizing processes. The unique automated software for insurance companies helps reduce the time and cost of performing mission-critical business functions like claims processing, benefit administration, and more.

- Member enrollment portal for seamless management of policy holders’ eligibility under managed care plans

- Leverage digital tools to compare products in real time, assess benefits, and streamline customer feedback

- In-built wizard automates recurring payments

- Includes medical provider integration tools and provider portal

Life Insurance

InsureEdge accelerates life insurers’ speed to market by modernizing policy lifecycle. Insurers can develop and generate new life and annuity plans, automate operations, and efficiently manage work processes by leveraging this insurance management software’s self-service and easy-to-use features.

- Automated rule-based underwriting for less complex/low face value applications

- Leverage the power of analytics to strategize your life insurance business

- Automate tricky tasks using Artificial Intelligence

Cannabis Insurance

InsureEdge is designed to accommodate the unique needs of cannabis insurance, an exponentially rising industry of the United States. The state-of-the-art digital insurance process management solution helps cannabis insurers digitize their operations by automating their end-to-end processes while meeting the inter-state multi-state regulatory and compliance requirements.

- Digital-first and cost-effective insurance workflows

- One common platform covering General & Product Liability, Commercial Property, and Cyber Security

- A growth-friendly, multi-company, and multi-state setup

- Quick and hassle-free implementation

Why Choose InsureEdge as Your Insurance Management System?

Web-based digital platform-driven customer experience

Supports multiple lines of business

Reduced policy servicing TAT

Better adherence to regulation and compliance

Increased team productivity

Better insights powered by data-driven dashboards and reports

Damco’s InsureEdge Reviews

“The most practical solution for our insurance operations. The desktop version of it has one screen where you can manage policies, customer and claim details. This solution also provides a centralized repository for all documents, thus increasing the overall productivity.”

“The tool that reduced time in policy clearance. A highly seamless policy and claim management process. The reporting become easy with this tool, just a single click to create reports. The interactive tool dashboard really helps in reporting.”

"This solution is a game changer for our operations, it practically does the robot work for us with task automation, and our data accuracy got a major upgrade. It's like our productivity got a turbo boost, and customers are loving the smoother experience."

FAQs

There are multifold benefits of an insurance management software like InsureEdge. From automating mundane, manual tasks to saving time, money, frustration, and lost business – an efficient insurance company software like InsureEdge stimulates your business growth. Whether it is a small insurance firm or a large enterprise covering multiple geographies, the capabilities of such a software for insurance company management maximizes revenue through improved productivity. For more, read our detailed article.

InsureEdge is one of the leading, end-to-end insurance management systems for agents, carriers, and customers who can pick and choose the offerings that are suitable for their business. The cost of such cloud-based insurance software system usually depends on the desired feature set. Contact us for a demo today and we can get the exact pricing information according to your business requirements.

As one of the leading insurance software companies, we understand how critical customer data is for your business, especially with employees working from different geographical locations. Our insurance tech experts have designed InsureEdge by keeping data security as the priority. You can customize the insurance software solutions’ configuration, add/delete/modify users, and control their access to your modules.

Our simple 4-stage implementation process ensures that InsureEdge is up and running in no time. However, several factors play an important role in the implementation time, including required module customizations, scope of operations, business goals, our insurance technology team ensures on-time implementation of the best insurance software in sync with your requirements.

InsureEdge is a unified, end-to-end policy administration and claims management software for insurance companies and is easy-to-use, scalable, and secure enough to handle business- sensitive data. It is developed to work for multiple lines of business such as Life, Health, and P&C insurance, and interacts seamlessly with all the existing systems and legacy software.

As one of the best insurance software companies, we leveraged extensive insurance domain knowledge and experience to create InsurEdge, one of the most preferred insurance management systems for agents, carriers, and employees alike.