Lending companies today are equipped with a range of options when it comes to loan management software. Based on the kind of loan offered by a business, there are certain characteristics that one should consider while choosing a loan origination and servicing software. Providing your customers with the best loan management service is vital if you want to stand out in the competitive lending industry. An appropriate tool for loan processing can make the difference between a business being at the top of its game or just one of the many options for borrowers to select from without any differentiating factor.

The loan management software has a dual purpose. The first is to streamline the lending process from the loan application to the final decision. The second purpose is to decrease errors by handling redundant tasks like collections. Reliable software is equipped with a range of features that make the lending process easier and provide a business edge in the competitive lending industry.

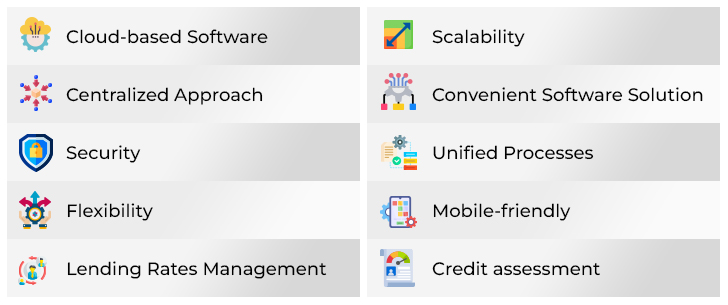

Important Features of a Loan Management System You Need to Consider

A loan management system should have the requisite tools that can help streamline the entire loan process. The software should include the vital features that help complete a deal faster and also provide more accurate analytical insights and customer data to flourish in today’s market.

Here are some important features your loan management system needs to have to improve borrower experience:

Cloud-based Software

Some businesses do not have the option of an on-demand IT team to support new software implementation. In such a case, having cloud-based software is beneficial. A reliable loan management system offers ease of deployment with the help of its cloud functionality to facilitate deployment for lenders. This ensures fast implementation, software flexibility, and the ability to contact the IT department of your service provider for support. In a lot of cases, these cloud-based systems also include automatic updates and regular upgrades. Most of all, being on the cloud provides your team easy access to loan management software from anywhere and the availability of information faster.

Scalability

Every business wants to grow and expand its services and products. A lot of loan management systems are fixed and hard-coded in a manner that it becomes challenging for the software to support a business as it grows. A reliable loan management system for your organization should have scalable modules that align with the changes introduced in your business as it grows. The software should allow you to introduce new services and products in your business to meet the latest needs of the market.

Centralized Approach

It is important to have a centralized storage system that hosts the various stages of a loan lending lifecycle. The lending industry often faces a lack of sufficient systems that work effectively from beginning to end in a loan cycle. Small businesses, especially, cannot afford to have different systems that store and retrieve the data of borrowers. Choosing software that supports the various loan management system modules, ranging from origination to servicing, will help your company save a huge amount of money every month and provide your organization with a comprehensive view of the profile of your loan applicant. You will be able to see the lending stage of the application, the person who’s handling the case, and all the concerned information from anywhere, anytime.

Convenient Software Solution

Time plays a key role in the lending industry. Thus, discovering a tool that can assist your team to begin functioning quickly is important. The loan management system that you choose should be an easy-to-use software that shouldn’t require a lot of time in staff training. Thus, successful user adoption is of utmost importance when choosing loan management software for your business.

Transform Your Lending Process with LoansNeo

Security

While managing the sensitive data of borrowers, it is important for lenders to make sure that they follow the best practices of data security. You need to select a lending software that allows your business to set up centralized data storage that can be accessed by authorized people using proper permissions. Also, as a lender, you need to ensure that your loan management software complies with the privacy standards of the industry and has the highest compliance measures and certifications.

Unified Processes

While getting ready to complete the lending lifecycle, lenders need to consider different modules like onboarding, credit assessment, funding, underwriting, etc. With the help of a system that provides all these modules built into the platform, supports customizable modules, and allows integration of third-party apps, you reduce your burden and make the lending process hassle-free. You also boost customer experience and save the time of your team.

Flexibility

Every lender runs their organization their way and every business has its specific requirements. Hence, it is vital to choose a loan management system that is dynamic and can be configured easily. This way you can find out what’s best for your business and make the required changes to the loan management software so that it aligns with the functionality of your business.

Mobile-friendly

The present-day borrower is looking for the fastest and easiest way to get loans from lenders. To stay competitive in the market, lenders can’t afford to stay stuck with outdated software. To keep yourself updated with the present trends and maintain an edge in the market, you require a loan management system that can be easily accessed from anywhere, on any device. The majority of borrowers today have their personal smartphones, and having a mobile-ready feature is pivotal for your loan management software.

Lending Rates Management

An effective loan management system should be able to manage the lending rates of all kinds of loans, automatically calculate origination fees or commissions, or apply base lending rates that are period-specific and depend on the credibility of the borrower.

Credit assessment

The success of a lending deal depends on the accuracy of the credit assessment. Thus, it is important to find lending software that can help assess the creditworthiness of applicants. The system should be able to draw out information from the various credit bureaus and provide the right information in a timely manner. The best loan management systems provide these integrations to promote efficiency and offer a comprehensive view of the credit scores of the applicant.

Conclusion

To stay updated with the emerging trends in the financial market, it is vital to streamline the lending process. This way you can cater to your business needs in an easier and faster manner. While choosing the best loan management system for your business, it is important to consider factors like personalization, scalability, and cloud-based software. Such a system can meet the long-term and short-term requirements of your business and allows you to process loans efficiently without any errors.