The finance sector has been bogged down for a long time due to the weight of time-consuming and resource-intensive processes like KYC, account opening, customer services, etc. Making the situation even challenging, the finance sector is stretched thin for both time as well as resources. Everyone from sales reps to C-suite needs well-organized financial data and quick analysis to make the right decisions at the right time. Implementing RPA in finance, therefore, helps in gaining the most powerful commodity, which is time.

Given the highly saturated and intensely competitive nature of the finance sector, RPA is creatively disrupting the businesses, helping them strive and thrive in dynamic and volatile environments. It is an investment that delivers results right from day one. The rule-based bots can easily imitate human actions and perform no-brainer tasks much more efficiently. It is a fail-proof way to simplify complex processes, streamline tedium workflows, and save big on costs and time. No doubt why RPA in the BFS sector is projected to reach $1.12 billion by the year 2025!

Is RPA the Right Thing to Implement in Finance? Let’s Find Out

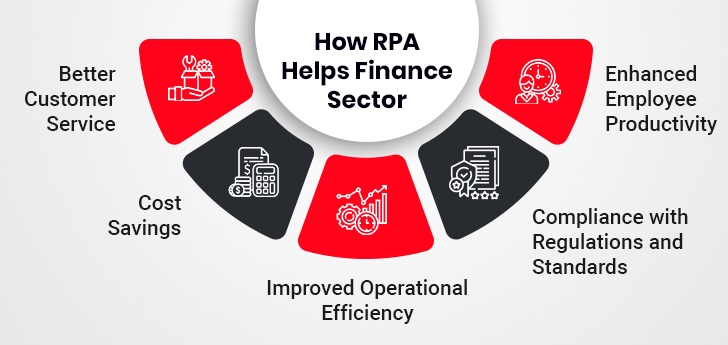

Robotic process automation in finance holds immense potential to revolutionize non-core but important processes at granular levels and reshape the outcomes in the future. As with automation, businesses are better equipped to perform repetitive manual tasks such as data entry, data capturing and verification, Know Your Consumer (KYC), financial reporting and closing, etc., at an exponentially faster speed and much more proficiently than a manual operator. Leaders, thus, embrace automation as it sustainably revolutionizes processes at every level and enables employees to focus on creativity, planning, and decision-making. Consequently, businesses can deliver exceptional customer experience and complement their peers in the industry.

Discover the Strategic Benefits of RPA

RPA Use Cases in Finance

Automation brings in many business opportunities for organizations and individuals. Leveraging RPA in financial services bridges gaps in legacy systems and drives greater efficiencies, including operations and audits. It helps businesses to accelerate time to value, increase throughput, and reduce the possibilities of human error. Let’s go through some of the strategic use cases of robotic process automation in finance in detail:

1. Data Management

Delivering operational and financial reports is often a challenge for businesses operating in this sector. Moreover, making these reports includes various non-core yet essential activities, like data collection, cleansing, formatting, aggregating, processing and analysis to get business-critical insights. RPA technology, thus, takes over all these rule-based tasks, resulting in astute analysis and visual representation of insights at a faster turnaround time.

2. Accounts Reconciliation

The bots can efficiently manage processes, including uploading transaction data from various sources and executing exceptional research and validation. This digital workforce can oversee the task of accounts reconciliation that includes creating, balancing, noting, and remediating discrepancies within the journal entries. The task of posting data from applications such as Excel to sub-ledgers can also be offloaded to bots. Furthermore, businesses can leverage automation to streamline the financial closing and reporting process by creating and delivering compliant financial data to regulatory bodies.

3. Compliance

The nature of the industry demands that financial institutions, banks, and insurance companies be legally compliant. Adhering to all such laws and compliances becomes challenging for businesses as every state, country, company, trade union, etc., has different standards. Whereas, failing to comply with these rules can lead to lawsuits or hefty penalties. Thanks to RPA in the finance sector, the new virtual workforce addresses compliance-related discrepancies in real-time and assists companies in abiding by the laws. These intelligent bots also ensure that the KYC information is accurate, helping boost a company’s reputation.

4. Client Onboarding

Customers today value hassle-free onboarding experiences more, where the process is done with just a few clicks and doesn’t take much time. By leveraging robotic process automation solutions strategically, financial institutions can streamline and accelerate their customer onboarding process. Bots can be used to automate ancillary tasks including KYC (Know Your Customer) checks, document verification, account setup, etc. This not only creates a more positive and hassle-free experience for customers, but also expedites time-to-revenue for businesses.

5. Fraud Detection and Prevention

RPA in finance can be used as a trusted watchdog against all suspicious and fraudulent activities. Unlike manual operators, the bots can tirelessly scan and analyze large datasets of financial transactions. They can identify patterns and anomalies that deviate from established norms, indicating potentially fraudulent activity, and flagging them for human review. Such a proactive approach facilitates timely financial controls and safeguards against potential financial losses.

Discover RPA Trends in Insurance

The Way Forward – Intelligent Process Automation

Leveraging RPA in financial services is the only sustainable way forward to cope with the rising costs and shrinking budgets. This virtual workforce can be integrated with existing systems; thus, translating into faster processes, quicker time-to-market, and efficiency gains. It can also assist the organizations in elevating their customer experience, employee experience, and ease their procurement processes. Therefore, implementing automation is beneficial for both the institution and the employee.

Besides, RPA, when combined with AI results in an IPA or Intelligent Process Automation. It supports businesses with rules-based decision-making tasks; thus, enhancing the bottom-line growth of every business significantly. You can seek professional assistance for RPA implementation to embrace the transformative impact of this revolutionary technology and scale new heights.