Inject More Credibility Into Your Claims Adjustment Business

During a major catastrophe, both the insurer and the insured want the same thing-to process property damage-related claims faster, efficiently and accurately. Insurance companies take the help of claims adjusters to inspect the damaged property and prepare an accurate loss estimation report. The adjusters use advanced estimation tools such as Xactimate to prepare the loss reports on the basis of gathered loss information and sketches/images of the structure, which then gets reviewed by the quality assurance (QA) team before getting submitted to insurers. But, even a small human error during report preparation can lead to multiple reviews by the QA team, site revisits, disagreements between insurers and claimants and also inaccurate claims settlements. So, how can one ensure accurate claims estimation?

Damco’s Accurate Loss Estimation Solution

Damco’s Machine Learning (ML)-powered-solution validates the loss estimation report using the tools adjusters use and identifies the errors in minutes. It helps adjusters and carriers prepare a fast and accurate loss estimate report which is critical to processing a claim efficiently while reducing the claims handling cost and unnecessary rework. The solution solves the following challenges for carriers and adjusters:

For Insurance Adjusters

- Human errors during loss estimation report preparation

- Multiple reviews by Quality Assurance teams

- Pressure of submitting loss reports on time

- Over-stretched workforce during a major catastrophe

- Less room to scale business due to occupied QA and adjuster teams

- Low credibility in adjustment business

For Insurance Carriers

- Discrepancy between actual damage and value mentioned in loss reports

- High claims handling cost

- Inaccurate claims settlement

- Delay in the claims process

- Dissatisfied customers

How it Works

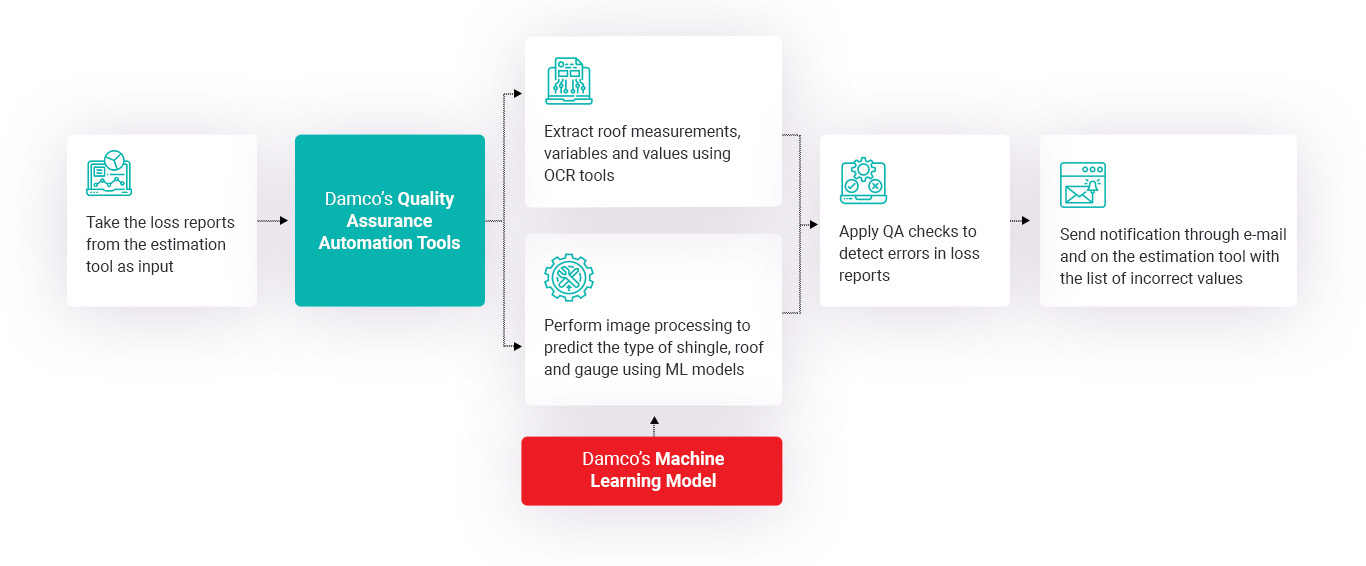

The Advanced Analytics (AI)-based solution leverages Optical Character Recognition (OCR) tools and Machine Learning (ML) models to analyze the images captured in the loss estimation reports. It can feed in different sets of QA rules and checks to detect errors as per your requirements.

Success Story

Damco helped a leading US-based independent insurance adjusting firm eliminate human errors in loss reports, increase the productivity of QA teams and improve customer experience with faster claims settlements.

The client was facing challenges with its loss estimation reports that lacked accuracy with respect to the identification of house roof material (Hip, Gable, and Shed) and type of roof shingles. This led to multiple checks by the Quality Assurance team before the report was submitted to the insurance carrier. Know more

Why Damco?

We are a Big Small Company

Big in terms of wide coverage of technology, maturity of processes and complexity of projects delivered; small in terms of less hierarchy, unmatched attention and agility

We are Global

2000+ strong team across US, UK, Luxembourg, Middle East, Caribbean and India

More Than Two Decades of Experience

Demonstrated 26+ years of experience in delivering IT services & solutions to customers worldwide

And Flexible

Offer flexible engagement models. Teams can be made available onsite, off-site, offshore or in a hybrid engagement

Delivering Solutions Befitting Your Needs

With expertise in emerging & legacy technologies, we deliver best-suited solutions appropriate for your business needs

Focused On Quality

Commitment to Quality and Established Engineering Processes, ISO & CMMI certified organization

With Best-In-Class Expertise

Functional competence and technology expertise for a broad range of industries and platforms

Ensuring Success. Always

We are committed to partner-centric business model building sustainable relationships taking full ownership of the engagement success